The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

When Nadya Okamoto, founder of period care brand August, spoke with investors interested in her pre-seed business in June 2021, they were compelled by Okamoto’s vision for a more inclusive, gender-neutral period product. But they were even more intrigued by August’s hyper-engaged community of a few thousand people on a little-known platform called Geneva, what Okamoto calls “slack for Gen-Z.”

The fledgling brand successfully raised around $2 million before it had an actual product ready to manufacture and sell. Instead, Okamoto secured its investment based on the fact that August already “had a very tight-knit community of several hundred and then maybe a thousand ‘Inner Cycle’ members who were super passionate about what the ‘Inner Cycle’ was doing,” Okamoto said, referring to the name of the brand’s “home” on Geneva. August’s Inner Cycle community offered a space for members to share their period stories, ask questions about what it was like to get their periods for the first time and educate themselves with resources focused on period care for trans people, for example.

Brands are constantly recalibrating their marketing strategies to accommodate the latest social media craze, to varying degrees of success: Clubhouse came and went like a supernova, while TikTok has sustained the interest of over a billion users worldwide. Geneva is the latest platform to capture Gen-Z and brands’ attention, but it has yet to prove whether it’ll last. As marketers prioritise brand building over increasingly less effective performance marketing, brands say that Geneva’s engaged audience has helped set it apart from other social media fads — though it still has a ways to go before scaling that engagement is possible.

“The community is huge for retention,” Okamoto said. “We have a lot of people who haven’t subscribed to August but they join the community because they’re interested and then they fall in love with the brand because of the community.”

ADVERTISEMENT

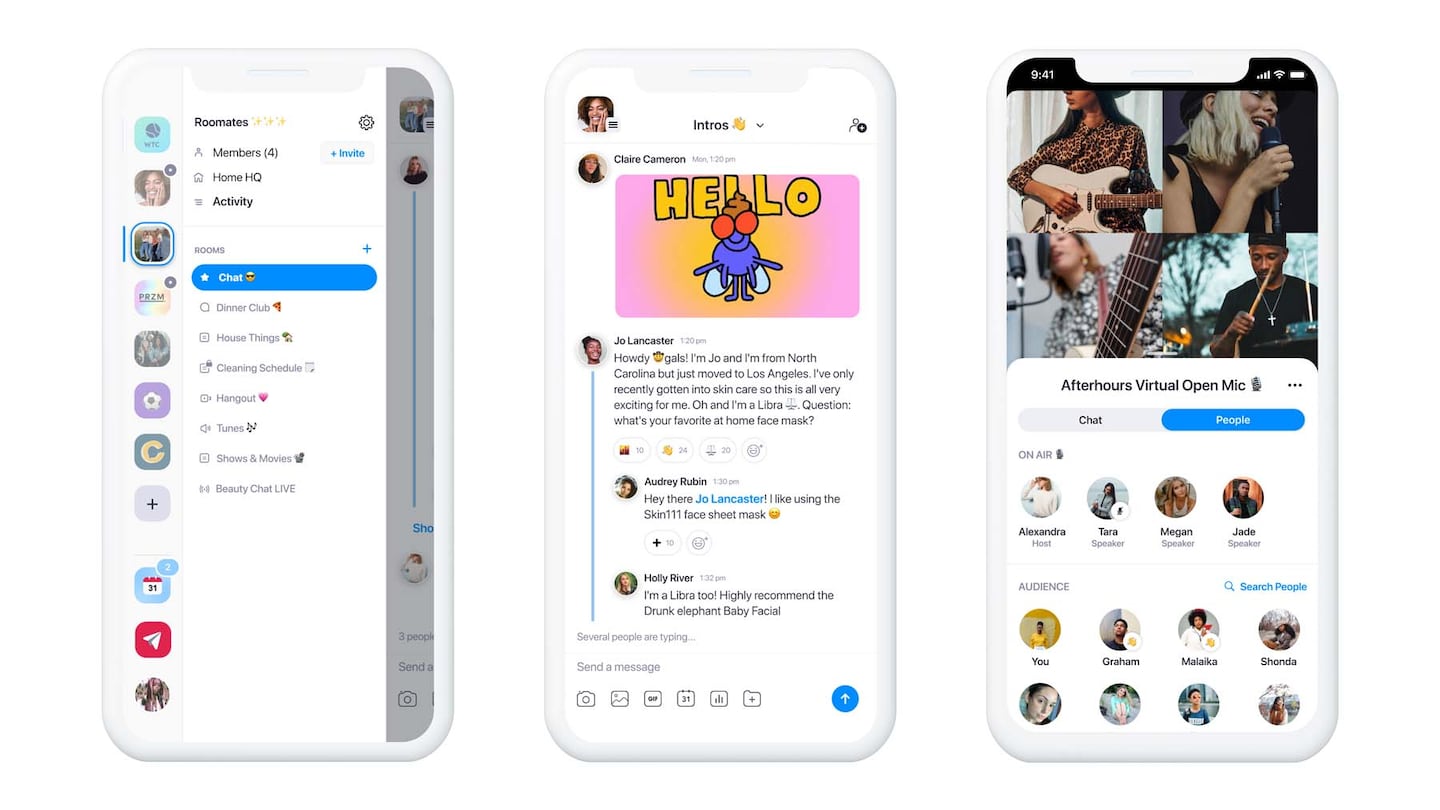

Geneva, which was founded in 2019 and went live in March 2020, works like this: Anyone can set up a “home;” think of it like the main hub where admitted members can enter different rooms (chat rooms like in Slack, audio rooms like on Clubhouse or Twitter Spaces, or even video rooms like on Zoom or Instagram Live) and discuss the room’s topic. Book clubs, creator-led communities, sororities, run clubs and brand ambassador programmes are a few examples of the kinds of “homes” that exist on Geneva.

