The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

This article first appeared in the special edition of The State of Fashion: Watches and Jewellery, co-published by The Business of Fashion and McKinsey & Company. To learn more and download a copy of the report, click here.

To many, “fine jewellery” is synonymous with images of Tiffany blue or Cartier red. To others, it conjures up De Beers’ historic “A Diamond Is Forever” marketing campaign. Despite the prominence of their names and logos, branded jewellery players — defined as brands that are known regionally or internationally and priced with a brand premium — make up just 20 percent of the fine jewellery market today. By contrast, premium to ultra-luxury watches see brand penetration extend to as much 90 percent according to McKinsey analysis. The unbranded fine jewellery segment still dominates the global market, but as consumer preferences shift, it represents a significant opportunity for brands to convert new buyers.

With consumers gravitating towards brands that represent their values and flocking to online shopping where larger brands have the scale and resources to fiercely compete, the branded fine jewellery market is poised to drive industry-leading growth at a compound annual growth rate (CAGR) of 8 to 12 percent from 2019 to 2025 — which is more than double the rate of the overall jewellery market. We expect the largest growth to come from Asia, with 10 to 14 percent CAGR, or roughly three to four times the overall market. Based on that trajectory, branded fine jewellery will account for approximately 25 to 30 percent of the market by 2025, equating to $80 to $100 billion in annual sales.

“Because of this unbranded market, [jewellery] brands have a big capacity to grow… compared to watchmaking. Because when you grow in watches, you have to grab market share from other brands but, when you grow in jewellery, you don’t have to kill your neighbour or your competition,” said Hélène Poulit-Duquesne, chief executive of Boucheron.

ADVERTISEMENT

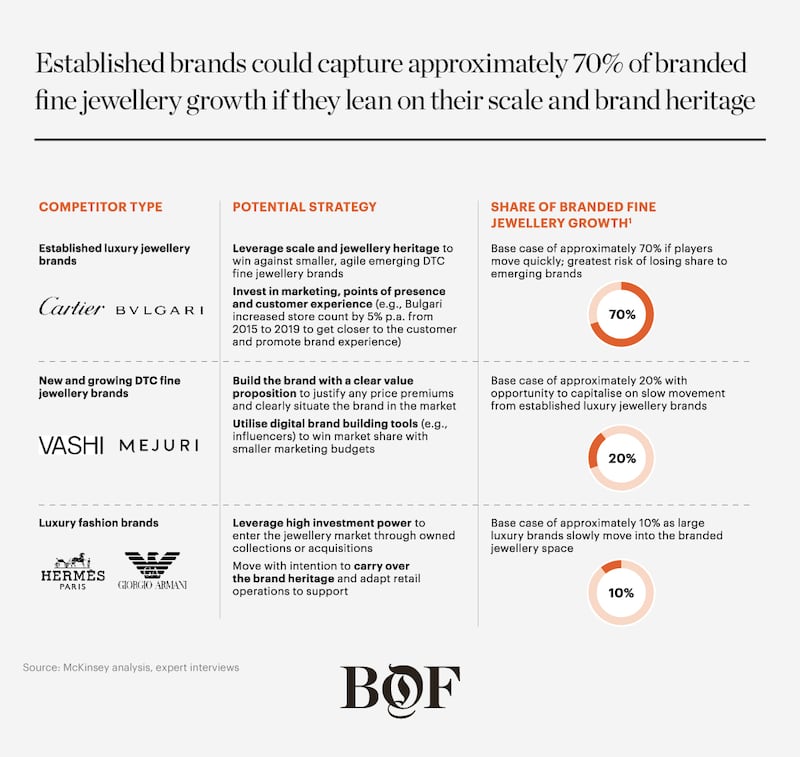

Equivalent pieces of branded fine jewellery can command prices up to six times higher than that of unbranded fine jewellery, so competition for the expanding value pool will be fierce. Three types of players are poised to jump on the opportunity to convert consumers from unbranded to branded jewellery with a premium price tag.

