The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

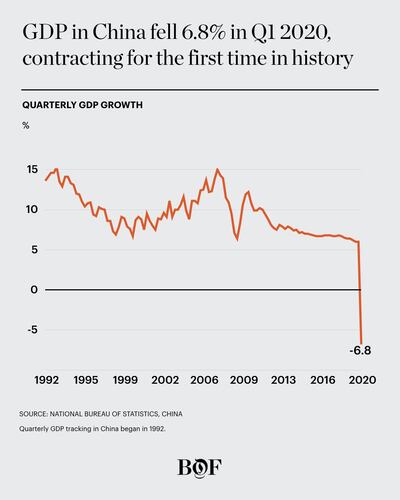

LONDON, United Kingdom — Predicting China's economic future just got a whole lot harder. The country's National Bureau of Statistics revealed last week that its $14 trillion economy shrank by 6.8 percent in the first quarter of 2020 — making it the first contraction since quarterly GDP records began decades earlier. The news brought Covid-19's dramatic impact on the world's largest luxury market into sharp focus and gave executives pause for thought.

Just hours before the news was released, LVMH’s Chief Financial Officer Jean Jacques Guiony reported an uptick in demand from mainland China, with sales up 50 percent year-over-year in early April, during the group’s first quarter earnings call. However, now there is concern among luxury executives that earlier positive momentum could be thwarted by a dent in consumer confidence.

Will previously bullish Chinese shoppers who have never witnessed a period of economic decline in their lifetime suddenly become more restrained with their spending — or even tighten their belts?

"Chinese consumers will react the best to this crisis [compared to consumers in other international markets]," Mario Ortelli, managing partner at Ortelli & Co, told BoF. But whether "the best" will be good enough for luxury brands to avoid a prolonged and painful recovery remains to be seen.

ADVERTISEMENT

Since China emerged from its two-month-long lockdown, business leaders have looked to the nation's shoppers for clues on how the crisis will play out. And as companies' balance sheets showed promising signs of a Chinese rebound, the market became a beacon of optimism in the face of bleak macroeconomic forecasts elsewhere around the world.

But even before China’s economic contraction cast a dark shadow over the market horizon, the mainland’s idiosyncrasies — from its unique consumer culture to its fast-paced, insular tech ecosystem — meant that its effectiveness as a bellwether for global luxury performance was limited.

An Imperfect Barometer

Mainland China’s importance to the luxury sector can’t be overstated. According to Bain & Company, Chinese customers accounted for 90 percent of the constant growth of the market in 2019, reaching 35 percent of the value of luxury goods. The mainland’s overall contribution to the global luxury market totalled €30 billion last year (approximately $32.6 billion).

Despite China’s Q1 contraction, a range of factors — like its unemployment rate, which improved slightly in March after a record-making high in February — suggest that the worst is over. Some business leaders remain optimistic about growing short-term demand for high-end goods in China — the first major economy to attempt a restart post-lockdown.

“A lot of the companies I am talking to are doing 70 to 80 percent of the sales they were doing last year at this time, which is pretty impressive,” said Amrita Banta, managing director at Agility Research & Strategy.

Following the peak of the luxury market’s decline in China — which Erwan Rambourg, global co-head of consumer and retail research at HSBC, pegged at February 10 — its recovery is showing signs of a V-shaped trajectory.

The fact that sales in mainland China are up, even 50 percent, gives me little to celebrate.

Rambourg observed that while sales were down 80 to 90 percent two months ago, each week since has brought about a 10 percent improvement. He reckons that most brands are now likely growing year-on-year (LVMH confirmed that key assets like Louis Vuitton, Dior, Sephora and Bulgari have seen strong growth since mid-March) and should expect "much more impressive growth" in May and June.

ADVERTISEMENT

But this — and LVMH’s April uptick — needs to be taken in context, particularly where the group reported a 15 percent drop in first quarter revenue year-on-year. LVMH arch-rival Kering, which reports its first-quarter results on April 21, has warned of a similar decline across the board.

“One needs to look at sales by nationality, not at sales by geography,” said luxury expert and Bernstein analyst Luca Solca. “The fact that sales in mainland China are up, even 50 percent, gives me little to celebrate.”

