The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

[ SHANGHAI, China —Opens in new window ]

You can't not see it if you're Chinese. With their long leather whiskers, Celine's Belt bags look just like catfish, hence the affectionate pet name given to them by Chinese consumers. Nicknames for top luxury brands' most iconic products are becoming more and more popular among young Chinese consumers, according to a new report from McKinsey & Co.

These names have become “an easily recognisable currency or symbol on social media,” says Lan Luan, one of the authors of the report.

The nicknames are derived in different ways. There are aesthetic resemblances, like Longchamp's 'Dumpling Bag' and Gabriela Hearst's 'Wonton Bag', known to most as the Le Pliage shopper and Nina bag respectively. There are sound-alikes, such as Chloé's 'Piglet Bag', whose official name, Drew, sounds like the Chinese word for pig. There are pop culture references, such as Prada's Saffiano handbag, renamed the 'Murderer Bag' after it was worn by Léa Seydoux's assassin in Mission Impossible: Ghost Protocol.

What's in a name? Gucci's Jackie and Hermès' Kelly are named after Jackie Kennedy and Grace Kelly, who sported the bags after their release. Fendi's Baguette is named after its resemblance, carried under the arm, to a loaf of French bread.

ADVERTISEMENT

But bags like the Birkin and Baguette were coined by the brands themselves, and the Jackie and Kelly, whose names were adopted by the brands retroactively after the bags were worn by celebrities, are glamorous and aspirational. Even the humble baguette hints at Parisian sophistication.

The same can’t be said for catfish or wontons.

Prada's so-called 'Murderer Bag' and Longchamp's 'Dumpking Bag' | Source: Prada and Longchamp

Nicknames are far more functional in China. Indeed, there’s something impish about the juxtaposition of European high fashion with everyday Chinese culture, with cheeky, clever nicknames like SK-II’s ‘Ex-boyfriend Face Mask’ — known as the Facial Treatment Mask, with its supposed prowess in inciting up post-breakup regrets — serving to entertain consumers.

However, “older examples happened at a time when we were not talking about rejuvenating the luxury clientele or millennials,” says Pablo Mauron, partner and managing director China of Digital Luxury Group, a Swiss-founded digital agency.

Some Chinese consumers, he says, “love luxury products but are not international at all, don’t speak other languages, and are maybe not that sophisticated. They just need to find an easy way to refer to a product or a brand.”

Beauty products’ nicknames, for instance, tend to describe their packaging in a literal way. Examples include Estée Lauder’s ‘Little Brown Bottle’ of Advanced Night Repair, L’Oréal’s ‘Little Fountain Pen’ eyeliner, MAC’s ‘Bullet’ lipsticks, Armani’s ‘Little Fatty’ liquid lipstick, and Clé de Peau Beauté’s ‘Grenade’, a.k.a The Serum.

Acronyms are another popular way for Chinese consumers to circumvent problems remembering, spelling and pronouncing foreign product names, and their commonly clunky Chinese translations.

ADVERTISEMENT

"In China, people more often refer to Louis Vuitton as LV, Vacheron Constantin as VC, and Van Cleef & Arpels as VCA," says Mauron. "It's not just finding a cute nickname that resonates and is fun. In the case of these acronyms, it's a simple way to refer to the brand without having to struggle to pronounce that name."

Chinese luxury consumers are still new to luxury, so consumers and influencers need to leverage these names more.

Most Chinese consumers didn’t grow up with luxury brands around. McKinsey found that nine tenths of the Post-'90s generation demographic, a third of Post-’80s, and almost half of the Post-’65s only began engaging with luxury products in the past three years.

“Chinese luxury consumers are still new to luxury, so consumers and influencers need to leverage these names more,” Luan says.

Tao Liang, the leading Chinese influencer better known as Mr. Bags, says product nicknames can be seen everywhere in China. Although they can be an important shortcut and sometimes help oil the wheels of the sales machine for entry-level consumers, they are not just popular "among those purchasing their first few luxury products."

