The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

Hello BoF Professionals, welcome to our latest members-only briefing: The Week Ahead. Think of it as your "cheat sheet" to what everyone will be talking about on Monday.

THE CHEAT SHEET

Farewells and New Beginnings at Paris Fashion Week

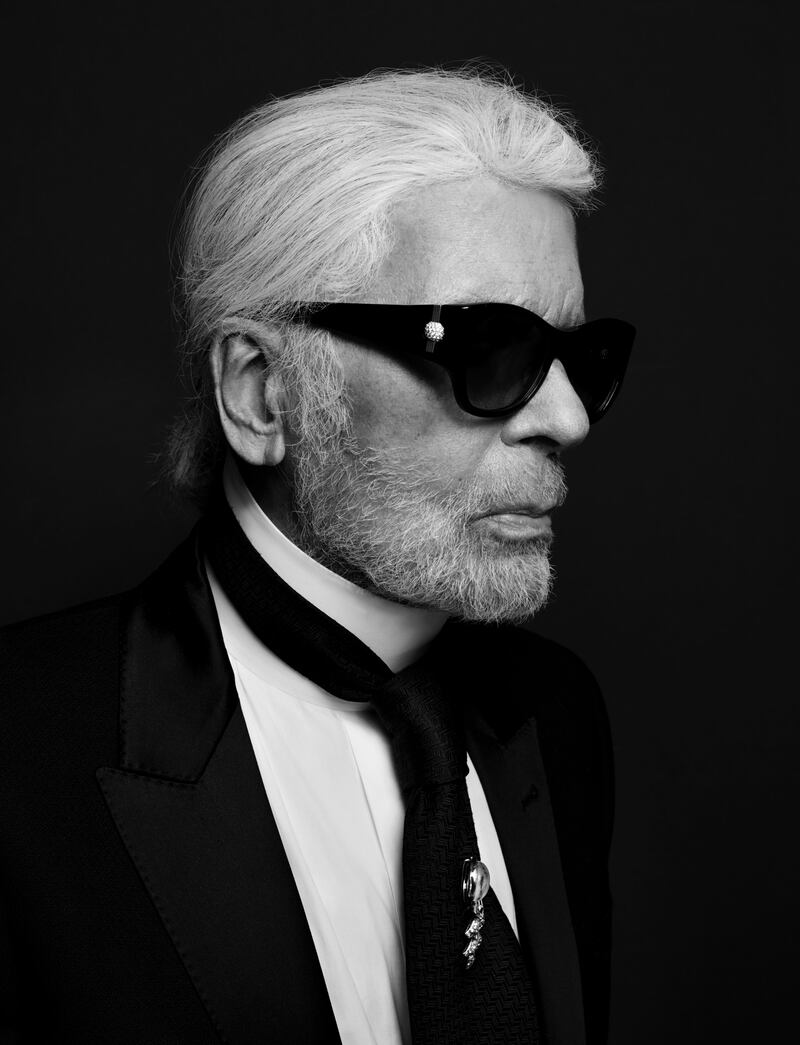

Karl Lagerfeld at the Chanel Autumn 2017 haute couture show in Paris | Source: InDigital.tv

ADVERTISEMENT

As the industry descends on Paris, the passing last week of the man who defined what it meant to be a designer for multiple generations will no doubt monopolise conversation between shows - followed closely by speculation about what Lagerfeld's death means for Chanel. The fashion house has yet to reveal the form or timing of its tribute to the designer (and their show isn't until March 5). Elsewhere, the week will bring hotly anticipated debuts at major brands, including Bruno Sialleli's attempted revival of Lanvin, and opens with new blood - Rokh, Jacquemus and Marine Serre show Monday and early Tuesday. Hedi Slimane's second Celine show is unlikely to be as shocking as his first, with the collection destined for new flagships in New York and beyond as part of LVMH's grand plan to turn the label into a €3 billion-a-year brand. And there's the usual corporate stunts - Evian is promising a "full collection" - presumably of water bottles - designed by Virgil Abloh, and Tommy Hilfiger's collaboration with Zendaya will show in an "experiential runway event."

Nobody Watches the Oscars Anymore. But the Red Carpet Still Matters

Lupita Nyong'o in Versace at the Academy Awards in 2018

The Bottom Line: The point of the red carpet is exposure, and social media offers more of that for iconic looks than ever (the flip side being that brands can achieve similar buzz when one of their paid stars makes a Starbucks run dressed in their clothes).

Retail Earnings Season May Take a Grim Turn

Gap store | Source: Shutterstock

The Bottom Line: These companies can tinker with their business models all they want, but it's the product that's the problem; mid-range basics, "sexy" marketing campaigns and budget department stores have gone out of style.

COMMENT OF THE WEEK

ADVERTISEMENT

A self portrait by Karl Lagerfeld | Source: Courtesy

"I can't help but think that he lived until his last breath immersed in his biggest pleasure: letting his imagination fly through his work." — Giorgio Armani

SUNDAY READING

Professional Exclusives You May Have Missed:

The Week Ahead wants to hear from you! Send tips, suggestions, complaints and compliments to brian.baskin@businessoffashion.com.

Was this BoF Professional email forwarded to you? Join BoF Professional to get access to the exclusive insight and analysis that keeps you ahead of the competition. Subscribe to BoF Professional here.

In 2020, like many companies, the $50 billion yoga apparel brand created a new department to improve internal diversity and inclusion, and to create a more equitable playing field for minorities. In interviews with BoF, 14 current and former employees said things only got worse.

For fashion’s private market investors, deal-making may provide less-than-ideal returns and raise questions about the long-term value creation opportunities across parts of the fashion industry, reports The State of Fashion 2024.

A blockbuster public listing should clear the way for other brands to try their luck. That, plus LVMH results and what else to watch for in the coming week.

L Catterton, the private-equity firm with close ties to LVMH and Bernard Arnault that’s preparing to take Birkenstock public, has become an investment giant in the consumer-goods space, with stakes in companies selling everything from fashion to pet food to tacos.