Chinese consumers historically do about one-third to half of their luxury spending at home, preferring to buy while traveling outside Mainland China. But with global travel retail at a standstill, brands would need to see sales domestically double or even triple in order to recapture global spend, said Solca. LVMH’s uptick therefore illustrates this reality. “There is no disconnect here, because Chinese luxury spend [overall] also seems to have contracted.”

Moreover, not all companies will benefit from a rebound.

“Recovery will be totally uneven and differentiated among brands,” added Ortelli, who forecasts that top-of-mind brands who set their budgets at over 20 percent annual revenue growth among Chinese consumers in early 2020 will close the year at 5 to 10 percent. Brands that banked on [mid-single digit] percentage growth could go into negative territory, he warned.

The crisis has and will continue to accelerate the re-shoring of China’s luxury spending as consumers refrain from travelling and spending abroad, but it won’t come cheap for brands. “If the repatriation that was supposed to appear over 10 years appears overnight, this will carry very significant adjustment costs,” Solca said.

While Ortelli does recommended that brands with resilient Chinese demand allocate their marketing spend and inventory to the mainland, he suggests that companies should exercise caution as import taxes and a potential second outbreak could make it difficult to shift stock further down the road. “If we have a second outbreak in two weeks, everything changes again. This is a moving target.”

An Asian Outlier

ADVERTISEMENT

Referring to the fact that China was the first country to experience lockdown and the first to see it lifted, Nike’s Executive Vice President and Chief Financial Officer Andy Campion suggested during an earnings call on March 24 that “our team in Greater China has given us a playbook for the rest of the world.”

At that time, Campion told investors that the sportswear giant’s Greater China business was already making strides from recovery into a period of normalisation, citing strong double digit (nearing triple digit) growth in the brand’s digital business and the reopening of around 80 percent of its 7,000 local stores.

“We're also executing on this playbook in Japan and Korea,” added Campion, noting that Nike planned to progress through the three phases (the third is a return to strong growth) on different timelines across global markets.

You have a very vertical V in China, [but] they'll have a very flat V in Korea.

Yet Japan has not emerged from the throes of its outbreak — its government on April 16 declared a nationwide state of emergency following a surge in confirmed cases. South Korea, however, could be a bright spot.

According to Rambourg, South Korea is the only other country that could follow China's V-shaped recovery lead. The South Korean government succeeded in flattening the country's virus curve dramatically without shutting down its economy. Consumer confidence has remained largely intact as a result, but a rally will likely be tempered as the economy's decline wasn't as steep as the mainland's.

“The rebound won’t be as impressive,” added Rambourg. “You have a very vertical V in China, [but] they'll have a very flat V in Korea.” What’s more, the luxury market in South Korea — though globally significant and influential — is nowhere near the size of China’s.

More broadly, almost all of the G-20 economies will register a recession this year. In an update made by the Economist Intelligence Unit (EIU) on April 14, South Korea is now predicted to shrink by 1.8 percent in 2020 and Japan by 1.5 percent. In Europe, the figures range from a 2.6 percent contraction in Russia to a 7 percent contraction in Italy. Indeed, with economies as diverse as the US, Australia, Mexico, Brazil, Saudi Arabia and South Africa all in negative territory, the only countries in the group still predicted to register full-year economic growth in 2020 are India (2.1 percent), Indonesia (1 percent) and China (1 percent).

Travel Retail on Pause

Mainland China is still a recruitment market when it comes to luxury, meaning a significant proportion of its consumers are new to the segment and will have a more voracious appetite for high-end goods post-pandemic. The same can't be said for shoppers in the US and Europe. The country's avant-garde tech and e-commerce ecosystems — and the likelihood that lockdowns abroad will last longer than Beijing's two-month measures — make the odds of a V-shaped recovery in the West increasingly unlikely.

The recovery curve will differ for consumer markets that are still feeling immense pressure from local outbreaks and rely on mainland Chinese tourists to boost retail performance. Take Japan, Hong Kong, Singapore and European countries like France, Italy and the UK, which are either cautiously avoiding second outbreaks or in the midst of their first round of lockdowns.

Once tourists come back, it will benefit Europe — like it will benefit Hong Kong, Singapore and Japan.