“They are not just nicknames,” he explains. “They’ve become the [official yet unofficial] Chinese name for certain products. For example, when you ask someone about Le Pliage, they might not know what it is, but when you mention Longchamp’s ‘Dumpling Bag’ they’ll get it, even if they’re not hardcore fashion fans.”

Liang says he enjoys coining names for products on his platforms, like the "Big Mouth Bag" for Tod's Wave Bag. He does so for colours too, describing the greyish-blue shade as "Foggy Blue".

How valuable nicknames are to brands operating in China — which McKinsey predicts will deliver 65 percent of additional luxury spending heading into 2025 — is difficult to assess.

Estée Lauder’s ‘Little Brown Bottle’, L’Oréal’s ‘Little Fountain Pen’ eyeliner, MAC’s ‘Bullet’ lipsticks, Armani’s ‘Little Fatty’ liquid lipstick, and Clé de Peau Beauté’s ‘Grenade’ | Sources: respective brands

ADVERTISEMENT

“We don’t have quantitative analysis on this, but the products with widely known nicknames are normally highly popular,” says Luan. “It is hard to establish the cause-effect relationship. The products with nicknames are more likely to perform well not only because they have nicknames, but also because they have unique design, emotional value or functionality can resonate with consumers,” she says.

While they can also help consumers search for products and make purchases, nicknames can be a liability and undermine brand positioning or open the door to competitors. Brands rarely hold the trademarks to nicknames that emerge organically online.

"It's a fantastic opportunity for daigou," Mauron says, referring to luxury's cross-border shoppers. "They're going to be shameless, target that keyword like crazy, and take advantage of the fact that you're not doing it."

For brands that find their products attached to a rather unfortunate nickname, there is not much they can do to intervene. “They don’t really get to shape online behaviour [in terms of how] people talk, search, or the [nicknames] people use, ” Mauron says. “If people start to refer to your bag as the catfish bag, good luck changing that.”

If people start to refer to your bag as the catfish bag, good luck changing that.

However, he says, even if a brand can’t adopt a nickname because it undermines their positioning or encourages rivals, brands shouldn’t disengage. If a given nickname becomes “super popular”, he says, “you should make sure that you have a paid strategy that at least gives you visibility through advertising on this keyword, even though you cannot use it on your own channels.”

While the brands BoF spoke to were unwilling to go on the record, their local Chinese management were well aware of the nicknames given to their products. Some have begun working with e-commerce platforms and insight agencies to try to create and promote new nicknames for their products.

“I remember in the first few years working on promotional projects with brands, they would try to make sure their product names are correct,” says influencer Fang Yimin, better known as Becky Li. “But in the past couples of years, brands are more willing to accept this culture. They don’t jump out to say ‘no this is not what the bag is called’.”

“Beauty brands especially like nicknames,” she tells BoF.

This accommodating approach aligns with Luan’s advice for brands to get out ahead of the problem by working with influencers and consumers.

“We believe going forward, brands should take more initiative to create nicknames so they can truly reflect the brand and product positioning, and also connect to Chinese consumers,” she says.

Mr. Bags is more circumspect about the ability for brands to make their own nicknames go viral.

“Many brands [already do] try to give Chinese names to their new styles, but in most cases they don't get what they want. Either the name is not a good fit with the bag, or the design of the bag is not so brilliant that it [lives up to the name] or qualifies as a successful ‘It' bag,” he says.

时尚与美容

FASHION & BEAUTY

Forever 21 store | Source: Shutterstock

Forever21 Confirms Exit from China Market

US fast fashion retailer Forever 21 shut down its China online store and its shops on Chinese e-commerce platforms on April 29. Meanwhile, its brick-and-mortar stores offered deep discounts, leading to speculation that the fast fashion giant may soon pull out of China (It has now confirmed it will exit the China market entirely). Forever 21 opened its first China store in 2008, and exited the Taiwan market in March and closed its Hong Kong flagship in 2017. (Sixth Tone)

