The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

In 2021, 71 percent of fashion executives expect their online business to grow by 20 percent or more, according to the BoF and McKinsey & Co. State of Fashion Report 2021. Yet, to enable growth, fashion executives must overcome the more reserved spending habits developed amid the economic uncertainty of the pandemic.

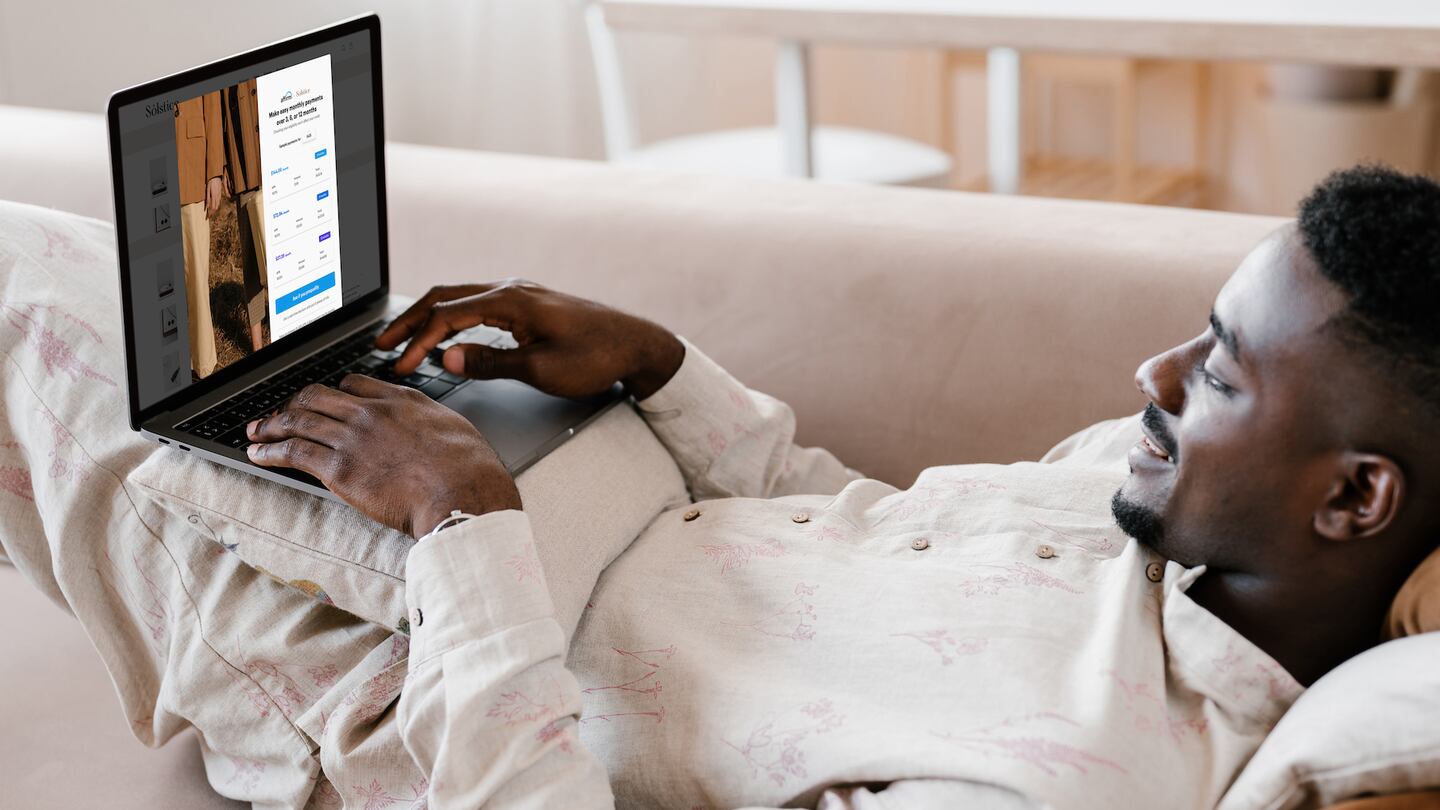

Buy Now, Pay Later has become the fastest-growing online payment method in the US, UK, Australia, Brazil, France, Japan and the Netherlands. The first to enter this space in the US in 2012, payment solutions company Affirm promises its users no late fees and provides upfront breakdowns of monthly costs.

Affirm operates across verticals including apparel and beauty, home and lifestyle, travel, personal fitness, electronics, auto, experiences and more. Its customer base is over 6.2 million across a network of 7,900 merchants, including brands like Walmart, Peloton, Oscar de la Renta, Audi and Expedia.

The company’s financial product and core values of transparency, flexibility and fairness, reflect the sentiments of risk-averse younger consumers, who now represent the largest cohort globally. Affirm sees the synergy of its values with those of consumers as a key competitive advantage.

Now, BoF sits down with Affirm’s Chief Marketing Officer Greg Fisher to hear more about how retailers can leverage Buy Now Pay Later solutions as revenue tools to further customers and market to new segments — and how Affirm speaks to and leverages consumer interests today.

How can pay-over-time solutions appeal to the next generation of consumers?

Millennials and Gen-Zs grew up in a financial crisis, so they generally have an inherent distrust of credit cards. They want transparency to counter that distrust, which is where I think we’ve been gaining reliable customers with Affirm. We show consumers exactly what they owe, upfront at checkout, and it never changes. Even if you’re a couple days late on your payment, we won’t charge a late fee.

