The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

WASHINGTON, D.C., United States — In the 12 months since Donald J. Trump was elected President of the United States, the country has witnessed a series of radical moves from its new leader, including his order banning visitors from seven Muslim-majority countries in January 2017, US withdrawal from the Paris Climate Accord in June and a sudden escalation in tensions with North Korea in October.

Most recently, reports have surfaced indicating that Special Counsel Robert Mueller, who is investigating whether members of Trump’s campaign staff colluded with Russia to help steer the outcome of the election, now has enough evidence to bring charges against Michael T. Flynn, Trump’s former national security advisor. (Former campaign chairman Paul Manafort has already been indicted on charges including conspiracy and money laundering).

However, the President’s effect extends beyond politics. Trump’s influence on the greater cultural conversation — consider Alec Baldwin’s weekly turn on Saturday Night Live, Hulu’s dystopian hit television series "The Handmaid’s Tale" or George Clooney’s latest film, "Suburbicon" — is palpable.

And fashion is not immune. The President and his family’s taste for the excessive — from gold drapes in the Oval Office to First Lady Melania Trump’s flounce-heavy garments — is, intentionally or not, reflected on the runway, where go-go '80s, Reagan-era fashion, heavily logo-ed and decorated, currently dominates. “The Reagan Era was the beginning of the luxury boom,” notes Pamela Danziger, founder of luxury research firm Unity Marketing. “That luxury lifestyle was part of the economic boom that happened under the Reagans. We could see a very similar thing happening under the Trump White House if he can bring the economy back.”

ADVERTISEMENT

Many would argue that the economy is indeed back: Unemployment is lower than it has been in a decade (4.5 percent) and gross domestic product is growing at a faster pace than it has in two years. And yet, the Trump presidency has ushered in a quiet period for luxury goods consumption in the US, with the market projected to widen just 2 percent in 2017, compared with 6 percent in both Europe and Asia, according to an October 2017 report by Bain & Co.

Why? For one, more than 800,000 fewer tourists visited the US in the first half of 2017, a three percent drop from the same period a year earlier according to the US Department of Commerce. That, in part, is due to the strong dollar — the number of UK tourists was down over 6 percent during the period — but also, perhaps, due to the administration’s extremist policies. As the President’s plans for a wall between the country and Mexico have crystalised, tourists from that country have also increasingly steered clear, with the number of Mexican visitors down almost six percent through May 2017.

But while spending may not currently be as robust as luxury brands would like, tax cuts — proposed by Republican lawmakers in early November — may help spur sales, at least in the short term. The proposed plan cuts the corporate tax rate to 20 percent from 35 percent, which critics say will primarily benefit top-earning executives and shareholders, not the majority of corporate employees. The plan will also work to eventually eliminate the federal estate tax, which only benefits individuals with estates worth over $5.5 million and couples with estates worth over $11 million. Eliminating the alternative minimum tax will only benefit households with incomes over $200,000.

Many wealthy Americans, from Atherton, California, to Greenwich, Connecticut, do not support this plan — and did not vote for President Trump. And yet, there are pockets of wealth where the tax benefits of voting for a Republican candidate won out over any other considerations. He may have ran on a populist, “America First” platform, but more than 400 counties where Trump won the popular vote boast a median income higher than the 2016 national average of $57,617, with more than 40 over $80,000.

