The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

SHANGHAI, China — As show-goers decide their outfits for tomorrow's Shanghai Fashion Week kick-off, event organisers find themselves preparing a warm welcome for designers who haven't always been welcomed by the establishment. Fortunately for them, a few intriguing fashion outsiders always manage to reach the inner circle.

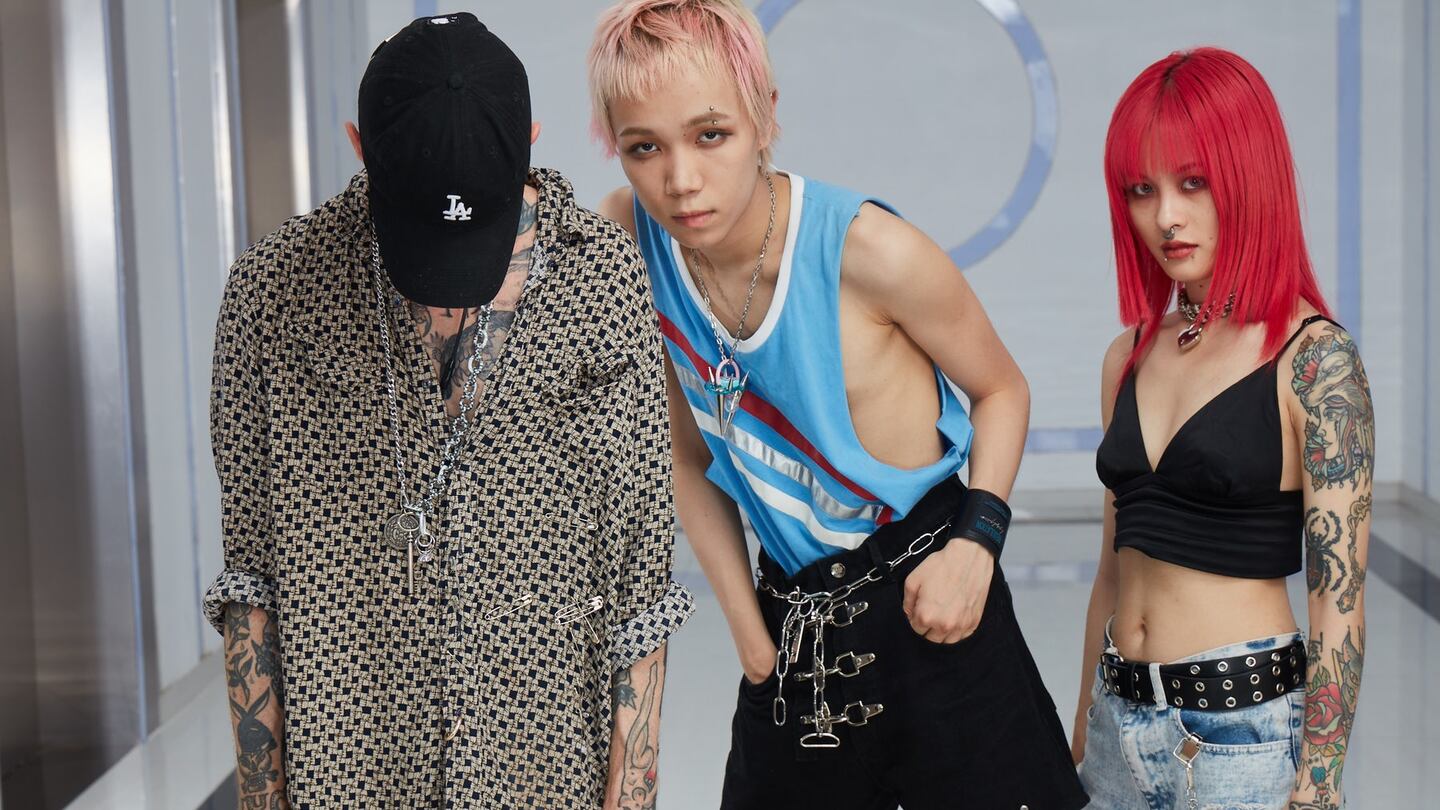

SuperR, Lucency and Roaring Wild will be presenting collections at Labelhood but — despite this being their debut at fashion week's youth focused platform — the brands are already famous to millions of Chinese consumers. Their secret? All three have been incubating on China's most fertile independent designer brand breeding ground, Alibaba's Taobao and Tmall e-commerce platforms.

