The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

Hello BoF Professionals, your exclusive weekly briefing is ready, with members-only analysis and a digest of the week’s top news. Don't forget to download the BoF Professional iPhone app.

The merger of Yoox and Net-a-Porter in 2015 formed what was, and still remains, the leader in global luxury e-commerce. On Wednesday, the company, listed on the Borsa Italiana stock exchange, reported net sales of €1.5 billion ($1.8 billion) in the nine months ending September 30, up from €1.3 billion ($1.5 billion) during the same period in 2016. So far this year, Yoox Net-A-Porter Group (YNAP) has clocked 6.8 million orders across its properties, compared with 5.9 million in the first nine months of 2017.

While no other entity can touch YNAP in terms of revenue, two major players have emerged as serious threats to its dominance in a rapidly growing market that is expected to account for 25 percent of overall luxury goods sales globally by 2025, according to Bain & Company. First, there's online luxury marketplace Farfetch, which earlier this year reportedly began the process of appointing bankers for a public listing that could value the company at $5 billion. Then, in September, private equity firm Apax Partners acquired a majority stake in MatchesFashion, the local chain of London-based luxury boutiques that has been transformed into a major online force, now valued at a reported $1 billion. Market observers expect that Apax aims to take the company public at a multi-billion dollar valuation of its own.

But while Farfetch and MatchesFashion’s valuations are speculative, their implied valuation multiples of revenues and profit are much higher than that implied by YNAP’s current market capitalisation, which hovers around €4 billion ($4.6 billion). YNAP's annual revenues are significantly higher than those of Farfetch or MatchesFashion, with steady double-digit annual growth rates. Adjusted EBITDA (earnings before interest, taxes, depreciation and amortisation) is healthy, reaching €156 million ($181 million) in 2016 and set to increase again in 2017.

ADVERTISEMENT

Does this mean that YNAP is undervalued vis-a-vis the rising competition?

YNAP has long managed the online stores of several major luxury brands, including Armani.com and Chloe.com. In 2013, it entered into a joint venture with Kering to launch the online stores of several of the group’s brands, including Alexander McQueen and Bottega Veneta. But this business now accounts for less than 10 percent of YNAP's overall revenues.

MatchesFashion has more pointedly challenged the Net-a-Porter side of YNAP's business, attracting global luxury goods consumers with a tight buying edit that sets the company's product offering apart from the somewhat blander buys of its rivals, especially major department stores, which have become increasingly undifferentiated. MatchesFashion has also done the hard work of mastering global distribution, reaching parity with Net-a-Porter. The company has developed into a trusted brand that boasts a high-quality customer experience — something that is not easy to replicate. In 2016, the retailer generated £204 million ($268 million), up 61 percent from a year earlier, with online sales up 73 percent.

What appears to be YNAP’s greatest asset, after its first-mover advantage, is the depth and breadth of its business. YNAP is not only a purveyor of online luxury goods, but also a major off-price player — Yoox and The Outnet generate over 40 percent of its annual sales — as well as a business-to-business service provider. That interplay between the businesses means that brands are deeply embedded with YNAP, making it advantageous to collaborate even further. (For instance, YNAP operates the back-end of Giorgio Armani’s website; Net-a-Porter recently launched an exclusive Giorgio Armani capsule collection.)

“The integration of the two companies made a lot of sense, with clear scope for synergies,” said Flavio Cereda-Parini, managing director of luxury goods research at Jefferies, who set a 12-month price target of €40 for the stock. (It’s currently hovering around €30.) “[YNAP] remains the go-to multi-brand platform for brands given track record and reach. Smaller players like MatchesFashion and [Neiman Marcus Group-owned] Mytheresa.com do not yet possess the firepower or global footprint.

“We expect YNAP to remain the dominant multi-brand online player in luxury in a segment that will see much consolidation and the likely demise of smaller players that are not profitable and may struggle to source product, especially as brands are expected to command a greater say in distribution and pricing,” Cereda-Parini said.

However, not everyone believes there will be a “winner takes all” outcome in the luxury e-commerce race. “There is room for more than one,” Wilson said. “Farfetch and YNAP in particular have different business models that both serve a purpose for brands and consumers. Investors appreciate the capital-light model used by Farfetch, which enables it to offer broad product depth. However, the benefits of YNAP’s alternative approach are currently under-appreciated.”