Shunning Bad Luck, Hong Kong Buys Into 'Pre-loved' Fashion

Motivated by the desire to reduce waste and save money, Hong Kongers are now flocking to fashion resale websites such as Retykle and Guiltless, non-profit pop-ups like Redress, and stores including HULA and OnceStyle. While HULA's online sales have tripled each year since 2016, Global player Vestaire Collective established its Asia-Pacific headquarters in Hong Kong in January 2018, and saw active users grow more than 200 percent in Asia the same year. While online platforms like Xianyu and Zhuan Zhuan have also entered the second-hand fashion market in Mainland China, the US resale clothing market has grown 21 times faster than the retail market over the past three years. (Reuters)

Anta's Sharemarket Surge Crowns New Sportswear Billionaire

Wang Wenmo, the director of Chinese sportswear brand Anta, had a fortune worth $1.2 billion on Friday according to Forbes, after Anta's stock closed at HK$57 (US$7.20).The 62-year-old reached the milestone after shares in the company rose by a third in 2019 on optimism about the Chinese economy and Anta's acquisition of European sports giant Amer. Anta's chairman Ding Shizhong and deputy chairman Ding Shijia are already members of the three comma club, each worth about $4.5 billion. (Forbes)

科技与创新

TECH & INNOVATION

Screenshots from a deepfake video of Barack Obama created by Buzzfeed | Collage by BoF

China Wants to Make Deepfakes Illegal

A draft law being deliberated by the Standing Committee of the National People's Congress (NPC) would ban the use of deepfakes, software that uses AI to digitally replace one person's face with another's in videos. Shen Chunyao, a senior legislator of the NPC's Constitution and Law Committee said the technology not only risked infringing on intellectual property but also posed a national security risk. Back in February, a video that spliced Yang Mi, one of the country's biggest actresses, into to a 25-year-old TV drama, went viral, spurring discussions of the technology's impact on privacy and intellectual property rights. The issue isn't unique to China, and commentators worldwide are growing increasingly concerned as coders are moving on to replace entire bodies rather than faces alone. (China Daily)

Apple’s Q2 Results Beat Expectations, Despite Striking Out in China

Apple's share price rose 6 percent on news that it had eclipsed market expectations of $57.49 billion during the second fiscal quarter of 2019, reporting earnings of $58.015 billion. That's not exactly cause for celebration in Cupertino, however, as profits were down 5 percent year-on-year, and plummeted a whopping 22 percent in Greater China. The numbers are especially worrying considering the impact of the country's numbers on the tech giant's performance — China accounted for 90 percent of Apple's decline in earnings. (36kr)

Funds Targeting China's Nasdaq-style Tech Board Are in Hot Demand

China's first batch of mutual funds modelled on the Nasdaq-style technology board have quickly sold out. Seven fund houses each aimed to raise 1 billion yuan ($148.4 million) in their new, tech-focused funds, and each hit their targets on day one. Shanghai's Science and Technology Innovation board will give investors exposure to sectors such as semiconductors, biotech, artificial intelligence and high-end manufacturing. (Reuters)

消费与零售

CONSUMER & RETAIL

Pinduoduo's website | Source: Pinduoduo.com

Office of the US Trade Representative Lists Pinduoduo Among Notorious Markets

The Office of the United States Trade Representative (USTR) has added Pinduoduo to its list of notorious markets for 2018. The USTR said China's third largest e-commerce platform relied on "a catalogue of improbably low-priced goods" to attract users from the countryside and provincial towns. They said shanzhai, or parasite brands', products, were a particularly common form of counterfeit products on the site. Alibaba-owned Taobao and DHgate were the other Chinese e-commerce platforms listed by the USTR, while bricks-and-mortar markets included Shenzhen's Huaqiangbei Electronics Markets and Luohu Commercial City, and Beijing's Silk Market. (Worldipreview and the USTR)

Chinese Consumers Are Driving Puma’s Growth Amid Trade War

Puma began 2019 with its strongest quarter ever, largely thanks to China. Sales in the Asia-Pacific increased 28.6 percent to $478 million over the first quarter of 2018, outstripping global growth of 15.3 percent to $1.47 billion. Puma was able to meet increased demand in China having freed up local production by moving some of its footwear factories to Vietnam and Indonesia. Other shoe brands have also moved their manufacturing out of China, with Adidas saying Vietnam has now overtaken China as its top supplier for footwear. (Footwear News)

