The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

This article first appeared in the special edition of The State of Fashion: Watches and Jewellery, co-published by The Business of Fashion and McKinsey & Company. To learn more and download a copy of the report, click here.

The fine jewellery industry’s dubious track record on sustainability was put under public scrutiny during the 1990s “blood diamond” scandal, which exposed the dark underbelly of the diamond and jewellery industries awash with conflict gemstones. It also served to spotlight the industry’s negative impact on the communities and countries that power the supply chain, as well as its limited traceability and accountability. Although this catalyst led to some positive reshaping of the diamond market in the form of the Kimberley Process, diamond sales from conflict areas forged ahead.

While the fine jewellery industry as a whole has been slow to implement market-wide changes in terms of sustainability — and where change has occurred, it has been driven primarily by mitigation of scandals — changing consumer tides are influencing a shift in executives’ mindsets. Executives are now viewing ethically and environmentally sound practices as a business opportunity. By 2025, we expect sustainability-influenced purchases will account for 20 to 30 percent of all fine jewellery sales (equivalent to $70 to $110 billion). This would be a remarkable three- to four-times increase from 2019.

Given the timing of the opportunity, operating in a more sustainable manner should be seen as “a source of competitive advantage in the post-crisis future as the world’s economy bounces back,” said Louis Chan, assistant principal economist of the global research team at HKTDC, which operates the Hong Kong International Jewellery Show and the Hong Kong International Diamond, Gem and Pearl trade shows.

ADVERTISEMENT

To be sure, the fine jewellery industry’s negative impact on the environment and its numerous workers upstream in the value chain persists today. At the source, an estimated 250 tonnes of earth are shifted for every carat of diamond extracted — which will equate to 1.5 times the weight of Mount Everest over the next five years — by miners who make as little as $3 per day in some regions. Meanwhile, further downstream, diamond polishing emits 160 kilograms of CO2 per carat. Unmitigated, this would translate to 160 to 170 megatonnes of CO2 emissions in the next five years — the equivalent of the yearly emissions from the entire country of Singapore. This activity is fundamental to both the fine jewellery and watch industries that source precious materials. And the impact is not limited to diamonds alone.

“Gold is definitely an issue,” said Damian Oettli, head of markets at the independent conservation organisation WWF. “In the Amazon and in African regions, really large stretches of ecological systems are being destroyed through… gold mining activities, both industrial and artisanal.” Indeed, gold mining generates 20 tonnes of waste for every 9 grams of gold mined, with mining companies dumping 180 million tonnes of hazardous waste into water streams every year, which is more than 1.5 times the waste US cities send to landfill on a yearly basis. Meanwhile, fine jewellery and watch supply chains for silver, farmed pearls and other gemstones are tarnished with their own harmful activities.

But the groundswell is building. Topics like polluted waterways and worrying miner mortality rates that threaten the glossy, romantic image the fine jewellery industry has fought for so long to preserve and present to consumers cannot be ignored.

Industry executives are beginning to notice a palpable change in the intensity of calls from consumers for greater sustainability, both environmental and social, especially among the coveted young luxury consumer. While just 12 percent of Baby Boomers are willing to pay more for products deemed to be sustainable, this number nearly triples to 31 percent for Gen-Z consumers. Moreover, the opportunity in the luxury sector is ripe — 58 percent of younger consumers who bought luxury goods in 2019 say that sustainability is an important consideration in their purchase.

Yet fine jewellery companies have a way to go to convince consumers that they are serious about sustainability. Brands’ abilities to get away with paying lip service to sustainability and disguising marketing as substantive progress — be it through environmental greenwashing or performative social justice — will diminish as consumers increasingly call out empty marketing claims. Indeed, McKinsey research indicates that 9 in 10 Gen-Z consumers believe companies have a responsibility to address environmental and social issues. This will demand a step change in brands’ engagement with these issues over the next five years, calling for ambitious commitments and substantiated, certified evidence of progress.

“If a brand claims to be sustainable, it will need to show that this indeed is true in the court of public opinion,” said Gaetano Cavalieri, president of CIBJO, the World Jewellery Confederation. “Those brands that are able to convince their consumers that they are honest, above-board and ready to change, will be the ones that win consumer confidence and loyalty.”

