The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

TOKYO, Japan — Luxury resale sites might seem like a threat to sales of new luxury product at retail stores. But, as with luxury cars and gadgets, services offering an easy way to offload unwanted items often encourage further consumption and attract new customers without the means to shop at full price.

In Japan, wardrobes are bursting with little-used luxury clothing and accessories. (With an estimated value in the range of ¥600 billion to ¥1.2 trillion, about $5 billion to $12 billion, Japan’s luxury market is one of the largest in the world). And while some consumers like to hold onto personal items for sentimental reasons, many others would be happy to resell their little-used luxury goods — if only there was an easy way to do it.

Across the Japanese market, there has long been a plethora of consumer-to-consumer (C2C) services that make it easy for buyers and sellers to find each other. But when it comes to buying expensive luxury goods, where stakes are higher, lack of trust — driven by the fear of counterfeits and quality concerns more broadly — often becomes a barrier to transaction.

To solve this problem, several services, acting as trusted intermediaries, have sprung up in Japan. The key to their expansion — and where they threaten existing used goods stores (of which there are now more than 10,000 in Japan) — is their use of a model whereby they don’t take title to merchandise, but simply provide product checks and payment guarantees, which help to smooth the flow of transactions.

ADVERTISEMENT

The first company to make a real success with this kind of service in Japan is the US-based site The RealReal, which launched a Japanese version in August 2013. The RealReal Japan was initially headed up by Keisuke Seto, formerly head of Groupon Japan. But this spring, The RealReal lured former head of Louis Vuitton Japan, Kyotaka Fujii, to run the business. Seto, meanwhile, remains as founder and shareholder.

