The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

Hello BoF Professionals, welcome to our latest members-only briefing. China’s colossal size and dynamism makes it a top priority for any global business, but it remains opaque to many in the fashion industry. Leveraging our rare access and local knowledge, the BoF China team demystifies the Chinese market with weekly industry analysis and the wider socio-cultural context you need to sharpen your focus.

SHANGHAI, China — When Apple CEO Tim Cook rang in the New Year by sending letter to shareholders warning of an earnings downgrade for the first quarter due to waning Chinese demand, stocks of international consumer goods companies, including some fashion and luxury players, shuddered.

With slowing GDP growth, the world’s worst performing stock markets in 2018, real estate uncertainty and an ongoing trade war with the US, there has been little in the way of positive economic news emanating from China in recent months.

“Urban households are in the doldrums as trade war fears, Xi’s financial de-risking campaign and a strict policy on real estate have dampened confidence. China’s middle class have now grasped that they are living in a very different world under Xi,” explained Diana Choyleva, chief economist at Enodo Economics.

ADVERTISEMENT

Adding to the bad news pile, last week saw two high profile business leaders in China publicly and uncharacteristically warning that a protracted economic cold spell could hit the country.

Baidu CEO Li Yanhong, also known in English as Robin Li, sent a New Year letter to employees that in part warned that China's economic restructuring is “as cold and real as winter to every company", in spite of Baidu's positive performance in 2018, which saw the search engine surpass 100 billion yuan, or $14.6 billion, in revenue, a 20 percent increase over 2017.

China's middle class have now grasped that they are living in a very different world under Xi.

This came only days after self-made billionaire Chen Hongtian, in a speech to the Harmony Club, an elite gathering of tycoons, warned that “winter will be very cold … it’s hard to predict and all that I can say is that difficulties [for private enterprises] are much bigger than people expected.”

The assumption that consumer confidence would also wane in the face of what are complex and serious macroeconomic challenges is therefore not an unreasonable one. It’s already being felt in the watch market, with the Federation of the Swiss Watch Industry reporting a slump in China sales in November, and the country’s watchmakers lowering their expectations for orders over the next three months.

“I don't have a very positive outlook for China's economy in 2019, I'm sorry to say," Sara Hsu, associate professor of economics at the State University of New York at New Paltz, tells BoF. "I think a number of factors have to change in order for China's economy to do well again and for people to start spending more, especially on luxury goods. It's possible that this will pick up again by 2020 but it will take significant reform of the Chinese economy,” says Hsu.

On the other hand, some consumer companies have reported strong China growth in recent months. At the end of December, Nike announced that its fourth quarter sales were up 31 percent in China, and Q1 fiscal 2019 results from international beauty giants Estee Lauder and L'Oreal reported strong sales growth in the country (even so, all saw share prices drop in the wake of Apple's poor earnings forecast last week). Luxury players Tiffany & Co., LVMH, and Richemont have called out China's economic malaise as reason for lowered expectations and results in recent months.

It's possible that consumption will pick up again by 2020 but it will take significant reform of the Chinese economy.

However, China’s so-called ‘coming winter’ masks a more complex market story. For luxury companies in particular, a more pertinent issue than an overall slowdown in economic output or consumer spending is the question of which consumer groups are most likely to be tightening their belts and whether there are other market forces contributing to the success or failure of individual consumer brands in the country.

Apple, for example, has seen intense competition in the Chinese marketplace from local smartphone makers who have innovated at a faster pace and offered similar quality products at a lower price point — Huawei last year overtook Apple as the world’s second largest smartphone vendor, and they, along with Xiaomi and Oppo, increased their market share in the third quarter.

ADVERTISEMENT

In contrast, within the luxury fashion and beauty spheres, there is no domestic player to compete for market share with global giants such as LVMH and Gucci parent, Kering.

Mario Ortelli, managing partner of luxury advisors Ortelli & Co, is confident that China’s luxury spending will still increase in 2019, even if it is at a slower pace than that in 2018, with opportunities particularly apparent for those who have prepared for increased demand domestically.

“Repatriation of the luxury spend will continue and it will favour the brands with a strong retail network in China, established domestic e-commerce operations and relationship with the local digital platforms,” he said.

“I expect that the consumers will be more discerning and will polarise their purchases towards their favourite brands and therefore we will see an even higher gap between winners and losers.”