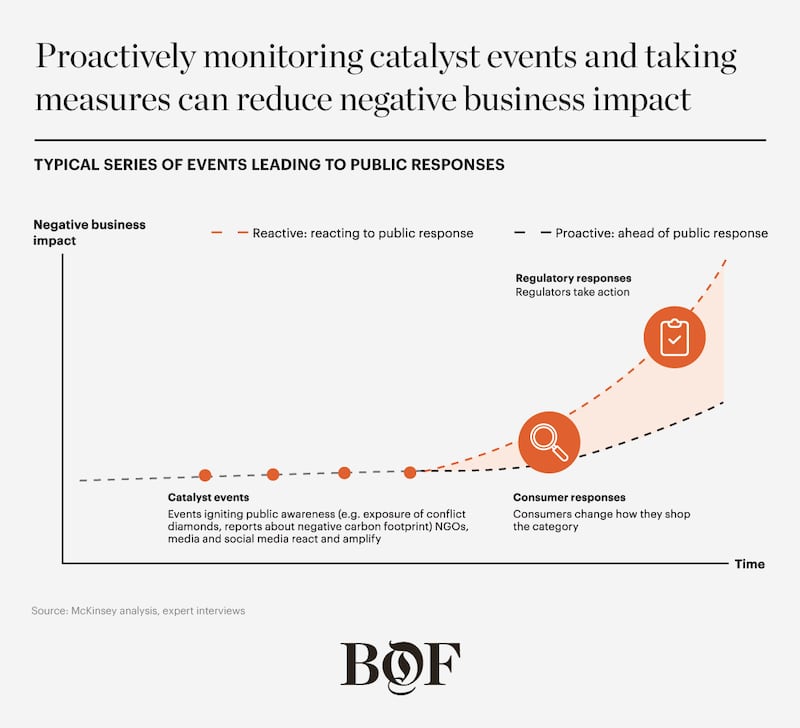

If history from other sectors such as food and the automotive industry is indicative of fine jewellery’s future in sustainability, shifts in consumer sentiment are often indicators of regulatory change to come (see Exhibit 14). Regulatory standards in the fine jewellery industry, even if not yet widely enforced or adopted, are starting to emerge to help structure sustainability best practices, such as the Conflict Minerals Regulation that came into force in the EU in January 2021 to ensure responsible sourcing of minerals such as gold.

Recent regulation builds upon a series of industry-led initiatives. In 2005, the Responsible Jewellery Council (RJC) was established with the goal of determining a set of standards for social and environmentally sustainable practices in jewellery supply chains. In 2013, the Better Gold Initiative was developed by the Swiss government in tandem with the industry-led Swiss Better Gold Association to build transparency and responsibility in the gold supply chain, with measures aimed at preventing conflict gold and minimising mercury emissions from mining. Most recently in 2021, the Certification Standard for Sustainable Diamonds was released by official standards development body SCS Standards to provide a unified transparency framework for assessing and certifying mined, lab-grown and recycled diamonds.

ADVERTISEMENT

The fine jewellery industry, however, has yet to collectively agree on a single standard or set of standards, and critics suggest that existing certifications do not hold the industry to a high enough account. The certification space will likely mature over the next few years to foster further transparency.

“If you really want to talk about a responsible supply chain, you need everyone along that chain to join hands [instead of] a lot of isolated efforts,” says Responsible Jewellery Council executive director Iris Van der Veken. “[Going forward, the] movement needs to accelerate [which is why] we call this the decade of action.” Companies will need to take a 360-degree, holistic view of all facets of sustainability, including but not limited to workers’ rights, diversity and inclusion, mining impact, waste, emissions output and energy use.

Swarovski says it obtains 35 percent of its energy for its integrated manufacturing and production sites from renewable sources, up from 33 percent in 2015-2016, which is a small but noteworthy step towards UN 2030 Sustainable Development Goals which indicate that companies should be substantially increasing their share of renewable energy. Meanwhile, companies are becoming more vocal about sustainability as part of their marketing strategies. Pandora announced in May 2021 that it will stop using mined diamonds and will use only lab-grown diamonds as a “testament to our ongoing and ambitious sustainability agenda,” said Pandora chief executive Alexander Lacik in a statement. However, some industry leaders like CIBJO’s Cavalieri have suggested that such moves are a blunt instrument that “inadvertently [jeopardises] the livelihoods of countless African miners through no fault of their own.” On top of this, lab-grown diamonds have faced criticism for their intensive use of energy, and how sustainable they are compared to mined diamonds is hotly debated.

At the higher end of the market, Tiffany & Co has launched a new product range made from recycled gold, indicating a step change away from the company’s traditions. The company has also established its own chain-of-custody controls, becoming the first global luxury jeweller to disclose the countries of origin of its newly sourced, individual diamonds of 0.18 carats or larger, and since February 2021 has established science-based emissions reduction targets.

Just as there is a business opportunity in sustainable transformation, there is also a risk in companies not acting, with a clear danger of inflicting harm on both the environment and communities throughout the value chain. A failure to reflect shifting consumer attitudes may also lead to negative reputational consequences: In an emotion-driven retail category such as fine jewellery, the costs of such lapses can be significant, tarnishing high-lifetime-value relationships. At the same time, mounting investor pressure will make access to capital more difficult and expensive for businesses that do not show a real desire to act.

