The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

NEW YORK, United States — In the fashion start-up boom of the last decade, every new brand had its own unique origin story. But most had one thing in common, at least in the official corporate history: a charismatic founder who, with nothing but a dream and boatloads of venture capital, nurtured their love of minimalist sneakers or vintage-inspired fast fashion into a thriving apparel empire.

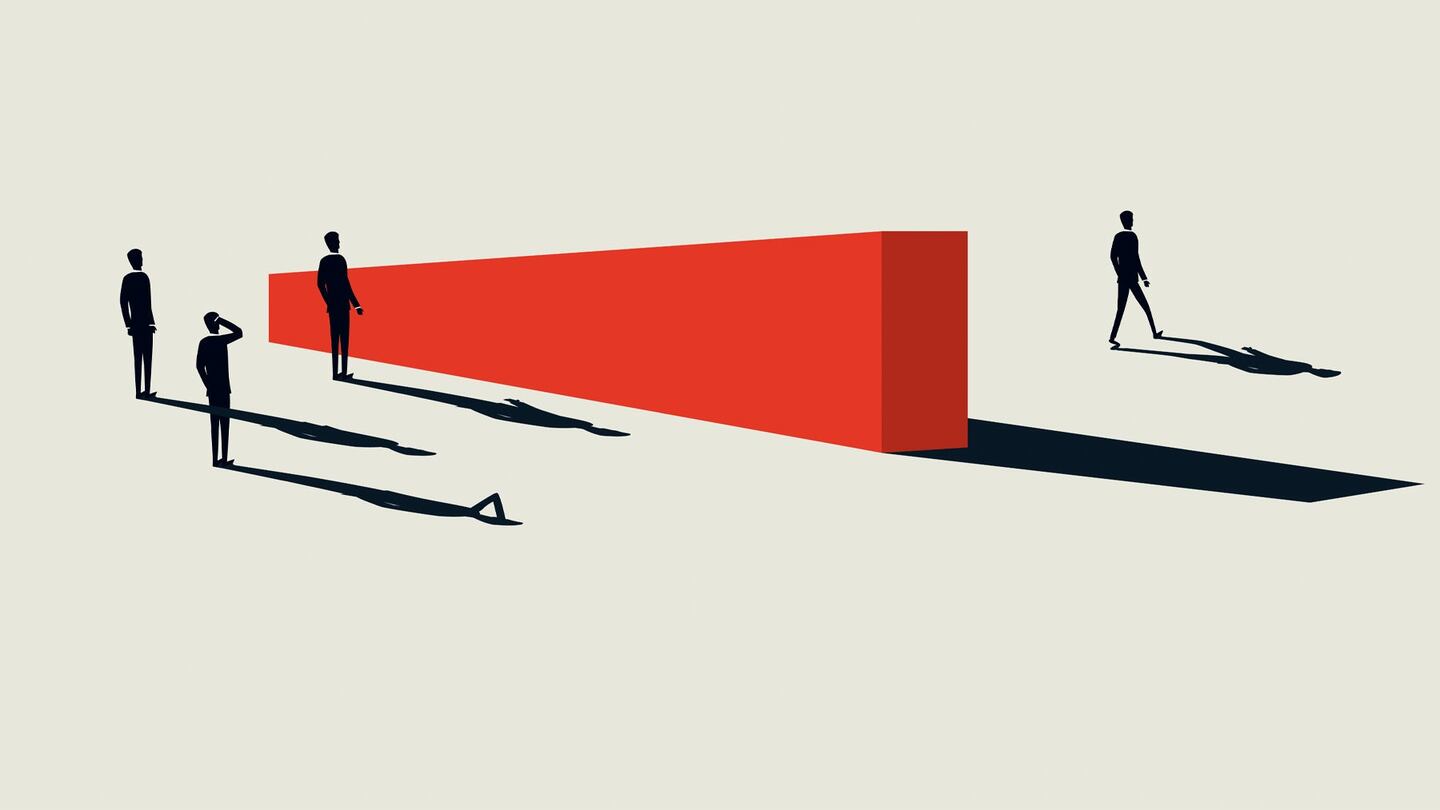

What happens after the founder leaves — or is forced out — is a story that gets told less often. But it’s time for the industry to start reading up: there were a record number of chief executive departures at US companies in 2019, with over 1,600 exits, according to executive outplacement firm Challenger, Gray & Christmas, which began collecting this data in 2002.

