The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

COLUMBUS, United States — At the Midwestern retailer L Brands, which owns Victoria's Secret, Bath & Body Works and Pink, there are divisions devoted to product development, to store design, to logistics. But a little-known group called Strategic Patterning wields unmatched power.

Made up of just a few employees led by Jamie McFate, a constant confidant of Chairman and Chief Executive Officer Leslie H. Wexner, Strategic Patterning serves as his eyes and ears. This group — which usually consists of five-to-six people, including McFate and his longtime friend, Anton Auerbach — contracts dozens of freelance scouts across the globe to file reports that were analysed and presented directly to Wexner.

But the group is also a way for Wexner to keep close tabs on executives across the L Brands portfolio without being outwardly perceived as meddling in their decisions. Strategic Patterning often works with executives to develop new concepts. Some have taken off, such as loungewear and products for Bath & Body Works. Pink, the more wholesome, teen-friendly Victoria’s Secret sub-brand was also workshopped within the group. But others, like multiple proposals to add plus sizes to the Victoria’s Secret offering, were dismissed despite a compelling business rationale.

McFate, based in Columbus, has worked at the company for more than 26 years and often travels with Wexner and his family outside of work. Auerbach, McFate’s proxy in New York, joined L Brands more than 15 years ago. McFate technically reported to Ed Razek, the creative director behind the Victoria’s Secret fashion show and other marketing projects. At least until this week, when an internal memo revealed that Razek is retiring.

ADVERTISEMENT

But in reality, McFate has always had a direct line to Wexner. (Some employees categorised Razek as a figurehead and spokesperson, while McFate is Wexner’s “right hand.” Despite Razek’s public-facing role, his involvement in Strategic Patterning was minimal).

The complex personal dynamic between Wexner, McFate and Auerbach — who are extremely close — has made for a work environment that several former employees called “toxic.” And while many executives have cycled in and out of L Brands over the years, the composition of Strategic Patterning has remained consistent — to Wexner’s detriment, many argue.

Ultimately, it always goes back to what Les wants.

“He became so disconnected, having all the wrong people around him,” said a former employee who, like others, requested anonymity for fear of potential legal repercussions. “Ultimately, it always goes back to what Les wants,” added another former employee.

At Victoria’s Secret, that meant delivering on a persona dreamt up by Wexner and his creative deputies. The executive loves to reference the late director Sidney Lumet’s autobiography, “Making Movies,” often likening brand building to filmmaking. One former employee described “Victoria” as a half-French, half-English girl who attends a boarding school in the UK and spends her summer break in the South of France. (A source inside the company confirmed this description, but said “Victoria” was in her mid-30s.)

“They live in a fantasy,” the employee said of Wexner and his inner circle.

It’s a fantasy that has endured for decades, and made the company billions of dollars. For many years, Wexner’s track record in brand building earned him the power to do as he pleased. The executive bought Victoria’s Secret for the bargain-basement price of $1 million in 1982, transforming the business from a struggling local chain to the world’s most famous lingerie maker. At its peak in 2016, it generated $7.8 billion in annual sales in North America alone, accounting for 62 percent of total revenues at L Brands.

Over the past three years, however, Wexner has faced the harsh realities of declining sales and shrinking margins at his marquee business, which, while still one of the world's leading lingerie brands, has increasingly found itself out of sync with cultural change and the direction of the market.

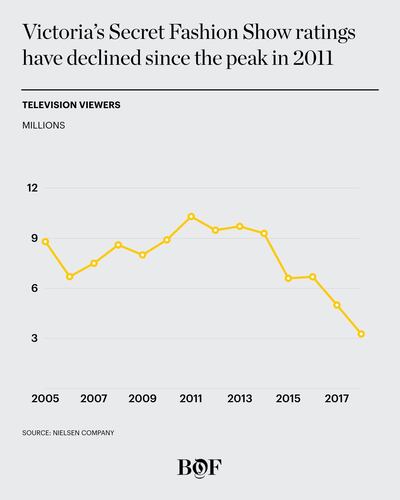

In 2018, its famous Victoria's Secret Fashion Show — a made-for-television spectacle featuring a parade of skinny lingerie-clad girls wearing feathery "Angel" wings, punctuated with radio-friendly musical acts — had its lowest ratings ever: 3.3 million viewers, down from 6.7 million just two years before. In the publicity leading up to the event, Razek was scrutinised after making unsavory comments regarding transgender and plus-size people to American Vogue, only to be lambasted on social media. (He apologised afterwards.)

ADVERTISEMENT

Now, Wexner’s longtime relationship with Jeffery Epstein, the Upper East Side financier charged with the sex trafficking of minors, has come under the microscope. A convicted sex offender, Epstein allegedly used his association with Victoria’s Secret — for years considered a gold standard in modelling contracts — as a way to lure young women. Wexner and Epstein were so close that Epstein, for a time, even had power of attorney, allowing him to act on Wexner’s behalf in personal business and legal matters.