Unlike some industry shifts, calls for more responsible business practices are expected to impact companies of all sizes and geographies. Companies that buy diamonds and gemstones wholesale will come under the same degree of scrutiny as vertically integrated players that operate their own mines. A sustainability-minded consumer cares about impact, and whether a company takes a visible stand. Bulgari’s head of sales and retail, Lelio Gavazza, said that demonstrating jewellery’s sustainability credentials with traceability is especially important to younger consumers. “We [aim] to trace as much as possible; when we do not do that, we are out of business,” he said. Bulgari sources gold certified against the RJC’s Chain of Custody Standard and, in 2019, the company exclusively sourced recycled gold.

Fully committing to improving sustainability practices will undoubtedly impact companies’ bottom lines. On materials alone, there is up to a 20 to 25 percent cost increase when switching to fair-trade gold to ensure it is mined in ethical conditions. The effect is the same with responsibly mined gemstones, which have an average cost increase of 10 to 15 percent. The question remains as to how much of these costs customers will be willing to absorb, but it is unlikely that it will be the totality.

Pressure will therefore build on both pricing and margins. Brands known for distinctive and recognisable designs will likely have the upper hand with their ability to command premium price points. Similarly, small brands that embed sustainability into their brand identity will have a head start in capturing younger consumers who are willing to pay a premium for credible, sustainable pieces. This could prove a valuable strategy for younger brands to move rapidly in an industry where highly resourced, large brands dominate. For instance, the made-to-order fine jewellery brand Vashi has seen its profile grow rapidly thanks in part to its ethical positioning where it uses Kimberly Process mined diamonds and 100 percent recycled gold and platinum.

ADVERTISEMENT

For larger companies that cannot overhaul the supply chain overnight, there are still steps that can help jumpstart the journey. For instance, they can begin by critically evaluating the current state of their supply chain to understand current baselines and set goals for the future. Others might consider launching new collections that are sustainably sourced to capture the sustainability-minded consumer and learn best practices to incorporate into the remainder of their collections.

While a quantum leap is required to bridge the fine jewellery industry’s current sustainability gap, companies must act fast to achieve the transformation needed. To be sure, capitalising on this opportunity will require sizeable investments, but companies should focus their sustainability efforts on three key strategic areas:

Make Sustainability a Top Leadership Priority

If change is to stick, companies must set a clear sustainability agenda and embed priorities throughout the entire organisation – from front-line sales associates to the CEO and across teams from the marketing department to supply chain management. Doing so requires sustainability to be a top item on the executive agenda, and given the magnitude of change required, any less will ensure failure. This means investing time in building the necessary know-how and putting appropriate capital expenditure behind sustainability goals to turn rhetoric into action. Partnerships to drive innovation or ensure compliance with the highest of standards can certainly help, but should not replace full ownership within the company.

Create End-to-end Transparency and Define Priority Areas

In the short term, actively tracking and reporting on environmental and social impact and corporate governance structures should be seen as the baseline. However, the wave of consumers demanding more than the baseline is already underway. Over a longer timeframe, operating to the highest standards across the supply chain will become table stakes in many markets, making it imperative to reduce environmental impact and ensure ethical working conditions are upheld. New technologies, such as blockchain, can help improve materials’ traceability, and other innovations in mining can help make jewellery less damaging to ecosystems, more supportive of local communities and less resource-intensive.

Improve Research and Design Processes

Companies should re-evaluate their use of materials. Using more recycled materials is a good first step, and fine jewellery players can consider pushing this further by embedding circularity principles into their model, allowing customers to trade in or redesign old jewellery. There are also opportunities in product innovation, where smaller brands and young designers are already finding success with alternative materials like found objects.

The inaugural edition of The State of Fashion: Watches and Jewellery report co-published by The Business of Fashion and McKinsey & Company forecasts a shake-up in priorities for hard luxury as well as different recovery scenarios across geographies and consumer segments. To learn more and download a copy of the report, click here.

BoF Professionals are invited to join us on July 13, 2021 for a special live event in which we'll unpack findings from the report. Register now to reserve your spot. If you are not a member, you can take advantage of our 30-day trial to experience all of the benefits of a BoF Professional membership.

Explore the six seismic shifts from the report:

The Future of Watches:

The Future of Jewellery:

Click here to explore more from this special edition report, including executive interviews.

This week, more luxury brands will report first-quarter results, offering clues as to how broad and how deep the downturn is going to get.

Fashion brands are edging in on the world’s largest gathering of design professionals and their wealthy clients, but design companies still dominate the sector, which is ripe for further consolidation, reports Imran Amed.

Blocking the deal would set a new precedent for fashion M&A in the US and leave Capri Holdings in a precarious position as it attempts to turn around its Michael Kors brand.

After preserving his fashion empire’s independence for decades, the 89 year-old designer is taking a more open stance to M&A.