The increase of domestic luxury spend has been a major luxury industry story in China over the past 12 months, with recent research from HSBC predicting a 50/50 balance is “in sight” a far cry from the three-quarters of luxury purchases made by Chinese consumers outside of their home country as recently as 2016, according to data from McKinsey.

Some luxury companies that have become reliant on traveling Chinese spend have left themselves over-exposed to changes in consumer patterns.

“Brands like Tiffany & Co definitely run the risk of being exposed as they rely heavily on Chinese buyers shopping internationally and we may see consumers economising on overseas trips this year,” said China Market Research Consulting's senior researcher Benjamin Cavender.

The extent of the fall in overseas purchasing will be difficult to gauge until after the all-important Chinese New Year holiday at the start of February, when the extent of any overseas spending slowdown will become more pronounced.

ADVERTISEMENT

In terms of getting an early 2019 read on overall consumption in China, the recent three-day public holiday to celebrate the Western new year saw retail sales grow more than six percent in Beijing and more than 10 percent in Shanghai over the same period last year.

China’s Ministry of Commerce is predicting a nine percent rise in retail sales this year, a similar rate to the 9.1 percent recorded over the first 11 months of 2018 (the most recent figures available).

“[But] the reality is that the majority of consumers who are driving luxury spending right now in China are still able to spend but they are worried about the future so may be holding back on purchases,” Cavender said.

“This means that there is still a lot of opportunity for luxury brands but they have to be tighter about planning their product launches and inventory and have to work harder to provide retail experiences that will bring consumers in store and get them to spend because consumers will be thinking more about each purchase."

China may indeed be entering a prolonged economic winter, but that doesn’t mean uniform suffering for luxury brands who remain responsive to the needs of Chinese consumers.

时尚与美容

FASHION & BEAUTY

Burberry's Chinese New Year Campaign | Source: Burberry

Kris Wu Launches His Own Fashion Label

After years of being one of China's most sought-after spokespeople for brands of all stripes, from fast food giants to luxury names, singer and actor Kris Wu—who boasts more than 44 million followers on Weibo — has launched his own fashion and accessory brand in conjunction with a jewellery-making affiliate of smartphone maker, Xiaomi. A Tmall store for the new brand, Accessory Culture Evolution (A.C.E) has launched, with jewel-encrusted pendants, prominent chains and stud earrings all part of the hip-hop inspired offering. Wu holds a 45 percent stake in the company and will act as creative director. According to reports, this marks Wu's first personal stake in a company. (Caixin)

Chinese New Year Campaigns from Global Brands Take a Turn for the Bizarre

Chinese New Year marks one of the biggest spending periods of the year for Chinese consumers, making it too important for marketers to get wrong, but efforts to launch unique campaigns that stand out in an increasingly crowded marketplace can easily stray into uncomfortable territory. This year, offenders already include Bulgari, which launched a Weibo and WeChat campaign wishing people a "Happy Jew Year" (the incoming Chinese zodiac animal is the pig, and the mandarin word for pig is "zhu" pronounced similarly to "jew" in English), while Burberry's so-called "creepy family portraits" campaign attracted a lot of attention online from netizens who compared the aesthetic to "an Asian horror movie". As Dolce and Gabbana have experienced in recent months, when it comes to tone deaf Chinese advertising campaigns, any publicity is not necessarily good publicity. (What's on Weibo / Jing Daily)

Li Ning's Pronounce Collab Boosts International Fashion Week Outreach

Chinese athletic brand Li Ning has held high-profile events at New York and Paris fashion weeks in recent years, in an effort to boost their fashion chops and international name recognition. In 2019 it's London's turn. Showing on the official schedule of men's fashion week as part of its collaboration with up-and-coming Chinese label Pronounce. Three full looks from the "Pronounce x LINING" capsule collection showed on the catwalk and marked the first time the sportswear giant has collaborated with an independent Chinese brand. Li Ning's ongoing fashion pivot seems to be paying off with revenue in the first half of 2018 increasing 17.9 percent to 4.7 billion yuan and net profit increasing by 42 percent to 269 million yuan. (BoF China)

