The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

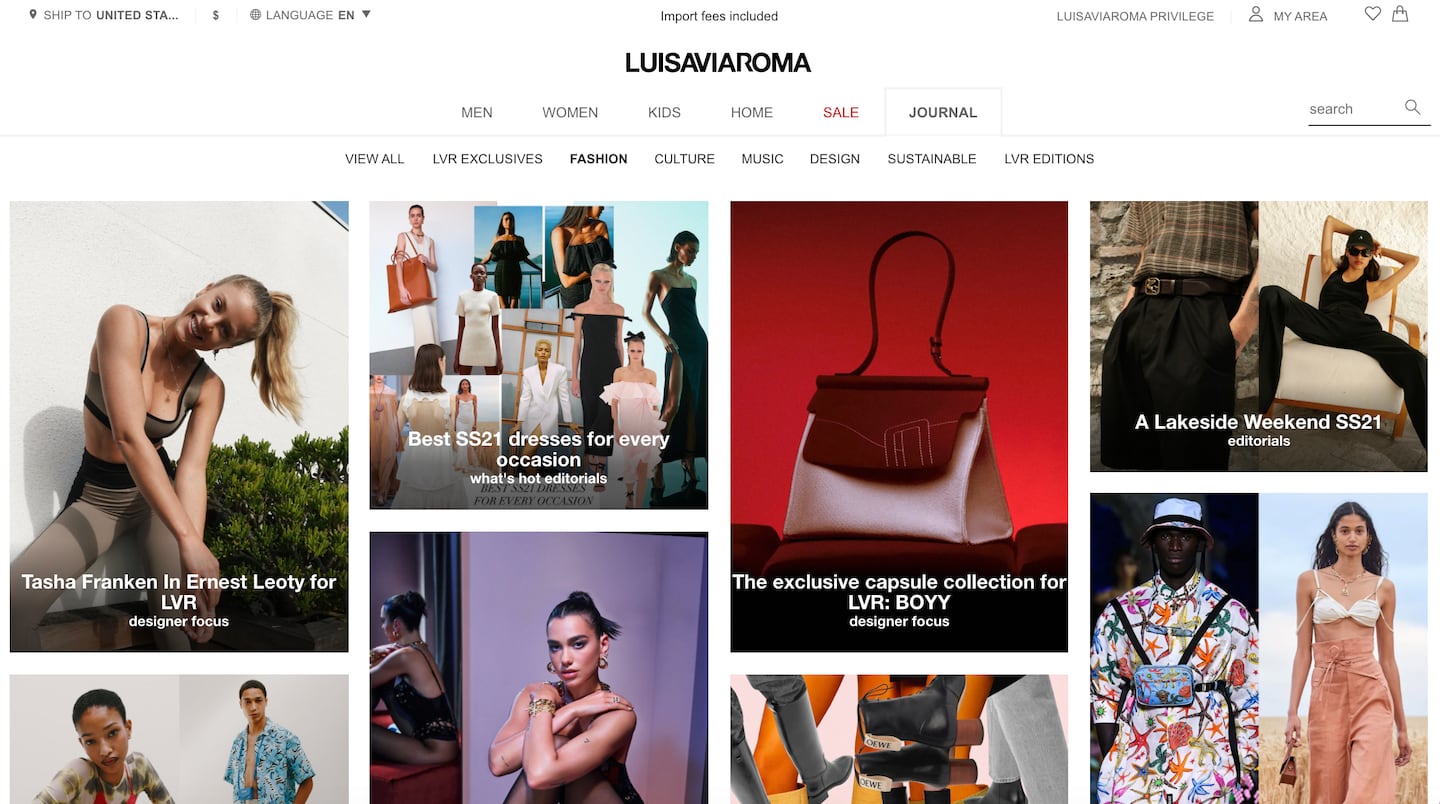

Family-owned Italian e-commerce retailer Luisa Via Roma is beefing up its efforts in the United States, with plans to invest in editorial content and launch a magazine this September to help double its turnover from the country in the next two years.

The retailer hired Kate Davidson Hudson, the co-founder of content and commerce platform Editorialist, to oversee its expanded content strategy as editor-in-chief. More US hires and offices are planned.

