The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

LONDON, United Kingdom — The Savigny Luxury Index ("SLI") fell 1.4 percent this month, relative to a 0.7 percent drop for the MSCI. Corporate newsflow could not have been better but warnings of a more uncertain path ahead curbed investor enthusiasm for luxury.

Big news

LVMH, Kering, Hermès, Moncler, and Brunello Cucinelli all posted impressive first half results. The three industry leaders were notably firing on all cylinders, with all of LVMH's divisions growing, Gucci and Saint Laurent continuing their spectacular ascent and Hermès yet again proving the ultimate brand in the luxury business. All luxury players confirmed that consumer confidence had returned to China, and that Europe was faring better since the terrorist incidents that hit the sector hard at the end of 2015. Some words of caution came as to the prospects of currency headwinds in the second half, but a warning from undisputed sector king Bernard Arnault about an impending sector crash resonated strongly.

Armani announced that it would streamline its brand portfolio, regrouping its activities under Giorgio Armani, Emporio Armani and A|X Armani. The company's sales declined by 5 percent in 2016, partly owing to market conditions but also raising issues as to continued relevance of the brand.

ADVERTISEMENT

Tiffany, whose sales have been struggling in the face of stiffer competition and a weaker North American market, appointed Alessandro Bogliolo as CEO. Alessandro had previously spent 16 years at Bulgari and was most recently CEO of Diesel. Lanvin appointed Olivier Lapidus as Creative Director, replacing Bouchra Jarrar who lasted only 15 months in the job. His appointment has raised eyebrows, with some industry observers fearing that this latest appointment might only serve to accelerate the brand's fall from grace.

Michael Kors agreed to acquire Jimmy Choo for close to £900 million, a whopping 37 percent premium to the company's share price on the day of announcement. The group has been struggling from over-exposure of the Michael Kors brand, and is using its cash pile to acquire a second brand pillar, echoing Coach's recent acquisition of Kate Spade. Mulberry announced a 50/50 Japan distribution joint venture with Onward Global Fashion Co, reinforcing links with Japanese apparel group Onward, whose European subsidiary Onward Luxury Group already holds licensing rights in shoes and apparel for the British affordable luxury brand.

Going up

• Moncler and Brunello Cucinelli came at the top of the leaderboard this month on the back of strong first half results, gaining 11 percent and 8 percent respectively. Moncler now has a bigger market cap than Ralph Lauren – who would have banked on that a few years ago?

• Swatch and Richemont posted gains of 8 and 4 percent respectively as signs of recovery in the luxury watch market started to emerge.

Going down

• Luxottica’s shares took a nosedive after Essilor cut its full-year revenue growth forecasts to 3 percent. The Italian group’s shares ended 4 percent down in July.

• LVMH and Hermès both ended the month down (3 percent and 1 percent respectively), owing to their cautionary remarks about the outlook for the second half of the year.

ADVERTISEMENT

What to watch

Both Coach and Michael Kors brought the big guns out in terms of acquisitions. Could these two groups form affordable luxury conglomerates to rival the likes of LVMH and Kering at the higher end? Whilst Coach has tidied up its own act before acquiring Kate Spade, the jury is out on Michael Kors, whom a number of industry observers believe rode the wave too freely and has a more fragile core business.

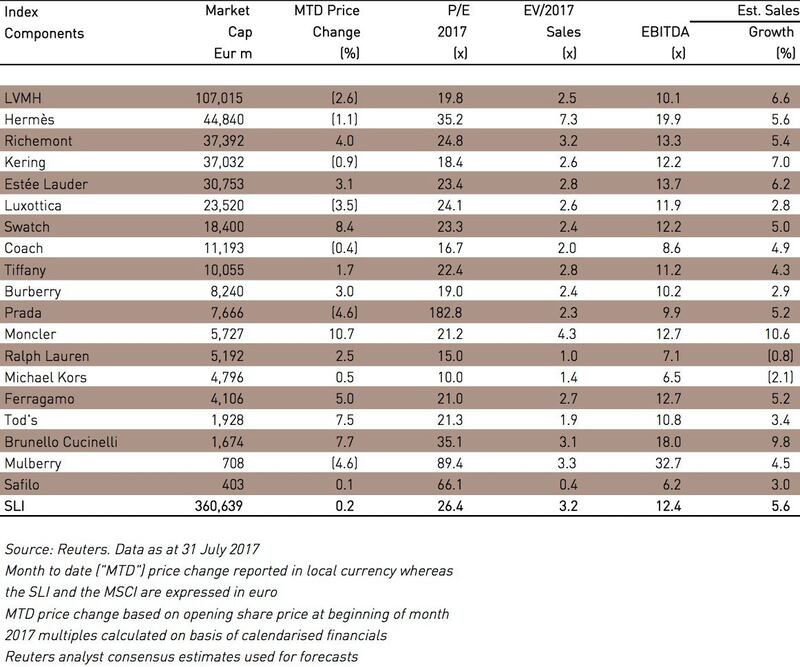

Sector valuation

Hermes saw Chinese buyers snap up its luxury products as the Kelly bag maker showed its resilience amid a broader slowdown in demand for the sector.

The group’s flagship Prada brand grew more slowly but remained resilient in the face of a sector-wide slowdown, with retail sales up 7 percent.

The guidance was issued as the French group released first-quarter sales that confirmed forecasts for a slowdown. Weak demand in China and poor performance at flagship Gucci are weighing on the group.

Consumers face less, not more, choice if handbag brands can't scale up to compete with LVMH, argues Andrea Felsted.