科技与创新

TECH & INNOVATION

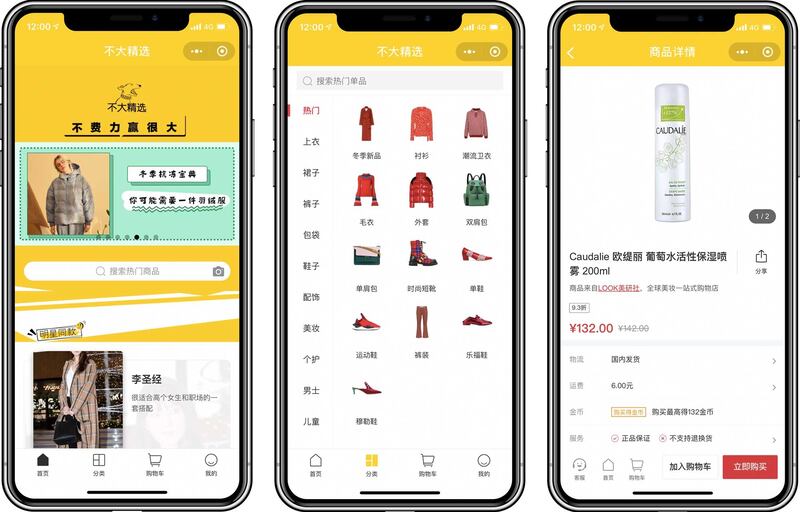

Influencer Gogoboi's mini-program | Source: Gogoboi

China’s Internet Watchdog Launches yet Another Vaguely Worded Crackdown

The start of a new year has done nothing to dim the ambitions of China's Cyberspace Administration to scrub clean the country's online life. It's latest campaign, forecast to last for the next six months will target "harmful information" relating to rumour-mongering, pornography, violence, terrorism or gambling, on websites, smartphone applications, messaging tools or livestreaming platforms. Unclear is how this crackdown will differ from the current status quo, in which these kinds of information are already restricted across all platforms. Government agency directives like this in China are commonly vague, and deliberately so, encouraging users to self-police to ensure they don't wander too close to the blurred lines or grey areas at the edge of acceptability. (China Daily)

Alibaba Reaches Settlement with Shareholders

According to SEC filings, Alibaba has agreed to pay a $75 million to settle a class action lawsuit brought by shareholders in a Californian court over alleged violations of the United States Securities Act stemming from the company's blockbuster IPO in 2014, prior to which the company allegedly did not disclose a regulatory warning about counterfeiters. News of the case being put behind the Chinese e-commerce giant (pending court approval) saw shares rise two percent. Alibaba will be happy to put the episode behind them as they continue their crusade to convince the world they are a responsible partner for brands looking to crack the China market. (CapitalWatch)

Wechat Mini-Programs Attracted 4.3 Billion Yuan in Funding Last Year

Investment in WeChat mini-programs boomed in 2018, with 4.3 billion yuan, or $626 million, invested. This represents six times the investment seen in 2017, with most of the funding concentrated in the e-commerce and service sectors. Take for example Look, which raised $22 million in March last year. The company helps KOLs like Gogoboi monetise their influence on WeChat by curating products to sell from Look's available catalogue, removing the burden of logistics. Almost two years after the launch of WeChat's mini-programs it makes sense that VCs are paying attention to the booming growth in end-users, strong O2O features and social capabilities of the mini-program environment. Expect the trend to continue. (Walk the Chat)

消费与零售

CONSUMER & RETAIL

Canada Goose's Beijing flagship | Source: Weibo

Chinese Consumers Flock to Canada Goose, in Spite of Diplomatic Spat

The Canadian outwear brand had postponed the opening of its Beijing flagship for a fortnight after the arrest of Huawei executive Meng Wanzhou in Vancouver last month. December saw Canada Goose shares drop 37 percent following the arrest and rumours of the brand's troubles circulated on Chinese social network, Weibo, alongside predictions of a long-running boycott on Canadian goods as retaliation for Meng's arrest. No boycott materialised when the Canada Goose finally did open its doors in Beijing, however, with customers braving -12 degree temperatures and waits of over 30 minutes just to get in the front door. Three days after opening, over the New Year holiday, wait times had increased to more than an hour. (WhatsOnWeibo)

Toys ‘R’ Us Asia Outlook Couldn’t Be More Different in China Than in US

Remaining "cautiously optimistic" about the prospect of brick and mortar operations in Asia, the Fung Retailing Group-backed Toys 'R' Us Asia, which divorced from its debt-laden American parent company last November, is planning to add 60 stores to its current count of 550 across the Asia region in 2019, most of them in China, where the company already boasts 182 doors. According to Jo Hall, Toys 'R' Us Asia's chief commercial officer for Greater China and Southeast Asia bricks-and-mortar toy stores remained highly relevant in Asia, as a "hands-on experience" was important for consumers young and old. This could spell good news for other industries reliant on the experiential nature of brick and mortar retail operations, including the luxury sector in China. (South China Morning Post)

