The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

Adidas’ new chief executive has his work cut out for him.

On Tuesday, the brand confirmed Bjørn Gulden, who currently has the top job at Puma, as its new CEO. News of his impending appointment had sent the company’s shares up 21 percent last week. (They remain down around 50 percent year-to-date.)

On Wednesday, Adidas offered up a laundry list of problems its new leader will confront: the company cut its profit guidance for a fourth time this year, forecasting net income of €250 million ($250.7 million) in 2022, down from a target of €1.3 billion at the start of the year. Bloated inventories, which will require markdowns to move, plus the loss of the brand’s Russia business and rapidly shrinking sales in China have taken their toll. After falling by as much as 2.8 percent after the results announcement, shares closed yesterday up 3.7 percent.

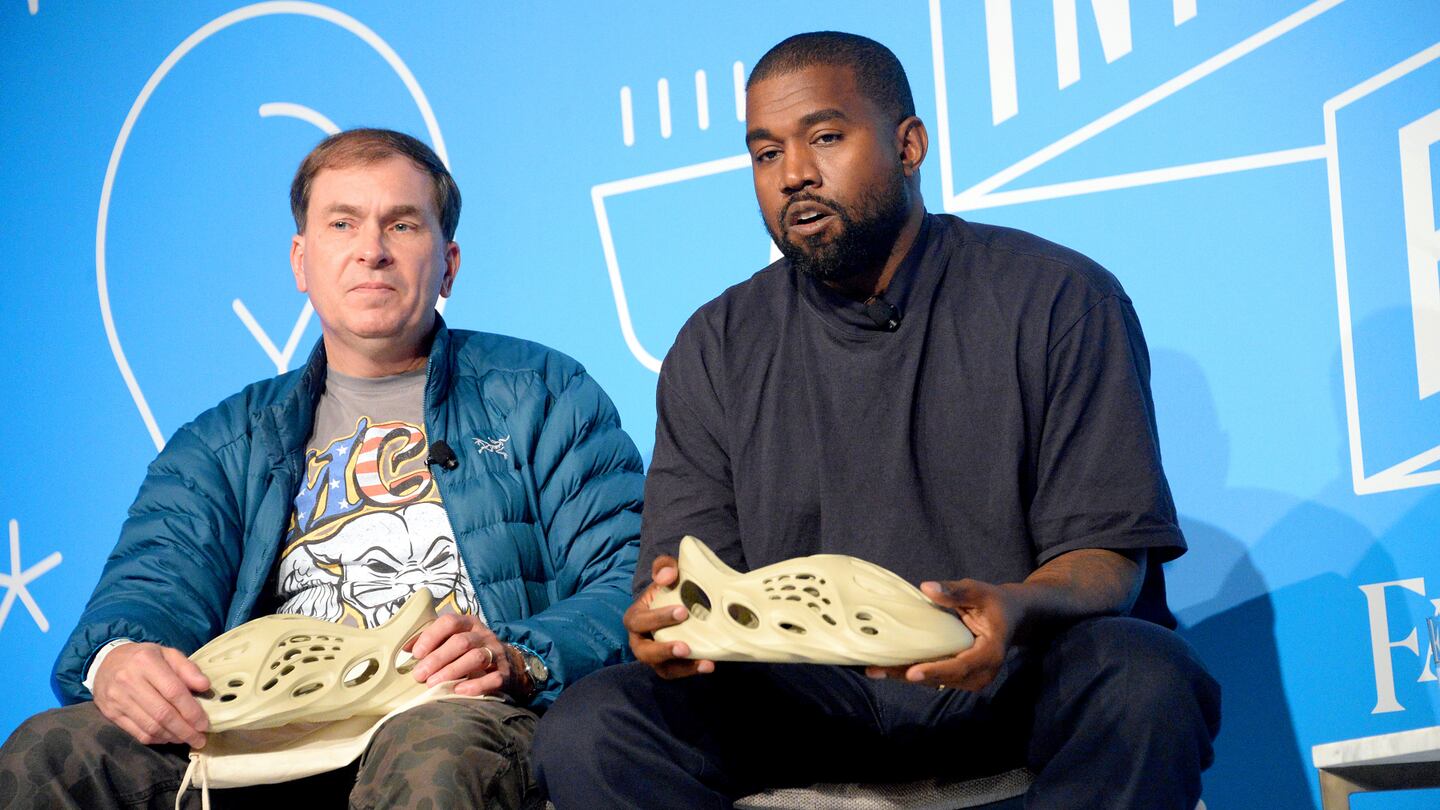

But it’s the sudden implosion of the Yeezy partnership last month that turned a challenging year into a disastrous one for the brand. Ye released a “White Lives Matter” T-shirt at his controversial YZYSZN9 show in Paris in early October and made subsequent anti-semitic statements which made his relationship with Adidas and several other brands untenable.

ADVERTISEMENT

The fallout was particularly costly for Adidas, which had a 10-year deal with the rapper formerly known as Kanye West that was set to expire in 2026. The company said Wednesday that ending the partnership would reduce revenue by €500 million for the remainder of the year. Analysts at RBC Capital estimate lost Yeezy revenues could total as much as €1.8 billion in 2023. (Adidas posted sales of €21.23 billion last year, second only to Nike in the activewear category.)

