The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

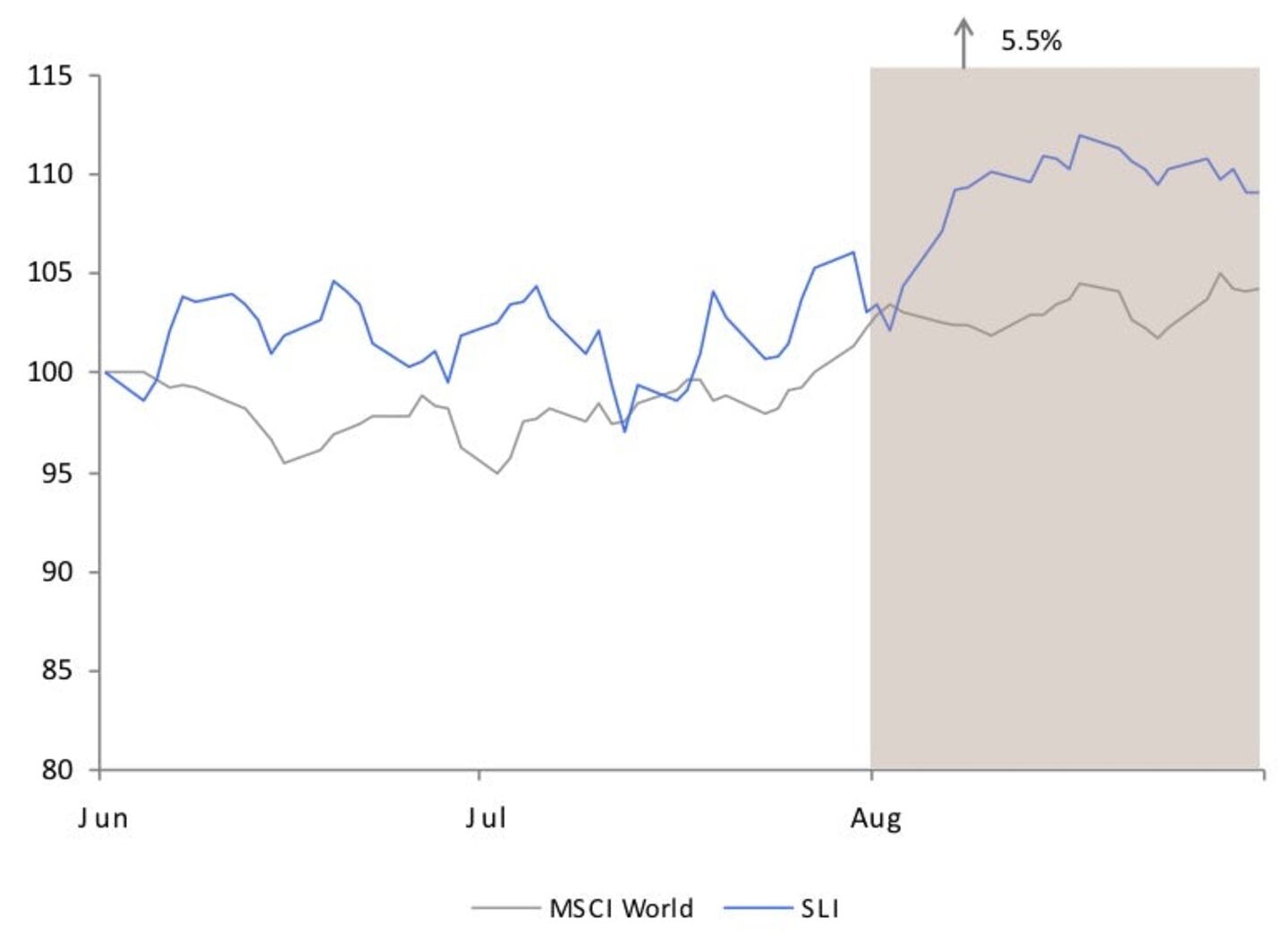

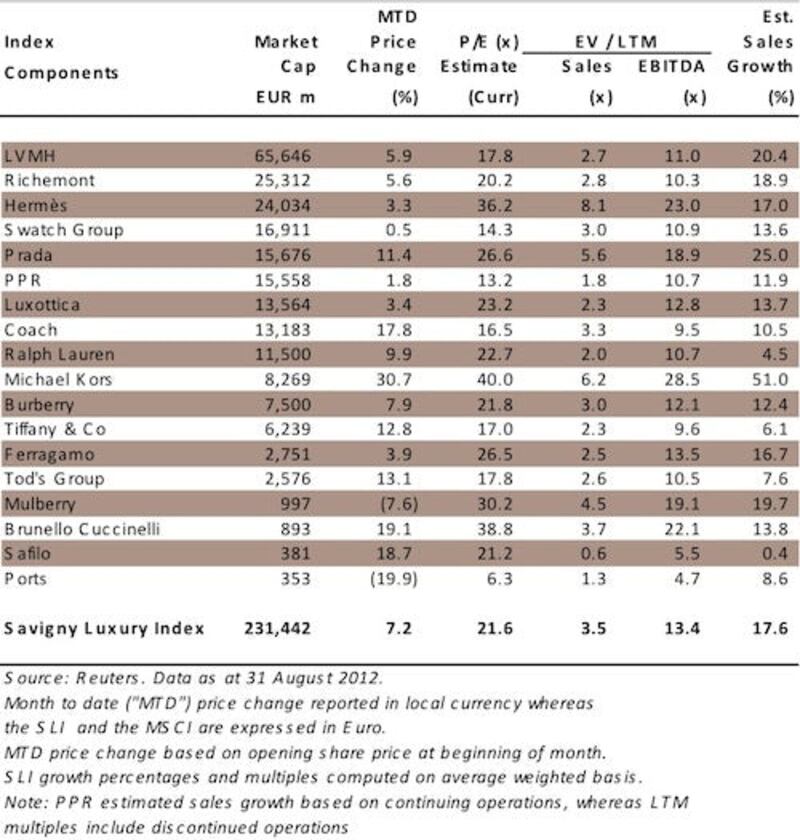

LONDON, United Kingdom — The Savigny Luxury Index ("SLI") gained 5.5 percent in August, outperforming the benchmark MSCI World Index ("MSCI") by over four percentage points. Strong results by sector leaders confirmed continued growth in Asia and increased tourist spending in Europe, thanks in part to a weaker euro.

Big news

Going up

Going down

ADVERTISEMENT

What to watch

Sector Valuation

Pierre Mallevays is a contributing editor at The Business of Fashion and founder and managing partner of

Savigny Partners, a corporate advisory firm focusing on the retail and luxury goods industry.

With consumers tightening their belts in China, the battle between global fast fashion brands and local high street giants has intensified.

Investors are bracing for a steep slowdown in luxury sales when luxury companies report their first quarter results, reflecting lacklustre Chinese demand.

The French beauty giant’s two latest deals are part of a wider M&A push by global players to capture a larger slice of the China market, targeting buzzy high-end brands that offer products with distinctive Chinese elements.

Post-Covid spend by US tourists in Europe has surged past 2019 levels. Chinese travellers, by contrast, have largely favoured domestic and regional destinations like Hong Kong, Singapore and Japan.