The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

Opens in new window

Opens in new windowDiscover the most relevant industry news and insights for fashion professionals working in retail, updated each month to enable you to excel in job interviews, promotion conversations or perform better in the workplace by increasing your market awareness and emulating market leaders.

BoF Careers distills business intelligence from across the breadth of our content — editorial briefings, newsletters, case studies, podcasts and events — to deliver key takeaways and learnings tailored to your job function, listed alongside a selection of the most exciting live jobs advertised by BoF Careers partners.

Explore global job opportunities in retail on BoF Careers today, from a digital learning and retail excellence specialist at Maison Margiela in Paris to an assistant store manager at Paul Smith in London, a sales assistant at Carhartt WIP in Berlin, a men’s tailored clothing expert at Bloomingdale’s in New York, or an associate store leader at On in Hong Kong.

Key articles and need-to-know insights for retail professionals today:

ADVERTISEMENT

1. How Matches’ Collapse Could Impact Independent Fashion

The closure of Matches, announced after Mike Ashley’s Frasers Group abandoned plans to turn around the loss-making e-commerce site, blindsided employees and brands. The move occurred just days after the retailer’s buying directors flew back from placing orders at Milan Fashion Week, and less than three months after Frasers acquired the site.

Matches’ downfall has compounded an already punishing climate for independent fashion businesses, whose limited funding and niche offering often make it impracticable to operate retail stores, but for whom the path to profitability at wholesale is increasingly narrow. [...] Turmoil at larger rival Farfetch, which sold to South Korea’s Coupang in a December deal that wiped out most shareholders, provided another signal that brands should rethink their dependence on luxury e-commerce. Still, for many independent labels, the changes may have come too late.

2. Innovation Won’t Save Department Stores. The Right Products Will.

Some longtime observers of companies such as Macy’s, Kohl and Nordstrom fear the endgame may be approaching. Last month, Macy’s announced it will close another 150 stores by 2026, effectively halving its footprint from 2018. Kohl’s and Macy’s have both been targeted by activist investors more interested in selling off their real estate assets than revitalising retail.

Right now, department stores cannot compete with Instagram and TikTok as engines of product discovery, said Andrea Wasserman, a retail veteran and former executive at Nordstrom. But they have something online platforms do not: a physical footprint. “For inspiration and for convenience, you still have to go into stores,” she said. “You can follow any influencer on TikTok but you still need a place to go to see a new style or brand.”

ADVERTISEMENT

3. Visa, Mastercard Reach $30 Billion Deal With US Retailers

Visa Inc. and Mastercard Inc. agreed to cap credit-card swipe fees — a deal that US merchants say will save them at least $30 billion over five years — in one of the most significant antitrust settlements ever, following a legal fight that spanned almost two decades. The deal, which is subject to court approval, also would allow retailers to charge consumers extra at checkout for using Visa or Mastercard credit cards and use pricing tactics to steer customers to lower-cost cards.

In recent years, merchants have grown increasingly vocal about their opposition to these fees, which typically amount to about 2 percent of a purchase and totalled more than $100 billion last year. While Visa and Mastercard set the level of these fees, it’s the banks that issue the cards that actually collect most of that revenue.

When Daniel Ervér was named chief executive of H&M Group in January, the appointment was widely received as a surprise, and not necessarily a good one. The company’s problems are well-documented at this point: H&M has struggled in a post-Shein world, occupying the rapidly shrinking middle between ultra-cheap online competitors and Zara’s “upscale” fast fashion. In interviews after his appointment, Ervér spoke to the need to “react quicker” to new trends, à la Shein, but also sell more high-priced items, like Zara.

While the chain has been closing stores to cut costs, its many brick-and-mortar locations remain a key advantage over the online-only competition. Zara-owner Inditex demonstrated as much earlier this month when it reported record sales of €35.9 billion ($39 billion) in 2023, up 10.4 percent. It also remains to be seen whether Ervér will have the same commitment to sustainability as his predecessor, Helena Helmersson, who aimed to pitch H&M as an unlikely (and often controversial) champion of green fashion.

ADVERTISEMENT

5. Pressure Eases on Nike, But Problems Remain

Nike beat Wall Street expectations with its latest earnings results, posting flat growth in the quarter ending Feb. 29 compared to the same period last year, with sales of $12.4 billion. Analysts were expecting a slight decline. It’s hardly a robust sign of recovery for the beleaguered sportswear behemoth. But it will provide breathing room for a company which faces a deepening identity crisis under chief executive John Donahoe, who announced a $2 billion cost-cutting plan late last year amid stagnant sales.

But it’s important to note that Nike still dwarfs Adidas: the former’s annual revenue of $51 billion is more than double its German counterpart’s €21.4 billion ($23.3 billion). But investors favour Adidas, whose shares are up 40 percent in the past year. So too do consumers, who in recent years have flocked to get their hands on the brand’s booming retro sneaker franchises including the Gazelle, Samba and Campus — a trend that has eclipsed the appeal of Nike’s chunky basketball sneakers such as Jordans, Air Forces and Dunks.

