The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

SHANGHAI, China — In this pulsing metropolis where 24 million residents jostle for space and success, nothing stays the same for long. Areas like Yangpu, Hongkou, Baoshan, and Jiading were once known for their proud industrial heritage and manufacturing clout, or for their shanty towns populated with sex workers and small time gangsters.

Today, the hum of factories is now a distant memory and, fortunately for locals, the dodgy dealers have moved on to greener pastures. Investment started pouring in a couple years ago and now there are vast swathes of these neighbourhoods that have transformed into family-friendly places to browse, shop and enjoy a meal in air-conditioned comfort. Elsewhere this would be called gentrification; in China, they just call it progress.

According to figures from CBRE, over the next three years, 98 percent of the 2.65 million square metres of the total new retail supply expected to come online in Shanghai will be in secondary and decentralized areas of the city, leaving only two percent for traditional “prime” retail areas.

There is talk around town that Shanghai’s periphery will – for some time, at least – become the new epicentre of investment. The implications for fashion brands seem clear enough. Those still heavily reliant on physical retail, had better get acquainted with these hitherto unfashionable districts of the city and get ready to compete for China’s wider suburban retail opportunity.

ADVERTISEMENT

Downtown is Saturated

Urban demographers could wax lyrical about the layers of evolving social and economic drivers for this outward shift, but there is also one very simple alternative explanation.

Shanghai’s most famous and successful malls – meccas of luxury such as Plaza 66, IAPM, K11 and Taikoo Hui – are ensconced in the traditional downtown shopping meccas of Huaihai Lu and Nanjing Xi Lu. And to put it rather bluntly, these two areas are almost full.

There is no more land for these core shopping malls to be opened downtown.

“There is no more land for these core shopping malls to be opened downtown,” Zino Helmlinger, Senior Director and Head of Retail for Eastern China at CBRE, says matter-of-factly, adding that the trend outward has been ongoing since at least 2015.

When throngs of white collar workers are on their lunch breaks in the riverside financial district of Lujiazui, it is the gleaming storefronts of Shanghai IFC where they peruse Cartier and Louis Vuitton with requisite Starbucks cup (or bubble tea) in hand.

Likewise, Xintiandi, sitting just behind the middle section of Huaihai Lu has long attracted crowds of well-heeled Shanghainese shoppers and free-spending tourists from across the country. Xintiandi Plaza, a newly revamped mall in the area, boasts not only Tom Ford Beauty's largest store in Asia, but also a focus on Chinese design as a point of differentiation.

There is little doubt that these and other well-trodden fashion retail thoroughfares will continue to be disproportionately important to the bottom line for most fashion brands in the years to come. However, a look at the most anticipated new developments in the pipeline, such as Swire Properties’ 120,000 square metre Taikoo Li Qiantan in the outer regions of Pudong district, are spread wide across Shanghai’s fringes.

The expansion of high-quality mall developers from the city centre to more decentralized areas means that brands – even those without a saturated retail footprint downtown – are following them further and further out. Leading the pack are domestic giants such as Peacebird and a few big international names like Nike, Uniqlo, Adidas, Muji and Calvin Klein.

ADVERTISEMENT

Interestingly, Allbirds is also eyeing Taikoo Li Qiantan for future brick and mortar expansion, even though it just launched in China in April with their first retail outlet at Swire’s Taikoo Hui development in Nanjing Xi Lu.

Aerial view of Rui Hong Tiandi in Shanghai's Hongkou District | Source: Courtesy

According to Allbird’s International President, Erick Haskell, the Shanghai government’s plan to relocate a portion of Lujiazui’s business district to the Qiantan development, as well as Swire’s plan to give Taikoo Li a strong focus on fitness and lifestyle makes it a good fit for his brand.

“I’m really bullish on the area, it is going to become more of an area with families and a community, so I think it could be an important area and I’m particularly excited about that project and how it’s oriented,” he says.

According to Cushman & Wakefield data, the 2.7 million square metres of mid-to-high quality retail stock currently online in Shanghai’s downtown areas is already dwarfed by the 13.4 million square metres found in suburban areas. The opportunity for fashion brands lies in the growing consensus that these outer districts are far from tapped out in terms of land and shopping centre redevelopment opportunities.

Serving the Multi-Nodal City

Thanks to Shanghai's decades-long economic boom and its newly inducted middle- and upper-middle class consumers, the city is leading the nationwide "consumer upgrade", a neologism the government uses to describe the country's evolving spending habits, meaning spending more, spending smarter and spending for experiences.

On the downside, that same boom has priced many ordinary Shanghainese people and migrants from other parts of China arriving in the boom town looking for work, out of central residential locations.

