The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

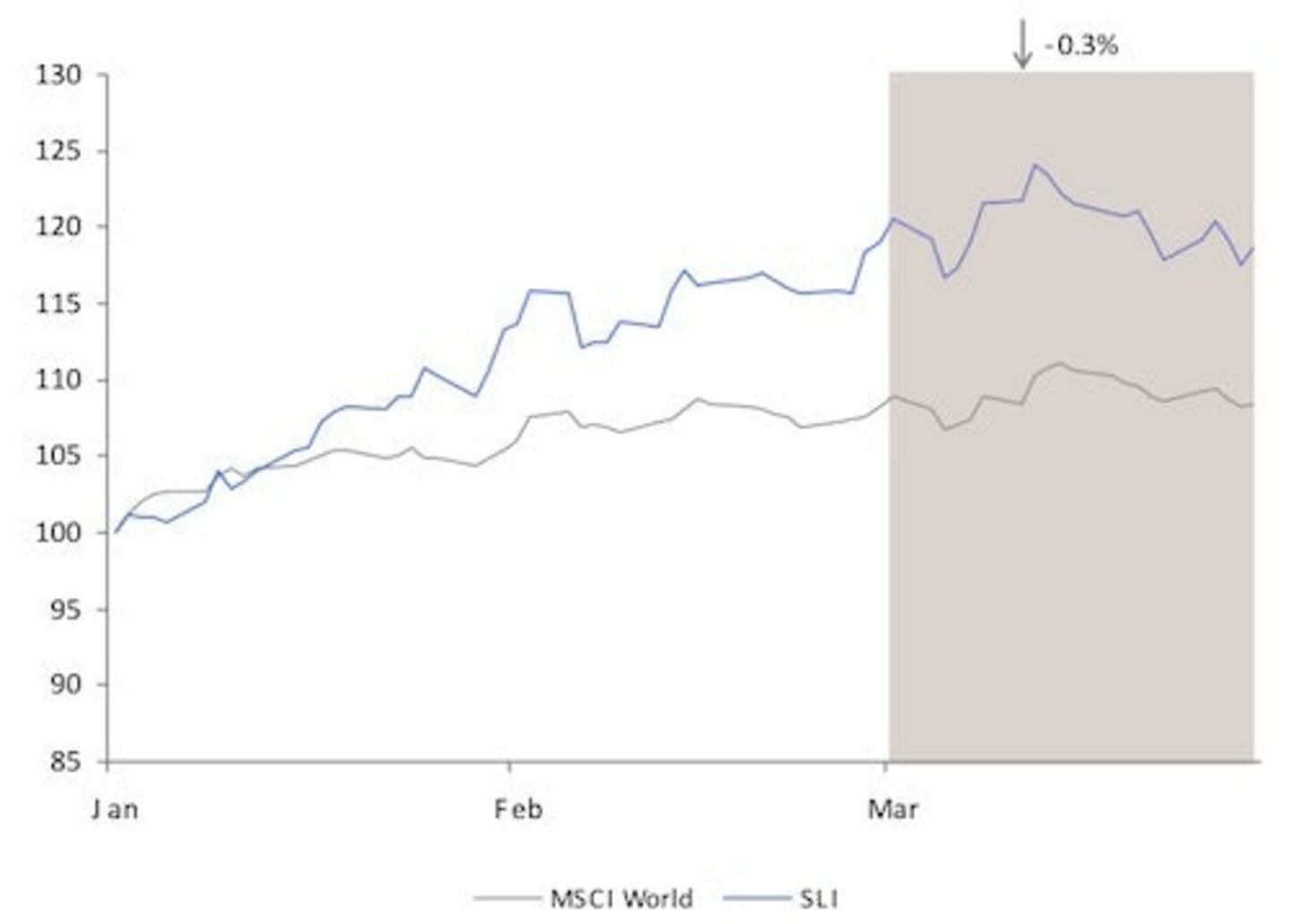

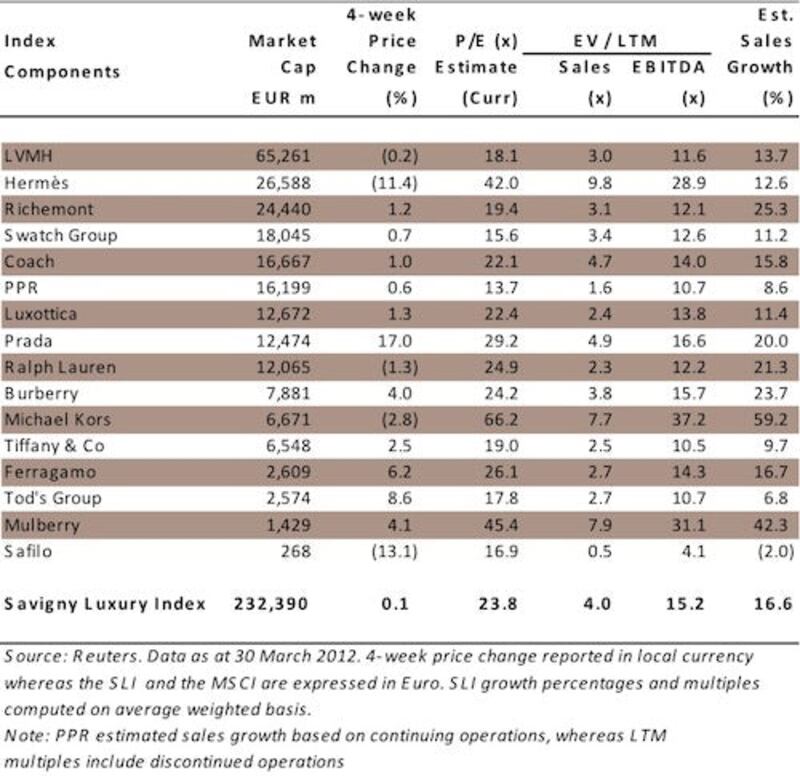

LONDON, United Kingdom — The Savigny Luxury Index (SLI) traded in a relatively narrow bandwidth this month, slipping 0.3 percent, whilst the benchmark MSCI World Index (MSCI) edged up 0.2 percent. Worries over a slowdown in China were offset by yet another string of exceptional results announcements, resulting in a status quo for the month of March.

Big news

Going up

Going down

ADVERTISEMENT

What to watch

Sector Valuation

Valuation multiples: making sense of the madness

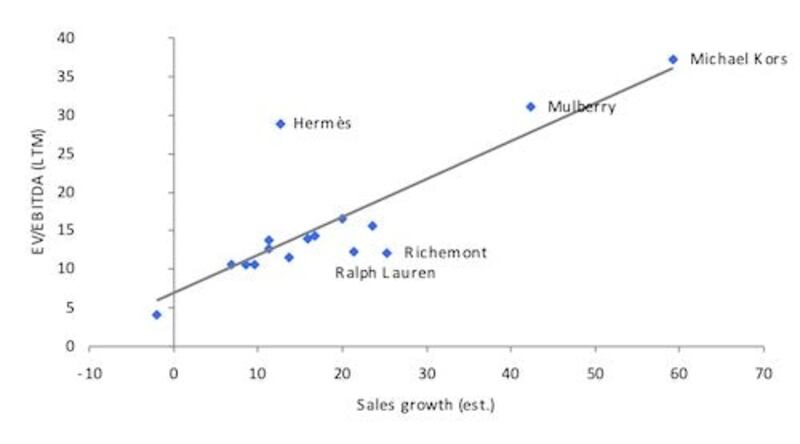

At first sight some valuation multiples look staggering, with for example Michael Kors and Mulberry both enjoying EBITDA multiples in excess of 30 times. This contrasts with the multiples of some industry leaders barely notching above 10 times. Why such discrepancy?

The answer is clearly and resoundingly market anticipation of growth prospects. The graph below plots EBITDA multiples against the analysts’ consensus for sales growth estimates in the current fiscal year for each of our SLI constituents. The correlation is very strong indeed.

EBITDA Multiples vs. Estimated Sales Growth

Three groups stand out from this:

Pierre Mallevays is a contributing editor at The Business of Fashion and founder and managing partner of Savigny Partners, a corporate advisory firm focusing on the retail and luxury goods industry.

With consumers tightening their belts in China, the battle between global fast fashion brands and local high street giants has intensified.

Investors are bracing for a steep slowdown in luxury sales when luxury companies report their first quarter results, reflecting lacklustre Chinese demand.

The French beauty giant’s two latest deals are part of a wider M&A push by global players to capture a larger slice of the China market, targeting buzzy high-end brands that offer products with distinctive Chinese elements.

Post-Covid spend by US tourists in Europe has surged past 2019 levels. Chinese travellers, by contrast, have largely favoured domestic and regional destinations like Hong Kong, Singapore and Japan.