We also offer consumers flexibility. Whether a bi-weekly payment plan or a monthly option, we let them choose their time frame of repayment. It also gives our younger consumers purchasing power. For a product that once seemed unattainable, you can spread that payment with flexible terms, allowing you to get that upgrade responsibly.

Finally, it is convenience. Even if a payment plan isn’t available at a retailer, we have an app through which you can create a virtual card number and check out at pretty much any merchant that accepts credit cards. You’re also now able to put that card number into your Apple Wallet and checkout at a store using it. You can use Affirm pretty much anywhere.

What can merchant partners gain from leveraging Affirm’s payment solution?

Seeing a payment solution partner on an e-commerce site can reduce friction and convert consumers at a higher rate, which makes Affirm a meaningful partner as a revenue accelerator and effective marketing strategy for merchants. We also have about 6.2 million consumers in our network and we’re able to match the right consumer with the right merchant through qualified leads.

Our app has also become a shopping destination — and it is where we connect millions of our consumers with exclusive offers from our merchants, with a tailored algorithm to personalise brands and categories to each user. We can learn more about our consumers and their general behaviour in this way, and we’re able to offer more personalised, one-on-one recommendations from our merchant partners.

We’re bringing in a whole new set of consumers that are asking for the flexibility Affirm provides.

So, Affirm is an efficient spend in marketing dollars, because you can get a higher intent consumer that is aligned with the merchant site. We’re bringing in a whole new set of consumers that are asking for the flexibility Affirm provides.

How do you support your merchant partners in connecting with consumers?

We’ve got an extremely robust marketing plan, taking advantage of seasonal buying and news-worthy moments, putting together communications personalised to consumers — and we’re involving our merchants every step of the way. The more we can bring the merchants in, and the earlier we start that journey, the higher the potential of that merchant acquiring a consumer and closing the sale of a higher or average order buy.

We’ve got an entire team at Affirm dedicated to making sure our merchants are getting full value out of their partnership with Affirm — from A/B testing, to see how and why new consumers join our partners’ sites, to strategising how far up the funnel they should be exposed to Affirm in the shopping journey. We’re partners every step of the way — some on my team talk to their accounts almost daily.

As we go forward, championing our values will be the way that we grow our company, to ensure we’re retaining consumers who respect and care about our brand — and when you look across our merchants, they’re looking to partner with a company that has values like ours. As this payment category becomes more competitive, it would be easy to make compromises on our values for short-term gains and short-term profit. Instead, we’re leaning into businesses that are feeling challenged to actually help them.

What consumer behaviour do you believe retailers should be aware of long-term?

I think pay-over-time is where more and more consumers are headed. In the New Year Survey we conducted, looking at consumer behaviour of 2,000+ US consumers, 45 percent of respondents said they used Buy Now, Pay Later in 2020 and 54 percent are interested in using the solution in 2021.

Indeed, when you look at the solution’s penetration with Millennials and Gen-Z, awareness and adoption is still in the early stages so, in the future, we’re expecting a significant increase in usage — especially among the brands that are truly thinking about and preparing for a long-term relationship with that younger consumer base.

Affirm is an efficient spend in marketing dollars, because you can get a higher intent consumer that is aligned with the merchant site.

At Affirm, we believe in treating people the right way. It would just take one moment to erode that complete trust we have with Gen-Zs. Millennials are also strongly aligned with brands’ purpose and values. To ensure we continue to speak to those cohorts, we must inherently uphold the values we’ve held on to since day one.

How is Affirm evolving their marketing strategy for social media?

I think social and influencers that come with that space are becoming one of our most meaningful channels to talk about Affirm. It’s much more focused on specific interests to certain audiences, whether that’s home fitness, electronics or gaming. Being able to talk about Affirm in the context of a specific audience makes the product more approachable.

Our strategy around influencers has really matured over the last year. We’re leveraging hundreds of micro-influencers that can hit that message harder with better comprehension, rather than influencers with bigger audiences. We started doing this last quarter and we increased brand awareness by over 25 percent in three months. So next year, we’ll continue to use a selection of micro-influencers.

We’re also looking at all kinds of new ways that people might be discovering items on social and then checking out and paying for them, like in-app commerce on Instagram, for example. We’re looking into the management of that discovery platform, to reduce the friction at the checkout process across all the major social media platforms.

What are you looking forward to in 2021?

I think my biggest objective is creating brand affinity and increasing awareness of Affirm. I want to look for those meaningful intersections between when people are thinking about their shopping journey around each category, or even a specific item, and then bring in someone they trust to help us tell that story. Becoming part of the moment and part of the culture is how we’re going to build this brand.

For me, the best way to introduce someone to Affirm would be through a recommendation from friends or family — the second best is an influencer or celebrity that they interact with frequently. There’s a degree of trust there and they can help tell that story. I’m excited about what the next year holds around that strategy.

This is a sponsored feature paid for by Affirm as part of a BoF partnership.

From analysis of the global fashion and beauty industries to career and personal advice, BoF’s founder and CEO, Imran Amed, will be answering your questions on Sunday, February 18, 2024 during London Fashion Week.

The State of Fashion 2024 breaks down the 10 themes that will define the industry in the year ahead.

Imran Amed reviews the most important fashion stories of the year and shares his predictions on what this means for the industry in 2024.

After three days of inspiring talks, guests closed out BoF’s gathering for big thinkers with a black tie gala followed by an intimate performance from Rita Ora — guest starring Billy Porter.