The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

“Looks great but will it fit me?” It’s a question regularly faced by millions of people shopping for fashion online.

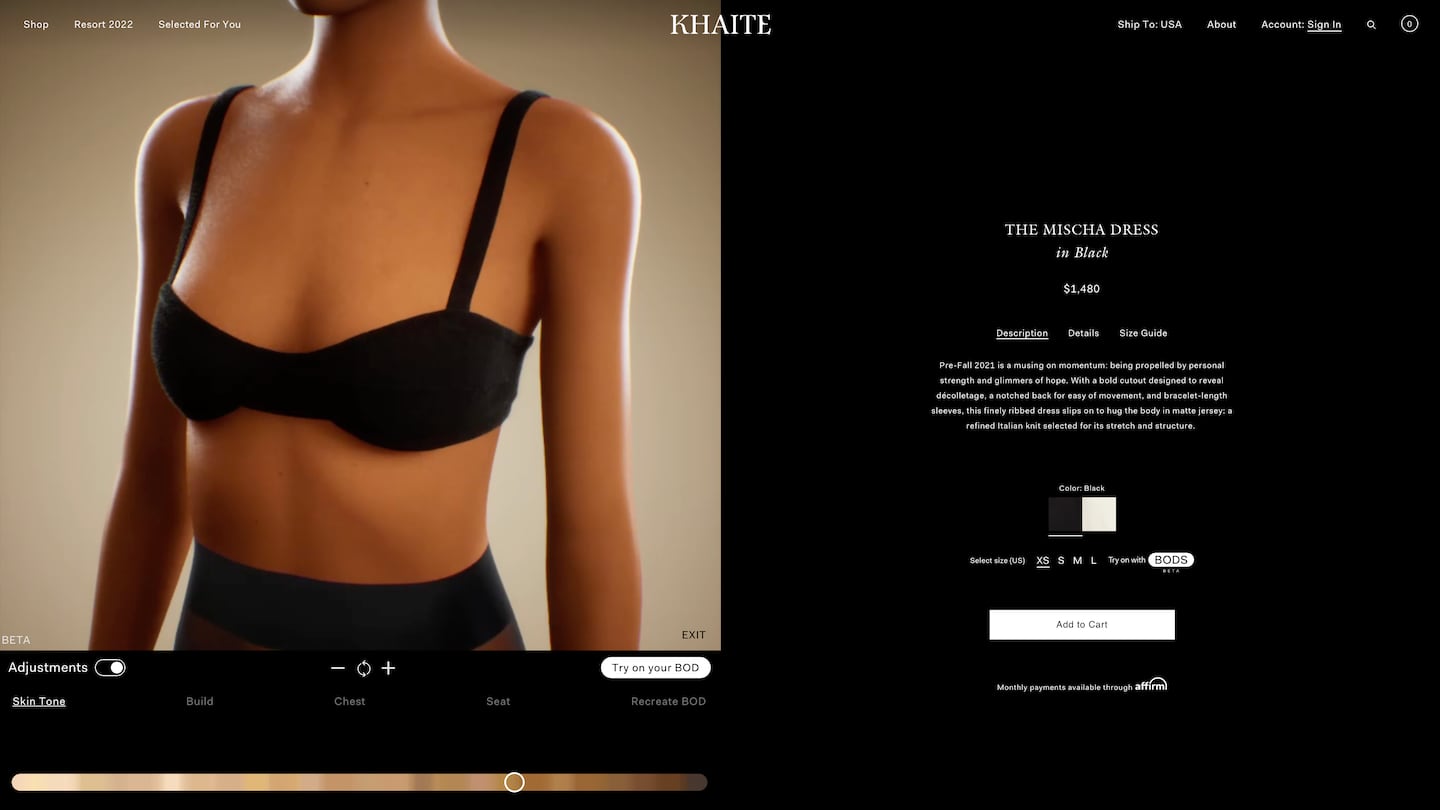

This week may bring good news, at least for admirers of New York label Khaite’s tailored and feminine looks. Starting Thursday, visitors to Khaite’s website will be able to create a 3D digital, photorealistic version of their bodies by uploading a few selfies and sharing some key measurements. The resulting figure can be adjusted in size (and skin tone) before shoppers dress their digital counterparts in the label’s wares, giving them a new tool, beyond the standard size and measurement information that most sites display, to better evaluate whether a product that catches their eye online will actually fit right.

