The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

When Joseph Sartre worked in China in the mid-2010s, he noticed that people there were using all kinds of apps and platforms to shop. He wondered when the West would catch up.

For Sartre, a venture investor specialising in early-stage start-ups, it wasn’t an idle question. Last month, he announced his new fund, Interlace Ventures, alongside partner Vincent Diallo. With $14 million in capital, their goal is to identify and invest in “the next Shopify at its earliest stage,” whatever form that might take.

Interlace is typical of the current wave of venture capital flooding into fashion and retail. Where a few years ago funds were on the hunt for the next great brand, retail services and technology companies are finding the warmest reception in Silicon Valley these days. For investors, Shopify, an e-commerce services company that helps brands set up online shops and which benefitted enormously from last year’s e-commerce boom, is the new Allbirds or Glossier.

“Anybody could create a brand these days,” Sartre said. “We’re looking for ways for legacy brands and existing brands to be more efficient.”

ADVERTISEMENT

Anybody could create a brand these days. We’re looking for ways for legacy brands and existing brands to be more efficient.

Global venture investing hit an all-time high in the first quarter of 2021 and shows no signs of slowing. In fashion, much of that money is going toward start-ups looking to solve the problems faced by brands that were the recipients of previous waves of funding. E-commerce marketing platform Yotpo, addresses the problem of building strong connections with consumers with services related to customer reviews, loyalty programmes and text messaging. It raised $230 million in March, with a valuation of $1.4 billion. Bloomreach targets the problem of the endless grid of products with its use of AI to help retailers personalises search and product recommendations. It raised $150 million in January. GoPuff addresses the problem of consumers’ rising expectations for order fulfilment with warehouses positioned to deliver orders within 30 minutes. It raised $1.15 billion in March.

The focus on services is also an acknowledgement by some investors that the online market is too crowded with brands, making it harder to predict which new natural deodorant or athleisure line will become the next unicorn.

“Think about [retail] companies worth over $10 billion in the past 10 years. I can’t think of one on the product side,” said Nick Brown, managing partner at Imaginary, which has backed Skims, Mejuri and other brands. “Look at the valuations of Shopify, the valuation of Stripe on the payment side and the valuations of Attentive, Afterpay and Affirm… [Some of] these are not only $10 billion businesses but $100 billion businesses.”

That’s not to say there aren’t new brands looking for the next “unsexy” category that can be given a digital, Gen-Z makeover. Nail care accessories and other hygiene-related products are hot right now, according to Sam Kaplan, investor and a former partner at Burch Creative Capital. But to overcome investor scepticism, these companies must prove they can stand out from the pack and have a clear route to scale.

“The last decade was really defined by direct-to-consumer and the ability for more and more people to start their own brands,” said Jason Bornstein, principal at Forerunner Ventures and Bonobos alum. “And so for us, the focus has shifted in the next decade to thinking about the [longevity] of brands.”

From Brands to Services

Brown described Imaginary’s shift in focus for its new investments as a natural evolution.

“Over time as a byproduct of investing in a lot of consumer product companies, you start to understand the pain points,” he said. “It could be payments, communication between wholesalers and brands, influencer tools and analytics — anything that’s forcing a brand to be better at what they do.”

ADVERTISEMENT

There’s no shortage of opportunities. As the e-commerce landscape has become more saturated, brands are struggling with rising advertising costs and the difficulties of finding new customers once they’ve saturated their core demographic’s Instagram feeds with sponsored posts.

Sartre said he sees potential in companies that can serve as “enablers” by finding creative ways to get brands in front of potential customers. He cited Co-op Commerce, a service that allows brands to advertise on each other’s websites as part of the checkout process, which raised $5.8 million in a seed round that counts Shopify and Bonobos founder Andy Dunn as investors. Interlace is not an investor.

Bornstein pointed to Hightouch, a company that enables retailers to view their data across any business platform, from Salesforce to Facebook Ads, allowing all of their internal teams to be informed by customer insights and make smarter decisions around consumer needs. Forerunner is not an investor in Hightouch.