Shenzhen-based Roaring Wild was founded a decade ago by rap and skate-loving creative director Meng Bingan, also known in English as BG. Today, it's one of China's best–loved homegrown streetwear brands.

SuperR, meanwhile, boasts a passionate fan base of more than a million followers on its social media accounts. When Labelhood co-founder Tasha Liu announced the inclusion of the brand to its Shanghai Fashion Week line-up, she said many SuperR fans took to social media to praise the decision.

ADVERTISEMENT

According to Liu, the move to include 'Taobao brands' is a natural extension of the fashion market development in China and what Labelhood’s young fashion-loving audience are looking for.

Starting on Taobao gave us this kind of freedom. We could put whatever we like in our store and see the customer reaction right away.

“In China, Taobao is quite a unique platform, you can launch a collection and people can build their own brand identity and adapt designs according to their customers’ feedback. These brands are really close to their customers,” Liu explains.

Shaking Off Its Old Reputation

For many years, the term ‘Taobao brand’ was a way to describe a brand in a derisive way because the platform wasn’t deemed suitable for 'respectable' fashion brands. The latter would always gravitate toward Tmall. However, this kind of shorthand is becoming less accurate and less meaningful, Liu suggests, much in the same way that the lines between a “wholesale brand” or a “DTC brand”, have blurred significantly in the Chinese context.

“All of them can talk about design, all of them collaborate with KOLs, celebrities, press. Brands are much more equal,” Liu says.

Liu says the Taobao designer brands in China are now rebranding themselves as “Chinese DTC” brands because of their ability to create and cultivate a highly engaged consumer community online, sell products directly to that community and use the feedback from their community to design new products and reach new consumers.

As in the West, the Taobao model – DTC with Chinese characteristics – has upended the idea of price point as a reliable metric for quality. Design-led Taobao brands with vertical manufacturing integration and the lower overheads of an online model are showing consumers they can get quality fashion for an affordable price.

TMF fashion show at Taobao Maker Festival | Source: Alizila

ADVERTISEMENT

"You can go to Zara and get this heartless, soulless commerce but for a similar price, you can buy from us and get the story and get the design and get the personality and community," says Babyghost co-founder Joshua Hupper.

Babyghost, which celebrates its tenth anniversary next year, is a regular at both Shanghai Fashion Week and New York Fashion Week and has built its business on the back of Taobao and more recently on Tmall. These two Alibaba-owned platforms now account for more than 80 percent of its total sales.

A Lifeline for Young Designers

In 2010, Hupper and Babyghost co-founder Qiaoran Huang started selling on Taobao after a trip home to China from their New York base convinced Huang that the platform was where her young compatriots were shopping. The pair have since relocated to Shanghai.

Relying heavily on direct-to-consumer channels wasn’t necessarily the plan for Babyghost at its inception. Hupper and Huang did the rounds at fashion weeks and showrooms looking for wholesale partners, but the numbers “didn’t add up” at the end of the day, as Hupper puts it.

“Starting on Taobao gave us this kind of freedom. We [didn’t] have to get selected, we could put whatever we like in our store and it was so interesting to see the customer reaction right away,” Huang explains.

“There are so many brands on Taobao right now. If you want to look at what’s going on in Chinese fashion, you shouldn’t just look at fashion week, that’s just a small part, you should go on Taobao, there are so many cool brands on there.”

Similarly, the growth of Chinese designer brand Ms Min over the past decade has been more of an organic process than a premeditated plan. The brand, which has Taobao and Tmall to thank for much of its journey, is now sold globally from Totokaelo in New York to Plum in Beirut, and will mark its ten-year anniversary with a major show in Beijing later this month.

