The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

NEW YORK, United States — Every day before the pandemic, designer Amy Smilovic and her husband, Frank Smilovic, took the train from Connecticut to the Wall Street offices of Tibi, the fashion brand they built into a $55-million-a-year business over two decades. And every day, Amy would contemplate a way out.

“Before Covid hit, there was not a day that my husband and I weren’t thinking, ‘If only we could only be as small and nimble and profitable as we were as a five-year-old company,’” she said recently via phone, working from her office once again as New York City emerges from the final phase of lockdowns. “Somehow, in all the million-dollar orders and the churn and the inventory, we would fantasise, ‘What’s the unwind here?’”

For years, the fashion industry has championed fast growth and ballooning sales, even at the expense of the underlying health and stability of the business. Tibi, which successfully pivoted in the early 2010s to better reflect Smilovic's own sharp, confident style, was one of countless brands swallowed by the system.

The designer said that, up until 2020, her label remained profitable — but where businesses in other industries often see margins grow as they scale, Tibi’s shrank. The company was spending an average of $49,000 per day, including cost of goods and operating goods. Rent for her single retail store, in SoHo, is $1 million a year. Rent on the corporate offices is also $1 million a year. The couple, who had relied on bank loans, not outside investors, for funding, were dreaming of the day when they could do the once-unthinkable: shrink the business to a more manageable size. They used their office lease, up in five years or so, as a benchmark.

ADVERTISEMENT

Those fantasies became an unexpected reality on Friday, March 13, as New York prepared for its first phase of government-mandated lockdowns. Smilovic swiftly laid off over half her staff — more than 40 people — some of whom had worked for her for more than a decade. Her only choice, she believed, besides insolvency, was to make severe cuts. After all, her fabric orders for the Pre-Fall and Fall seasons were already paid for, over $4 million that would be near impossible to recoup.

It was painful, making those phone calls, in one day, in succession. But in some ways, Smilovic got her wish: a smaller, leaner team, and an opportunity to do things differently. “All of the sudden, we were back to 2005,” she said.

Not every designer will be granted such a reset. The global pandemic, which has brought on a severe recession, has swiftly transformed consumption habits. Like many industries that rely on people spending money on things they don't technically need, fashion is set to shrink about 35 percent this year, according to a report released by BoF and McKinsey.

This will be devastating for even the most protected brands, but there are many — even perhaps the majority — that were in Tibi's situation pre-pandemic: outwardly successful and internally facing looming financial cliffs and burnout. The pandemic made it impossible to pretend the fashion system was still functioning. Brands face tough choices in the months and years ahead. Those that manage to survive must ask themselves, what does a healthy business even look like?

What Remains

The industry wasn't always so broken. Over the past 20 years, high-end fashion transformed from a cottage industry of family-run businesses to a global sector controlled by just a few groups that made their fortunes selling high-margin accessories to fast-growing consumer markets, like China. Conglomerates LVMH, Kering and Richemont — combined with two large independent brands, Hermès and Chanel — controlled about 40 percent of the €281 billion market for personal luxury goods in 2019, according to a BoF estimate. Post-pandemic, it's likely that those groups, especially LVMH and Kering, will become even more dominant as independent players are wiped out.

Today, consumers can buy jeans, T-shirts and other closet staples for less than $10 apiece. To compete, designer garments are often discounted so drastically that, despite the initial high markups, it’s increasingly difficult to profit from them at all.

This means that many fashion brands are operating on margins so slim that they didn’t have the cash reserves to sustain the business for even a short period of time when the lockdowns hit. At the beginning of the pandemic, one American chief executive of a billion-plus dollar brand told me that, without layoffs, the company would be insolvent within months.

ADVERTISEMENT

This way of working is particularly prevalent in the US, where the retail industry has been drowning in debt for years, forcing closures and bankruptcies. Barneys New York, Opening Ceremony, Lord & Taylor, Need Supply, Totokaelo, Jeffrey: these stores, on which many fashion brands relied, are gone — often leaving unpaid bills with their shutterings. Neiman Marcus filed for Chapter 11 bankruptcy protection. Saks Fifth Avenue and Nordstrom have closed stores and laid off employees.

Because of the diminished perceived (and real) value of many fashion brands, few investors are interested in rescuing them. A significant number of labels are already backed by private equity firms or venture capital, meaning that they were incentivised to grow at any cost in order to get big and prominent enough to be sold to a larger group. Those acquisitions were already few and far between. But now they will only likely happen at a bargain-basement price.