Alibaba Reaches $250 million Settlement for Securities Class Action Suit

Alibaba Group Holding Limited will pay quarter of a billion dollars to settle a lawsuit, alleging that the e-commerce company concealed a regulatory warning about its ability to stop counterfeit goods sales prior going public in 2014. The lawsuit has been pending since January 2015. Alibaba said it would turn its attention to creating more value for society. (Sina Finance)

政治、经济、社会

POLITICS, ECONOMY, SOCIETY

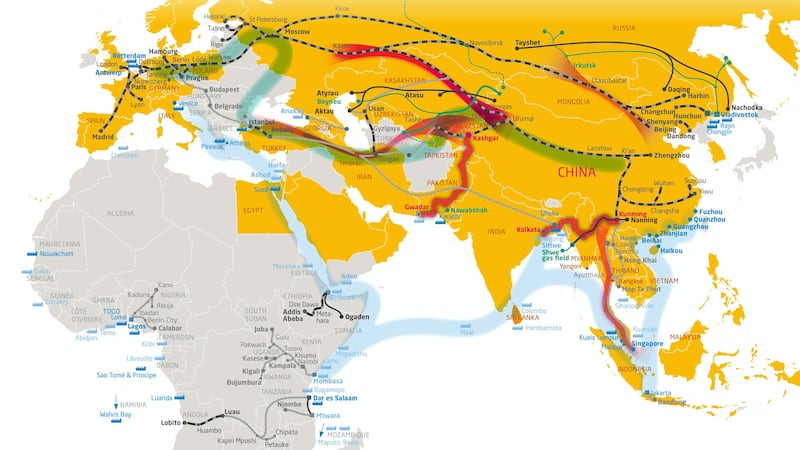

Planned and completed "Belt and Road" infrastructure projects | Source: Mercator Institute for China Studies (MERICS)

China Wants to Use Global Media to Dispel Belt and Road Debt Risks

President Xi Jinping called on media outlets outside China to boost public support for his Belt and Road initiative, which is facing increasing criticism abroad. Beijing's grand infrastructure building project has been described as a "debt-trap" by critics, with Sri Lanka's handover of its Hambantota Port to China being cited as evidence. Xi's efforts to win over foreign media are part of a broader soft-power push that has included financing Mandarin language courses and investments in African media outlets. Meanwhile, China is also introducing some of its censorship tools and measures to Africa. (Quartz)

Triple Whammy Sees China’s Stocks, Bonds, and Yuan Sink

Despite just completing its best quarter since 2014, the Shanghai Composite Index was down in April amid record foreign selling. Chinese sovereign debt was heading for its worst monthly drop in more than eight years, and the yuan fell by its furthest since October last year. The Chinese markets are closed from Wednesday to Friday, leaving investors to hope for a rally next week. (Bloomberg)

China’s Tinder Removed From App Stores Amid Government Crackdown on Cyberspace

Tantan, owned by Beijing-based Momo, was suspended from multiple app stores in China as part of a perpetual clean up of cyberspace behind the Great Firewall. Tantan is currently China's largest dating platform, with 90 million registered users and six million daily active users. Momo, which acquired Tantan last year for an estimated $760 million, said it was working with the relevant government authorities to return to business as usual. (SCMP)

China Decoded wants to hear from you. Send tips, suggestions, complaints and compliments to zoe.suen@businessoffashion.com.

With consumers tightening their belts in China, the battle between global fast fashion brands and local high street giants has intensified.

Investors are bracing for a steep slowdown in luxury sales when luxury companies report their first quarter results, reflecting lacklustre Chinese demand.

The French beauty giant’s two latest deals are part of a wider M&A push by global players to capture a larger slice of the China market, targeting buzzy high-end brands that offer products with distinctive Chinese elements.

Post-Covid spend by US tourists in Europe has surged past 2019 levels. Chinese travellers, by contrast, have largely favoured domestic and regional destinations like Hong Kong, Singapore and Japan.