ADVERTISEMENT

White collar couples looking for “more bang for their buck,” as Shaun Brodie, Head of Occupier Research, Greater China at Cushman & Wakefield puts it, along with families seeking more space for their households. These often constitute grandparents, parents and one or two children (since the one-child policy was lifted nationwide in 2015) under the same roof – and are now populating far flung districts and former satellite cities that have recently been incorporated into Shanghai’s sprawling municipality.

A burgeoning transportation infrastructure has made this middle-class residential spread even more feasible, allowing for relatively convenient office commutes from places such as Baoshan, Jiading, Nanhui, Fengxian and Jinxian. In just over a decade, Shanghai’s subway system has grown from four lines to 16, servicing 10 million passengers daily.

Once, it would have taken 90 minutes and several busses for the more than 2.5 million residents of the western Shanghai district of Minhang (a population comparable to the entire city of Chicago) to reach the downtown office towers of Huaihai Lu. Today it’s a 25-minute ride on the metro.

Even as transport upgrades makes downtown commuting more convenient from formerly far-flung areas, according to Albert Chan, Director of Development, Planning and Design for real estate giant Shui On Land, Shanghai has developed to be far more “multi-nodal” than other world cities, like London or New York. And this necessitates a different retail approach.

The people who live in a community [now] tend to live, work and play in that community.

In a mega-city, “geographically nine-times the size of Seoul”, it makes sense that Shanghai “is more decentralized,” Chan explained. “It’s not [one] strong core and then suburban areas.”

“The people who live in a community [now] tend to live, work and play in that community,” he added.

Transforming Local Communities

From the Yangpu District in the north to Songjiang in the south, the young couples and families who sought the Shanghai dream of property ownership in up-and-coming suburbs soon realised that their local options were extremely limited when they wanted to hang out and relax together on the weekend.

Into this breach stepped a new generation of mall developers, many of them primarily residential developers who saw the need for retail and lifestyle spaces for the communities they were building in Shanghai’s outer districts.

Even major developers, such as Shui On Land – perhaps most famous for the rejuvenation of the 23 city blocks in Shanghai now known as Xintiandi – have been looking outside of the city's retail sector's epicentre for new opportunities. The firm’s ongoing Ruihong Tiandi development (‘Rainbow City’ in English) in the regenerated northern district of Hongkou is a case in point.

Although Hongkou is not a suburb, it is still indicative of the community-centred mixed-use retail, residential, lifestyle, commercial projects popping up in non-traditional retail locations beyond the main thoroughfares catering to a new generation of gentrified, middle-class residents.

[Hongkou's Hongzhen Old Street] was infamous for being unruly and dangerous. That area needed a complete regeneration.

“[Hongkou’s Hongzhen Old Street] was infamous for being unruly and dangerous. That area needed a complete regeneration,” Chan explained, adding that some long-time residents of the area also clambered onto the middle-classes when outsiders started moving in.

Hongkou was initially built up in the 1800s as part of the international settlement, housing mainly American and British imports, before Japanese occupation in the 1930s gave the district its nickname, “Little Tokyo”. During World War II tens of thousands of Jewish refugees from Europe flooded into Shanghai, one of the last ports open to them, with the majority packed into the “Jewish Ghetto” in Hongkou.

By 1949, most of the Jews had gone, but Hongkou district – in particular the area known as Hongzhen Old Street – remained something of a ghetto, a crumbling shanty town where prostitutes openly plied their trade in the narrow lanes and shady figures did shady deals, only two kilometres from the grandeur of Shanghai’s riverside Bund Promenade.

“Now [it’s] just such a nice community, the dilapidated environment of the past has been wiped out,” Chan says. “Hopefully we can build in a sense of belonging, instead of just putting housing here and a shopping mall over there.”

Initially a residential project, Rainbow City is now a 1.7 million square metre community development, which includes a four-part, 550,000 square metre retail and lifestyle development. There is a focus on lifestyle brands and family friendly experiences, alongside an entertainment hub, complete with live music venues surrounded by dining and leisure venues.

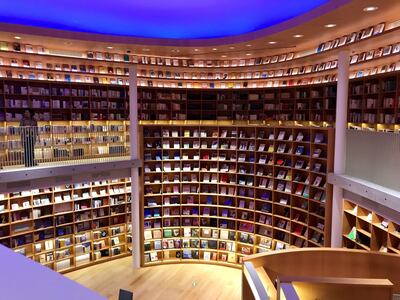

Tadao Ando designed Xinhua Bookstore in Minhang District's Aegean Place | Source: Courtesy

A staggering twenty-nine new malls opened within Shanghai's Minhang District in 2016. A year later, Aegean Place bowed. The 240,000 square metre complex is a mix of mid-market retail, including mainstays of Shanghai mall life, such as Guess, Li Ning and Adidas, with a hefty dose of family-friendly entertainment and dining options, along with an art space and a spectacular bookshop designed by Pritzker Prize-winner Tadao Ando.