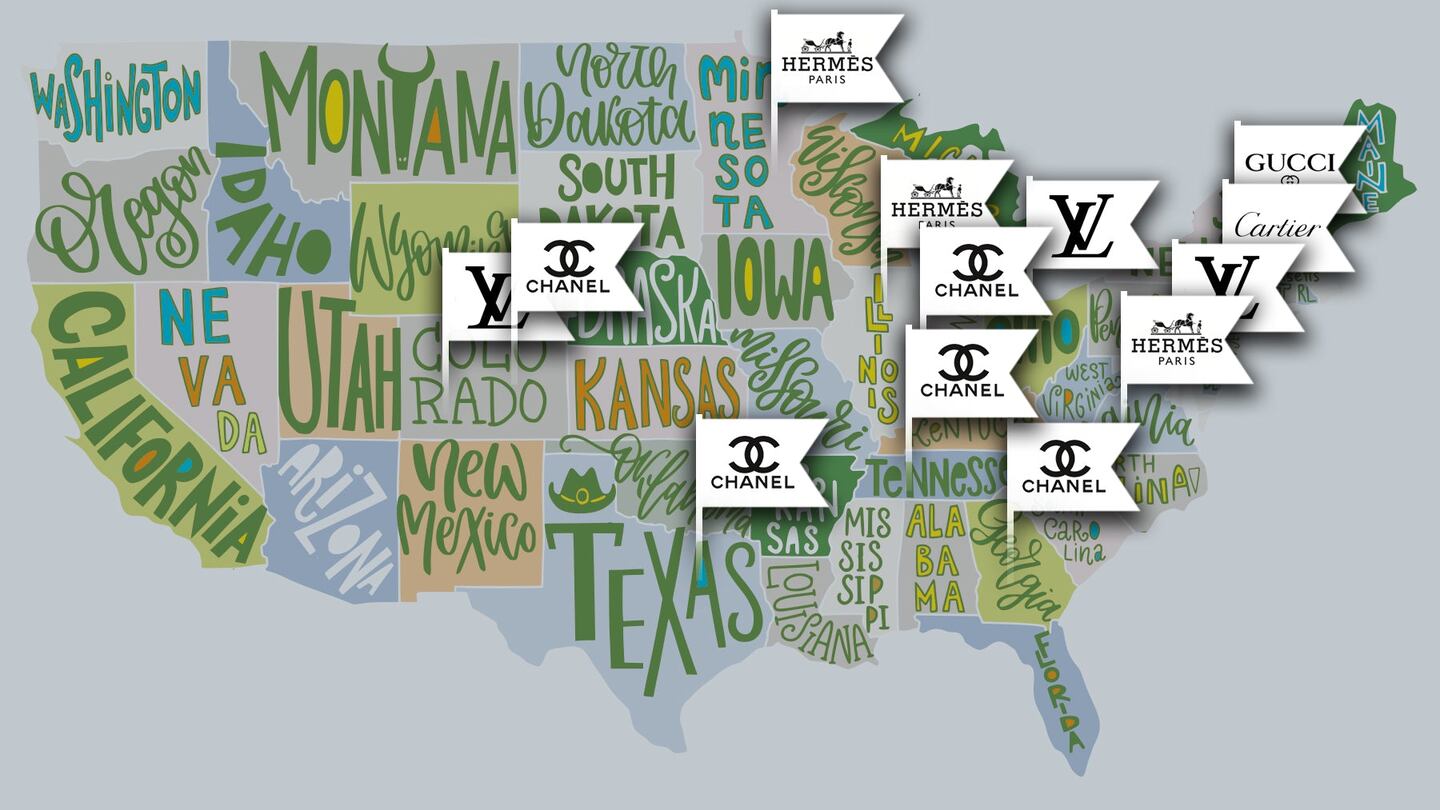

What brands are selling in Trump’s America, then? BoF tapped luxury resale site The RealReal, which trades in everything from Céline luggage totes to Rolex watches, to find out which brands rule in 17 of the 20 wealthiest counties in the country where Trump won the popular vote, ranging from a median income of $86,823 in Collin County, Texas, to $109,926 in Douglas County, Colorado. The national median household income in 2016 was $57,617.

Tony McGovern — a data scientist and co-founder of data-design firm Em Data — culled the county information from US Census Bureau data. The RealReal ranked the top five brands in each county by scanning sales from the first 10 months of 2017. Three of the top 20 counties — Stafford County, Virginia; Carver County, Minnesota; and Williams County, North Dakota — were not significant drivers of sales for The RealReal, so they were not included in the findings.

