The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

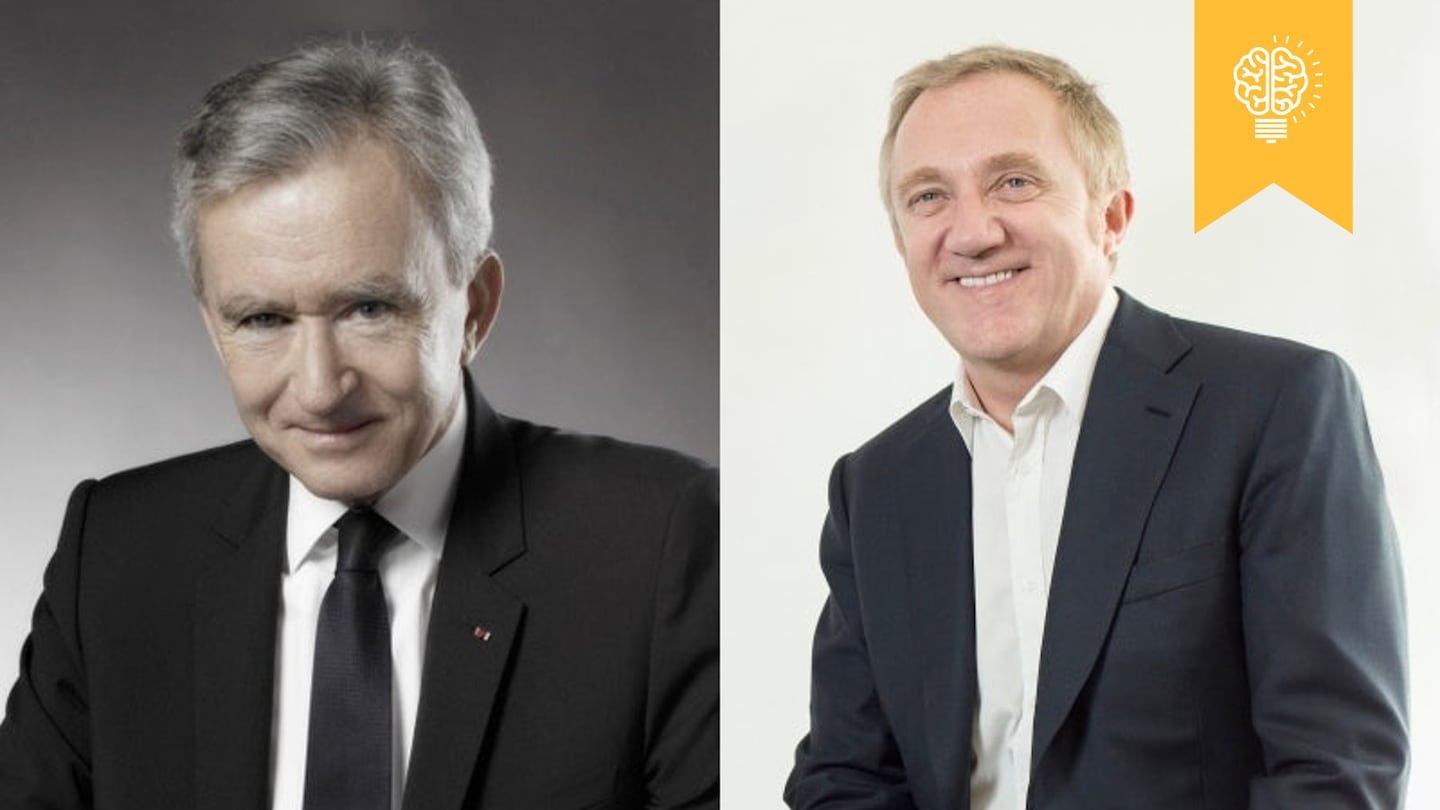

PARIS, France — Louis Vuitton Möet Hennessy (LVMH) and Kering, the French conglomerates that dominate luxury fashion, both operate strong brands in many categories, yet they have crucial features which distinguish their approaches and prospects for growth. Which is best positioned for growth?

