The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

LONDON, United Kingdom – Tough comparables, as well as the uncertainty in regard to the outcome and impact of trade wars, have dampened the effect of yet another string of great results by the sector.

Big news

Whilst results have been strong, demonstrating continued growth in the first half of 2018, investors have been jumpy, over-reacting to a first half sales target miss by Kering and a warning by Moncler that continued momentum in the second half of 2018 might prove challenging.

Profits have been rising across the board, with some notable achievements: Kering first half operating profit up 53 percent, LVMH first half operating profit up 41 percent, Swatch first half net profit up 67 percent, to mention a few. In addition, Hermès’s announced that it sees first half profit margins matching the records it set last year. One could be forgiven for expecting the SLI to have soared, rather than inched up, this month.

ADVERTISEMENT

But there is a lot of uncertainty around at the moment, with conflicting views as to the outcome and impact of Trump's carpet-bombing of international trade agreements — and investors don't like this.

Beauty was flavour of the month with a total of seven transactions being announced in July: in colour cosmetics, Pat McGrath Labs, Kiko Cosmetics and Iconic London received investment from private equity firms Eurazeo, Peninsula Capital Partners and Blue Gem Capital Partners, respectively, and Butter London was acquired by Astral Brands. Skincare brand First Aid Beauty was acquired by P&G, soaps and fragrances brand Sabon Shel was acquired by Yves Rocher and Scandinavian cosmetics distributor Solis International was acquired by Scandinavian Cosmetics Group.

Two French heritage brands also changed hands in July: men’s underwear brand Eminence, founded in the 1940’s, was acquired by Israeli apparel group Delta Galil Industries and a portfolio of outdoor sports brands including ski goggles and apparel brand Bollé, founded in 1888, was acquired by private equity firm Alvarez & Marsal Capital. Other brands in the portfolio included Cébé and Serengeti Eyewear.

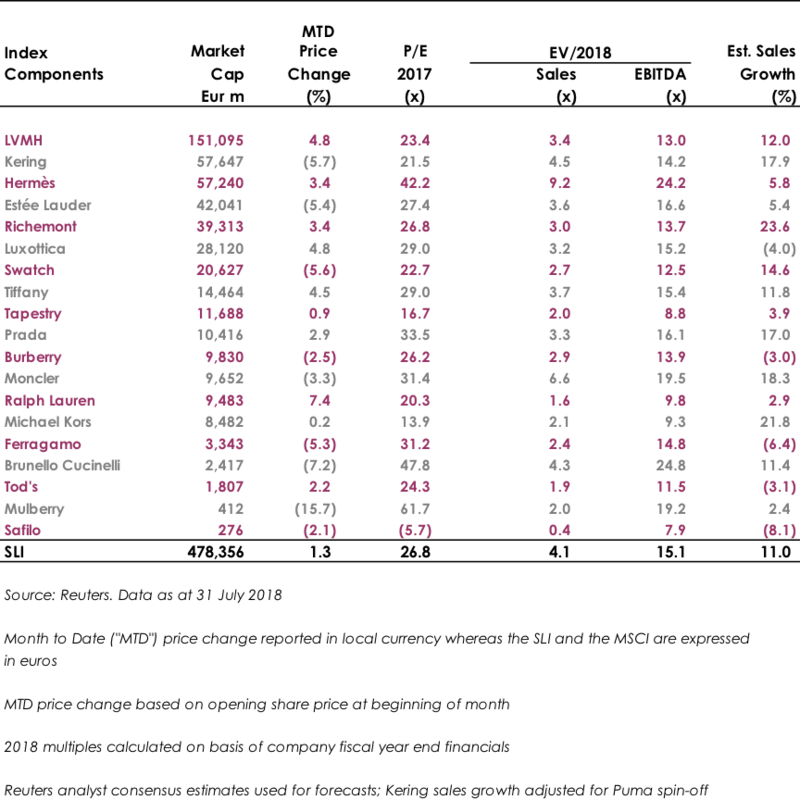

Volatility has returned to the Savigny Luxury Index (“SLI”) with strong results tempered by concerns over outlook and mounting global trade tensions. Our index rose 1.3 percent this month; nevertheless, this was a robust performance relative to a decline of 1.5 percent for the MSCI.

SLI vs. MSCI

SLI Graph July 2018 | Source: Courtesy

Going up

Going down

ADVERTISEMENT

What to watch

According to Research and Markets, the global online jewellery market is set to grow at an annual rate of 16 percent during the period 2018 to 2022. The opportunity here is with branded jewellery players, which still account for a small portion of global jewellery sales.

While the bigger players such as Tiffany will have an edge, smaller and more nimble players are likely to emerge. In the UK, Vashi, an online jewellery brand that has evolved into omni-channel retailing offering a less formal approach to buying jewellery, is creating waves. We would expect more of this to come.

Sector Valuation

In 2020, like many companies, the $50 billion yoga apparel brand created a new department to improve internal diversity and inclusion, and to create a more equitable playing field for minorities. In interviews with BoF, 14 current and former employees said things only got worse.

For fashion’s private market investors, deal-making may provide less-than-ideal returns and raise questions about the long-term value creation opportunities across parts of the fashion industry, reports The State of Fashion 2024.

A blockbuster public listing should clear the way for other brands to try their luck. That, plus LVMH results and what else to watch for in the coming week.

L Catterton, the private-equity firm with close ties to LVMH and Bernard Arnault that’s preparing to take Birkenstock public, has become an investment giant in the consumer-goods space, with stakes in companies selling everything from fashion to pet food to tacos.