Adidas executives offered up a first glimpse at the brand’s post-Ye future on Wednesday, confirming it plans to still use the sub-brand’s designs, which it owns the rights to, without the Yeezy name, which belongs to Ye. Adidas anticipates savings of €300 million in 2023 in royalty and marketing payments as a result, chief financial officer Harm Ohlmeyer said Wednesday.

Meanwhile, the company’s leadership has high hopes for a new partnership with streetwear designer Jerry Lorenzo and his Fear of God label. Lorenzo will play a central role in the brand’s strategy to elevate its lifestyle offering, which includes popular collaborations with Balenciaga and Gucci.

Adidas will be betting that Gulden, who previously worked for the company as senior vice president of apparel and accessories in the 1990s, can transform the embattled brand’s fortunes as he did for his previous employer’s. Puma’s annual sales increased by €5.3 billion from 2014 to 2022 under Gulden’s leadership. Over that time, the brand established a clear identity that saw its performance-forward basketball and running gear paired with high-profile celebrity partnerships, including Dua Lipa and chess grandmaster Magnus Carlsen, that exposed the brand to a wider audience.

That playbook is an easy fit with Adidas’ current strategy, which also leans heavily on collaborations. Only now, he’ll have a much bigger budget to play with, analysts say.

“He’s got the experience, he knows the industry and he knows sports inside out,” said Adam Cochrane, a retail and luxury analyst at Deutsche Bank. “He’ll be able to get things moving quicker for Adidas than people would have anticipated had there been a different external hire.”

Still, Gulden will be entering “a complex and risk-filled situation” and will need to wean the brand off its over-reliance on Yeezy to drive growth while also reversing a steep decline in China, where annual profits have contracted by €1 billion since 2019, Cowen analysts said Tuesday.

An early test will be strategising exactly how the brand will sell its existing unsold Yeezy products (of which it owns all related IP, designs and colourways) without the Yeezy name. Profiting off products designed in collaboration with Ye could invite further scrutiny to the brand, which came under criticism from both employees and customers for its near three-week silence between placing the partnership under review following Ye’s Paris show and ultimately terminating it on Oct. 25.

ADVERTISEMENT

“To the extent that there are products sitting in their warehouses with ‘Yeezy’ written on the product or the packaging, maybe there’s a challenge as to how you clear that inventory,” Cochrane said.

Gulden will also be tasked with reversing the brand’s fortunes in China. Its revenue was down 27 percent in the third quarter, as consumers continue to favour homegrown alternatives like Li-Ning and Anta.

Ultimately, experts believe a turnaround is achievable under Gulden.

The brand has a deep catalogue of styles it can tap to drive sales in the absence of Yeezys. Adidas’ Stan Smiths are evergreen among consumers, while its Samba and Gazelle sneaker lines have enjoyed a resurgence in popularity over the past year.

In light of the Yeezy termination and Rørsted’s imminent departure, Adidas has newfound freedom to expand the highly-anticipated partnership with Lorenzo and his streetwear label Fear of God, which is set to roll out in early 2023. The Yeezy collaboration was “mistakenly expanded far too large” by Rørsted, Cowen analysts noted. Under the direction of a new CEO, Adidas may be able to redirect resources previously earmarked for Yeezy to invest in the Jerry Lorenzo collaboration. Adidas may also benefit from Fear of God’s sizeable streetwear audience — the brand and its sub-label, Essentials, have a combined 3 million followers on Instagram.

In Lorenzo, Adidas may have found a ready-made, albeit less famous, figure to fill the role vacated by Ye as the brand’s foremost collaborator. The upcoming Fear of God Athletics sub-label could give Adidas the streetwear credibility that it currently lacks without Yeezy, while it’s anticipated Lorenzo’s wide remit will see him infuse the brand’s lifestyle apparel category with streetwear-inflected products at high-end price points.

“Consumers know Lorenzo and he seems to have had incredible success [with Fear of God]. I think that will feed through into a much more exciting basketball-lifestyle category for Adidas,” Cochrane said. “Will it replace all the lost sales from Yeezy? Possibly, but it’s obviously not gonna happen overnight.”

The sportswear giant cut its profitability forecast for the fourth time this year as it continues to confront the fallout from its split with Ye.

The German sportswear giant’s partnership with Ye generated $1.7 billion in 2021, accounting for nearly 7 percent of its annual revenue. Now that the company has cut ties with the rapper, will it keep selling Yeezy designs?

The brand ‘has no longer any relationship nor any plans for future projects related to this artist,’ parent company Kering said.

Daniel-Yaw Miller is Senior Editorial Associate at The Business of Fashion. He is based in London and covers menswear, streetwear and sport.

Nordstrom, Tod’s and L’Occitane are all pushing for privatisation. Ultimately, their fate will not be determined by whether they are under the scrutiny of public investors.

The company is in talks with potential investors after filing for insolvency in Europe and closing its US stores. Insiders say efforts to restore the brand to its 1980s heyday clashed with its owners’ desire to quickly juice sales in order to attract a buyer.

The humble trainer, once the reserve of football fans, Britpop kids and the odd skateboarder, has become as ubiquitous as battered Converse All Stars in the 00s indie sleaze years.

Manhattanites had little love for the $25 billion megaproject when it opened five years ago (the pandemic lockdowns didn't help, either). But a constantly shifting mix of stores, restaurants and experiences is now drawing large numbers of both locals and tourists.