The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

While on an editorial shoot for her T-shirt brand Liana in 2017, Lili Chemla found herself wishing she had a matching pair of pants to make for a stronger visual. When she started making them soon after, business picked up. There was something about sets, she realised, that was resonating with consumers.

Two years later, she launched “Leset,” a brand centred around that very concept, offering mix-and-match clothes in solid colours. Sales are up 200 percent this year from the same period in 2022.

Gone are the days where reaching for a set was synonymous with a matching Lilly Pulitzer top and skirt. Open Instagram or walk down the street in Soho, and it appears we’re living in a world of sets (also known as co-ords): workout sets in spandex, lounge sets in soft knits, sparkly party sets, breezy linen summer sets, office-appropriate sets.

Consumers are flocking to sets in search of easy outfits that marry sophistication and comfort. New arrivals in the womenswear set category increased by around 75 percent between 2019 and 2022, according to retail intelligence firm Edited. Today, there are matching sets that feature bra tops with pants, slip dresses with button downs, and swimsuits with camp collar shirts, to name a few. Sets have also gained traction amongst men, especially in the athleisure and vacation wear categories.

ADVERTISEMENT

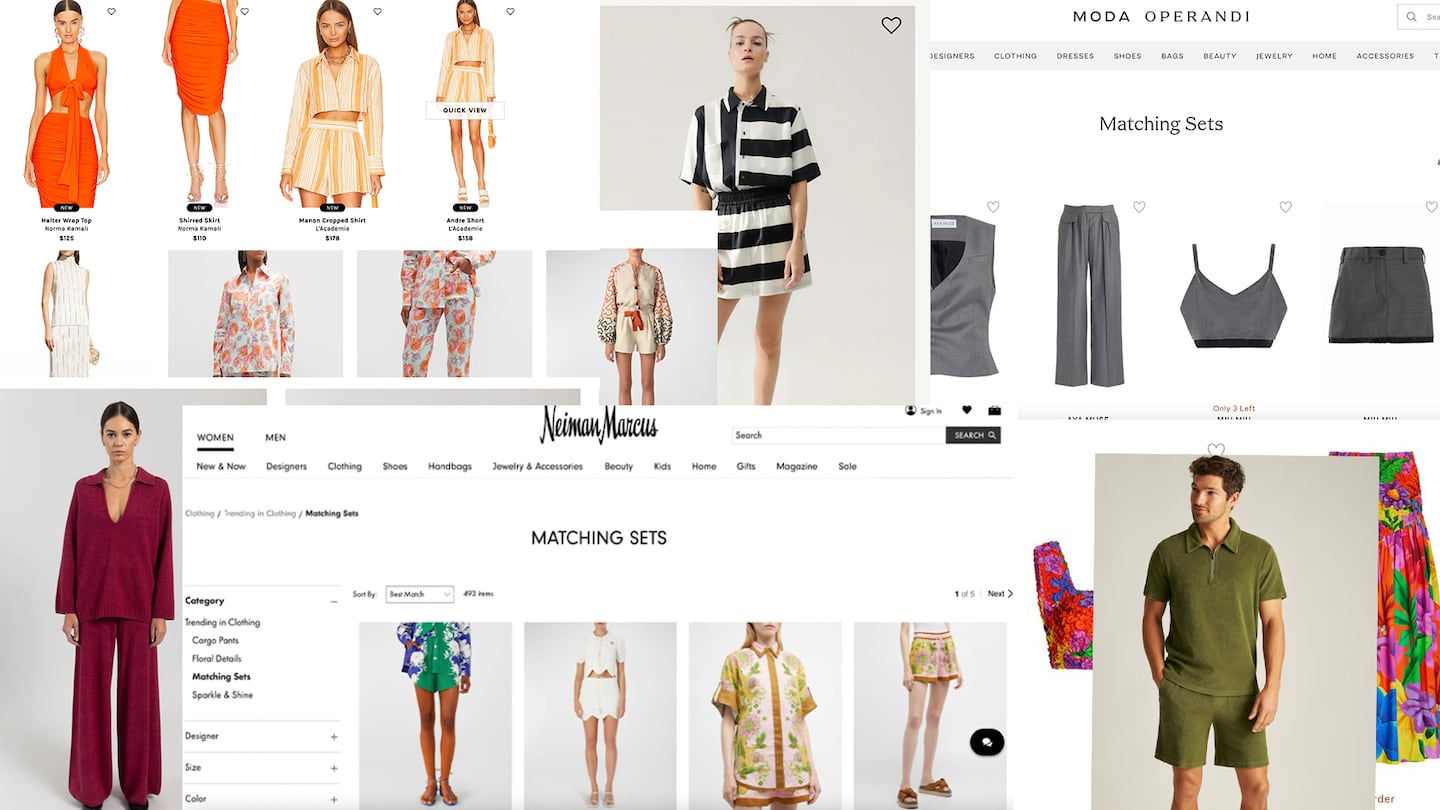

At retailers like Moda Operandi, Neiman Marcus, Mythersea and Revolve, the set has its own devoted product category, with products from labels like Reformation, Deiji Studios, Staud, Ilana Kohn and The Frankie Shop. Buyers say sets now make up some of their best-selling styles. Fast fashion retailer Shein saw sales of sets on its website spike 20 percent in September 2022 year-over-year, a spokesperson for the fast fashion giant said in an email.