Even brands at the apex of American fashion, with glitzy, global name recognition, are being dragged down. For instance, The Row, the quiet-luxury label independently owned by Ashley and Mary-Kate Olsen, was estimated to have surpassed $100 million in annual sales by establishing extensive global distribution and offering a tremendous number of different styles each season. It is one of just a few luxury brands outside the major groups that has managed to build a significant business in shoes and handbags over the past decade — and all the while being based in the US, a region whose marquee names have struggled to obtain true luxury status.

But when Barneys New York filed for bankruptcy in 2019, it owed The Row more money than any other label: $3.7 million. The brand laid off several longtime staff members this year and has considered closing its ready-to-wear line to shift solely to accessories, according to people familiar with internal discussions. In the end, the company chose to continue producing all categories, including menswear, which it launched in 2018.

This is just one example of a brand that appeared untouchable — burnished by unwavering editorial support, impeccable retail stores, a strong distribution footprint and the founders’ presumed personal wealth — reckoning with some of the same questions its less-desirable counterparts are facing. Many American fashion businesses may contract by 50, 60 or 70 percent this year, far exceeding the industry-wide average. Those that rely on multi-brand retail, rather than their own sales channels, will be hit hardest.

The natural inclination might simply be to give up.

"A lot of businesses are going to crash," said Michael Williams, a marketing and retail consultant who has advised brands including Patagonia and Tracksmith, and writes the popular blog-turned-newsletter A Continuous Lean. "They don't have enough of a reason to exist."

As the industry has changed, so have the skills needed to operate successfully. Designers need to be creative marketers and commercially minded in order to sell products to consumers. Creative genius-types who lack an interest in how their clothes are presented beyond a runway rarely get the top jobs these days. Instead, they serve as part of the support team.

ADVERTISEMENT

For designers willing to straddle the creative-business divide, this year’s upheaval is an opportunity to win back control.

“There’s been a lack of honesty in the industry,” said Sarah Law, founder of the hardware-forward accessories label Kara. Since starting in 2013, Law has eschewed many of the traps in which many of her peers have fallen, from overspending on publicity to accepting unfair retailer terms.

“There are a lot of designers and people who have been suffering for a while, and have hidden it for the sake of press and the industry itself," she said.

While the details will be different for each business, "what has to go out the window is [caring] about the perception of the brand," said Julie Gilhart, president of Tomorrow Consulting, which advises labels and start-ups. "You hear people saying that they need to do this" — stage a fashion show, sell at a certain retailer — "because if they don't, it won't look right. That's out the window. What you're working towards is surviving and being the most authentic to your situation."

It’s time to get rid of the “shoulds” and go into positive crisis mode, Gilhart said. “You have to think about what you like doing, and what can create revenues and help keep people employed.”

Selling in New Ways

Fear of God designer Jerry Lorenzo, who is based in Los Angeles, hasn't released a ready-to-wear collection in two years. Instead, he finances his independently owned business, which was founded in 2013 and is profitable, with a staples line called Essentials as well as collaborations, including a recent partnership with Ermenegildo Zegna. While other designer labels were releasing six or more concepts a year, Lorenzo used his self-imposed flexibility to develop his seventh line, revealed in mid-August, over an extended period of time. He worked with a factory in Los Angeles to create the exact finish he desired on Japanese selvedge denim, and established relationships with Italian factories to introduce suiting and superior wovens and knits into his repertoire.

“It takes a while to put the pieces together to propose something that is worthy of sharing,” he said recently during an appointment in his LA showroom. “I truly believe the product will make room for you… So whether it comes out in August or December, it’s just as valid.”

For Smilovic, selling things differently meant not only building a smaller spring collection — her design team now consists of four people, down from nine — but also experimenting with new business models, including pre-ordering, a way to better manage inventory by getting an upfront commitment from the customer. While many brands ask for money in advance of the collection being manufactured to help pay for production, Smilovic doesn't. Instead, she's using the reservation system to gauge demand, sending that information to retailers so they know what styles are trending in her direct channels. To save on production costs during the pandemic, she has sometimes used the leftover fabric from her Pre-Fall and Fall order.

And when it comes to retail, Smilovic has exited most department stores, which she compares to loan sharks.

