The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

Hello BoF Professionals, welcome to our latest members-only briefing: The Week Ahead. Think of it as your 'cheat sheet' to what everyone will be talking about on Monday.

THE CHEAT SHEET

Tennis Has its Fashion Moment

Roger Federer | Source: Uniqlo

ADVERTISEMENT

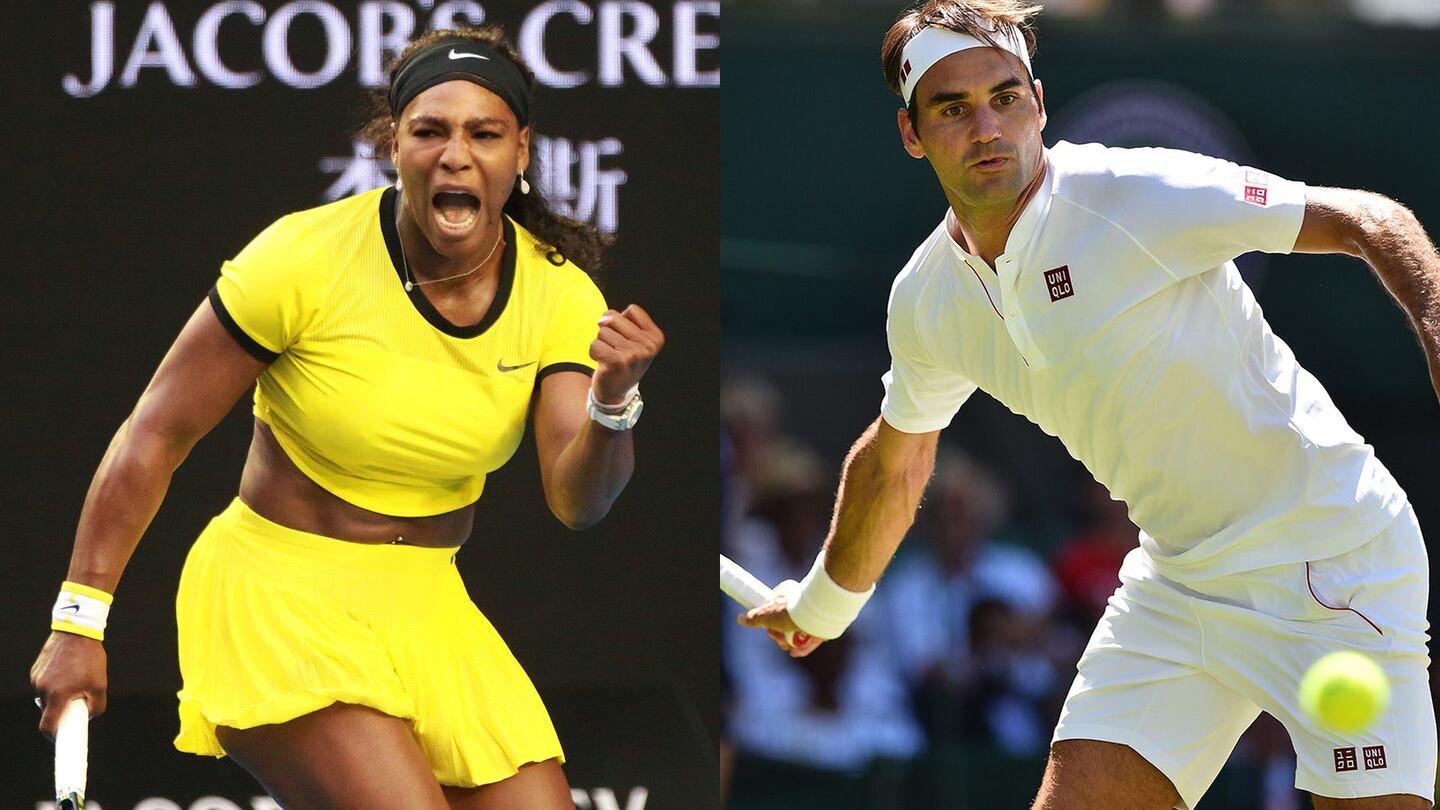

Tennis tournaments increasingly double as fashion shows. Serena Williams will be wearing a Virgil Abloh-designed Nike kit when she takes the court at the US Open this week. On the men's side, Roger Federer will play in a red Uniqlo polo and matching shorts intended for wear both on and off the court, offering some hints as to where his blockbuster deal with the Japanese brand will go. At a press event last week, Federer said he would bring his "very classic, nice style" to Uniqlo, while Uniqlo president of creative John Jay said Federer's reach will ideally extend well beyond tennis and into the mix-and-match high-performance basics the company calls Lifewear. Uniqlo needs a famous face. If anything, it was early to the red-hot athleisure trend, but has struggled to grow brand awareness with Western consumers. Federer, 37, is nearing retirement, but has the potential to be a rare athlete who resonates in the public consciousness long after his playing days are over. Williams may loom larger in the American public's imagination, and she's only just begun to flex her muscles in the fashion industry, introducing her own line in May as well as custom sneakers for Nike and other gear. Adidas is also very much in the mix, outfitting young stars like Alexander Zverev, 21, who some see as Federer's heir.

Shopping Malls: Not Dead Yet

Westfield Southcenter outside Seattle | Source: Shutterstock

J. Crew Waits... and Waits for a Preppy Comeback

J. Crew | Source: Flickr/Mike Mozart

Retail Health Check: The Sequel

Source: Shutterstock

A number of mall retailers appear to be on the mend. The winners have followed similar playbooks: update their style, slim down inventories and, perhaps most importantly, wait for weaker competitors to shrink or fold. This week brings some fresh data points, including a resurgent Abercrombie; Tiffany & Co., fresh off announcing it would renovate its New York flagship; and PVH, which has seen strong sales for Calvin Klein and Tommy Hilfiger.

ADVERTISEMENT

The Bottom Line: Some iconic retailers aren't going to make it, but the survivors are increasingly well-positioned to thrive.

COMMENT OF THE WEEK

Helmut Lang Spring/Summer 2018 | Source: InDigital

"When a brand is bought and then the figurehead leaves is there any real authenticity? With so many amazingly modern cool brands out there I think consumers tend to walk away from brands if there is no creative leader there that they can identify with."

-@lanetabb on layoffs at Helmut Lang.

SUNDAY READING

Professional Exclusives You May Have Missed:

From Around the Web:

ADVERTISEMENT

Editor's Note: Last week's newsletter misstated that 600 brands will exhibit at Indie Beauty Expo. This is incorrect. The event featured 250 brands.

The Week Ahead wants to hear from you! Send tips, suggestions, complaints and compliments to brian.baskin@businessoffashion.com.

Was this BoF Professional email forwarded to you? Join BoF Professional to get access to the exclusive insight and analysis that keeps you ahead of the competition. Subscribe to BoF Professional here.

The rental platform saw its stock soar last week after predicting it would hit a key profitability metric this year. A new marketing push and more robust inventory are the key to unlocking elusive growth, CEO Jenn Hyman tells BoF.

Nordstrom, Tod’s and L’Occitane are all pushing for privatisation. Ultimately, their fate will not be determined by whether they are under the scrutiny of public investors.

The company is in talks with potential investors after filing for insolvency in Europe and closing its US stores. Insiders say efforts to restore the brand to its 1980s heyday clashed with its owners’ desire to quickly juice sales in order to attract a buyer.

The humble trainer, once the reserve of football fans, Britpop kids and the odd skateboarder, has become as ubiquitous as battered Converse All Stars in the 00s indie sleaze years.