The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

BEIJING, China — Lisa Yan is the new face of the Chinese luxury consumer: female and fashion-forward.

The 26-year-old finance saleswoman checks social media daily to see what celebrities or friends are wearing. She wears Burberry coats, alternates between a light blue Valentino bag and a black Dolce & Gabbana one for work, and reads magazines such as Vogue before trying to replicate the newest styles.

While women have long dominated luxury shopping globally, they're just now catching up with men in China, who historically had greater purchasing power and accounted for most business- related gift giving. Companies from Chanel to LVMH Moet Hennessey Louis Vuitton SA are stepping up to meet demand from the country's new breed of female "fashion addicts," dedicating more floor space to women's wear amid a crackdown on expensive gifts such as watches.

“Its a rebalancing of the consumption between females and men,” said Mario Ortelli, a senior analyst at Sanford C. Bernstein in London. “Women are becoming more independent, becoming richer, and so are buying for themselves.”

ADVERTISEMENT

Men accounted for 90 percent of China's high-end purchases in 1995, according to industry consultant Bain & Co. Women now make up about half, Bain said in a report last month. That still trails the global average in mature markets, where female consumers account for about two-thirds.

Bain estimated China’s domestic luxury market to be worth 116 billion yuan ($19 billion) last year.

‘Fashion Addicts’

"Luxury buying by Chinese women is driven by jobs and peer pressure," said Yan, whose collection also includes bags from Louis Vuitton and Saint Laurent Paris. "These are items we've eyed in the past and now are able to afford. We also see friends around us carrying these things."

A growing group of “fashion addicts” in China will continue to fuel the trend toward women’s high-end apparel, according to Bain’s report. These are Chinese consumers -- mostly female, middle-income professionals in larger cities such as Shanghai, Beijing, and Guangzhou, who shop for personal use and are knowledgeable about fashion as well as luxury.

“The fashion addicts are well informed and looking to stand out from the crowd,” Bruno Lannes, Bain’s Shanghai-based partner, said in an interview. “They are a lot more into fashion than accessories, bags or watches.”

Getting China right is a high-stakes play for the luxury companies. After outpacing growth in the rest of the world for years, spending on the mainland -- which excludes Hong Kong, Macau and Taiwan -- grew at the slowest pace last year since at least 2000, according to Bain, after President Xi Jinping started a campaign to rein in lavish spending. Chinese people are also increasingly shopping abroad, where prices are lower.

‘New Era’

ADVERTISEMENT

Spending on expensive menswear and watches both fell in China last year, data from Bain shows. Meanwhile, demand for women’s wear, cosmetics and perfume increased 10 percent, making them the fastest-growing categories in China’s luxury-goods industry. In contrast, apparel sales are declining as a percentage of global luxury sales, according to Bain.

“Nobody expects any changes to government policy,” Lannes said of China. “That’s why it is the beginning of a new era, and brands have to rebase their business.”

Retailers such as Louis Vuitton and Chanel have set aside more store space in China for fashion apparel, while Hugo Boss AG, Coach Inc. and Tod's SpA are expanding women's wear collections in the country.

Overseas Buying

Although Chinese customers are the world’s biggest luxury buyers by nationality, accounting for 29 percent of high-end purchases last year, mainland sales have slowed as Chinese shoppers now buy more than two-thirds of their items overseas, according to Bain.

Prices are between 30 to 40 percent lower in Europe and as much as 25 percent lower in Hong Kong, according to Bernstein’s estimates.

Chanel’s black leather Sac Classique bag sells for 35,200 yuan in China, according to the company’s local website, while it sells for 2,950 euros, or the equivalent of about 24,400 yuan, in a boutique in Paris.

Refocusing on women’s fashion can help luxury-goods makers counter the overseas-buying trend, Bernstein’s Ortelli said.

ADVERTISEMENT

“You can postpone the buying of a watch or piece of jewelry,” Ortelli said. “But if you have an important dinner today, you don’t go to Hong Kong to buy your dress.”

‘Own Money’

Still, ready-to-wear apparel has its drawbacks. Gross profit margins are at least 10 percentage points lower than those for leather goods, analysts from HSBC Holdings Plc and Bernstein said.

“Diversification is a good thing to revive interest and drive sales,” said Erwan Rambourg, Hong Kong-based managing director and global co-head of consumer and retail research at HSBC. “It’s obviously less positive in terms of margins and returns on investment.”

With apparel and shoes, brands have to carry different sizes and need more space to display them, Rambourg said. Apparel retailers also tend to hold sales at the end of a season, he said.

Still, shoppers like Carry Zhuang, a 32-year-old who works in the media industry in Shanghai, are grabbing companies’ attention as a way to overcome the slowdown.

