The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

SEATTLE, United States — As Amazon's fashion ambitions continue to grow, with its traditional basics line expanding into trend-led private labels, department stores and discount retailers are particularly vulnerable to the e-commerce giant's low prices, Prime membership benefits and data backbone.

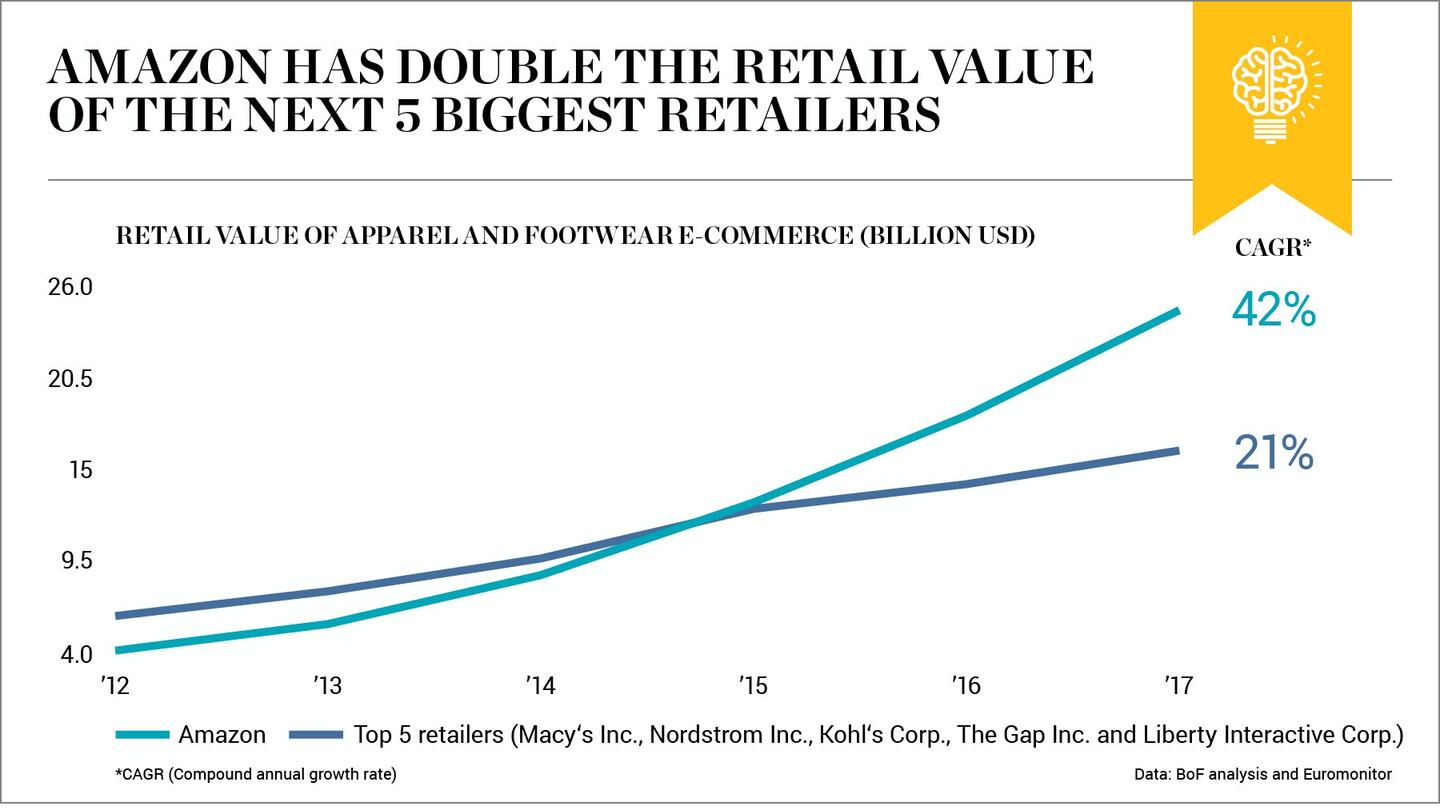

While in 2012, the five biggest e-commerce apparel retailers combined (Macy's Inc., Nordstrom Inc., Kohl's Corp., Gap Inc. and Liberty Interactive Corp., according to research firm Euromonitor) had more value than Amazon, by 2017 figures have reversed, with Amazon commanding almost double their value.

What’s more, Amazon’s compound annual growth rate (CAGR) in the period from 2012 to 2017 was 42 percent, almost double of the next five largest retailers in apparel e-commerce where CAGR was 21 percent, and 27 percent at Walmart.

Indeed, it has been swallowing market share from some of America’s biggest retailers. According to Euromonitor, Amazon's market share in apparel and footwear e-commerce globally was 6.3 percent in 2012, and rose to 12.9 percent in 2017. For the US, the figures are higher: market share was 14.4 percent in 2012, compared to a staggering 35.3 percent last year. Today, Amazon’s apparel and footwear business makes up a third of the overall US e-commerce apparel and footwear market.

ADVERTISEMENT

Amazon's apparel and footwear business makes up a third of the overall US e-commerce apparel and footwear market.

The company’s rise becomes more pointed when it is connected to department store’s woes. A record 12,000 store closures are projected for 2018, up from 9,000 in 2017, according to Cushman & Wakefield, and department stores like Macy’s and Walmart reported lower-than-expected yearly results, fuelling analyses of a retail apocalypse.

A key to its success are private labels, or sub-brands which allow for a data-driven experimental approach and have expanded into apparel, with seven clothing and accessories labels altogether. Private labels like Ella Moon and Lark & Ro, which hit revenues of $10 million in 2017, added to the continued success of Amazon Essentials (items like polo shirts and T-shirts), as shoppers are increasingly opting out of department stores in favour of Amazon’s convenient interface.

But not all retailers are vulnerable. The e-commerce retailer's low penetration into the luxury market makes high-end labels less susceptible to share losses, for now. However, department stores are at high risk of losing share to Amazon, given increased visitation trends. A report from Cowen & Co cites 87.7 percent of Macy's shoppers also visited Amazon, followed by Sears at 87 percent, all pointing to Amazon's apparel business increasingly dominating.

What was once a go-to site for basics is increasingly becoming an e-commerce site for fashionable pieces — in fact, Amazon’s recently-launched private label ranges are the 4th most bought clothing brand on the site after Nike, Under Armour and Hanes, according to a study by Coresight Research.

But overtaking Amazon may need more than fashion-forward clothing labels. The e-commerce giant’s data-driven approach to product as well as logistical convenience are at the forefront of innovation. Judging by the numbers, Amazon remains far ahead of the rest.

Related Articles:

[ Walmart and Amazon Battle to Boost Fashion CredentialsOpens in new window ]

[ The Retail Apocalypse Is Fuelled by No-Name ClothesOpens in new window ]

[ Amazon 'Still Has a Long Way to Go' in Conquering Fashion MarketOpens in new window ]

From analysis of the global fashion and beauty industries to career and personal advice, BoF’s founder and CEO, Imran Amed, will be answering your questions on Sunday, February 18, 2024 during London Fashion Week.

The State of Fashion 2024 breaks down the 10 themes that will define the industry in the year ahead.

Imran Amed reviews the most important fashion stories of the year and shares his predictions on what this means for the industry in 2024.

After three days of inspiring talks, guests closed out BoF’s gathering for big thinkers with a black tie gala followed by an intimate performance from Rita Ora — guest starring Billy Porter.