ADVERTISEMENT

In the early years, Ms Min’s designer Liu Min built a cult following on Taobao through a store she opened in 2009 to sell pieces from her highly curated vintage collection.

“She wore a mask and photographed herself in these looks with an almost Cindy Sherman-esque vibe and this shop went viral early in the Taobao days,” recalls Liu Min’s husband and Ms Min’s president Ian Hylton, adding that when Liu was ready to launch her own collection, it made sense to turn back to Taobao.

Why would you turn down the place where you have the largest captive audience imaginable?

“Even though designers were not going on Taobao at the time, we couldn’t see any reason not to go on Taobao. Why would you turn down the place where you have the largest captive audience imaginable?”

According to figures released last year by Taobao and CBNData, 480,000 people per day purchase an item from independent fashion, furniture and jewellery designers on Taobao.

In spite of the fact that Ms Min grew over the years to include 50 wholesale partners, including Lane Crawford where it’s the first Chinese brand to sit in the ‘designer’ segment, alongside international brands such as Céline and The Row, 40 percent of their sales still come from online.

“Taobao was then, and Tmall is now, one of our top performers [among all our retail channels],” Hylton says.

The Divide Between Taobao and Tmall

The distinction between Alibaba’s two major platforms is far from clear these days. They were originally categorized according to their status as C2C (Taobao) and B2C (Tmall), but consumers and vendors don’t follow as rigid a delineation as they did in the past. For instance, a search from Taobao’s app will return results from Taobao, Tmall, as well as Tmall Global, Alibaba’s cross-border e-commerce platform.

In all, as of June 2019, Alibaba Group reported that its China retail marketplaces had 755 million mobile monthly active users, representing a quarterly net increase of 34 million users.

Meng Bingan, the designer for Roaring Wild | Source: Courtesy

As a general rule, Taobao is considered the go-to marketplace for Chinese consumers to access cheap or mid-priced domestic market goods. Tmall is higher up the value chain and incorporates more international offerings, including, more recently, a plethora of designer brands like Michael Kors, Alexander McQueen and Bottega Veneta all available through the Luxury Pavilion "app within an app". Last month, Richemont and Alibaba announced that a Net-A-Porter online flagship will be also be placed on the app.

Registered foreign brands generally prefer to sit in Tmall and, particularly the more rarefied position of Luxury Pavilion, where they won’t share space with cheap manufacturing brands, or worse, fake or grey market products. These are less prevalent than they used to be on Taobao, but are far from being eliminated completely.

Independent Chinese designers might open a Taobao store (there are more than eight million of them currently in operation), but following success there, they somtimes move up to a brand-operated Tmall store.

Alibaba’s Appetite for Independent Design

Taobao is proving to be an interesting way for Alibaba to align its own brand with creativity. Last month in the city of Hangzhou, where Alibaba is headquartered, the online giant presented the latest instalment of its Taobao Maker Festival which is designed to promote creativity and independent design on the platform. Supermodel Naomi Campbell made an appearance at the event and catwalk shows there featured high-profile local brands such as Particle Fever and Chen Peng.

“We want to provide a platform that supports young creators closer to home, encouraging them to design more, make more and try more,” Chris Tung, chief marketing officer at Alibaba Group, told media at the festival.

“It’s all about discovery. Sales come naturally when [consumers] love a product.”

Even if opening a Taobao store isn’t possible or right for young international brands, Alibaba's pivot toward independent design presents an opportunity for them to tap into a consumer who is increasingly passionate about indie fashion.

The Taobao opportunity for big international brands lies elsewhere. Since some are beginning to look to collaborate with hot, young Chinese designers – recent examples include Angel Chen's hook-up with H&M and Feng Chen Wang's Converse collab – Taobao is arguably a good place to discover new talent as that is where the next generation are getting their start.

