The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

LONDON, United Kingdom — The Savigny Luxury Index ("SLI") fell by 2.2 percent over the month, underperforming the MSCI World Index ("MSCI") by almost three percentage points. Investors are concerned that the standoff between the West and Russia over its annexation of Crimea could result in a drop in valuable Russian tourist income for the luxury goods sector.

Big news

• The US and the European Union have agreed to prepare possible tougher economic sanctions and visa restrictions in response to Russia's annexation of Crimea. Russian tourists are the second largest luxury goods consumers behind Chinese tourists and their inability to travel would have an impact on the sector's sales. Whilst some of the slack would be picked up by Russians spending locally, luxury companies still have a relatively small presence in the market: Louis Vuitton for example only has a handful of stores in Russia out of nearly five hundred worldwide.

• Following Baselworld, most watch brands have trimmed their forecasts for 2014 and now expect sales growth of five to seven percent, the lowest rate since the financial crisis of 2008. Sales of high-end watches, hit by the current Crimean crisis as well as the Chinese government's crackdown on corruption, will be the most affected. High-end brands are chasing new revenue streams, notably through customisation or bespoke watches. Mid-priced brands such as Longines and Tissot (both owned by Swatch) are more upbeat and see China as a big market opportunity for 2014.

ADVERTISEMENT

Going up

• Embattled Mulberry benefitted from a reprieve in its share price, gaining almost 8 percent over the month, following the resignation of its CEO. Despite this, the UK leather goods specialist is still at a three-and-a-half year low after three profit warnings in 18 months .

• Luxottica's share price surged 4.5 percent following the announcement of its partnership with Google to design and distribute Google's much anticipated spectacles.

• Hermès gained 3.5 percent over the month on the back of strong annual results and reassurance that both China and Russia remained strong markets.

Going down

• Burberry's share price suffered a loss of nearly 10 percent following a downgrade by the company's joint house broker. The broker forecasted flat earnings for the next two years, driven by unfavourable exchange rate movements.

• Ferragamo was down 7.7 percent over the month. The company was downgraded by a couple of research houses despite it beating analyst expectations with its 2013 results and confirming growth for 2014.

• A hefty one-off charge following a legal battle with Swatch took the shine off fourth quarter results for Tiffany, in spite of strong holiday sales. The stock lost 7.6 percent over the month.

ADVERTISEMENT

What to watch

• The retail property market is frothing up. The bigger groups are taking advantage of their strong balance sheets and the current low interest rate environment to buy large slugs of prime luxury retail estate. Rents on the likes of Place Vendome, Bond Street and Via Montenapoleone have doubled in five years to between Eur12,000 and 15,000 per square metre. The issue is whether (and when) this bubble will burst, especially given overall slower growth dynamics for the sector.

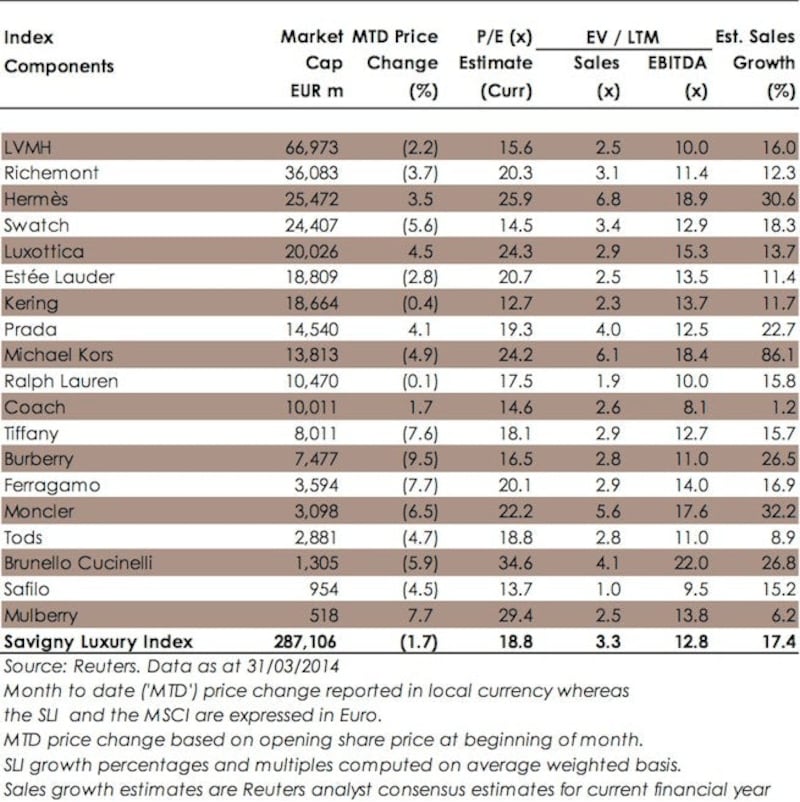

Sector Valuation

From analysis of the global fashion and beauty industries to career and personal advice, BoF’s founder and CEO, Imran Amed, will be answering your questions on Sunday, February 18, 2024 during London Fashion Week.

The State of Fashion 2024 breaks down the 10 themes that will define the industry in the year ahead.

Imran Amed reviews the most important fashion stories of the year and shares his predictions on what this means for the industry in 2024.

After three days of inspiring talks, guests closed out BoF’s gathering for big thinkers with a black tie gala followed by an intimate performance from Rita Ora — guest starring Billy Porter.