Unlocking China’s Next Generation Spending Power

A new white paper released by data intelligence company, Kantar World Panel, along with tech giant Tencent, shows Generation Z, a demographic born between 1995 and 2003 have start to purchase luxury and cosmetics products from age 15, much younger than previous generations, with their spending in the cosmetics and shoes sectors accounting for 30 percent of China's total in 2018. The Chinese Gen-Z cohort is 149 million strong, and will account for 40 percent of global Gen-Z purchases by 2020, according to the report, proving it's never too soon to start looking at China's next generation of consumers. (Jing Daily)

政治,经济与社会

POLITICS, ECONOMY, SOCIETY

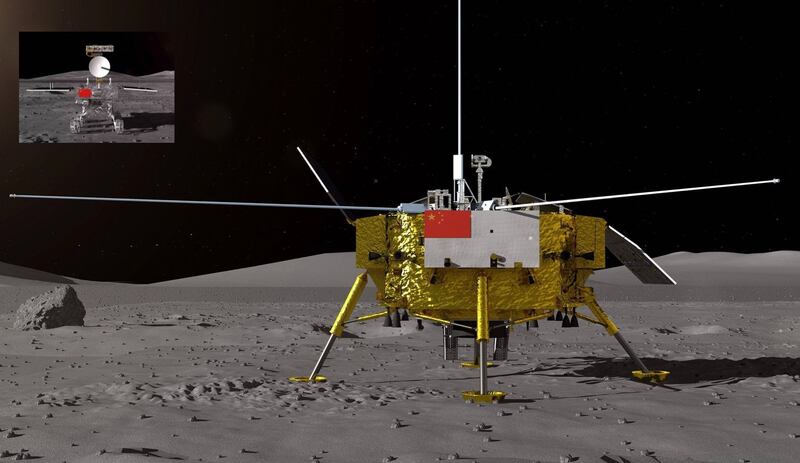

Images of Chang'e 4 as seen on Chinese state television | Source: Nasa

China US Trade Talks Should See Both Sides Seeking a Graceful Exit

Though the US greeted the new year with positive jobs news while China's economic news has been consistently negative thus far in 2019, both countries enter the latest round of trade talks in Beijing, which kicked off on Monday, increasingly aware of the interdependence of their economic successes and failures. A worsening slump in Chinese consumer demand will hurt many more US companies than Apple, and both sides should be trying their upmost to seize the opportunity to make a deal prior to the March 1 deadline for increased US tariffs to kick in, even if the deal is less than perfect. (Bloomberg)

Why China’s Moon Landing Matters

Space exploration has always gone hand in hand not only with narratives of the forward momentum of human civilisation, but also as a geopolitical quest for prestige and power. As with the space race between the US and Russia in the middle of the 20th century, China's ambitious agenda for space exploration in the 21st, which last week saw the country land its Chang'e 4 spacecraft on the far side of the moon, is as much a win for China in its bid to be seen as a technological and geopolitical leader of humanity as it is for humanity itself. (The Atlantic)

Xi Jinping’s New Year Speech Boasts of Self-Reliance, Pledges Continuing Reform

As well as hyping the economic and social achievements of China's 2018, by almost all measures a muted one economically for the country, President Xi Jinping's New Year address emphasised the "self-reliance" of the Chinese people, 40 years after the country's opening up, and on the eve of the People Republic of China's 70th anniversary, to be marked later this year. In speaking of the 40 years since China re-opened its doors to the world, Xi said: "The world has seen China's accelerating reform and opening up, and its determination to carry it forward. China's reforms will never stop, and its doors will only open ever wider." (CGTN)

China Decoded wants to hear from you. Send tips, suggestions, complaints and compliments to our Shanghai-based Asia Correspondent casey.hall@businessoffashion.com.

With consumers tightening their belts in China, the battle between global fast fashion brands and local high street giants has intensified.

Investors are bracing for a steep slowdown in luxury sales when luxury companies report their first quarter results, reflecting lacklustre Chinese demand.

The French beauty giant’s two latest deals are part of a wider M&A push by global players to capture a larger slice of the China market, targeting buzzy high-end brands that offer products with distinctive Chinese elements.

Post-Covid spend by US tourists in Europe has surged past 2019 levels. Chinese travellers, by contrast, have largely favoured domestic and regional destinations like Hong Kong, Singapore and Japan.