In the lead will be established fine jewellery brands already operating in the segment. Bulgari, for example, is increasing production, launching two to three collections per year — a significant increase in cadence from its former launches — and is investing more in marketing. Similarly, other brands such as Cartier are expanding their store footprint in a bid to increase visibility. We expect these large fine jewellery brands to account for the lion’s share of the segment’s expansion over the coming period, capturing up to 70 percent of growth in the branded market by 2025. However, while incumbent brands have the advantage of size, investment power and brand equity, they will need to move fast to keep ahead of other players that enter the market.

One such challenger will be new and growing direct-to-consumer (DTC) brands, often targeting a specific value proposition like sustainability or a point of view on design. These brands could account for 20 percent of growth in the branded market by 2025. More nimble by virtue of their often digital-first presence and close connection to consumers, these players will aggressively acquire customers through social media and paid marketing, testing and iterating on messages and techniques to most efficiently capture the target consumer.

“Being direct-to-consumer, we know more about our client [than some larger, traditional jewellers], because we don’t have a third party or an intermediary... [so] I know my customer. I can service them directly. I know what their desires are,” said Danielle Sherman, founder of LA-based DTC fine jewellery brand Sherman Field which specialises in heirloom and personalised pieces such as chain necklaces and lockets.

Finally, luxury fashion brands are expected to make up 10 percent of growth in the branded market by 2025. Fine jewellery has the potential to become fashion’s next big growth engine, taking over the role from leather goods, which has generated twice the growth of apparel and jewellery in recent years. There is significant opportunity for expansion for larger fashion houses whose fine jewellery segments today make up a relatively small proportion of their revenues (less than 8 percent for LVMH — prior to the acquisition of Tiffany & Co — and less than 6 percent for Kering, for example).

“It’s the biggest potential we have right now,” said Michael Burke, chairman and chief executive of Louis Vuitton. “Fine jewellery is one of the highest-growth categories we have, if not the highest.” A number of fashion brands, such as Chanel and Giorgio Armani, have recently launched or reinvigorated their fine jewellery lines. However, despite the attractiveness of the opportunity in branded fine jewellery, the slower product cycles and higher price points compared to many fashion categories mean luxury fashion brands will need to earn legitimacy and find the right consumer niches. High-end players can be expected to target the highest price points first to create a brand halo effect that provides a foundation to quickly descend the price ladder. These players will carry over their brand heritage and ensure their channels, including brick-and-mortar stores, are set up to operationalise the nuances of the fine jewellery category.

While the opportunity to convert consumers to brands is large, the challenge is not just in capturing value, but also in retaining it. In what can be long purchase cycles between one piece of fine jewellery to the next, pressure will be placed on retaining valuable brand-conscious consumers over their lifetime.

One key to retention will lie in meeting the ever-rising customer expectations of brands. Today, consumers increasingly look to brands to fulfil a desire for affiliation, purpose and deeper meaning. With this, there is an opportunity to convert customers who previously bought commoditised, unbranded fine jewellery by drawing them into the brand story. To capture the unbranded market, “it’s about creating an emotional connection,” said Jacques Roizen, Pandora’s senior vice president and general manager of China. “If brands like ours want to grow their share, we need to give our consumers a reason to feel that affinity.”

ADVERTISEMENT

For companies looking to expand their branded fine jewellery offering, they will find the strongest tailwinds in Asia, where branded fine jewellery is expected to grow at a CAGR of 10 to 14 percent between 2019 and 2025, making it the fastest-growing region. In China, only 15 percent of the fine jewellery market is currently branded, but local heritage brands like Chow Tai Fook and Chow Sang Sang already have loyal followings and niche brands such as Hefang, Yvmin and Ooak are beginning to gain traction — particularly from Millennials — and are taking share from affordable global brands and unbranded jewellers.

“This trend is particularly obvious in mainland China and the rest of Asia, where there is a mushrooming of micro brands from both groundbreaking new names — small and big — and spin-offs of well-known brands,” said Louis Chan, assistant principal economist of the global research team at HKTDC, which operates the Hong Kong International Jewellery Show, among other industry shows.

Still, strong demand for international brands remains, and these are likely to continue to outperform their local rivals over the next five years.

