The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

Hello BoF Professionals, your exclusive 'This Week in Fashion' briefing is ready, with members-only analysis on the key topic of the week and a digest of the week's top news.

On Tuesday, Apple announced that Angela Ahrendts is exiting the company in April, five years after the longtime fashion executive and catalyst of Burberry’s luxury reboot joined the Silicon Valley technology giant as its head of retail. As soon as the news broke, the front rows at New York Fashion Week came alive with speculation. Could Ahrendts be plotting a return to fashion? And if so, where?

Ralph Lauren was a frontrunner even before Ahrendts popped up at the brand’s fashion show on Thursday morning. The American stalwart — which, at the peak of its relevance in the in the 80s and early 90s, became a status symbol for millions of consumers, with its New England upper crust prep and Western Americana allure — has fallen into a state of affairs that isn’t as dire as Burberry when Rose Marie Bravo was drafted in to save the storied British label after years of over-licensing and brand dilution, setting the stage for Ahrendts’ reboot. In fact, on Tuesday, Ralph Lauren reported rosy financial results, beating analyst estimates. But nonetheless, the brand’s current situation shares some similarities with the issues and opportunities Ahrendts faced at Burberry.

Interestingly, Ahrendts joined Ralph Lauren’s board as a non-executive director last August. And fueling the rumors still further, former Burberry designer Christopher Bailey, with whom Ahrendts partnered closely to remake Burberry, is said to have held his own talks with Ralph Lauren about a top creative role. A spokesperson for the company refuted the speculation, saying: “there are no plans for Angela to join Ralph Lauren outside of her existing capacity as a board member.” The spokesperson added there were no plans for Bailey to join the company either.

ADVERTISEMENT

Apple’s announcement suggested that Ahrendts is leaving the company “for new personal and professional pursuits” and chief executive Tim Cook called her departure “bittersweet.” But whatever Ahrendts does next, her track record at Apple was mixed and, despite a celebratory interview with Vogue Business last week, her tenure contains cautionary lessons for luxury fashion players.

Ahrendts joined Apple in 2014 with much fanfare — and a hefty pay package. She soon set about evolving the company’s network of stores, which former Apple executive Ron Johnson had transformed into some of the most productive retail spaces on the planet, widely admired and imitated for their open, light-filled architecture and a seamless, personalised customer experience that often felt like magic, but was powered by a blend of well-trained sales associates and behind-the-scenes technology.

Central to Ahrendts’ vision was the idea of turning Apple Stores from shopping destinations to community centres or what she called Town Squares, where “the best of Apple comes together and everyone is welcome.” Apple stores are certainly more inviting than they have ever been. Where else can you spend an hour listening to music or sit under a real tree and read an iBook, without anyone bothering you? There's also the roster of classes she introduced, dubbed Today at Apple, designed to showcase the wide array of creative applications for Apple devices.

The results were nothing to dismiss. According to eMarketer, Ahrendts helped to boost average sales per square foot by 21 percent to $5,637 over her tenure — and that doesn’t include the emphasis she placed on sales outside of Apple’s stores. She introduced a successful iPhone upgrade programme and played a role in growing online sales.

But Ahrendts’ signature was perhaps most obvious in the sparkling flagships, designed by Foster + Partners, which she launched in major cities, like London, Paris, Milan and Chicago: brand temples with tactics taken straight from the “shock and awe” playbook favoured by luxury houses. To be sure, these stores were aesthetically impressive and had features like the glass fountain and large outdoor amphitheatre at Apple Piazza Liberty, as her Milan flagship was christened.

And yet, her focus on glitzy locations in major urban areas came at the expense of stores in smaller markets where growth opportunities lie. Nowhere was this truer than in China, where Apple sales have slumped. A wider slowdown in the country’s economy, eating into Chinese demand for iPhones, is surely the primary culprit. But as local rivals aggressively targeted second- and third-tier cities, the 70-odd stores that Ahrendts opened in Greater China during her tenure failed to deliver results. Here, there are lessons for luxury fashion brands, which too often focus their attention on building brand temples in global capitals, while paying less attention to smaller markets where new wealth creation is driving opportunity.

At the same time, Apple’s shiny new flagships were optimised for the wrong thing. While Ahrendts poured money into elaborate Town Squares, the company’s once revolutionary in-store customer experience suffered. Perhaps nowhere is this more glaring than at Apple’s famous Genius Bars, which set new standards for in-house tech support when they were first launched back in 2001. These days, many Apple users can no longer make impromptu visits to the company’s Genius Bars and long waits for appointments and deteriorating service have become increasingly frustrating for customers, especially in urban locations.