Avatars are not new to the fashion sector. Major luxury brands have already created virtual collections for games like Animal Crossing and League of Legends, or to dress CGI models. But now the same technology that powers these games is being deployed to solve a perennial business problem in fashion e-commerce: the billions of dollars in lost sales and returns that weigh the sector down each year because consumers are unable to easily “try before they buy” as they would in a physical store.

On Khaite’s website, customer avatars developed by the fashion tech firm Bods look less like Sims characters and more like the virtual influencer Lil Miquela. They enable shoppers to see themselves in a range of items from every angle, quickly change sizes, and, in theory, notice where a too-small sweater pulls across the shoulders, zooming into a level of detail as fine as the hair follicles on Khaite’s cashmere sweaters.

ADVERTISEMENT

“Had games not done years of insane R&D … we wouldn’t be able to swap dresses on Khaite’s website in real-time and change the colour and change the size,” said Christine Marzano, a former fit model and the co-founder and chief executive of Bods, which is debuting its avatars exclusively with Khaite while it remains in beta version. The firm is betting its detailed computer-generated graphics will compel luxury shoppers to use the technology where other solutions more complicated than answering a few questions have suffered from low adoption.

Fashion-tech firms have spent decades trying to better guide online shoppers towards products that fit properly, contending with sizing categories that vary from country to country, brand to brand and fabric to fabric. Their goal is to boost online sales and to reduce returns, which are about three times as high for e-commerce as they are through brick-and-mortar channels, a costly pain point for retailers who lose money shipping, processing and cleaning returns.

Today’s more popular fit-tech partners — True Fit, Secret Sauce Partners’ Fit Predictor and Snap Inc.-owned Fit Analytics — help to cut down on the rate of returns by quickly recommending sizes to customers based on a few questions about their measurements or the size of another item in their closet, using large amounts of data collected from their retail clients.

But these types of platforms have not managed to completely solve the problem, made more complicated as every new collection with a slightly different fit hits the sales floor. In 2020, as online sales boomed amid pandemic lockdowns, so did returns. In the US, e-commerce returns doubled over 2019, accounting for $102 billion worth of products — or 18 percent of total online sales last year, according to the National Retail Federation, which said apparel was the second-most returned product category. The wrong fit and colour was the top reason for initiating a return, according to a 2019 global survey from returns company Narvar, which also showed nearly half of US consumers surveyed regularly buy multiple sizes of the same item.

As e-commerce sales stick, if not at lockdown levels then at least above sales volumes seen pre-pandemic, the race to solve the fit problem is more urgent than ever.

At the same time, at least some consumers are growing more conscious of the environmental cost of e-commerce. “Now that e-commerce penetration has grown so much, we as consumers are inundated with packages,” said Andrea Wasserman, head of global commerce at Verizon Media. “There has never been more interest in reducing returns among consumers.”

But not all retailers have the inclination, after a year of sales declines, to invest in new technologies. Walmart, which saw sales soar by $35 billion in 2020, is an exception. The big-box chain paid an undisclosed sum in May to acquire the Israeli virtual fitting room firm Zeekit, which lets shoppers see how a piece of clothing might look on them by overlaying the items on a selfie.

A Complex Challenge

ADVERTISEMENT

The fit problem is as old as fashion e-commerce itself. Many of the startups that picked up funding in a wave of interest in the “fit guidance solutions” space in the mid-2010s have shuttered. Meanwhile, many of the success stories were acquired and embedded into larger platforms, including Fits.Me, acquired by Rakuten in 2015; Metail, acquired by Hong Kong manufacturer TAL Group in 2019; and Virtusize, acquired by Japanese investors in 2018 and now only operating in parts of Asia. (The Zozosuit, one of the most noticeable flops in the space, is relaunching this year.)

Today, retailers ranging from Farfetch to Calvin Klein offer fit recommendations powered by specialised fit tech firms. Israeli firm MySize has helped Levi’s and Turkish apparel brand Penti each reduce returns by as much 50 percent in some regions, said MySize founder and chief executive Ronen Luzon.

There has never been more interest in reducing returns among consumers.