Investors are also looking at companies that provide speed and convenience to consumers, whose expectations around e-commerce rose during the course of the pandemic. The relentless e-commerce surge has created explosive demand for logistics startups that promise fast delivery to brand clients, such as GoPuff.

Sustainable Investing

The next era of retail investing will be defined by a widening consumer base. Millennials are reaching their earning prime, but their younger counterparts are beginning to gain spending power, too. And while Millennials made catchphrases like “sustainably sourced” and “ethically made” ubiquitous among direct-to-consumer brands, Gen Z will hold brands to those promises and have higher expectations, investors say.

Resale and companies that enable other forms of “recommerce,” such as reusable packaging, are a major focus for Interlace. In May, the fund invested in Treet, which helps brands set up peer-to-peer resale marketplaces. Late last year, Interlace participated in the Series A funding of Olive, a logistics company that consolidates orders from brands in reusable totes.

“It’s a much more comprehensive view of sustainability,” said Steven Himmel, partner at Vanterra Capital, which has invested in the likes of Bombas and Naadam. “[Gen Z] consumers are more aware of their waste, from food waste to fashion apparel.”

ADVERTISEMENT

Finding Their Niche

A decade into the direct-to-consumer boom, most major product categories have several start-ups — if not dozens — competing with established players. Going forward, brands need a unique speciality to stand out, investors say. Scrubs maker Figs, for instance, held its initial public offering in May and now has a market capitalisation north of $7 billion. Kim Kardashian’s shapewear brand Skims is hardly two years old but is now valued at $1.6 billion after its April funding round. Last week, it landed a deal with the Olympics to provide undergarments to all 626 female athletes competing this summer.

“It’s easier to be specific and more defined in your product range than more generalist,” said Brown.

Vanterra’s Himmel said his firm is also looking for companies that address a specific function.

“I don’t want to just wear any type of reading glasses, I want to wear reading glasses that adjust to blue light, like Felix Gray (one of Vanterra’s assets),” he said. “We’re diligent with opportunities in the functional apparel space, integrating tech into wearables.”

Customisation is another avenue of growth, according to Mike Duda, founder of early-stage investment firm and branding agency Bullish. He points to Function of Beauty, a customised hair and skin care brand, that has a reported $1 billion valuation and Bayer’s acquisition of supplements brand Care/Of in September.