"It is posing a potentially grave problem for L Brands…," wrote The New York Times, which probed the association in a front-page story on July 25th. "Wexner, the longest-serving chief executive in the S&P 500 and L Brands' largest shareholder, once praised Epstein as 'a most loyal friend' with 'excellent judgment and unusually high standards.'"

In a statement issued before the story on July 15th, the 81-year-old Wexner denied any knowledge of the “illegal activity charged in the indictment,” saying that he cut off dealings with Epstein “almost 12 years ago,” more than a year after police began investigating the financier. (A spokesperson for L Brands offered no further comment regarding Wexner's relationship with Epstein.)

This week, Wexner also told Wexner Foundation associates that Epstein misappropriated "vast sums of money from me and my family," although he didn't indicate how much. When Wexner found out about this in 2007, he said he immediately severed ties with Epstein. In 2008, Wexner said Epstein did pay back some of the money. A $46 million portion of those recovered sums went to the charitable organisation. But Wexner was adamant that the money was originally taken from the family, not the foundation.

The L Brands board of directors recently hired an outside law firm to review the Epstein connection. (Wexner has said that Epstein acted as his personal advisor only, not an advisor to L Brands.) But Wexner’s tight control over the company has made observers question whether he was able to disentangle his personal matters from those of L Brands.

Wexner’s power over the company was once considered an asset that, along with focus and dedication, helped him to build several billion-dollar-plus brands that ruled suburban shopping malls across America for many years.

“He did all the right things for that time period,” said Jane Hali, a retail analyst. “He had great prices and great places in the mall that were thriving then.” Hali also praised Wexner’s approach to promotions and marketing, namely the famous Victoria’s Secret catalogue and theatrical television ads and shows. “But this doesn’t apply anymore,” she said.

Some of the challenges facing L Brands stem from wider shifts in the retail landscape. The economic and cultural institution of the mall Wexler helped to build is collapsing under the weight of e-commerce and social media. Observing the decline in the mid-priced apparel market, Wexner sold 75 percent of The Limited in 2007, finalising the rest of the sale three years later. The apparel chain — which was something like the Zara of its time when Wexner founded it 1963 — has since closed all 250 of its stores.

ADVERTISEMENT

Victoria's Secret fashion show 2016 in Paris | Source: Shutterstock

But Victoria's Secret kept growing with no signs of slowing down until 2016. In February of that year, then-Chief Executive Sharen Jester Turney resigned, much to the surprise of analysts given that, in the prior year, Victoria's Secret generated record-beating revenue despite decreased foot traffic to malls. At the time, the brand accounted for over 60 percent of the US lingerie market, according to research firm IBISWorld.

Instead of immediately replacing Turney, Wexner assumed her responsibilities in addition to his role as group chairman and chief executive. Two months after her exit, the company decided to close Victoria’s Secret’s swimwear business and its print catalogue, cut 200 jobs and restructure the brand into three divisions — beauty, lingerie and its sub-brand Pink — each with its own leader. By the end of the year, Victoria’s Secret had dragged down L Brands’ profitability. Its stock price, which reached $100 per share in late 2015, began declining. By the end of 2016, it had fallen to $66 per share.

It was around this time that challengers promising an alternative to Victoria's Secret flooded the lingerie market. They offered a wider range of sizes and more comfortable styles, including wireless bras, a trend Victoria's Secret largely missed. They also tried harder to solve fit problems and focused on online sales, while eschewing the increasingly outmoded image of sexiness embodied by Victoria's Secret by celebrating ethnic diversity and a wider range of body types in their advertising campaigns.

The strategy resonated with younger shoppers in particular, putting pressure on Pink. In 2017, American Eagle's body-positive lingerie line Aerie — which pivoted its approach to marketing beginning in 2014 — reached approximately $493 million in sales, up 27 percent year-over-year. Startups including Savage X Fenty, Third Love and Lively — recently acquired by Wacoal for $85 million — also began stealing away customers with inclusive sizing and marketing that preached self-love.

Yet Victoria's Secret stuck to its traditional formula, bringing its fashion show to Shanghai at the end of 2017 to support its launch in China, which the company hoped would offset losses in the US. But the show was overshadowed by reports of operational chaos, particularly around visas. The fashion show's television ratings declined sharply and North American sales for Victoria's Secret declined 5 percent, while operating income declined 21 percent. Comparable-store sales were down 5 percent. (International sales at Victoria's Secret and Bath & Body Works accounted for just 4 percent of total revenue at L Brands in 2017.)

In 2018, things worsened, despite L Brands offloading some of its other properties to cut costs. (In addition to closing multi-brand retailer Henri Bendel, the company also sold Canadian lingerie line La Senza.) Then came Razek's Vogue interview, in which he said that he would not put curvy or transgender models in the show because they did not fit in the Victoria's Secret "fantasy."