In fashion, founders have exited maturing start-ups like Away and Outdoor Voices (though in both cases the executives had second thoughts). The pandemic and protests have increased scrutiny of corporate culture, leading to the ouster of founders at Ban.do, Reformation, Refinery29 and more.

Each one of those steps [of growth] require different skill sets from the CEO and their direct reports.

Often, these figures were not only chief executives but also their chief fundraiser, chief creative officer and chief brand ambassador. Their successors must often build, almost from scratch, the corporate structures needed to manage day-to-day operations at a large, fast-growing company. At the same time, they must preserve the magic that got the business there in the first place. How those tasks are handled can make or break a company.

ADVERTISEMENT

“Each one of those steps [of growth] require different skill sets from the CEO and their direct reports,” said Steve Blank, author of a number of books on entrepreneurship. “And what it looks like from the outside is sometimes messy.”

BoF looked at how three companies handled a founder stepping down or assuming a new role.

Thinx

Thinx, which sells menstruation underwear, found quick success with provocative branding and unique products. However, Founder Miki Agrawal left the company in 2017 amid allegations of a toxic company culture, erratic behaviour and mismanagement.

Shama Amalean, then chief operating officer, took over as interim chief executive while the board looked for a permanent replacement. The immediate priority was to build a more professional environment. Thinx initiated a search for a head of human resources at the same time it was looking for a chief executive.

“We indicated to the organisation and made a commitment as a leadership team that this is how we wanted to professionalise the company going forward,” said Amalean. “It takes a long time and effort from every individual in the organisation and a concerted effort from leadership.”

Maria Molland was hired as chief executive in July 2017. A veteran of Dow Jones, Yahoo and eBay, she brought a more traditional skill set than Agrawal, with experience building and scaling companies, as well as a large professional network to recruit talent and advisors.

Amalean, who is again interim chief executive while Molland is on maternity leave, described the transition as “seamless.” The company outlined new parental leave and anti-discrimination policies, and sent out bi-annual engagement surveys to employees.

ADVERTISEMENT

In addition to tackling the company's internal culture, Molland made adjustments to fundamental aspects of its strategy as well. She shifted the company away from a solely direct-to-consumer model and into wholesale accounts like Nordstrom and Selfridges, expanding Thinx's presence internationally.

After Molland took over, the company closed out 2017 with $39.6 million in revenue. At the end of 2018, revenue grew 25 percent to $50 million, with London marked as the company’s second-largest market behind New York.

A founder's departure can signal to employees the new direction the company is taking.

Recent Glassdoor reviews of the company indicate Thinx hasn’t entirely solved its culture problems. Employees on the site said the company is “PR focused rather than people focused,” lacks diversity and is disorganised. In response, Thinx created channels for employees to ask questions and voice concerns to senior leadership anonymously. Amalean added that the company has recently hired an external consultant to review some of the issues raised in reviews, and is “embarking on a long term DEI [Diversity, Equity, and Inclusion] roadmap” to improve.

Moda Operandi

Áslaug Magnúsdóttir co-founded luxury site Moda Operandi in 2010 with Lauren Santo Domingo. The company grew quickly, and raised $36 million in a Series C round of funding led by RRE Ventures in 2012.

Scaling quickly, however, fed cultural differences between the two founders, and Magnúsdóttir made the decision to leave in 2013.

“We got to a place where there were two cultures within the company,” said Magnúsdóttir. “And that’s not something that works for long term success.”

Moda Operandi declined to comment.

ADVERTISEMENT

Funding rounds are inflection points for young companies, and often a time when founders should evaluate their role in moving the company forward. Magnúsdóttir said she liked the “early stages” of building a company, and would have eventually stepped down as the company grew, regardless of her relationship with Santo Domingo.