YNAP has also seen a deceleration in North America, where overall luxury goods sales growth has been slower in 2017 compared to Europe and Asia, according to Bain & Co. At YNAP, North American sales in the third quarter of 2017 grew 10 percent from 2016, down from 17 percent growth a year earlier. "According to management, this was also driven by a slightly weaker performance in the in-season business, where they made a strategic decision to have lower markdowns versus last year," Barclay analyst Andrew Ross wrote in a recent note. "While this helped margins, it had a detrimental impact on the top line." However, he said, "Long term, this approach by YNAP will strengthen relationships with brands."

ADVERTISEMENT

And, looking down the road, YNAP will not be without other challenges. On Wednesday, chief executive Federico Marchetti said that 2017 growth would likely net out at the lower range of its guidance, mostly due to the transfer of products from The Outnet to new warehouses that will integrate its inventory with the rest of the company's. Net-a-Porter's own transfer will happen by the summer of 2017, although the company says the integration of in-season merchandise should be more seamless.

“Once the process is complete by next summer, YNAP will be in a very strong position to accelerate growth while remaining the preferred partner of all its core brands,” added Cereda-Parini.

Disclosure: Carmen Busquets is an investor in Farfetch, and via Cabus Ventures, is part of a group of investors who, together, hold a minority interest in The Business of Fashion. All investors have signed shareholder’s documentation guaranteeing BoF’s complete editorial independence.

THE NEWS IN BRIEF

BUSINESS AND THE ECONOMY

Burberry CEO outlines plans as sales beat estimates. Following the resignation of long-time creative head Christopher Bailey and three years of profit declines, Marco Gobbetti has outlined a new strategy that includes revamping its leather goods and fashion programmes, tightening distribution, and playing to its strengths as a digital innovator. The end goal is to elevate Burberry, which reported first-half revenue 1.6 percent above average analyst estimates, from an "accessible" label into a true luxury player.

Tapestry posts weaker-than-expected sales. The company, which houses the Coach, Kate Spade and Stuart Weitzman brands, said quarterly sales were hit by inventory issues, hurricanes in North America and typhoons in Asia. Profit topped analysts' estimates while shares rose as much as 3.3 percent in New York. The company expects revenues for fiscal 2018 to increase about 30 percent versus fiscal 2017, with the acquisition of Kate Spade to add over $1.2 billion in revenue.

Shaw-Lan Wang will inject cash into Lanvin. The Chinese media magnate had been reluctant to further invest in the struggling label, which plans to explore new revenue streams through high-end homeware and hospitality projects. Auditors at the privately owned firm have filed a warning over its financial troubles. Sources said its provisional forecast for the year shows sales will fall 30 percent in 2017, after a 23 percent drop last year.

ADVERTISEMENT

Sales growth at Hermès picks up pace. The luxury handbag maker said sales growth accelerated in the third quarter as demand for its perfume and scarf lines proved particularly strong and its performance in Europe and the US improved. Revenue rose 11.3 percent year-on-year on a comparable basis. The French label is also benefiting from a revived appetite from Chinese consumers.

Michael Kors lifts revenue forecast, benefiting from Jimmy Choo. The fashion accessories maker predicts its recent acquisition of the upscale shoe maker will pay off before the end of the fiscal year. Kors also reported profit and revenue for its second fiscal quarter ahead of analysts' estimates. The affordable-luxury brand said it now expects revenue of $4.59 billion for the year ending April 2018.

Adidas third-quarter revenue rises. While the sportswear brand posted a revenue increase of 8.7 percent, less than half the growth rate of the previous three months and missing estimates, its operating profit advanced 35 percent to $923 million, beating analyst expectations. Adidas expects 2017 currency-neutral sales to rise between 17 and 19 percent and net income to increase between 26 and 28 percent.

Nordstrom sales hit by hurricane. The department store's quarterly same-store sales fell 0.9 percent from the year-ago period, worse than expected, as hurricanes affected traffic in Puerto Rico, Florida and Texas. The Seattle-based company said natural disasters would likely hurt full-year sales by $26 million. Macy's and Kohl's also reported that their third-quarter sales were hurt by hurricanes.

