The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

NEW YORK, United States — Some of China's biggest manufacturers that supply U.S. multinationals from Walmart Inc. to Nike Inc. find themselves in President Donald Trump's cross hairs as his administration discusses new import tariffs.

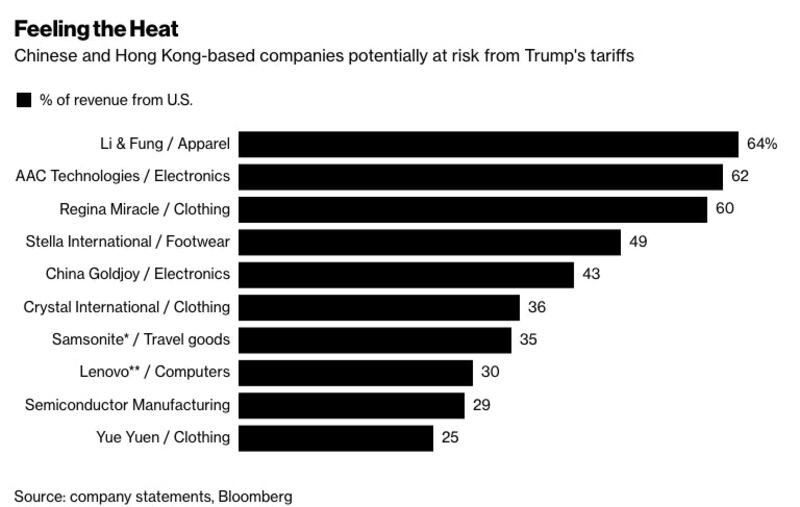

The US is considering taxing imports from shoes and clothing to consumer electronics, putting on the hook companies including Yue Yuen Industrial Holdings Ltd. and Li & Fung Ltd. that help fuel the about $450 billion in Chinese goods imported to America annually. Chinese manufacturers won’t be the only ones hurt in a trade war, as their close relationships as suppliers to American brands will likely create a ripple effect.

“Our greatest fear is a trade war,” said Eric Li, the owner of Huizhou Baizhan Glass Ltd., which has a factory in Guangdong province and makes glass lampshades for Home Depot Inc. and Lowe’s Cos. “I hope Trump realises that everything has a price. Americans also have things they need to sell to China and the world, so he should think of the consequences."

Many Chinese manufacturers are part of the global supply chain. Li & Fung, which sources clothes and toys for retailers, counts Walmart and Macy’s Inc. as customers, while Yue Yuen supplies Nike and Under Armour Inc.

ADVERTISEMENT

Virtually no sector will go unpunished. What would this do for the prices that American customers pay every day?

Yue Yuen generates about 25 percent of its sales in the US, while Li & Fung relies on the US for almost two thirds of revenue, according to Bloomberg data. The American Apparel and Footwear Association said that some 98 percent of shoes and 97 percent of clothing sold in the US is imported. Most of that manufacturing comes from China.

Companies that have products assembled in China, such as Apple Inc., may be hurt. It’s also not clear how tariffs might affect a borderless company like Samsonite International SA. The Hong Kong-listed company has headquarters in Mansfield, Massachusetts, and uses Chinese factories to make some of its travel luggage.

Chinese manufacturers may be able to mitigate the impact of US trade policy, as many have been shifting production to Southeast Asia over the last three years, said Bloomberg Intelligence retail analyst Catherine Lim.

Spencer Fung, chief executive officer of Li & Fung, noted that the company operates in 60 countries with more than 15,000 factories. “If there is any change in trade policy, we have the ability to channel production to any market quickly,” he said in an email response to questions.

The wide-ranging tariffs under consideration aren’t yet set in stone. Yuan Yafei, chairman of retail-to-finance conglomerate Sanpower Group that bought US-based Dendreon Pharmaceuticals LLC for $820 million last year, said an all-out trade war is unlikely.

“I think two big powers like China and the US should be partners, and a trade war won’t take place,” he said in an interview Wednesday. “The two countries need each other.”

US retailers successfully pushed back last year against a proposal by Republican leaders in Congress to apply a border tax on imports. Nevertheless, Trump has been ratcheting up global trade tensions this year, slapping tariffs on imported solar panels and washing machines in January and announcing duties on steel and aluminum imports last week.

Some analysts worry that if the situation intensifies, there will be few winners.

ADVERTISEMENT

“Virtually no sector will go unpunished. We’re really concerned about what this would do for the prices that American customers pay every day,” said Hun Quach, vice president for international trade at the Retail Industry Leaders Association in Arlington, Virginia. “Any punitive tariffs on imports will result in dramatically higher prices on everything from clothing, electronics, home goods.”

By Angus Whitley and Jennifer Kaplan, with assistance from Daniela Wei, Jing Yang De Morel, Tom Mackenzie, Hui Li and Rachel Chang; editors: K. Oanh Ha and Jeff Sutherland.

From analysis of the global fashion and beauty industries to career and personal advice, BoF’s founder and CEO, Imran Amed, will be answering your questions on Sunday, February 18, 2024 during London Fashion Week.

The State of Fashion 2024 breaks down the 10 themes that will define the industry in the year ahead.

Imran Amed reviews the most important fashion stories of the year and shares his predictions on what this means for the industry in 2024.

After three days of inspiring talks, guests closed out BoF’s gathering for big thinkers with a black tie gala followed by an intimate performance from Rita Ora — guest starring Billy Porter.