According to Rambourg's estimates, mainland Chinese tourists account for two-thirds of sales in Hong Kong, over a third of sales in Singapore, and a third of sales in European hot spots. With global travel at a virtual standstill, travel retail spending has also been decimated. Brands like Burberry — which is highly exposed to travel retail demand and attributes over 40 percent of global revenue to Chinese shoppers — already warned of a dramatic hit to sales in March.

The EIU predicted that the eurozone will be hit hard by macroeconomic forces. While locals in France and Italy are unlikely to carry the burden of recovery by splurging on high-end items post-pandemic, an eventual resumption of tourism flows from China — which already happened domestically, with a 366 percent boost in the first week of April, according to Chinese travel service provider Ctrip — could make an impact.

“Once tourists come back, it will benefit Europe — like it will benefit Hong Kong, Singapore and Japan,” Rambourg said. “You could see a swoosh recovery: not exactly a V, but a very progressive, very gradual recovery.”

However, brands shouldn’t expect this rebound to happen anytime soon. “It is likely that travel patterns will not go back to normal, not even [around the second half of 2020],” Solca told BoF.

A Luxury Laggard

Businesses in the US shouldn't expect their local market to follow China's trajectory or timeline as the US looks down the barrel of a 5.9 percent economic contraction this year, according to the IMF.

“The US will be the slowest, the longest to recover,” predicted Rambourg. “You’ll see a sort of L-shape curve, which means basically no recovery for a while.”

American retailers won’t benefit from a travel resurgence to the same extent or in the same way that cities across the Atlantic eventually will. Though research firm Tourism Economics estimates that the US economy could lose $10.3 billion in Chinese visitor spending due to Covid-19, HSBC estimates that less than 10 percent of the American luxury market is linked to tourism flows. “Luxury consumption in the US is mostly domestic with lower impact from tourists,” said Ortelli.

Even before the pandemic, geopolitical tensions between Beijing and Washington, a strong dollar and the lure of other destinations saw Chinese stateside tourism drop by over 8 percent. Increasingly frequent reports of racism against Asian Americans could further discourage Chinese tourists from visiting and spending the US.

You'll see a sort of L-shape curve in the US, which means basically no recovery for a while.

It doesn’t help that the US market is heavily influenced by the health of equity markets, which doesn’t bode well for sales. Luxury demand will evaporate if the markets go down, but a stock market rebound often precedes a lag in demand where consumers hesitate to trust the economy, value of their property or their own job security, said Rambourg.

“The equity market, the real estate market, wages... it depends on all these factors,” added Ortelli. “If the IMF is right and we’re entering a recession, America will be hit hard and US luxury consumption will have a big shrink.”

Though Chinese consumers will continue to drive global luxury growth, Ortelli recommends that brands make the most of what demand they do have stateside, across the eurozone and in China by analysing purchasing data across profiles like nationalities and age groups in order to target consumers with specific products and categories to maximum effect.

In the meantime, only brands who stay connected with shoppers — and double down on localisation strategies — will benefit from a rebound, Banta stressed. “It’s not a transactional relationship, it’s about staying close to your consumer, developing a relationship... In China particularly [they] have definitely returned to the brands who they are loyal to, who have remained respectful of the situation.”

Additional reporting from Casey Hall.

We’re tracking the latest on the coronavirus outbreak and its impact on the global fashion business. Visit our live blog for everything you need to know.

Related Articles:

[ Caution: China’s Luxury Rebound May Not Be What It SeemsOpens in new window ]

[ To Survive, Luxury Fashion Must HibernateOpens in new window ]

This week’s round-up of global markets fashion business news also features the China Duty Free Group, Uniqlo’s Japanese owner and a pan-African e-commerce platform in Côte d’Ivoire.

Affluent members of the Indian diaspora are underserved by fashion retailers, but dedicated e-commerce sites are not a silver bullet for Indian designers aiming to reach them.

This week’s round-up of global markets fashion business news also features Brazil’s JHSF, the Abu Dhabi Investment Authority and the impact of Taiwan’s earthquake on textile supply chains.

This week’s round-up of global markets fashion business news also features Dubai’s Majid Al Futtaim, a Polish fashion giant‘s Russia controversy and the bombing of a Malaysian retailer over blasphemous socks.