But these firms all face a range of challenges, from needing to make their fit predictions quicker and easier for impatient customers to needing to convince cash-strapped retailers to stick with them. And until recently, there hasn’t been much significant technology innovation in the space.

“We’ve just been nudging around the edges for the last few years,” said Tom Adeyoola, the co-founder of Extend Ventures and the founder and former chief executive officer of Metail until it was acquired in 2019. “And I think anything which comes out is just another iteration of startups that have been around in the last five to ten years, which isn’t a sort of big leap in technology.”

Meanwhile, some brands have sought out lower-fi solutions. Denim label Feel Studio encourages shoppers to answer a series of questions about their size and follows up with an email within 24 hours with fit recommendations. Others have invested in making the returns process easier. Untuckit and Outdoor Voices are among those that have offered free at-home trial boxes. They’re also among the brands that have turned to services like returns provider Returnly to encourage shoppers to exchange their products for others instead of simply returning. (Returnly was acquired for $300 million by Affirm in April.) Another returns firm, Happy Returns, offers more than 2,500 locations in the US where shoppers can drop off orders without any paperwork and promises to save retailers 20 percent of the costs of their returns in the first year.

The ‘Next Leap’ in Innovation

Industry observers predict advancements in augmented reality will help to power the next stage in fit recommendation tools for fashion e-commerce, much the way cosmetics and home goods retailers are already using AR-equipped mobile devices to project eyeshadow on eyelids or place furniture in a room.

But doing the same for fashion is challenging, due to differences in the way different fabrics lay on different bodies, said Veronika Sonsev, co-founder of CommerceNext, a firm that organises retail technology conferences. But she expects advances as phones become more sophisticated.

ADVERTISEMENT

It may be major tech companies targeting commerce opportunities more than specialised fit-tech players that power the next generation of innovation, however. “[The industry] needs a disruptive change from the likes of Snap or Facebook,” said Adeyoola.

Of the major social platforms, Snap is most clearly focusing on using augmented reality to drive online shopping. In May, the company spent $124.4 million to acquire the German firm Fit Analytics that recommends sizes based on customers’ weight, measurements and products they bought and did not return. In the last year, Snap has partnered with Farfetch and Gucci to offer virtual try-ons of outerwear and shoes.

“We’re very early, I think, in the development of augmented reality overall but the results we’ve seen tell us that if we can continue to drive efficiency, in terms of asset creation and scaling these sorts of try-on experiences, that retailers will really reap the benefits from embracing this new technology,” said Snap chief executive officer and founder Evan Spiegel to analysts in April. He said the company is “doing a lot of work right now” to experiment with retailers on ways to use AR to reduce returns.

In the meantime, more and more fit tech firms are hoping the “gamification” of their fit products will encourage customers to try them while shopping both online and in stores.

Israeli firm MySize recently announced an avatar product that generates a digital version of customers through their height and weight, with the added option to scan their bodies with their smartphones for more accuracy. While the product provides a better fit recommendation than the firm’s current questionnaire, it is also designed to be entertaining for customers to use, said Luzon.

After all, getting customers to engage is as much of a challenge as getting the technology right.

Editor’s Note: This article was updated on 25 June 2021. A previous version of this article said Virtusize is no longer operational. It was acquired in 2018 by a group of Japanese investors and firms and is operating out of Tokyo.

Related Articles:

Customers Love Free Returns. Here’s How Brands Are Navigating the Costs.

Can Technology Solve the Fit Problem in Fashion E-Commerce?

Online Clothing Retailers Hunt for Better Fit to Cut Costly Returns

Nordstrom, Tod’s and L’Occitane are all pushing for privatisation. Ultimately, their fate will not be determined by whether they are under the scrutiny of public investors.

The company is in talks with potential investors after filing for insolvency in Europe and closing its US stores. Insiders say efforts to restore the brand to its 1980s heyday clashed with its owners’ desire to quickly juice sales in order to attract a buyer.

The humble trainer, once the reserve of football fans, Britpop kids and the odd skateboarder, has become as ubiquitous as battered Converse All Stars in the 00s indie sleaze years.

Manhattanites had little love for the $25 billion megaproject when it opened five years ago (the pandemic lockdowns didn't help, either). But a constantly shifting mix of stores, restaurants and experiences is now drawing large numbers of both locals and tourists.