The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

Opens in new window

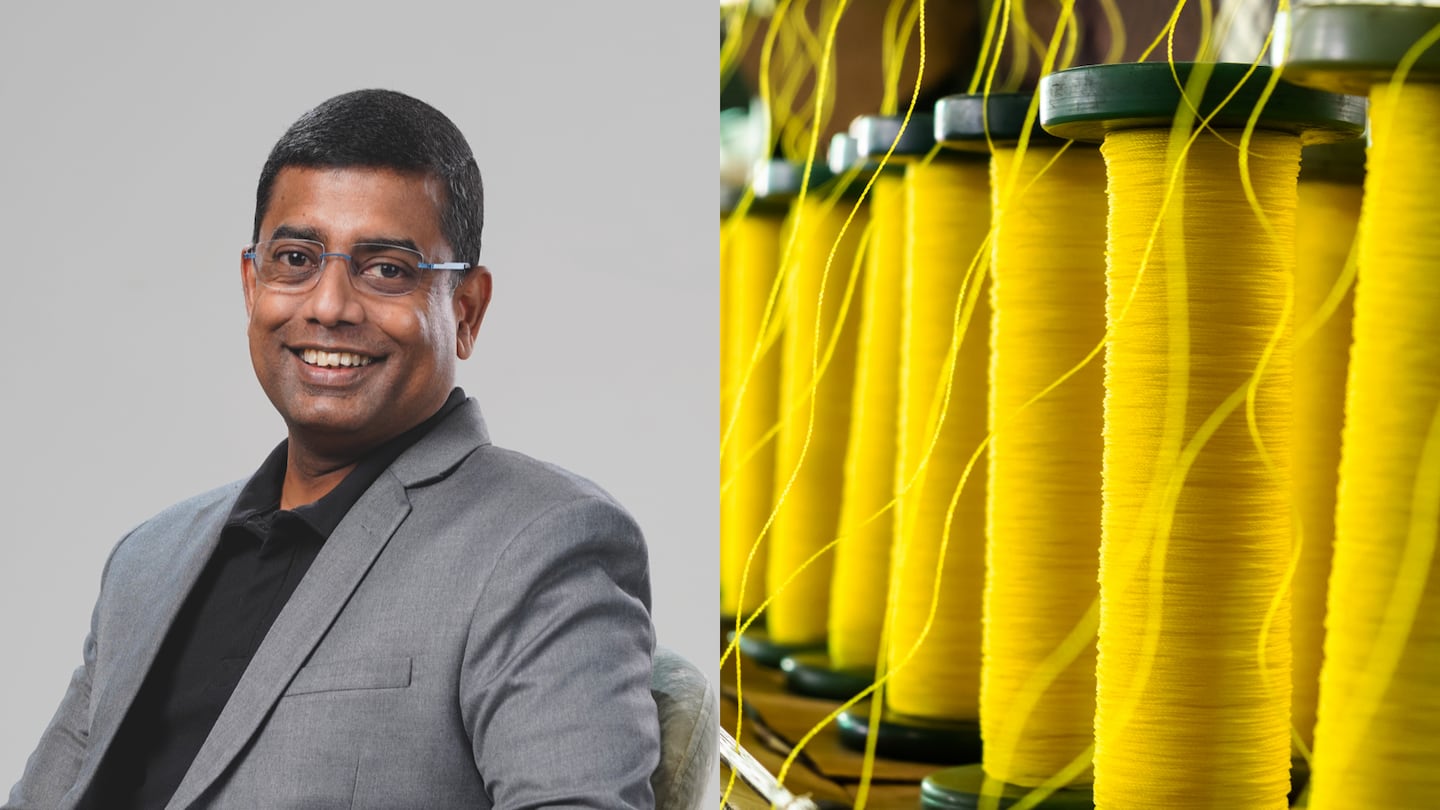

Opens in new windowBeing the head of South Asia’s largest apparel manufacturer arguably gives Suren Fernando a unique vantage point from which to observe the recent ups and downs of global supply chains, having spent the past two years of his lengthy career at MAS Holdings as chief executive. The textile and apparel manufacturer and exporter was founded more than 30 years ago in Sri Lanka, a country that has suffered extreme economic hardship in 2022, with inflation running as high as 70 percent and chronic shortages in everything from fuel to food, triggering political turmoil. It’s likely no surprise then that global risk mitigation is top of mind for the executive of the design-to-delivery company whose operations stretch across 53 manufacturing facilities in 17 countries, with approximately 115,000 employees.

Fernando believes that one of the keys to the success of the family-owned, business-to-business company, which he expects to record revenue of $2.4 billion in 2022, is its long-lasting partnerships with a range of global brands, from Victoria’s Secret to Nike. Another key is its ability to embrace the evolution of supply chain models over time, from the traditional singular focus on cost optimisation to today’s emphasis on building strength and resilience, be it through vertical integration, nearshoring or pushing the boundaries of on-demand manufacturing. Ultimately, Fernando said, not least because “as a manufacturer, you’re only as strong as your supply chain.”