Currently, Geneva is free to use and there are no paid ad tools for brands on the platform. Eventually, the company intends on building monetisation tools to allow communities to charge for different experiences within the homes (like virtual events), where it will then take a percentage of the revenue generated, said Kim Johnson, head of community at Geneva.

The company declined to offer user numbers, but Johnson said the platform has “basically tripled [daily active users]” since the beginning of 2022. Geneva has raised $22 million in venture funding, according to Crunchbase. (Johnson, for her part, worked at Glossier and led its community efforts for six years prior to joining Geneva.)

Despite the lack of paid tools since its launch, Geneva has attracted brands including jewellery maker Mejuri, sun care label Supergoop and hair care line Ceremonia, where each has a Geneva “home” with several rooms to spark conversation and offer product education and tutorials (brand homes on Geneva look the same as a home any one person could create.) Brands aren’t finding massive audiences there: Rare Beauty, Selena Gomez’s cosmetics line, has 94 members on its Geneva page, compared to 3.2 million followers on Instagram and 821,000 on TikTok. Still, the brand is “doubling down” on Geneva, said Ashley Murphy, Rare Beauty senior director of consumer marketing.

“While an Instagram DM is great, if you’ve ever been in an Instagram DM with 100 people … It’s too much, you can’t catch up,” Murphy said. “We really love the features that Geneva had where … you could have different rooms for different topics. That helps us to better serve our community and as we’re monitoring it and responding, it’s much easier from a UX perspective.”

Brands on Geneva also see it as a space to discuss elements beyond the product: Rare Beauty has focussed on mental health advocacy since its 2020 launch (Gomez herself has long been an advocate for mental health awareness). Consumers are coming to the brand’s Geneva home for mental health resources, like its Beauty Mental Health Council — a group of academics, mental health professionals and advocates who provide resources and guide discussions for the community, who can interact with those leaders. It’s a different experience than, say, learning about the brand’s $20 soft pinch liquid blush products in a viral video on TikTok.

“What we’re finding … is that those mental health posts are actually being saved the same amount as tutorials, which is almost unheard of … and even saved just as much as the Selena content,” Murphy said.

Geneva can also act as a product development and focus group platform, which is one way both Rare Beauty and August are using it.

ADVERTISEMENT

August’s Geneva home, which now has just over 3,200 members, has a room called the “August Townhall” focussed specifically on product development for August’s tampons and pads. The brand has grown to attract 30,000 customers; those customers may not discover August on Geneva, but Geneva helps bring them into the fold of the brand, leading to greater customer retention.

Geneva is still small, and without paid advertisement tools, it’s difficult for brands to see a black-and-white return on their investment on the platform. That may make it a more difficult sell at a time when tough market conditions mean brands are clamping down on unnecessary spending and limiting experimental efforts.

Murphy said that Rare Beauty’s small social media team, already responsible for keeping tabs on its Instagram, Twitter, TikTok and more, currently monitors its Geneva home. Geneva, however, isn’t evaluated using the same KPIs (such as likes or engagement rate) as other platforms.

“It’s all about community sentiment and what can we learn from them,” said Murphy. “The insights that they share are so invaluable.”

Okamoto — who has 3.2 million TikTok followers on her personal account which she uses to promote August — said that while the goal may be to grow on TikTok by tens of thousands daily, that’s not the case for August’s community on Geneva.

“On our Inner Cycle community, we really don’t want it to be this crazy large-scale thing because I think that so much of the beauty of it is that we do have engaged people who like feel like they know a lot of others and are able to like meet up in person and form a relationship,” she said.

Indeed, to achieve the kind of one-to-one relationship that both August and Rare Beauty prioritise with users on Geneva is nearly impossible to scale, whether for a small beauty brand or one with boundless resources.

“Right now people are seeing a lot of changes with Instagram and TikTok … there’s actually this desire we’ve seen a lot more for consistency,” Okamoto said. “People find when they have a question about the product or their order, the [Geneva] community has been a place where they first go to because it’s a way that they can get in touch with us.”

The world’s biggest PR firm and consultancy tapped the gender-fluid designer Harris Reed to help lead its “Gen Z Lab,” part-consultancy, part-data hub, to better understand the next generation of consumers.

Doubts over the reliability of advertising data from platforms and the dubious nature of so-called vanity metrics are forcing marketers to think smarter about how they measure success moving forward.

Leaked internal documents show Facebook is concerned the fashion and beauty content on its platforms can make users feel worse about themselves. But brands must assess their own culpability too.

Often left out of the picture in a youth-obsessed industry, selling to Gen-X and Baby Boomer shoppers is more important than ever as their economic power grows.

This month, BoF Careers provides essential sector insights to help PR & communications professionals decode fashion’s creative landscape.

The brand’s scaled-back Revolve Festival points to a new direction in its signature influencer marketing approach.

Brands selling synthetic stones should make their provenance clear in marketing, according to the UK’s Advertising Standards Authority.