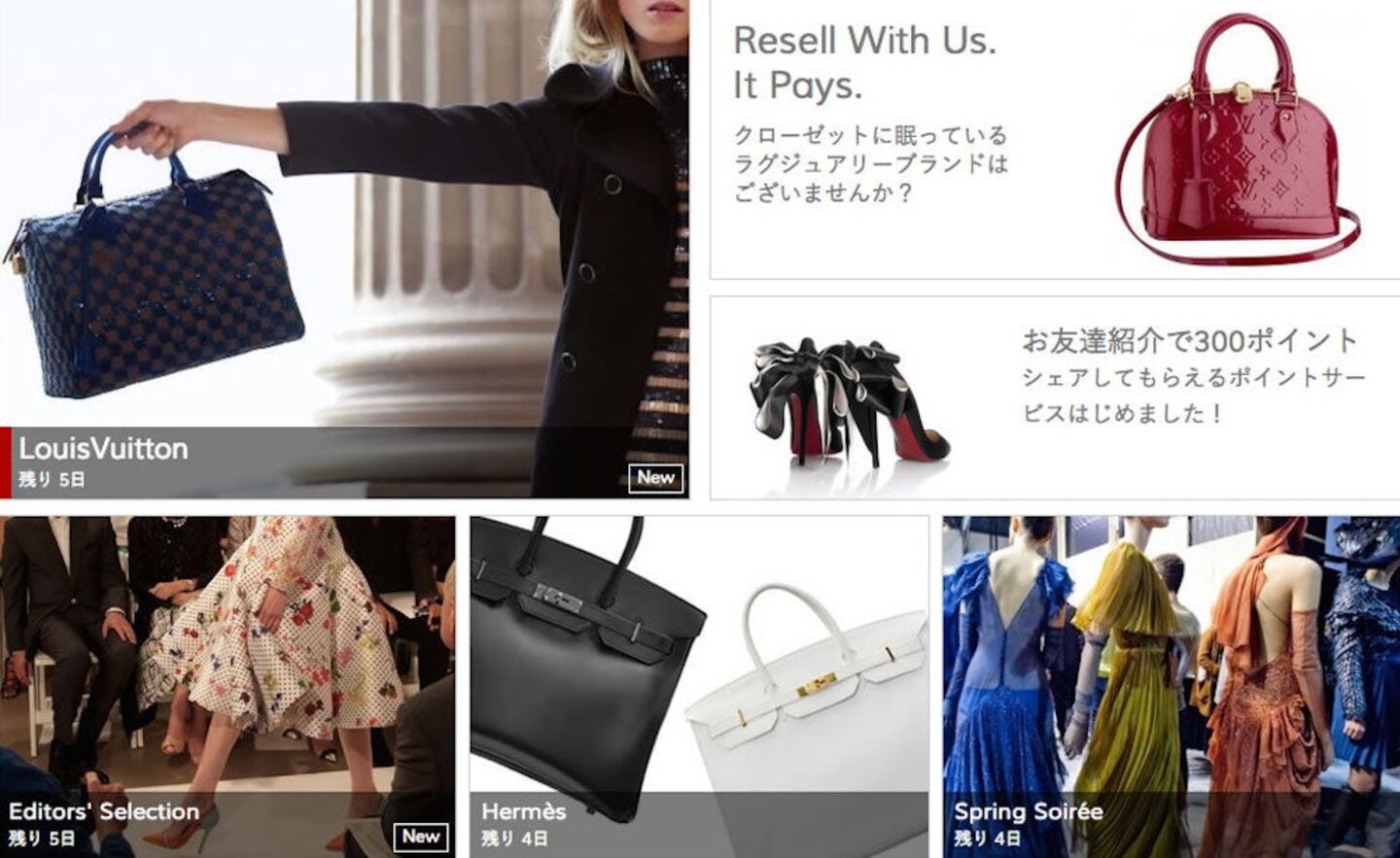

The RealReal is, essentially, a high-end used-goods store with a level of customer service that appeals to many Japanese. The RealReal offers what it calls a 'white glove service' whereby potential sellers need only make an appointment request through their smartphones and associates of The RealReal go through their wardrobes, select items that match a list of preselected luxury and designer brands and ship them to the company's warehouse, all for free.

This makes getting rid of stuff easy. And because The RealReal authenticates and grades each item, purchasers can trust the service. Products are held on consignment and then priced and sold in a series of flash sales at up to 90 percent off retail prices, but still in the range of ¥5,000 to ¥1 million. The seller gets to keep as much as 70 percent of the sale price — 60 percent at the start, rising to 70 percent for sellers with a turnover of more than ¥500,000 a year.

As well as home visits, this high return on sales is a key differentiator for The RealReal in a marketplace populated by many other second-hand retailers, such as Komehyo, Brand Off, Daikoku and Brandear. They too buy used luxury items, but generally offer sellers only 20 to 30 percent of the expected resale price, driven by the fact that they take title to products and, thus, risk.

But high service and big margins go down well in Japan. In its first full year of trading, The RealReal Japan expects sales in excess of ¥1 billion. In the US, the site hit reported sales of ¥6 billion in FY2013 and attracted a membership of 2.2 million after just two years in operation. Local CEO Fujii believes the Japanese market has even bigger potential, given the sheer quantity of well-cared-for luxury goods stashed away and the high level of demand.

Not surprisingly, The RealReal's success has encouraged local competition. There are also plenty of no frills C2C fashion marketplaces in Japan, such as Mercari, Fril, Locari, Stulio and Sumally. Just last month, a service not unlike The RealReal called Reclo was launched by Active Sonar, an e-commerce and direct marketing firm with reported sales of around ¥4 billion.

Like The RealReal, Reclo offers home visits, although limited to customers with 10 or more items to sell within Tokyo's 23 wards. Reclo hopes to differentiate from The RealReal by offering items for immediate sale, rather than adopting the flash sale model and says it will gradually lower prices of stock in order to maximise sell-through. Thus, an item that is still unsold after five days will be discounted by 5 percent, then discounted further in similar increments over three months, subject to limits set by the owner. Within 18 months, Reclo expects sales of 45,000 items and a membership of 300,000. In the longer-term, there is real potential for Japanese consumers to use services like The RealReal and Reclo to sell their unused luxury goods to consumers across Asia. Stay tuned.

JapanConsuming is a leading provider of intelligence on Japanese retail and consumer markets.

This week’s round-up of global markets fashion business news also features Brazil’s JHSF, the Abu Dhabi Investment Authority and the impact of Taiwan’s earthquake on textile supply chains.

This week’s round-up of global markets fashion business news also features Dubai’s Majid Al Futtaim, a Polish fashion giant‘s Russia controversy and the bombing of a Malaysian retailer over blasphemous socks.

As luxury marketing hits saturation point in Dubai during the Muslim holy month, global brands are ramping up their local engagement in other Gulf cities including Riyadh, Abu Dhabi and Kuwait City.

Chanel, Louis Vuitton and Tiffany & Co are among the brands expanding in Perth, Australia in a bid to tap its mining, oil and gas wealth and newfound status as a travel hub.