To succeed in seizing global market share both from rival brands and from unbranded jewellers, brands should invest without delay, use technology to get closer to the consumer and bring in diverse voices:

Make Daring Investments Now

Branded jewellery is emerging from the pandemic period as one of the hottest product categories for luxury players. Likewise, luxury consumers are expected to recover much faster from the economic impact of Covid-19 than their lower income counterparts. McKinsey research shows that in the US in particular, high-income earners will see notably faster spending recovery speeds than middle- and low-income cohorts, particularly among young and middle-aged consumers. In Europe, high-income consumers will also emerge fastest, but with less of a differentiation from middle-income consumers.

Brands must invest in product innovation, digital, direct-to-consumer channels and marketing, before the market fully recovers, to get ahead of competitors who do not move with the same urgency or who do not have the capital to do so. Furthermore, brands who dare to surprise the consumer stand to benefit. Tiffany & Co’s decision to use bright yellow instead of its signature blue in a pop-up store design in 2021 is one example. We expect the fastest movers to win market share.

Nurture Tech-Enabled Agility

ADVERTISEMENT

2020 marked a year of abrupt change in consumer preferences, shifting away from previous priorities to focusing on health and safety. Consumer preferences and sentiment will continue to rapidly evolve in the coming years, requiring brands to be closer to the consumer than ever before. Gone are the days when the pace of change can be driven by a brand’s long-life product cycle as the consumer is now in the driver’s seat, demanding better engagement on their terms and at their preferred pace. This means technology will increasingly be the enabler for customer engagement.

Brands should activate real-time listening posts to get rapid consumer feedback by leveraging technology that is fast to deliver. For example, some retailers have begun using AI-driven chat over SMS to get customer feedback immediately after leaving the store. The AI engine picks up on consumer responses and adjusts questions accordingly to quickly gather actionable feedback, which leading companies will follow-up on personally with customer service agents and embed into decision making.

Build a Diverse and Representative Advisory Board

A typical board of directors often prioritises longstanding industry experience and deep knowledge about a company. However, in the jewellery sector, it too often lacks young and diverse leadership talent. To better reflect a brand’s current and future consumers and create a greater sense of intimacy with them, brands should, at a minimum, create internal forums to engage in increasingly relevant dialogue about issues that are important to a wider range of consumers.

Those who wish to be more ambitious will consider creating an advisory board of young, diverse talent to advise the leadership team in a more formal capacity. Brands should look within and outside of the fine jewellery industry to find creative, young minds to challenge the executive leadership team and bring insights from new, out-of-the-box perspectives. More diverse thought leadership, especially when representative of the target consumer, can unlock new ideas and provide invaluable feedback.

As the share of the branded fine jewellery market is set to grow, brands must be careful to not get distracted by the sheer scale of the opportunity or the apparent familiarity of the undertaking. “There is potentially a huge opportunity, both in terms of market share and in terms of improved revenue,” said Gaetano Cavalieri, president of the World Jewellery Confederation CIBJO. “But it will require a leap of faith on the part of jewellery consumers.” Indeed, for brands to win over consumers in this highly competitive space will require a combination of speed, bold thinking and impeccable execution.

The inaugural edition of The State of Fashion: Watches and Jewellery report co-published by The Business of Fashion and McKinsey & Company forecasts a shake-up in priorities for hard luxury as well as different recovery scenarios across geographies and consumer segments. To learn more and download a copy of the report, click here.

BoF Professionals are invited to join us on July 13, 2021 for a special live event in which we'll unpack findings from the report. Register now to reserve your spot. If you are not a member, you can take advantage of our 30-day trial to experience all of the benefits of a BoF Professional membership.

Explore the six seismic shifts from the report:

The Future of Watches:

The Future of Jewellery:

Click here to explore more from this special edition report, including executive interviews.

After preserving his fashion empire’s independence for decades, the 89 year-old designer is taking a more open stance to M&A.

The sharp fall in the yen, combined with a number of premium brands not adjusting their prices to reflect the change, has created a rare opportunity to grab luxe goods at a discount.

Fashion’s presence at Milan Design Week grew even bigger this year. Savvy activations by brands including Hermès, Gucci, Bottega Veneta, Loewe and Prada showed how Salone has become a ‘critical petri dish for dalliances between design and fashion,’ Dan Thawley reports.

The Hood By Air co-founder’s ready-to-wear capsule for the Paris-based perfume and fashion house will be timed to coincide with the Met Gala in New York.