“It’s an incredibly difficult decision for people to make, I think because of how much people wrap their identities up in their start-ups,” said Aaron Harris, partner at accelerator Y Combinator, which invests in early stage companies. “But when it happens, and it’s done well, it creates a really fantastic and powerful situation.”

A founder’s departure can signal to employees the new direction the company is taking. Moda Operandi’s Series C round, for example, indicated it was time to scale.

Deborah Nicodemus, formerly chief merchandising and marketing officer at Canadian jewellery retailer Birks & Mayors, took over as chief executive, using her expertise to build out operational aspects of the business and bring on new talent.

Nicodemus brought on a new, more traditional merchandising and planning team, which previously was primarily comprised of former fashion editors and a who’s who of fashion legacies. She also expanded product offerings, including a foray into fine jewellery.

In 2018, after the company raised $165 million and was preparing to expand internationally, former Tesla executive Ganesh Srivats assumed Nicodemus’ position. Srivats supervised global growth development at Tesla, and fit the company’s new demands for expansion within the Chinese market and a stronger emphasis on consumer data.

Srivats has also updated the company’s executive suite to meet the expansion: hiring experienced team members from Tesla, Grubhub and Etsy.

Moda Operandi has struggled to implement the latest phase of its strategy, however. The company recently shuttered its menswear business, and laid off roughly 50 people earlier this year.

Santo Domingo stayed on with the company as chief brand officer, and has continued to operate as the face and authoritative aesthetic voice for the company. She’s listed as the leader in the company’s “About” section and her curated picks of each season are represented in the “Lauren’s Closet” section of the website.

Under Armour

For larger, more established companies, leaving or assuming a new role within the company can involve a longer transition process that takes months or years to execute.

Kevin Plank stepped down as Under Armour's chief executive in October, over 20 years after founding the activewear brand. His replacement was Chief Operating Officer Patrik Fisk, who had been with the company for two years. Plank stayed on as executive chairman and brand chief.

The transition came at a difficult time for Under Armour, which had seen declining sales and a series of controversies surrounding company accounting practices, employee expense accounts and Plank’s political views and behaviour towards women.

Under Armour declined to comment.

The company has struggled recently, even as rivals like Nike and Lululemon have benefitted from the boom in casual clothing sales during the pandemic.

The executive transition has been relatively smooth, however.

“Patrik has a tremendous amount of respect from the company both from Plank and the employees,” said Matt Powell, a senior analyst with research firm NPD Group. Frisk is credited with executing a tighter control on inventory, product planning and expenses since joining the company.

Frisk represents a more traditional, pragmatic approach to Plank. Some of the founder’s more recent gambles, including a record-breaking $280 million contract with UCLA that Under Armour recently announced plans to terminate, haven’t paid off.

Frisk, who has decades of experience within the footwear and apparel industry and served as chief executive of Aldo Group before joining Under Armour, can further streamline the company and usher in a more conservative, cost-cutting approach. The company has plans to cut $325 million in operating costs and $60 million from capital spending this year.

“I think he’s really set the company on the right path operationally over his tenure,” said Powell.

Powell doesn’t see Plank leaving the company completely, but believes he’s given Fisk autonomy to see the company to recovery and success.

“I don’t ever see him completely exiting, but at the same time I don’t see him deeply involved in the day to day decision making,” he said. “This was his baby.”

Related Articles:

[ Corporate Activism Put to the TestOpens in new window ]

[ As Brands Rush to Speak Out, Many Statements Ring HollowOpens in new window ]

Designer Carly Mark sparked conversation about what it takes to make it as an emerging designer in New York when she announced she was shutting her ready-to-wear line and moving to London. On Thursday she held her last sample sale.

To stabilise their businesses brands are honing in on what their particular consumer wants to buy, introducing new categories and starting conversations.

That’s the promise of Zellerfeld, a 3D-printing partner to Louis Vuitton and Moncler that’s becoming a platform for emerging designers to easily make and sell footwear of their own.

With a new heavyweight backer in Italian firm Style Capital — which helped Zimmermann secure a billion dollar valuation — the French contemporary womenswear brand has ambitions to go global. But it sits in a competitive and hard-to-crack category.