The exterior features a massive musical water fountain and an urban park. There is even an organic farm and pony rides on the roof, and uniquely, for Shanghai, the mall provides unisex public toilets and “husband rooms” where spouses can go for a rest when they grow tired of accompanying wives and girlfriends on shopping trips.

“Our in-store sales jumped even with the rise of online retailing,” Yao Haibo, the manager of Aegean Place told local media. “In an era when everyone is constantly checking their phones or tablet, we want to be a place where people put down their digital devices and reconnect with friends and family.”

Family-Friendly Fashion

Shanghai’s hot, humid summers, wet seasons, cold winters and notorious air pollution all combine to make malls an important centre of leisure and entertainment for the whole family, given they are largely indoors and temperature-controlled.

Unlike Shanghai’s largely luxury-oriented downtown malls, the new generation of community-focused suburban malls have a tenant mix that skews more heavily toward hospitality.

According to CBRE’s Zino Helmlinger, fashion tenants are simply not bringing in the same proportion of revenue as they once did for malls, while food and beverage (F&B) and family-friendly entertainment has become proportionally more valuable as it “keeps people on site”.

While in 2016 he says a typical Shanghai mall would have been 25 percent F&B and 35 percent fashion, these figures have now been almost reversed.

You also have more entertainment concepts that [...] [are] like mini theme parks within the mall.

“You also have more entertainment concepts that take a big chunk of space but can retain people for a few hours, [some are] like mini theme parks within the mall,” Zino Helmlinger says.

The Changfeng area of Putuo District has seen frenzied development of the business district and accompanying malls in recent years. At Joy City Changfeng Park, directly across the road from the large green area of Changfeng Park and also near to the Changfeng Ocean Aquarium, family-friendly entertainment and child-centred tenants are a major drawcard.

The mall not only boasts both a Lego Discoveryland theme park and a rooftop garden, its central atrium has a sandpit, ball-pit, mini go-cart track and stage, on which kids’ fashion shows and beauty contests are held. Kids’ gymnastics, taekwondo, English-learning and art schools are all present in the tenant mix, as are a variety of specialist toy and kids’ fashion retailers and cafes featuring their own play areas for kids.

In terms of fashion and beauty, Sephora and Pandora rub shoulders with H&M and Nike, Doc Martens even has an outlet here, though it focusses on children’s’ styles. The mall has, in short, everything a local middle-class family could possible want to do with their children on any given weekend.

Clearly, Shanghai’s suburban retail developments are not a good fit for every international fashion brand. For one, the price point of most brand tenants tends to skew more toward the affordable, casual or premium segment rather than designer or luxury.

Indeed, according to local retail experts, pure luxury players should be cautious, although opportunities remain largely untapped for accessible luxury brands (such as Michael Kors and Tory Burch) who might be able to sustain around 20 stores in a city the size of Shanghai.

The real luxury guys will have two or three or four stores and those will be in Nanjing Lu, Huaihai Lu and Lujiazui.

“The real luxury guys will have two or three or four stores and those will be in Nanjing Lu, Huaihai Lu and Lujiazui, those are the key luxury locations,” says James Hawkey, a retail strategy consultant who was formerly JLL’s Head of Retail for China.

However, for other brands looking to diversify, spread some risk or expand their footprint in Shanghai, it makes sense to consider these high-quality properties in more decentralized locations. “Suburban shopping centres sometimes sell more than downtown, because of population density and spending power,” Pandora’s manager for retail in China, Zhou Wei, says.

The cost savings are considerable too, with Cushman & Wakefield estimating the average first-floor asking rental of high-quality suburban malls, less than half that of a downtown mall like IAPM in Huaihai Lu.

Although some Chinese cities continue to see ‘ghost town’ retail developments plague the landscape, experts do not appear to be worried that there is a bubble in China’s fashion capital. To the contrary, even with millions of square metres still in the pipeline, it seems that there is still room for most of Shanghai’s malls.

“The good malls will thrive, will do very good numbers in terms of sales performance and then there will be the ones that painfully bounce along trying to make money,” says Hawkey.

[Only] a very, very small part of the [Shanghai] market will fail.”

Related Articles:

[ A New Model for Shopping MallsOpens in new window ]

[ Can Roller Coasters and a Bunny Garden Lure Shoppers Back to the Mall?Opens in new window ]

[ Keeping Pace With the Changing Chinese ConsumerOpens in new window ]

With consumers tightening their belts in China, the battle between global fast fashion brands and local high street giants has intensified.

Investors are bracing for a steep slowdown in luxury sales when luxury companies report their first quarter results, reflecting lacklustre Chinese demand.

The French beauty giant’s two latest deals are part of a wider M&A push by global players to capture a larger slice of the China market, targeting buzzy high-end brands that offer products with distinctive Chinese elements.

Post-Covid spend by US tourists in Europe has surged past 2019 levels. Chinese travellers, by contrast, have largely favoured domestic and regional destinations like Hong Kong, Singapore and Japan.