The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

LONDON, United Kingdom — Global sales of sneakers rose 10 percent to €3.5 billion last year, outperforming a 7 percent rise in handbags, according to consultancy Bain & Co.

Big news

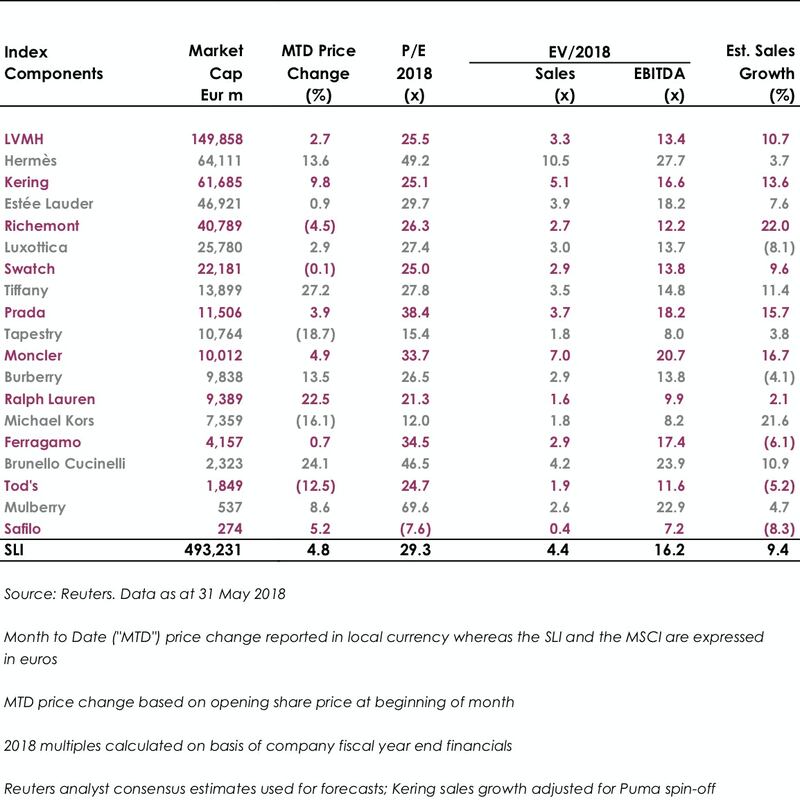

Results have polarised the luxury sector this month. On the winning side, we have the usual suspects Hermès, Moncler and Brunello Cucinelli, who show no sign of stopping. Tiffany, Ralph Lauren and Burberry joined the winning team by beating analyst estimates in their results announcements. These three groups have been working hard to redefine themselves and improve operations — Burberry and Tiffany both have new creative directors and Ralph Lauren's clean up act is well under way.

Also on the good news side was Safilo’s return to profitability in its latest quarter, whilst Estée Lauder kept its glow with a 15-quarter long track record of earnings beat, helped by its recently acquired millennial-friendly brands, and continued strength in its prestige portfolio as well as in its travel retail and online channels.

ADVERTISEMENT

On the losing side, Tod's and Ferragamo continued to disappoint with no signs of a turnaround yet in their quarterly results. Richemont's muted year-end results, with weak performance at its key watch brands and a hit to profits from two large-scale watch buy-back programmes, failed to impress. Tapestry and Michael Kors owned up to the challenge of multi-brand ownership, with the performance of their core/original brands being overshadowed by the need for more work at the brands they recently acquired.

Burberry acquired Italian luxury leather bags and accessories manufacturer CF&P this month, taking on board 170 employees, whilst LVMH lead a round of funding in Lyst, a global fashion search platform.

China-based acquirers closed a number of jewellery deals this month in the region, underscoring the interest in this category: Shenzhen Ideal Jewellery acquired retailers Jiangsu Cemni Jewellery and Chengdu Shumao Diamond; Private investors Chan Vincent Wing Sing and Hui Ka Man Emily acquired a 49.5 percent stake in Affluent Partners Holdings (a sourcing, design and distribution company specialised in pearls and jewellery); and textiles company Zhejiang Hangmin acquired gold jewellery specialist Hangzhou Hangmin Batar Jewelry.

There was also some outbound investment into Europe, with Hong Kong-based private equity group Naga Brands acquiring the German jewellery brand Tamara Comolli.

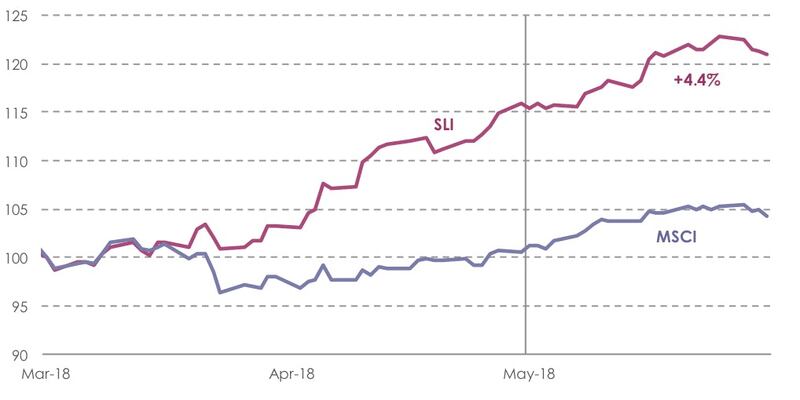

The Savigny Luxury Index (“SLI”) continued its ascent this month, despite the sky falling in on the EU creating uncertainty particularly amongst its Italian constituents. Our index rose 4.4 percent versus a rise of 3.6 percent in the MSCI.

SLI vs. MSCI

Going up

Going down

ADVERTISEMENT

What to watch

Sneakers have evolved from a mere luxury fashion trend to being a category in its own right. Premium sneakers can start at around $400 but can easily rise as high as $3,000, the price of a pair of Christian Louboutin's leather, crystal-embellished sneakers. Limited editions can sell for well over $10,000, including the Chanel X Pharrell Hu Race Trail pictured above.

The category grew 10 percent in 2017, making it the fastest growing segment of fashion. There are no signs that this will slow down — men and millennials, who are in the driving seat of luxury sales growth these days, are especially prone to buying sneakers, as well as other streetwear items. You only have to look at Balenciaga's recent success to understand the potential — the brand is now growing faster than Gucci.

Sector valuation

Fashion brands are edging in on the world’s largest gathering of design professionals and their wealthy clients, but design companies still dominate the sector, which is ripe for further consolidation, reports Imran Amed.

Blocking the deal would set a new precedent for fashion M&A in the US and leave Capri Holdings in a precarious position as it attempts to turn around its Michael Kors brand.

After preserving his fashion empire’s independence for decades, the 89 year-old designer is taking a more open stance to M&A.

The sharp fall in the yen, combined with a number of premium brands not adjusting their prices to reflect the change, has created a rare opportunity to grab luxe goods at a discount.