Retailers have reasons to be enamoured with the category beyond the sales bump. Two-piece outfits drive up order volume and simplify operations with streamlined manufacturing and approvals processes — especially important after years of supply chain disruptions and unpredictable sales.

A big reason why sets are so popular today is that they require little effort to style — no need to ruminate over which tops go with a particular skirt or pair of pants — but look sharp, both online and off.

“It makes the process of getting dressed easier, and it signals looking ‘put together’ even if you didn’t put that much thought or effort into it,” said fashion writer and consultant Harling Ross Anton, who likened the set’s rise to the romper’s popularity in the early 2010s. “There’s a visual impact that is really conducive to social media and that’s probably what’s made them even more ubiquitous.”

Early set styles were more casual, but today’s options include more formal styles such as tailored tanks and trousers and novel materials like leather, according to Lorna Hall, WGSN’s director of fashion intelligence.

At Neiman Marcus, a consumer appetite for “more refined, toned down elegance” is driving sales of occasionwear-focussed sets from brands like Casablanca, Lapointe and Farm Rio, said Jodi Kahn, the retailer’s vice president of luxury fashion in an email. The category has also matured to encompass subtrends, like last year’s vest-and-pants combo, said Kelsey Lyle, a buyer at Moda Operandi. This year, a popular look is a short tunic with pants.

The allure and convenience of sets have evangelised men, too. (After all, suits are a set in and of themselves). Retailers added nearly 10,000 new menswear set SKUs in 2022, versus nearly 8,000 in 2019, according to Edited.

Demand has risen at Todd Snyder in the past two years, said chief product officer Alejandro Rhett. The brand’s summer set — a button-down short sleeve top and shirt combo sold both in prints and monochrome — saw a sales surge last year, according to Rhett.

ADVERTISEMENT

Though only about 30 percent of customers currently buy full sets, the brand is increasingly developing new releases in matching pairs. Recently, men have been asking for terry cloth shorts to match their shirts.

“The trend is getting more and more prevalent,” said Rhett. “Guys are more willing to take more risks.”

For retailers, sets can help create efficiencies among suppliers and boost shoppers’ cart size. Coming off years of disruptions, simplifying supply chains and growing the bottom line has been a priority for brands and retailers, said Asher von Stein, a director in consultancy AlixPartners’ retail practice.

“[With most sets] you have one source for your raw materials and one source for your cut and sew. You need one round of approvals, you have one fewer quality checks to worry about,” said von Stein. “Retailers love it. There’s margin benefit to all of that.”

Stocking largely seasonless sets has helped Leset avoid product risk. The brand introduces a number of new products in fabrics it already offers, such as its Rio Ponte and Core Cotton materials. As a result, it can place safer bets on what type of items consumers will be interested in.

Luxury lifestyle brand Silk Laundry has found that sets have piqued the interest of both trend-forward shoppers looking for loud seasonal prints and basics buyers who wear monochrome button downs or slip dresses. In February, Silk Laundry extended its offer with a “Foundations,” segment on its site where consumers can purchase a set of matching pieces containing up to 14 items organised in themes, together at a discount.

Whether sold separately or together, sets drive up transaction value. After focussing its product assortment around sets, Silk Laundry, for example, has seen a 50 percent uptick in average order value in the last three years, said chief executive Reece Rackley. Leset’s typical customer checks out with a cart of at least two items. Moda Operandi links set pieces together on the site.

“It’s easy to add the top and then pick up the bottoms that are already attached,” said von Stein.

ADVERTISEMENT

In addition to displaying sets together, the retailer highlights the diversity of ways they can be worn with imagery showing them as separates.

That versatility translates to cost-effectiveness in the mind of the consumer, which could continue to drive shoppers to sets, said von Stein, especially as they hunt for value in today’s uncertain economy.

Demand for leggings and sweats may have peaked, but the pandemic’s comfort-first aesthetic is hardly dead. It’s simply mutating into something else: a yet-to-be-named category that incorporates stretch and softness into a staggering number of fashion staples, from trousers to jumpsuits.

The electric-pink hue has dominated fashion for the past year — thanks to a collusion of trends like Barbiecore and dopamine dressing, alongside major commitment from Pierpaolo Piccioli’s Valentino.

A cooldown in consumer spending hasn’t slowed momentum at luxury labels, fast fashion or off-price retailers. It’s brands stuck in the middle that are paying the price.

Joan Kennedy is Editorial Associate at The Business of Fashion. She is based in New York and covers beauty and marketing.

Antitrust enforcers said Tapestry’s acquisition of Capri would raise prices on handbags and accessories in the affordable luxury sector, harming consumers.

As a push to maximise sales of its popular Samba model starts to weigh on its desirability, the German sportswear giant is betting on other retro sneaker styles to tap surging demand for the 1980s ‘Terrace’ look. But fashion cycles come and go, cautions Andrea Felsted.

The rental platform saw its stock soar last week after predicting it would hit a key profitability metric this year. A new marketing push and more robust inventory are the key to unlocking elusive growth, CEO Jenn Hyman tells BoF.

Nordstrom, Tod’s and L’Occitane are all pushing for privatisation. Ultimately, their fate will not be determined by whether they are under the scrutiny of public investors.