It’s telling that Ahrendts is being replaced by Deirdre O’Brien, the company’s senior vice president of people, who will continue to oversee human resources, talent development and employee relations alongside her new role as head of retail and, according to Apple, will focus “on the connection between the customer and the people and processes that serve them.”

ADVERTISEMENT

In the digital age, physical stores are not just sales channels. They must be platforms for delivering impeccable customer experience. Brand storytelling is just one piece of the puzzle. Less flashy, but perhaps not sufficiently appreciated is the role of people, process and simply making customers feel good. The fashion industry would do well to pay attention.

THE NEWS IN BRIEF

FASHION, BUSINESS AND THE ECONOMY

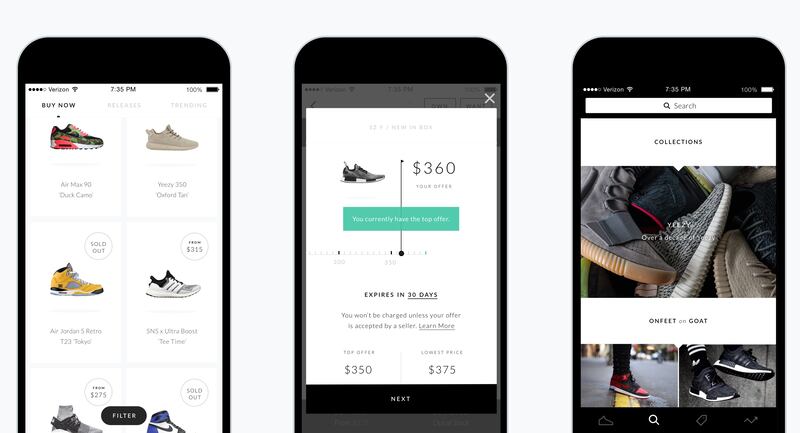

Goat app | Source: Goat

Sneaker reseller Goat lands $100 million investment from Foot Locker. The deal, Foot Locker's largest investment to date, valued Goat at more than $550 million and brings the total amount of capital raised by the sneaker marketplace to more than $197.6 million. The move will allow Foot Locker to tap into the secondary sneaker market, while Goat plans to scale in the US and abroad. It's part of a new wave of peer-to-peer e-commerce platforms like StockX, Grailed and Stadium Goods, where growing numbers of male millennials gather to buy and sell streetwear and sneakers to and from each other.

Capri Holdings climbs after raising revenue forecast. The company behind Michael Kors, Jimmy Choo and now Versace, climbed as much as 11 percent in early trading after raising its forecast for full-year revenue. Revenue will be about $5.22 billion, up from a previous outlook of $5.13 billion, the company said. Analysts had projected $5.2 billion. The company completed its €1.83 billion ($2.2 billion) purchase of Versace last quarter and said it expects about $900 million in revenue from the label in the next fiscal year.

Tapestry slashes profit forecast in volatile market. The owner of Kate Spade and Coach became the latest consumer-facing company to sound a wider alarm, citing "an increasingly volatile macroeconomic and geopolitical backdrop" as it missed both its own and analysts' expectations in the latest quarter and cut its guidance. The company projected earnings per diluted share in the range of $2.55 to $2.60 this fiscal year, down from the $2.75 to $2.80 it saw previously.

Hermès says Chinese sales momentum still strong. Chief executive Axel Dumas said he "did not see any change in momentum" in the luxury brand's stores in China, after it posted a 9.6 percent rise in fourth quarter sales at constant exchange rates, unchanged from three months earlier. Sales in Asia Pacific, excluding Japan, were up 13.1 percent at constant currencies, picking up from 11.7 percent growth in the third quarter. Fourth quarter revenues rose 10.1 percent on a reported basis to €1.7 billion ($1.93 billion). Its full results will be released on March 20.

ADVERTISEMENT

Ralph Lauren beats quarterly revenue estimates. The American company climbed in early trading after posting quarterly results that exceeded analyst estimates in almost every area as its increased marketing paid off during the holiday season. Company-wide same-store sales rose 4 percent last quarter; analysts had projected 2 percent growth. Ralph Lauren has been on a rebound in recent years, with executives hoping to target the younger customer by increasing marketing investment on social and digital, and featuring young social media stars in its campaigns.

Gucci pulls sweater criticised for resembling blackface imagery. The Italian fashion house has apologised for selling a $890 black turtleneck, whose extra-high collar features a pair of exaggerated red lips around an opening for the wearer's mouth. The brand, which has since removed the item from its online and physical stores, joins a growing list of companies including Prada, Dolce & Gabbana and H&M that have been called out for similar mistakes in recent months.