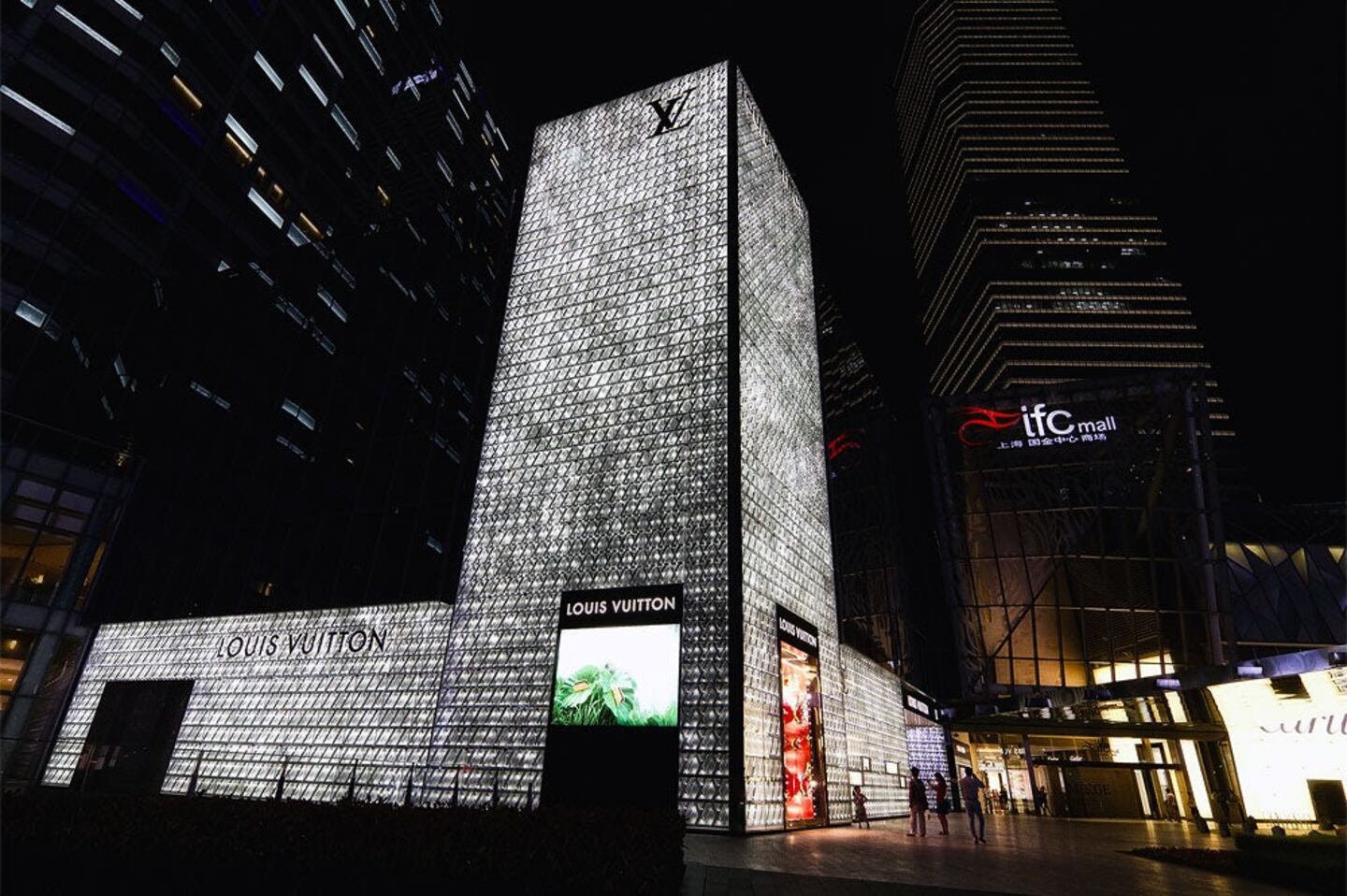

“We earn our own money,” said Zhuang, dressed in a black blouse and skirt and carrying a Ferragamo leather bag, while shopping in the city’s IFC Mall, home to luxury stores from Chanel to watch retailer IWC. “And we want to spend it on something we like.”

By Liza Lin with assistance from Andrew Roberts; Editors: Terje Langeland, Celeste Perri

This week’s round-up of global markets fashion business news also features Latin American mall giants, Nigerian craft entrepreneurs and the mixed picture of China’s luxury market.

Resourceful leaders are turning to creative contingency plans in the face of a national energy crisis, crumbling infrastructure, economic stagnation and social unrest.

This week’s round-up of global markets fashion business news also features the China Duty Free Group, Uniqlo’s Japanese owner and a pan-African e-commerce platform in Côte d’Ivoire.

Affluent members of the Indian diaspora are underserved by fashion retailers, but dedicated e-commerce sites are not a silver bullet for Indian designers aiming to reach them.