The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

Hello BoF Professionals, welcome to our latest members-only briefing: The Week Ahead. Think of it as your 'cheat sheet' to what everyone will be talking about on Monday.

THE CHEAT SHEET

Prada Has Something to Prove

Prada store | Source: Shutterstock

ADVERTISEMENT

This week, investors will be closely watching Prada, which may signal a return to growth. But that may not be enough for lingering doubters, who say the brand is simply too small to play in an LVMH-dominated luxury market. Prada has solved its biggest shortcomings, boosting online sales and introducing the "Cloudbust" sneaker line to gain an overdue foothold in the streetwear market. But further concerted efforts may be needed to sustain that momentum. Take e-commerce as an example: whereas LVMH, Richemont and Chanel are investing in e-commerce platforms, Prada still relies on lower-margin (though admittedly buzzy) wholesale partnerships with Net-a-Porter and MyTheresa.

The Bottom Line: Sales growth would be a good start, but Prada needs to demonstrate it has a long-term plan to compete with the luxury giants online.

Instagram is the Future, and Always Will Be

Source: Shutterstock

The Bottom Line: Look closely at the ads and sponsored posts in your Instagram feed this week. If those ads appeared in the pages of your favourite glossy magazine, how would you feel about the magazine's financial trajectory?

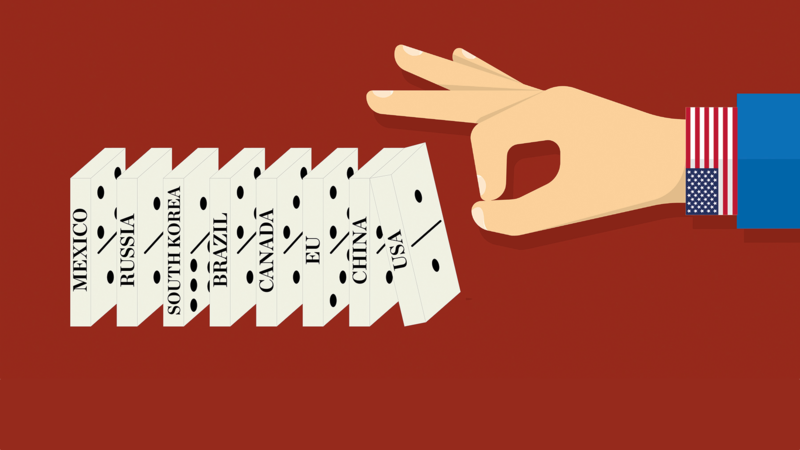

Tariff’s Bark is Worse Than Its Bite (For Now)

Illustration by Nerea Verdejo Blanco for BoF

The Bottom Line: Fashion isn't out of the trade war woods yet; US and European trade relations could still sour, and peace on the Western front could also give Trump leeway to pursue his trade war with China.

ADVERTISEMENT

Gucci store in Milan | Source: Shutterstock

The Bottom Line: Focusing on growth "slowing" to 40 percent is a distraction; as long as reference-heavy streetwear is in style and Chinese consumers keep spending, bank on Gucci as the industry's benchmark brand.

COMMENT OF THE WEEK

"Inclusivity means price. No amount of brainstorming, rebranding and catch-phrase concepts will ever change it. Simple as that. If you want to be inclusive, lower your entry level price points."

— @lukevault, commenting on "Is Inclusivity the next Exclusivity?"

SUNDAY READING

Professional Exclusives You May Have Missed:

From Around the Web:

ADVERTISEMENT

The Week Ahead wants to hear from you! Send tips, suggestions, complaints and compliments to brian.baskin@businessoffashion.com. We're also on the lookout for the best fashion-themed pop culture, so send us your books, music, tv and film recommendations as well.

Have you been forwarded this email? Get access to the exclusive insight and analysis that keeps you ahead of the competition. Subscribe to BoF Professional here.

In 2020, like many companies, the $50 billion yoga apparel brand created a new department to improve internal diversity and inclusion, and to create a more equitable playing field for minorities. In interviews with BoF, 14 current and former employees said things only got worse.

For fashion’s private market investors, deal-making may provide less-than-ideal returns and raise questions about the long-term value creation opportunities across parts of the fashion industry, reports The State of Fashion 2024.

A blockbuster public listing should clear the way for other brands to try their luck. That, plus LVMH results and what else to watch for in the coming week.

L Catterton, the private-equity firm with close ties to LVMH and Bernard Arnault that’s preparing to take Birkenstock public, has become an investment giant in the consumer-goods space, with stakes in companies selling everything from fashion to pet food to tacos.