BoF: Since the pandemic, the fashion industry has felt the acute challenges of what happens when supply chains break down. What has this meant for best-in-class supply chains?

Suren Fernando: Historically, supply chains — at least in our industry — were organised mostly for cost optimisation, looking at where you can source different components, at the lowest possible price and identifying the country that’s going to assemble products at the lowest manufacturing cost. That model worked very well for many years. It did put manufacturers like us under pressure to be cost-competitive, but the model fundamentally worked.

ADVERTISEMENT

Over the last two years, with this level of churn that we see in the external environment, the dynamics have changed significantly, and certain things that we took for granted have been questioned or even broken down. At the same time, you are dealing with new challenges, and new opportunities. Now the key theme that comes out of all of this is: how do you manage yourself more effectively for risk? And, therefore, agility and resilience play such a pivotal role in this regard.

BoF: At a practical level, what does managing risk — and building more agility and resilience — mean for MAS and your customers?

SF: A few years ago, MAS was predominantly supplying everything out of Sri Lanka. Today, we have a much broader manufacturing and sourcing footprint. Our largest manufacturing base is still in Sri Lanka, but we have a significant presence now in Indonesia, Vietnam, Bangladesh, India, Jordan, Kenya and Haiti, as well as a value-added service and a trading operation over in North Carolina in the US.

Our geographic expansion generally starts by working with one or two “anchor” customers, to understand what they want strategically, what they might see in a particular region. For example, if it’s Indonesia, it might be to take advantage of the availability of labour, and it has become an attractive sourcing destination if you are supplying to countries such as Japan or Australia, where they have preferential duty agreements. So it could be driven by duty, speed or proximity to market, or as before, cost advantages.

BoF: Where will nearshoring fit into this? As many fashion executives already understand, it’s one thing to want to adjust their companies’ global footprints and bring supply chains closer to their key markets; it’s another to actually be able to do it.

SF: Nearshoring is certainly on the radar of our customers, but now for slightly different reasons than before, and it carries its own risks. When nearshoring initially became a big topic six or seven years ago — even if it was just conversations happening at a very strategic level — the value unlock was clear to [MAS] customers, for two reasons: speed — for example, because it brought them closer to markets — and costs — because, for example, it may have brought certain preferential trade agreements. In these post-pandemic times, customers have also realised the importance of nearshoring as a form of risk mitigation.

But companies [looking to move supply chains closer to key markets] often underestimate the differences between [markets]; what is in one location [cannot be easily] replicated in another — things like compliance standards, be it environmental or social; education; technical skills, or service levels are not the same, and so on. So like I said, over the past few years, we’ve been able to navigate most of these challenges to organise ourselves differently.

When we [at MAS] embarked on a nearshoring strategy, we realised that there were certain limitations in executing it — specifically the sourcing of raw materials, the right talent and the technical skills to set up manufacturing operations weren’t always available. Over the last couple of years, we’ve been able to address these challenges to a certain degree [by building on-the-ground capabilities]. We now have a much better understanding of the sourcing capabilities available in certain regions, and local challenges.

ADVERTISEMENT

When we set up initially, we always have a fairly large core team or a tag team that will go out from Sri Lanka to set up the factory, we send certain people who have technical expertise and knowledge about quality, manufacturing techniques and so on. Our strategy has been to over-resource from Sri Lanka at the start to make sure that we set it up right, and then over a period of time, phase out the Sri Lankans and take on more local talent. Depending on the country, it might take longer. For example, in Haiti [where MAS has been since 2017], we still had to manage with a fairly large amount of Sri Lankans because the technical knowledge and experience that’s available in the country are quite limited.

But like I said, when you address a certain challenge or a risk element [when nearshoring], it also exposes you to certain other challenges that you have to manage. Having said that, our experience in the Americas has been good thus far.

BoF: Another big topic in post-pandemic fashion is on-demand manufacturing, which promises a way forward in terms of tighter inventory management. How has this played out for manufacturers like MAS?

SF: On-demand takes two forms, which have different dynamics. For certain customers, we have what we call “speed models” or “read and react models,” where the customer — generally a larger one — might put out a limited range with certain colours or styles, and depending on [how it] performs in the market, the customer will place a follow-up purchase order and they would want it at much shorter lead times.

Then you have the more personalised or customised product that we make on demand. We have experimented with several versions of this, even making products customised for a particular consumer. We have had some level of success, but I wouldn’t say it’s really taken off.

