The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

JOHANNESBURG, South Africa - South African investment firm Long4Life has agreed to buy fashion retailer Rage for 3.9 billion rand ($287.5 million) to strengthen its lifestyle brands business.

The amount will be settled through a combination of shares and cash from internal resources and bank debt, Long4Life said in a statement on Tuesday.

As part of the deal, Long4Life, which targets investments with a lifestyle focus, will issue 270 million ordinary shares at 5.50 rand per share, worth 1.5 billion rand in total.

Following this, the owners of Rage will hold about a 22.8 percent stake in Long4Life.

ADVERTISEMENT

The balance of 2.4 billion rand will be paid in cash.

"Rage presents an exciting opportunity to build on Long4Life’s existing lifestyle brands platform with additional cross selling opportunities," Long4Life said.

"The addition of Rage will amplify Long4Life's retail product offering to include all segments of the LSM market."

Brian Joffe, the owner of Long4Life, listed the investment firm in 2017 and has since made a string of acquisitions, including sporting goods retailer Holdsport and beauty chain Sorbet.

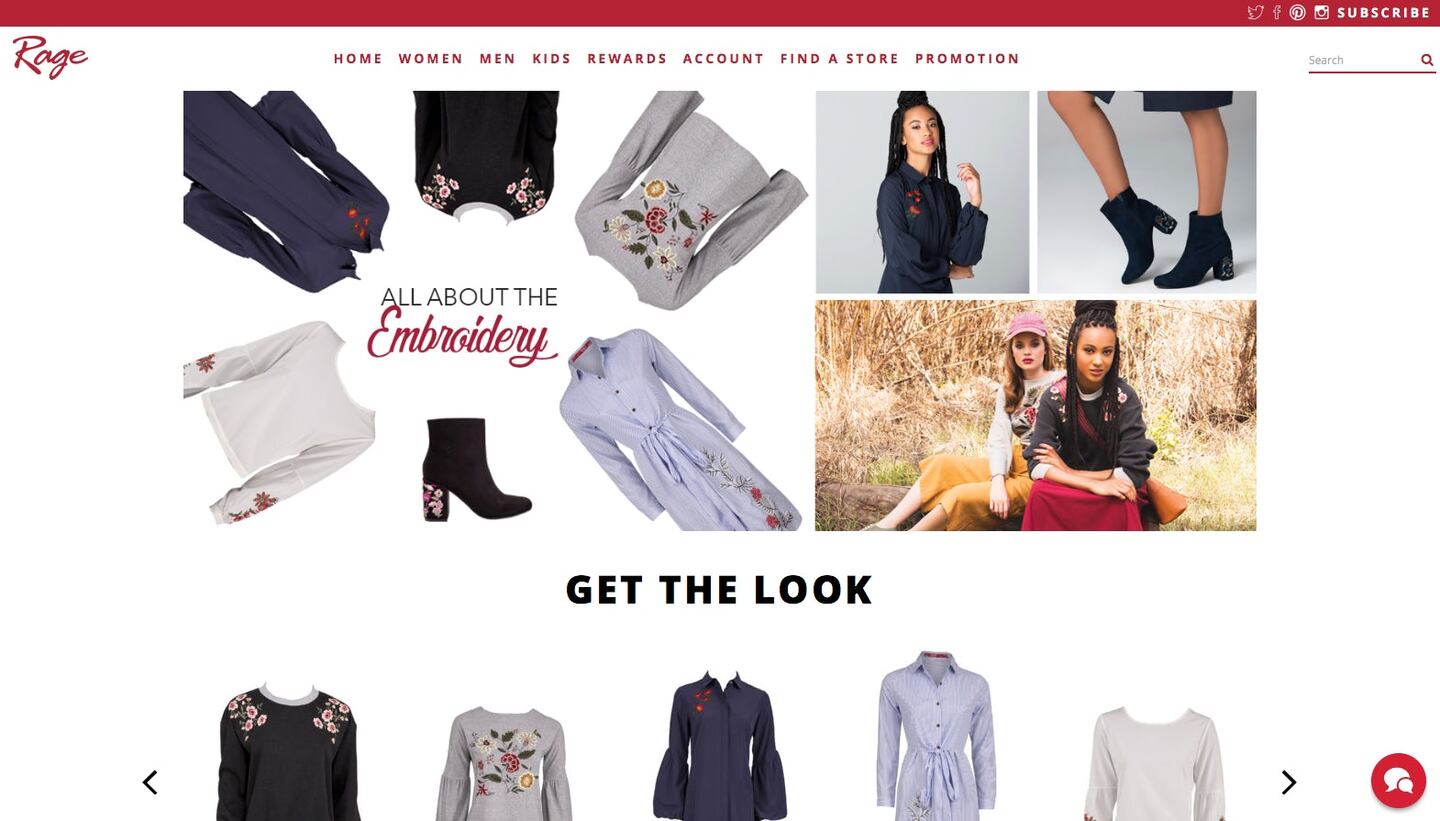

Established in 1996, Rage Distribution Proprietary Limited sells footwear, clothes and accessories in the adult and children's markets.

It currently has 555 stores across the country and plans to roll out about 90 new stores per year.

For the year to the end of June 2017, Rage is expected to make revenue of 1.3 billion rand and earnings before interest, tax, depreciation and amortization (EBITDA) of 360 million rand.

After the acquisition, the combined Long4Life group is expected to deliver EBITDA in excess of 850 million rand, the firm said.

ADVERTISEMENT

At 8:45am, Long4Life shares were down 0.5 percent at 5.68 rand.

By Nqobile Dludla; Editors: Louise Heavens and Mark Potter.

Nordstrom, Tod’s and L’Occitane are all pushing for privatisation. Ultimately, their fate will not be determined by whether they are under the scrutiny of public investors.

The company is in talks with potential investors after filing for insolvency in Europe and closing its US stores. Insiders say efforts to restore the brand to its 1980s heyday clashed with its owners’ desire to quickly juice sales in order to attract a buyer.

The humble trainer, once the reserve of football fans, Britpop kids and the odd skateboarder, has become as ubiquitous as battered Converse All Stars in the 00s indie sleaze years.

Manhattanites had little love for the $25 billion megaproject when it opened five years ago (the pandemic lockdowns didn't help, either). But a constantly shifting mix of stores, restaurants and experiences is now drawing large numbers of both locals and tourists.