Sales to the US currently represent 15 percent of Luisa Via Roma’s revenue. Chief executive Andrea Panconesi told BoF that the US was previously the company’s biggest market before a marketing push in Italy that started three years ago drove more sales in Europe.

In recent years, the luxury multi-brand online market has also become a much more competitive and capital intensive business, with the likes of Farfetch and Net-a-Porter fighting for customers who are increasingly turning online to shop — especially amid the global pandemic. Luisa Via Roma is one of the smaller players in the market, with revenues of $225 million in 2020, according to the company, compared to $1.7 billion in revenue at Farfetch and €450 million (about $546 million) in revenue at MyTheresa in the same year. Luisa Via Roma’s revenue is up 25 percent year-over-year so far this year.

ADVERTISEMENT

Panconesi, whose family started Luisa Via Roma as a store in Florence in 1929 and began selling online in 1999, said that while the company previously avoided external investors, “now we are open” to the possibility, he said. (Reuters reported last year that the company was exploring a sale.)

“We are open to the possibility of investment, although we have not formally decided to seek outside investors,” said a spokesperson for the retailer.

In the US, Luisa Via Roma is planning a content-driven marketing strategy. A similar approach in Italy in recent years focused on large-scale events with celebrities and influencers, as well as exclusive collaborations with luxury brands, including a multi-brand runway show curated by Carine Roitfeld and an annual fashion and technology summit. In the US, the strategy will be focused on editorial content as well as smaller events in major cities like New York, Los Angeles, Miami and others.

“We are very aware that we cannot compete with our biggest competitors in terms of spending money on Google,” Panconesi said. “But we are not interested in it. We want to make sure that we give our readers or our followers a different experience.”

The forthcoming LVR digital magazine is part of that strategy. While the editorial will be free to feature luxury items Luisa Via Roma does not necessarily sell itself, Davidson Hudson said it is designed to be shoppable, and will be bolstered by personal shoppers on social platforms like WhatsApp and Instagram and through live chat functionalities on the retailer’s website and app. On the mobile app, the editorial content will be personalised based on shopping behaviour.

“What we’re trying to do at LVR is create content that really closes the loop between aspiration and access at every touchpoint,” she said. “It’s going to be that organic traffic that’s going to drive a lot of the growth and make us hyper-competitive in that digital space.”

Brands have invested in producing content, like photoshoots and interviews, in recent years to draw in audiences online that might convert into shoppers. Content has been particularly important for multi-brand retailers like Net-a-Porter, which launched its Porter magazine in 2014, and Farfetch, which is trying to establish a brand identity with its audience, to stand out as online destinations for shopping as luxury brands work harder to bolster their own e-commerce operations.

While Luisa Via Roma pushed into the Chinese market in 2019 through a partnership with Chinese luxury e-commerce site Secoo, that deal has since ended and ”was not very successful,” said Panconesi. “For the time being, being alone, we concentrate in Europe and the US.” He said China will become a focus in 2021 again.

ADVERTISEMENT

The Italian retailer is considering the opening of another store this year as well, potentially in Istanbul. (Currently, Luisa Via Roma counts one store in Florence; it opened series of pop-ups in New York and Riyadh in 2019.) Panconesi said new stores will be designed as gathering places, with a strong atmosphere of music, art and design. “Not just to go in a store and see 100 different brands, one after the other,” he said.

Related Articles:

Andrea Panconesi of Luisa Via Roma on Becoming a Global E-tailer

Fashion brands are edging in on the world’s largest gathering of design professionals and their wealthy clients, but design companies still dominate the sector, which is ripe for further consolidation, reports Imran Amed.

Blocking the deal would set a new precedent for fashion M&A in the US and leave Capri Holdings in a precarious position as it attempts to turn around its Michael Kors brand.

After preserving his fashion empire’s independence for decades, the 89 year-old designer is taking a more open stance to M&A.

The sharp fall in the yen, combined with a number of premium brands not adjusting their prices to reflect the change, has created a rare opportunity to grab luxe goods at a discount.