According to the data, more traditional luxury brands tend to resonate with Trump supporters. Chanel, for example, ranked in the top five in 15 of the 17 counties. Louis Vuitton appeared 14 times. (For context: The RealReal's top-five selling brands in the US — ranked from one to five — are Chanel, Hermès, Louis Vuitton, Gucci and Cartier.) Which means Trumpland, in some ways, is a lot like the rest of the country.

Other popular labels included Christian Louboutin, Hermès, Gucci and David Yurman, one of the few American brands to appear more than once. Oscar de la Renta and Alexander McQueen were favorites in Morris County, NJ, where the median household income is $101,754, and Carolina Herrera popped up in Hamilton County, Indiana, where the median household income is $91,844.

ADVERTISEMENT

It may be no surprise that these are the names beloved by fans of Brand Trump, but whether or not the wardrobe of First Lady Melania Trump is driving brand sales is less clear. In the past, first ladies have used their exposure to promote designers. Michelle Obama is credited with helping to boost J.Crew’s profile, while Jacqueline Kennedy made the designer Halston famous by wearing one of his pillbox hats.

Thus far, Melania Trump has favoured designs from European fashion houses — Fendi, Roksanda Ilincic, Chanel — occasionally appearing in garb that some have deemed inappropriate. For instance, the First Lady was critiqued for wearing a $1,380 Balmain plaid shirt to host an event in the White House garden.

Of course, past first ladies — from Obama in an Alaïa belt to Nancy Regan in an Yves Saint Laurent skirt suit — were not always clad in American brands, and they have also been criticised for extravagant purchases. (Consider when Obama wore $540 Lanvin sneakers to a food bank.)

What seems to be a greater issue, however, is the current First Lady’s minimal attention to American brands. "To me, what’s actually very shocking is that we seem to have completely let go of the idea that first ladies should support American fashion designers,” says Kimberly Chrisman-Campbell, an art historian specialising in fashion and textiles. "The first lady’s preference for European designers is totally unprecedented in fashion history.”

Trump has donned American labels, like the western shirt from Raf Simons' first Calvin Klein 205W39NYC collection, which she wore on the White House lawn to great, if not entirely positive, fanfare. The piece's current sell-through rate is just 13 percent, according to retail analytics firm Edited. While the style did sell out at certain retailers — including CalvinKlein.com and BergdorfGoodman.com, which has since replenished it — many of those sales were made long before (or long after) the First Lady wore the piece.

No matter, though. Supporters of her husband seem to be sticking with Chanel.

What's Selling in Trumpland, USA:

Douglas County, Colorado

Median Household Income: $109,926

A wealthy enclave midway between Colorado's two biggest cities — Denver and Colorado Springs — Douglas has the highest median household income of any county in the state.

1. Chanel

2. Louis Vuitton

3. Gucci

4. Prada

5. Valentino

ADVERTISEMENT

Williamson County, Tennessee

Median Household Income: $104,367

This Nashville suburb includes the town of Franklin, home to many celebrities and musicians.

1. Chanel

2. Louis Vuitton

3. Valentino

4. Gucci

5. David Yurman

Hunterdon County, New Jersey

Median Household Income: $102,797

Located in the northwest part of New Jersey, Hunterdon is rural, with high taxes, and is a favourite amongst wealthy executives who commute into Manhattan.

1. Cartier

2. Chanel

3. Gucci

4. Oscar de la Renta

5. Valentino

Morris County, New Jersey

Median Household Income: $101,754

This northern New Jersey county is another New York City suburb favoured by commuters.

1. Chanel

2. Alexander McQueen

3. Oscar de la Renta

4. Hermès

5. Cartier

Calvert County, Maryland

Median Household Income: $98,937

A Washington, D.C. commuter suburb, Calvert also is also home to a few tourist beach towns.

1. Louis Vuitton

2. Gucci

3. Prada

4. Hermès

5. Chanel

Forsyth County, Georgia

Rife with history of racial conflict, Forsyth County is a predominantly white Atlanta suburb.