Fiercer Competition Than in the Past

Chinese marketplaces are a crowded arena and most industry leaders agree that it would not be as easy today to build a brand such as Ms Min, Babyghost or Roaring Wild as it was in 2010. And quite rightly, the best young designers in the fashion capitals of Europe and the US will continue to be advised to eschew Taobao in favour of Tmall.

Fierce competition among brands is also pushing up the cost of acquiring new customers and retaining them. For example, the cost per thousand user views (CPM) of advertisements placed on Tmall has increased on average by 60 percent since 2017.

Tapping into Taobao's social tools has been the real game-changer for sales.

Meanwhile, Tmall has been investing big in its overseas fashion week events to position itself as the Chinese gateway for international fashion brands. At the latest Paris Fashion Week, Tmall wrapped up its “China Cool” tour by showcasing Chinese brands Eifini and Peacebird.

"China Cool is our forward-looking vision for global fashion," said Jessica Liu, head of Tmall Fashion and Luxury at Alibaba Group. "We selected emerging and established brands who we think could have real international appeal. We have a unique role to play in this space and can be instrumental for China Cool to be discovered and enjoyed worldwide."

Cashing in on Alibaba’s Analytics

"On Tmall, there are these big [Chinese] brands like JNBY, Mo&Co., [and international brands like] Diesel. They have these big budgets and can buy a lot of marketing on the platform [but] Babyghost is a niche market," Huang says.

Much smaller Chinese brands such as Babyghost and Ms Min have been able to cut through the noise on Alibaba's platforms because of their strong communities, groups that have been built, not on the back of advertising, but through social engagement across multiple online platforms and through intimate offline gatherings.

“We know the girl we want [to target so] we just use the algorithm to talk to more specific people,” Huang says, adding that Alibaba’s data can tell them details like whether users recently became parents, or even their zodiac sign.

Tapping into Taobao’s social tools has been the real “game-changer for sales” for Babyghost this year, according to Hupper.

The brand hired an in-house live-streamer in April, a 23-year-old former super consumer of the brand who streams from a studio space set up in Babyghost’s Shanghai showroom from around 4:30pm to 10:30pm daily, trying on clothes, answering questions about fit and fabrication in real time, essentially, giving prospective and existing consumers more of a sensory experience than is generally available to online shoppers.

The embedding of social functions within platforms such as Taobao and Tmall has been a response to the rise of social commerce platforms such as Xiaohongshu and Pinduoduo.

“It makes sense for [some Chinese independent young designer] brands to start on Taobao. If independent designers are conservative and just want to sell wholesale, it won’t be good for your business. If you have a flagship store online, you can control your image, you can target your customers and have the right linkage with them,” Tasha Liu advises.

Global brands can draw the same lesson. Those who simply treat Taoabao and Tmall as e-commerce sales channels, as opposed to the social marketing platforms that they are fast becoming, will have a harder time competing with the rising generation of Chinese brands fluent in the latest functions of these giant platforms.

“International brands [still] don’t know how to play with their customers within the Taobao and Tmall system,” Tasha Liu says. “Social isn’t just about Weibo and WeChat [anymore].”

Additional Reporting by Christina Yao

Related Articles:

[ Forget Luxury, Cheap Clothes Mean Big Money in ChinaOpens in new window ]

[ Keeping Pace With the Changing Chinese ConsumerOpens in new window ]

[ Want to Reach Chinese Teens? Take It OfflineOpens in new window ]

With consumers tightening their belts in China, the battle between global fast fashion brands and local high street giants has intensified.

Investors are bracing for a steep slowdown in luxury sales when luxury companies report their first quarter results, reflecting lacklustre Chinese demand.

The French beauty giant’s two latest deals are part of a wider M&A push by global players to capture a larger slice of the China market, targeting buzzy high-end brands that offer products with distinctive Chinese elements.

Post-Covid spend by US tourists in Europe has surged past 2019 levels. Chinese travellers, by contrast, have largely favoured domestic and regional destinations like Hong Kong, Singapore and Japan.