What we are looking at now is on-demand, for example, with a T-shirt, where we would send the “blanks” from Sri Lanka and then have a printing facility onshore to make that customisation or personalisation and supply the customer from that location. We have a lot of experience in dealing with our core business in on-demand, but on the personalisation and customisation part of it, we have the models in place, but it’s been slow for customers to adopt.

BoF: MAS is all about vertical integration. How do you think the definition of vertical integration will evolve in 2023?

SF: For MAS, vertical integration, or verticality as we call it now, has always been important, We were the pioneers in developing that supply chain capability [in Sri Lanka]. Verticality is all about mitigating risk and offering speed, agility and cost advantages to the customer.

ADVERTISEMENT

Currently, in Sri Lanka, we source 50 percent to 60 percent of raw materials from within the island. We are able to source our own lace, our own bra cups, our own elastics, and so on, and even some of the accessories that go into making garments. It’s always been an important piece for us, because as manufacturers, you’re as strong as your supply chain.

Having the supply chain located very close to you and probably having a greater deal of influence over it certainly help us to read and react and respond to customer requests that much faster.

BoF: Sustainability has a role to play in supply chains today too. How do you prioritise discussions at MAS around sustainability?

SF: We launched what we call our “Plan for Change” … and have set ourselves 12 key targets to make sure that we achieve our ESG goals in the next three years. For example, if you look at product … we strive to generate 50 percent of our revenue through products that have some sustainability element by 2025. We are probably close to 20 percent today, so we have a very aggressive target to go for. Being a business-to-business manufacturer, we have to do it in close partnership with our customers. This has been on our agenda for many years, but sometimes really pushing the agenda with customers can be challenging because while you have conversations on sustainable products, you also have conversations on cost. But especially over the last two years, we have seen almost all our strategic customers make sustainability a priority and that’s really helped us to gain a lot of traction. So it’s in their interest and in our interest to make sure that we are achieve these goals jointly.

We are also mindful that in the very near future and maybe as soon as next year, there will be more regulation coming into play. Customers are pre-empting this and working closely with us to make good progress before it becomes mandatory and enforced.

BoF: Trust between manufacturers and brands eroded during the pandemic. What will be critical factors in 2023 to make sure that even as times get tough, trust remains on both sides?

SF: One position of strength that we at MAS have is 20- or even 30-year relationships with most of our larger customers, so there is a level of trust that has become mutually rewarding.

We have not been as close to the customers as we were previously, due to the pandemic and the limitations of travel.

As a supplier, we’ve always lived by our values, extremely high standards of compliance and governance and the right mindset to work with these customers with clear lines of accountability. Accountability goes way beyond ensuring that the products are made right and made well, especially in terms of the high standards of compliance and ethical standards that we practice in the business, and we’ve made them very transparent to our customers. Our door is always open for any customer to come and see the standards and the practices that we have internally in our business.

BoF: You’ve just finished two years as CEO of the entire company — having been CEO of a big MAS division before that. As you start your third year, what’s keeping you awake at night?

SF: One [challenge] primarily has to do with the softening market conditions, with volume looking poor because of inventory situations [due to companies with large amounts of stock on their hands] and consumers are facing certain pressures on pricing. We see this continuing maybe for quarter one, quarter two of next year.

Another is attracting, developing and retaining talent. … It’s a global phenomenon with talent. People move jobs and some even don’t want to continue the way that they worked before the pandemic. So really managing talent becomes a critical piece for me and the senior team.

This interview has been edited and condensed.

This article first appeared in The State of Fashion 2023, an in-depth report on the global fashion industry, co-published by BoF and McKinsey & Company.

The seventh annual State of Fashion report by The Business of Fashion and McKinsey & Company reveals the industry is heading for a global slowdown in 2023 as macroeconomic tensions and slumping consumer confidence chip away at 2022′s gains. Download the full report to understand the 10 themes that will define the industry and the opportunities for growth in the year ahead.

As supply chains remain under pressure, garment manufacturers have an opportunity to lean into vertical integration, nearshoring and small-batch production, while seeking closer upstream and downstream collaboration, according to The State of Fashion 2023.

Janet Kersnar is Executive Editor at The Business of Fashion. She is based in London and oversees long-form content, including Case Studies and Reports.

This week’s round-up of global markets fashion business news also features the China Duty Free Group, Uniqlo’s Japanese owner and a pan-African e-commerce platform in Côte d’Ivoire.

Affluent members of the Indian diaspora are underserved by fashion retailers, but dedicated e-commerce sites are not a silver bullet for Indian designers aiming to reach them.

This week’s round-up of global markets fashion business news also features Brazil’s JHSF, the Abu Dhabi Investment Authority and the impact of Taiwan’s earthquake on textile supply chains.

This week’s round-up of global markets fashion business news also features Dubai’s Majid Al Futtaim, a Polish fashion giant‘s Russia controversy and the bombing of a Malaysian retailer over blasphemous socks.