LVMH’s domination of two unrelated categories — leather goods and wines and spirits — helps smooth the volatility of its operating profit. The group is also building up a dominant position in beauty retailing, primarily through Sephora and travel retailer DFS, exploiting rich synergies with its perfumes and cosmetics business and steadily increasing asset returns.

By contrast, Kering's forays into lifestyle have not generated shareholder value. Synergies with luxury were never expected. Yet Puma's return on invested capital and earnings have both gone the wrong way since the acquisition in 2007. Also, Kering’s move into lifestyle has nullified possible valuation upside from the company’s progressive exit from general retailing to refocus on luxury. Ten years ago, we argued the merit of Kering’s stated aim of “value creation through luxury focus.” This focus still seems appropriate.

Advantage LVMH.

ADVERTISEMENT

This isn't the first time we have raised the spectre of ubiquity and the resulting loss of desirability of fashion goods. Coach, Burberry and Abercrombie & Fitch have all suffered. Louis Vuitton and Gucci, LVMH and Kering's largest brands, respectively, have each worked hard to protect their long-term appeal, increasing entry-level price points, injecting more novelty into their offering, tightening their grip on distribution and curbing store expansion.

Gucci appears to have been earlier in raising its entry-level price points and "ennobling" its communications, but then again Louis Vuitton always was more expensive. Vuitton, by contrast, recognised earlier the need to pause growth of new space and has traditionally kept a tighter grip on distribution, through its retail-only approach. Also, Vuitton seems to have worked harder to refresh its style and product offering in the past few years, bringing on new designer Nicolas Ghesquière. This will likely be a top priority for Gucci's new creative leadership, helmed by Alessandro Michele, over the next few years.

As their mega-brands lose their star sparkle and become cash-cows, the two groups will need to accelerate the growth of their smaller brands. Kering has a superior track record in this area, with the landmark examples of Bottega Veneta and Saint Laurent and the promise of more to come from its smaller brands including Alexander McQueen and Stella McCartney.

LVMH seems to have realised only recently the need for brand orchestration, managing different brands for different price points, style loci and consumer segments. It has yet to gain significant traction with many of its smaller brands.

Advantage Kering.

On the flipside, LVMH’s watches and jewellery division seems to offer more upside in the short term, especially as new product ranges and re-sized stores appear set to boost Bulgari's sales productivity and operating performance. What’s more, the group’s wines and spirits division should be ready to pay back on years of investment: champagne margins are recovering their pre-crisis fizz, cognac is normalising and single malt whisky is strengthening the mix. This is the group’s most important area where returns must materialise.

We expect selective retailing to be a positive net contributor at LVHM as Sephora and DFS continue to develop both physically and in terms of productivity. The growth relay in fashion and leather goods will not be created overnight, but Fendi, Marc Jacobs, Loro Piana are promising candidates.

Advantage LVMH.

ADVERTISEMENT

So which group is better positioned?

LVMH couples higher structural appeal with a higher stock market multiple, whereas Kering offers one of the most compellingly low valuations in the sector. Kering's reward for its efforts at Gucci will take time to emerge but Alessandro Michele has hit the ground running. He has rapidly taken responsibility for the brand's fashion week shows and will be fully immersed in the Spring/Summer collections to be presented in September. Moreover, the strength of the partnership between Michele and Marco Bizzarri, previously the CEO of Kering's couture and leather goods division and the newly installed as president and chief executive officer of Gucci, should keep things running smoothly and staunch the flow of bad news over the next 12 months.

All in all, this tips the scales in Kering’s favour in the short-term, though LVMH scores higher for long-term structural appeal.

Luca Solca is the head of luxury goods at BNP Exane Paribas.

Disclosure: LVMH is part of a consortium of investors which has a minority stake in The Business of Fashion.

From analysis of the global fashion and beauty industries to career and personal advice, BoF’s founder and CEO, Imran Amed, will be answering your questions on Sunday, February 18, 2024 during London Fashion Week.

The State of Fashion 2024 breaks down the 10 themes that will define the industry in the year ahead.

Imran Amed reviews the most important fashion stories of the year and shares his predictions on what this means for the industry in 2024.

After three days of inspiring talks, guests closed out BoF’s gathering for big thinkers with a black tie gala followed by an intimate performance from Rita Ora — guest starring Billy Porter.