Median Household Income: $97,886

1. Chanel

2. Cartier

3. Louis Vuitton

4. Prada

5. Valentino

Delaware County, Ohio

Median Household Income: $97,679

One of Columbus' fastest-growing suburbs.

1. Louis Vuitton

2. Gucci

3. David Yurman

4. Chanel

5. Christian Louboutin

Scott County, Minnesota

Median Household Income: $92,898

A suburb of the Twin Cities (Minneapolis and St. Paul), Scott is one of the fastest-growing counties in the state.

1. Hermès

2. Prada

3. Christian Louboutin

4. Louis Vuitton

5. Chanel

Rockwall County, Texas

Median Household Income: $92,150

The smallest county in Texas, Rockwall is also one of the fastest-growing.

1. Chanel

2. David Yurman

3. Christian Louboutin

4. Louis Vuitton

5. Chopard

Hamilton County, Indiana

Median Household Income: $91,844

This Indianapolis suburb has found its way onto several quality-of-life lists. In 2013, CNN Money named the city of Carmel (located in southwestern Hamilton County) the top place to live.

1. Chanel

2. Louis Vuitton

3. Hermès

4. Patek Philippe

5. Carolina Herrera

Putnam County, New York

Median Household Income: $90,497

The county is home to idyllic commuter towns including Cold Spring, Katonah and Garrison, many of which are favoured by artists and creative executives.

1. Gucci

2. Chanel

3. Louis Vuitton

4. Prada

5. Hermès

Elbert County, Colorado

Median Household Income: $90,270

Home to cattle ranches and farms, this Denver suburb is longstanding Republican.

1. Louis Vuitton

2. Givenchy

3. Yves Saint Laurent

4. Gucci

5. Frame Denim

Fauquier County, Virginia

Median Household Income: $89,610

A rural county in North Virginia, Fauquier is close to Washington, D.C.

1. Hermès

2. Ippolita

3. Chanel

4. Chopard

5. Cartier

Kendall County, Illinois

Median Household Income: $88,773

This wealthy Chicago suburb is one of the fastest-growing counties in the country.

1. Hermès

2. Louis Vuitton

3. Dolce & Gabbana

4. Fendi

5. Balenciaga

Suffolk County, New York

Median Household Income: $87,634

This Long Island county includes the Hamptons, Montauk and Fire Island, some of the wealthiest beach towns across the US. (And the centre of the New York social scene during the summer months.)

1. Chanel

2. Van Cleef & Arpels

3. Louis Vuitton

4. Hermès

5. Gucci

Rockingham County, New Hampshire

Median Household Income: $87,103

Just an hour's drive to Boston, Rockingham residents benefit from New Hampshire's zero sales tax.

1. Louis Vuitton

2. Cartier

3. Chanel

4. David Yurman

5. Harry Winston

Collin County, Texas

Median Household Income: $86,823

1. Chanel

2. Louis Vuitton

3. Gucci

4. Hermes

5. David Yurman

Related Articles:

[ Doing Business in Trump's AmericaOpens in new window ]

[ Counting on the USA: Fashion, Trump and America's $500 Billion Trade DeficitOpens in new window ]

[ In Trump's America, the Price of Speech and SilenceOpens in new window ]

The sharp fall in the yen, combined with a number of premium brands not adjusting their prices to reflect the change, has created a rare opportunity to grab luxe goods at a discount.

Fashion’s presence at Milan Design Week grew even bigger this year. Savvy activations by brands including Hermès, Gucci, Bottega Veneta, Loewe and Prada showed how Salone has become a ‘critical petri dish for dalliances between design and fashion,’ Dan Thawley reports.

The Hood By Air co-founder’s ready-to-wear capsule for the Paris-based perfume and fashion house will be timed to coincide with the Met Gala in New York.

Revenues fell on a reported basis, confirming sector-wide fears that luxury demand would continue to slow.