“Even as terrible as many of our department store relationships had gotten, you could not extricate yourself from them because you owed them so much on past deliveries,” she said, referring to the way stores often charge brands fees for everything from unsold or discounted product to items that showed up on the wrong hangers. “Then, all of the sudden, you were able to break the cycle.”

Tibi now has limited partnerships with Neiman Marcus and Bergdorf Goodman — on significantly better terms, she said — and Saks Fifth Avenue, where the brand is stocked at just two stores. She's more focused on maintaining relationships with hyper-focused specialty retailers. Last year, direct-to-consumer sales made up 26 percent of the overall business. Next year, she'd like it to be 50 percent.

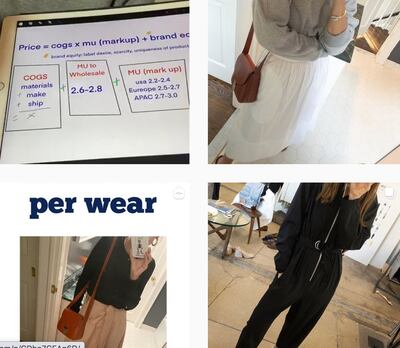

Tibi's Smilovic has transformed her own Instagram into a frank mix of business and personal advice | Photo: Instagram

Smilovic, who had already begun to understand the power of selling product via social media, has turned her personal Instagram account into a masterclass for aspiring designers and start-ups, breaking down everything from calculating the cost of goods and setting prices to what it means when someone accuses her of copying. For consumers less interested in industry mechanics, she has simultaneously built a reputation for offering frank, inspired advice on dressing and wardrobe-building. She's now selling sponsorships for Instagram Live events instead of a runway show, and envisions that Tibi's future is as much in content as it is in clothes. Her only hire during the pandemic has been a filmmaker.

Many labels are also seeing opportunity in the new crop of marketplaces that have emerged, from The Yes to Not Just a Label's NJAL+, which offer the exposure multi-brand retailers afford but operate on a commission basis, meaning that brands get to keep more of the profits. The largest and best-known luxury fashion marketplace, Farfetch, has often garnered a commission between 20 and 25 percent, a sliver compared to what's lost when a brand wholesales its goods to a department store. The cost of goods sold on the site increased to $721 million in the second quarter of 2020, up 48 percent from a year earlier. Much of that revenue was handed over to Farfetch's retail and brand partners.

Right now is a time to experiment. What’s most different today is that, in the past, there was a formula to follow, even if that formula didn’t always compute. Now, there is no formula.

Really, Actually, Thinking About Costs

Even if a designer manages to find new ways to make money and new places to sell their goods, profitability requires discipline, something many small business owners lack.

“A small brand generating $500,000 to $10 million a year should be able to be profitable,” said Gary Wassner, chief executive of Hilldun Corporation, a factoring firm. Designers often need the money they’re owed by department stores up front in order to produce their goods and keep the business running, but contracts often say that the store doesn’t have to pay until 30, 60 or 90 days after the product is delivered. Designers sell their invoices to Hilldun for a fee so they don’t have to wait. Hilldun also helps finance direct-to-consumer businesses by offering a line of credit.

Hilldun profits off of the fees and loan interest designers must pay to access these services. The company benefits from the convoluted way fashion currently operates. But Wassner would not have a business without independent brands — they make up the majority of his clients — and he has spent much of the pandemic talking with companies, figuring out new ways to keep them afloat.

Profitability, he said, often requires a bit of sacrifice.

“Good product is always the first and foremost reason for a successful business,” he said. “They must understand the production process, the sample process and how much they should be spending on product development and sampling. They really need to examine the [profit and loss statement] closely to see where they are leaking money.”

This is easier said than done, especially given the whimsical, often ludicrous expectations put upon designers to achieve out-of-this-world runway garments that serve as marketing for more commercial products. Development also helps a designer work out the kinks in an item. (It took accessories label Mansur Gavriel more than two years to develop its first two bags, which are the foundation of the company’s success.)

A look from Fear of God's seventh collection, which took two years to develop | Photo: Gregory Harris

“We overspend in research and development, we overspend on prototyping,” Lorenzo said. Consistent sales of Fear of God’s core collection has given him that freedom. The company is profitable, he said.