New Forms of Distribution

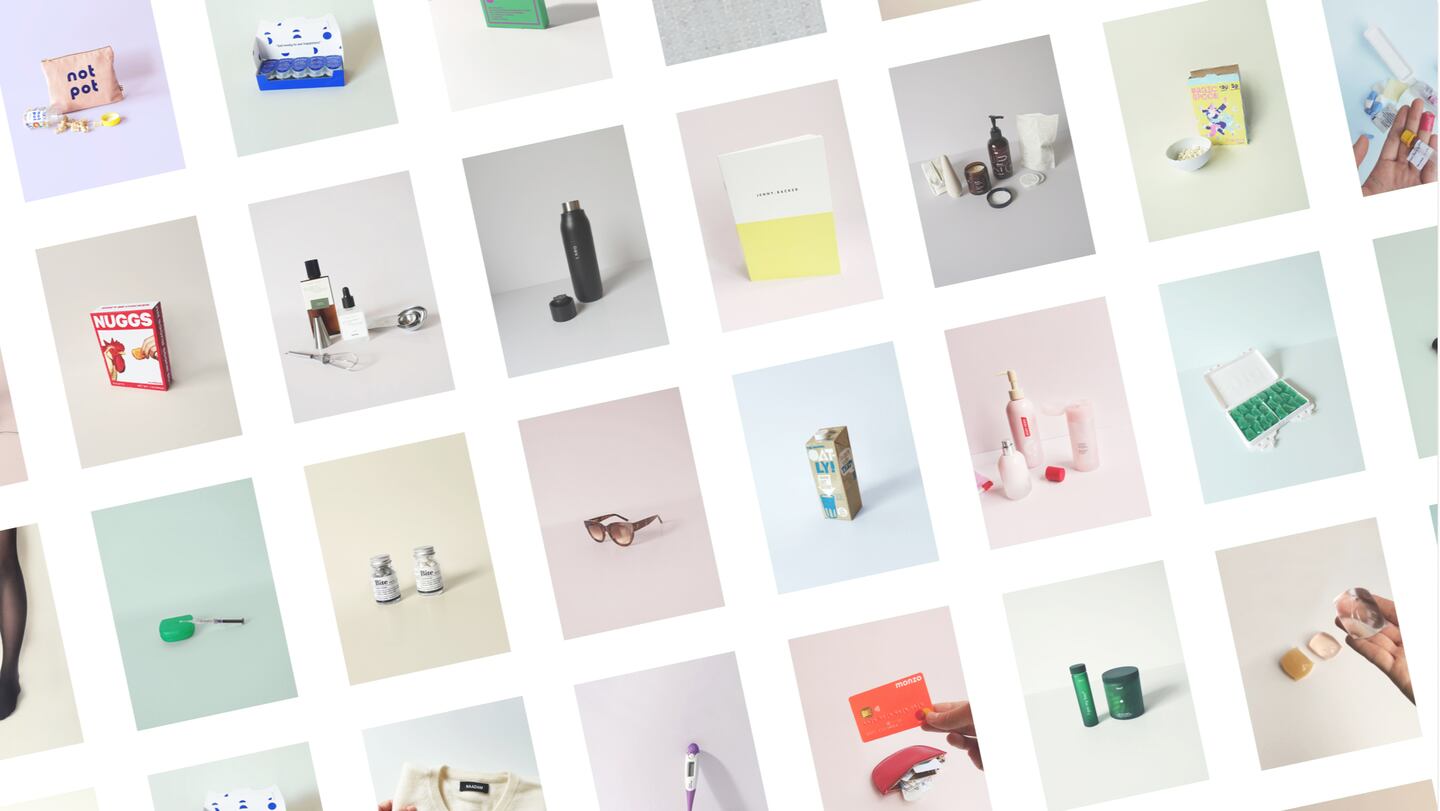

With so many direct-to-consumer brand choices today, there’s a new demand for product curation. In the past year, a number of multi-brand online retailers have emerged with the promise to help shoppers find and assess the hundreds of wellness labels and athleisure lines on the internet.

“The purpose of the department stores initially was to pull together all these products and brands with an edit [and] with a lens, and there was a convenience of having everything in one place,” Bornstein said. “There are amazing products and services that speak to consumers but because there are so many of them, there’s no context or ability to cut through the noise.”

Forerunner has invested in companies like Thingtesting, which began as an Instagram account that reviewed DTC companies, and The Yes, a shopping app that uses AI to personalise user shopping feeds.

“Early on in the firm’s history, [we saw] DTC as the product innovation,” Bornstein added. “But [looking at] the number of brands that are out there now trying to catch the consumer’s eye, if you can build an experience that allows them to shop the way they want to, that’s the future.”

Related Articles:

Where VCs Are Placing Their Bets

Designer Carly Mark sparked conversation about what it takes to make it as an emerging designer in New York when she announced she was shutting her ready-to-wear line and moving to London. On Thursday she held her last sample sale.

To stabilise their businesses brands are honing in on what their particular consumer wants to buy, introducing new categories and starting conversations.

That’s the promise of Zellerfeld, a 3D-printing partner to Louis Vuitton and Moncler that’s becoming a platform for emerging designers to easily make and sell footwear of their own.

With a new heavyweight backer in Italian firm Style Capital — which helped Zimmermann secure a billion dollar valuation — the French contemporary womenswear brand has ambitions to go global. But it sits in a competitive and hard-to-crack category.