THE BUSINESS OF BEAUTY

Source: Estée Lauder

Estée Lauder sales growth boosted by luxury skincare. The company raised its annual forecast after reporting better-than-expected quarterly results, sending its shares up 10 percent. Growth in the Asia-Pacific region, online and travel retail channels, brands such as La Mer, Mac Cosmetics and Origins and strong holiday sales of Jo Malone London fragrances fuelled a robust quarter, it said. The firm now expects adjusted profit for fiscal 2019 to be in the range of $4.92 to $5 per share from a prior forecast of $4.73 and $4.82. It also expects adjusted sales to grow between 8 percent and 9 percent. It had earlier forecast a range of 7 percent to 8 percent.

Kardashian sisters awarded $10 million in beauty brand lawsuit. In court documents obtained by TMZ, Kim, Khloe and Kourtney were awarded $10 million in damages, the amount Hillair Capital-owned Haven Beauty claimed it initially spent "saving" Kardashian Beauty. The sisters were first sued for $180 million in 2016, after the reality television stars were accused of breaching their licensing contract by failing to promote their Kardashian Beauty brand adequately. In response, the Kardashians took legal action against Haven, saying that company sold the brand's products without their consent or involvement. They had also claimed that Hillair had not paid for products branded in their name.

PEOPLE

Kanye West | Source: Shutterstock

Kanye West's identity stolen for fake NYFW contract. An individual claiming to be a former friend of West's and G.O.O.D. Music associate secretly contacted designer Philipp Plein to arrange a performance by the musician at the brand's New York Fashion Week presentation happening on Monday. The person reportedly posed as West's representative, negotiating a $1 million deal to perform at Plein's runway show. TMZ obtained what appears to be a contract document showing a Kanye West signature, presumably forged by the individual in question. According to a source, the person also had a $900,000 advance wired to an account which was cleaned out soon after.

Amazon founder Jeff Bezos says National Enquirer publisher tried to extort him. The billionaire founder and chief executive of Amazon has alleged that AMI, the publisher of the National Enquirer, threatened to release compromising photos of him. A post he published on the blogging platform Medium included posts he said were emails from AMI detailing what he described as "blackmail." Bezos, the world's richest person, is the single largest shareholder in Amazon, with 16 percent of the company's stock.

Nina Garcia reveals she is getting a double mastectomy. The American Elle editor-in-chief has penned a powerful essay disclosing that she's opting for the operation, consequently missing New York Fashion Week this season for the first time in 25 years. In the post, the editor explained that her health battle began in 2015, when she found out that she did have a gene mutation, which means she's at a high risk for breast cancer.

MEDIA AND TECHNOLOGY

Harper's Bazaar is launching paid content for brides. The American fashion title is introducing a subscription website as well as a premium tier that includes newsletters, videos and discounts. The vertical, called Bazaar Bride, is the first of its kind from publisher Hearst, which, under new president Troy Young, is trying to develop new sources of consumer revenue as print subscriptions decline.

The PR agency behind Warby Parker, Everlane and Glossier goes international. New York-based Derris has acquired London-based boutique agency Sample in a cash transaction. The company declined to disclose further details of the deal, but Sample will be immediately rebranded as Derris. The move underscores Derris' intention to serve its clients globally as many of them seek growth abroad — Razor brand Harry's and Glossier have both launched in the UK over the past year-and-a-half.

Amazon adds first-ever warning about counterfeit products. The e-commerce giant has addressed its counterfeit problem in a regulatory filing, which marks the first time Amazon has mentioned the word "counterfeit" in its annual report. It's a problem that could get worse, as the company is shifting more of its sales to third-party sellers.

Editor's Note: This article was revised on 11 February, 2019. A previous version of this article misstated that Angela Ahrendts gave an interview to Vogue. This is incorrect. The interview was given to Vogue Business.

BoF Professional is your competitive advantage in a fast-changing fashion industry. Missed some BoF Professional exclusive features? Click here to browse the archive.

From analysis of the global fashion and beauty industries to career and personal advice, BoF’s founder and CEO, Imran Amed, will be answering your questions on Sunday, February 18, 2024 during London Fashion Week.

The State of Fashion 2024 breaks down the 10 themes that will define the industry in the year ahead.

Imran Amed reviews the most important fashion stories of the year and shares his predictions on what this means for the industry in 2024.

After three days of inspiring talks, guests closed out BoF’s gathering for big thinkers with a black tie gala followed by an intimate performance from Rita Ora — guest starring Billy Porter.