For those that don't already have such a strategy in place, however, certain extras will have to be more closely considered. One way Tibi is cutting costs is by saying no to "exclusive" colours or styles often requested by retailers, meaning they are produced specifically for that store, and often to the detriment of the brand. (If a style doesn't sell, the brand will have to pay back the store for the leftover goods.)

“I will never do that again in the future,” Smilovic said. “You’re basically funding the company’s private label.”

Wassner, who has also invested in Jason Wu and A.L.C., said that brands need to think beyond gross margin and consider how much it will cost them to develop these types of products.

“You can’t live and die by what a buyer might say they want,” he said. “You need to say, ‘This is where I draw the line.’”

Law believes that it’s about being cautious and conservative. Like many young upstarts, she said Kara grew too quickly in the beginning after one hit bag propelled her forward. In less than two years she had seven employees and 50 store accounts. After recalibrating in 2017 following a few tough years, she employs just four people — five, before the pandemic — and manages a retail network of 45 stores, plus her own e-commerce.

“The pandemic has given us permission to do what we’ve already been doing,” she said. “I make plans on what I believe I can be responsible for accomplishing... it doesn’t always make me the coolest person in the world but I can keep doing what I really love.”

Now or Never

"The industry is in a unique position," said Rosie Assoulin, who sells two unique collections — and, like many fashion designers looking to put their creative energy into things other than garments, recently ventured into the wine-making business. "It can choose to finally change, or keep going on with business as usual. But I'm also not sure what that means. I know it's a pivotal moment, but we can't really see it because we're still in it."

For many brands, taking practical steps will not be enough to guarantee survival. For others, there will be financial advantages that allow them to remain in business for the time being without making the changes necessary for long-term health. But in order for independent brands to maintain their place in an ever-consolidating industry, the majority will need to operate in a more responsible, more innovative way.

"You can no longer live market to market, worrying about cash flow,” said Karen Harvey, an industry consultant and recruiter who runs a namesake firm. “It's critical to elevate your thinking above this inherent stress and find your brand's purpose and reason for being, so that you can then think a bit differently and adopt best practices that were not necessarily born in this industry.”

Responsibility also means social responsibility. As the industry faces a financial reckoning, it is also facing a moral one, forced to finally acknowledge that its patina of glamour and exclusivity has marginalised those without the wealth, class or connections to join its ranks — especially people of colour.

A user-generated image on Kara's Instagram account x image consultant @thetrillestb | Photo: Instagram

“Fashion doesn’t have to be so elitist and constantly cutting people out,” said Law, who has worked to make Kara feel inclusive since its inception, not only in its storytelling, but also in the designs, which are meant to appeal not to one aesthetic niche but rather to complement the owner’s personal taste.

“Brands are going to be better,” Williams added. “They’re actually paying attention to social issues in a real way now.”

Independent brands should also consider the advantages of being untethered. “They don’t have to be on the calendar, they don’t have to have a certain amount of SKUs,” Lorenzo said. “They have the freedom to express themselves at the highest level to what is most honest to who they are. Time is going to reveal who you are.”

Innovating can mean many things. It can be about adopting a new operating model, or something as simple and unsexy as incorporating predictive analytics into your inventory management. But it also means doing away with the “shoulds,” as Gilhart put it.

Smilovic, for one, is done with the game. “I’ve discovered that we are functioning much better as a much smaller company,” she said. “Big companies have the hardest time being authentic.”

Related Articles:

[ Independent American Fashion Businesses Are UnravellingOpens in new window ]

[ Is This the End of Wholesale, or the Beginning of Something Better?Opens in new window ]

[ How ‘Fashion’ Became a Bad WordOpens in new window ]

[ America Needs to Rethink Its Role in FashionOpens in new window ]

Designer Carly Mark sparked conversation about what it takes to make it as an emerging designer in New York when she announced she was shutting her ready-to-wear line and moving to London. On Thursday she held her last sample sale.

To stabilise their businesses brands are honing in on what their particular consumer wants to buy, introducing new categories and starting conversations.

That’s the promise of Zellerfeld, a 3D-printing partner to Louis Vuitton and Moncler that’s becoming a platform for emerging designers to easily make and sell footwear of their own.

With a new heavyweight backer in Italian firm Style Capital — which helped Zimmermann secure a billion dollar valuation — the French contemporary womenswear brand has ambitions to go global. But it sits in a competitive and hard-to-crack category.