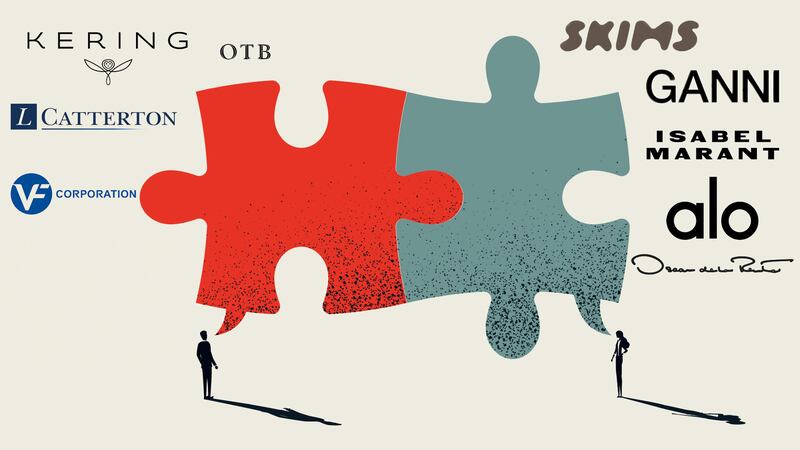

6. What a Fashion Company Is Worth Today

Today, there are a number of brands on the auction block, but few interested buyers. Last year, there were 118 acquisitions globally in the category, the lowest count in at least a decade, according to Dealogic. Ganni, A.L.C., Proenza Schouler and Isabel Marant are just some of the brands that have courted buyers or investors in recent years without securing a deal. When offers are made, they are more likely to follow the more conservative measure of multiples of EBITDA, or earnings before interest, tax, depreciation and amortisation.

Today’s market is a return to a sleepier era, before the days of ZIRP, or zero interest rate policy, a period lasting roughly between 2008 and 2021, when central banks globally slashed borrowing costs as a form of economic stimulus. Investors and large companies borrowed billions of dollars, which they poured into fast-growing, often unprofitable brands, such as Allbirds, or retail start-ups like Farfetch and The RealReal, in the hopes of generating big returns down the line as those businesses matured. For brands the options are stark: accept a lower price and a wider potential pool of buyers, or wait and hope today’s market conditions are temporary, and not the new norm.

There’s a reason brands spend millions of dollars on 30-second ads during the Super Bowl — they work. Temu’s 90 seconds spent telling American football fans to “shop like a billionaire” last month cost the Chinese shopping app an estimated $21 million. That was a drop in the bucket in a global marketing strategy, which according to JPMorgan is expected to total $3 billion this year alone and will encompass television ads, digital marketing and influencer partnerships. That effort appears to have succeeded. In January and February, Temu generated sales of $346 million — up from $77 million in the same period last year, according to Facteus, a data insights firm that tracks debit and credit card spending.

US consumers directed 0.65 percent of their online spending toward Temu, surpassing Shein, the previous Chinese-owned app to storm the US market, which held a 0.47 percent share, according to data provider Consumer Edge. (Amazon still has a healthy lead, at 16.5 percent). [...] However, analysts believe Temu is losing billions of dollars annually, between the cost of advertising and subsidising those low prices.

Since TikTok Shop’s roll out last year, it has quickly become a player in the crowded e-commerce space, despite backlash that it hurt user experience on the app, filling feeds with ads. According to TikTok, 5 million people made purchases on the platform during Black Friday and Cyber Monday. By February, the Shop had the same number of active users as Shein — and even began taking wallet share from the fast fashion behemoth, according to Earnest Analytics’ analysis of credit card data.

Gen-Z may have been the generation that put TikTok on the map during the pandemic, but they’re hardly the only people on the platform today — in particular, on TikTok Shop. Since September, TikTok’s favourability among Gen-Z has fallen 7 points, according to brand intelligence firm Morning Consult. In fact, it’s sales among Millennials and Gen-X, who have more spending power than younger shoppers, that are growing the fastest on TikTok Shop.

Opens in new window

Opens in new windowNordstrom, Tod’s and L’Occitane are all pushing for privatisation. Ultimately, their fate will not be determined by whether they are under the scrutiny of public investors.

The company is in talks with potential investors after filing for insolvency in Europe and closing its US stores. Insiders say efforts to restore the brand to its 1980s heyday clashed with its owners’ desire to quickly juice sales in order to attract a buyer.

The humble trainer, once the reserve of football fans, Britpop kids and the odd skateboarder, has become as ubiquitous as battered Converse All Stars in the 00s indie sleaze years.

Manhattanites had little love for the $25 billion megaproject when it opened five years ago (the pandemic lockdowns didn't help, either). But a constantly shifting mix of stores, restaurants and experiences is now drawing large numbers of both locals and tourists.