PEOPLE

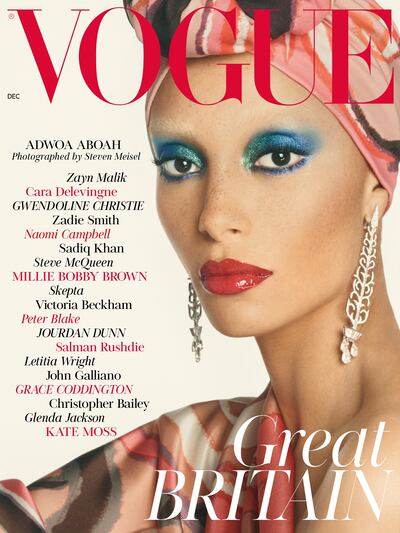

Adwoa Aboah covers British Vogue's December 2017 issue | Source: Courtesy

Edward Enninful reveals debut British Vogue cover. The first British Vogue cover by the title's new editor-in-chief features a '70s-inspired Adwoa Aboah wearing blue eye makeup and a headscarf. Enninful has made it clear that he wants his Vogue to be more inclusive and politically charged. Instead of style tips, the cover is adorned with names from Zadie Smith to Steve McQueen.

LVMH announces major executive reshuffle. Longtime Christian Dior Couture chief executive Sidney Toledano is stepping down, and will be replaced by Fendi chief executive Pietro Beccari. Toledano will step into the shoes of Pierre-Yves Roussel, becoming chairman of the LVMH Fashion Group and Roussel will transition into the role of special advisor to LVMH chairman and chief executive Bernard Arnault, effective January 2018. A successor for Beccari at Fendi has not yet been named.

Bernard Arnault responds to Paradise Papers. A leaked trove of 13.4 million documents reveal the financial dealings of large institutions and individuals that hide their wealth by investing in offshore funds. Arnault, the head of LVMH, responded saying that his assets were known to tax authorities. Wealthy individuals from Britain's Queen Elizabeth to companies like Nike and Uber were also named in the papers.

Rihanna, Amal Clooney, Donatella Versace to lead Met Gala. They will join Vogue editor-in-chief Anna Wintour in co-chairing the annual Costume Insitute Gala held by the New York Metropolitan Museum of Art. The theme for next year has been revealed as "Heavenly Bodies: Fashion and the Catholic Imagination."

TECHNOLOGY

China's e-tailers battle in run-up to Singles' Day. The Chinese shopping festival, which takes place each year on November 11, now dwarfs Black Friday and Cyber Monday — and represents a massive opportunity for global fashion brands. Last year, retailers and merchants on Alibaba's Tmall and Taobao marketplace amassed $1 billion in sales in the first five minutes, generating total gross sales of $17.8 billion in 24 days — a sum greater than Brazil's total e-commerce sales in 2016.

Apple is designing AR glasses. Seeking a breakthrough product to succeed the iPhone, the technology giant plans to launch an augmented reality headset in 2019 and could ship product as early as 2020. Unlike VR headsets that use a smartphone as the engine and screen, Apple's device will have its own display and run on a new chip and operating system.

US Vogue launches AR feature. The title has partnered with Apple to create an augmented reality iMessage extension, available exclusively on the iPhone X. Users can use the feature to create a multi-dimensional filter and apply it on iMessage. This is the first of many AR-powered products embraced by Condé Nast, which is eager to engage the reader in new ways.

BoF Professional is your competitive advantage in a fast-changing fashion industry. Missed some BoF Professional exclusive features? Click here to browse the archive.

From analysis of the global fashion and beauty industries to career and personal advice, BoF’s founder and CEO, Imran Amed, will be answering your questions on Sunday, February 18, 2024 during London Fashion Week.

The State of Fashion 2024 breaks down the 10 themes that will define the industry in the year ahead.

Imran Amed reviews the most important fashion stories of the year and shares his predictions on what this means for the industry in 2024.

After three days of inspiring talks, guests closed out BoF’s gathering for big thinkers with a black tie gala followed by an intimate performance from Rita Ora — guest starring Billy Porter.