Six months after the 2018 fashion show bombed, the company announced that it was cancelling its plans to air the annual runway extravaganza on television. Once a celebrated variety show — with major musical guests like Kanye West, Rihanna and Taylor Swift — it is now considered an example of what not to do when staging a mass-market fashion event, with repeated charges of cultural appropriation, objectification of women and general tone-deafness have made it a target of online activists long before it even airs. (It is usually filmed weeks in advance.)

L Brands has been vague about its future plans for the show. Currently, no models have been booked — which would have typically happened by this time in the year — and public relations and events agency KCD, which has helped produce the show for several years, has not been contracted. (KCD declined to comment.) With Razek out, sources suggest that the company will stage some sort of marketing event, but it could be quite different.

The show’s decline has coincided with a drastic dip in profits at Victoria’s Secret. At the end of fiscal 2018, operating income for the brand in North America was down 50 percent, while sales were flat. L Brands’ total revenue managed to increase, thanks to continued growth from Bath & Body Works, but the picture at Victoria’s Secret was looking grim.

By the time Epstein was arrested in New Jersey on July 6, 2019 — and a flood of coverage regarding his checkered past revealed that much of his wealth came from advising Wexner for nearly 30 years — L Brands was already a target for activist investors, including James Mitarotonda of Barington Capital.

But Wexner is not one to listen to others. That's because, for many years, he didn't have to. When Mitarotonda began making noise in March 2019, Wexner personally owned 17.3 percent of L Brands shares and virtually controlled the board, which included people with whom he has close personal ties, including his wife, his financial advisor, the former head of a university to which he pledged $100 million, and the head of a charity that partnered with an organisation led by his wife, according to the Wall Street Journal.

L Brands requires a 75 percent super majority to approve a takeover bid, spinoff or remove a director for cause. But even if activist investors were able to convince the board that Wexner was no longer fit to run the business, the company’s market capitalisation is still so large — $6.7 billion as of August 2019 — that the number of potential acquirers remains extremely limited.

However, Mitarotonda has since succeeded in pressuring Wexner to loosen his grip on power. He made considerable noise about the chairman’s close relationships with independent board members and the poor financial performance of the business, calling for a spinoff of Victoria's Secret or an initial public offering of Bath & Body Works. He also pushed for appointing new board members and splitting up Wexner’s chairman and CEO roles.

In the end, Wexner agreed to compromise on some key points. Two new independent board members were voted in, and Mitarotonda was hired as a special advisor, a role through which he will likely continue to advocate for change. Perhaps most importantly, the L Brands board may no longer be ruled by “super majority." A proposal to shift to a simple majority voting requirement will be voted on at the 2020 annual meeting. In exchange, Mitarotonda agreed not to conspire with others to take over L Brands (among other restrictions), according to company filings. Mitarotonda did not respond to request for comment.

Whether or not these actions will result in a noticeable shift in the way Victoria's Secret operates remains to be seen. This week, news broke that transgender model Valentina Sampaio will feature in a campaign for Pink. Razek's departure is another indication that change is afoot. Victoria's Secret Lingerie Chief Executive John Mehas, who was appointed in November 2018, will now oversee brand creative. (Razek's interim replacement at Victoria's Secret now reports to Mehas. The executive assuming Razek's L Brands duties continues to report to Wexner.)

“We’re committed to a full review of the business,” L Brands Chief Financial Officer Stuart Burgdoerfer said during a call with investors at the end of 2018. “Everything is on the table, including our brand positioning, marketing, talent, real estate, cost structure and, most importantly, our merchandise assortments.”

Wexner is likely banking on considerable support from allied shareholders, although an increasing number of investors are eager to see him step aside.

“These former brilliant retail CEOs had so many wins in their past that they could not see today’s customer for who they are,” Hali said. “They believed the old tools worked and were unable to change because of their past successes.”

Perhaps the mall king’s absolute rule is no longer.

Related Articles:

[ L Brands Falls as Wexner Ties to Epstein Come Under ScrutinyOpens in new window ]

The rental platform saw its stock soar last week after predicting it would hit a key profitability metric this year. A new marketing push and more robust inventory are the key to unlocking elusive growth, CEO Jenn Hyman tells BoF.

Nordstrom, Tod’s and L’Occitane are all pushing for privatisation. Ultimately, their fate will not be determined by whether they are under the scrutiny of public investors.

The company is in talks with potential investors after filing for insolvency in Europe and closing its US stores. Insiders say efforts to restore the brand to its 1980s heyday clashed with its owners’ desire to quickly juice sales in order to attract a buyer.

The humble trainer, once the reserve of football fans, Britpop kids and the odd skateboarder, has become as ubiquitous as battered Converse All Stars in the 00s indie sleaze years.