The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

This article first appeared in The State of Fashion 2022, an in-depth report on the global fashion industry, co-published by BoF and McKinsey & Company. To learn more and download a copy of the report, click here.

Executives in the global fashion industry are cautiously optimistic about the year ahead, though new and ongoing disruptions are beginning to erode that mood in some quarters. While some global markets are starting to recover after 18 to 20 months of pandemic-related turbulence, propelled by surging e-commerce adoption and domestic spending, challenges relating to supply chain bottlenecks and uneven consumer demand continue to hang over the fashion industry, undermining growth prospects.

Overall, global fashion sales are on track to pick up momentum in 2022, as increasingly hopeful consumers unleash pent-up buying power, refreshing their wardrobes as social life begins to resume in many key markets around the world. While the luxury sector is expected to achieve a full recovery by the end of 2021, the wider fashion industry is not set to return to pre-pandemic performance levels until early 2022. This is a much quicker recovery than was expected six months ago.

The industry’s recent emergence from a sustained period of turbulence is still weighing heavily on the minds of industry executives, as shown by their choice of the top three words to describe business conditions in the year ahead in our BoF-McKinsey State of Fashion 2022 Survey: “recovery” (cited by 59 percent of fashion executives), “challenging” (50 percent) and “changing” (42 percent). However, executives are leaving behind the all-consuming preoccupation with “uncertain” market conditions that they expressed in 2021 and turning their attention to driving growth in an altered market landscape — even though a degree of uncertainty around crisis recovery and inconsistency nonetheless persists in the year ahead.

ADVERTISEMENT

In 2022, fashion is poised to benefit from fundamental macroeconomic drivers. Consumer sentiment is on a positive trajectory, especially in markets where vaccination and saving rates are high. In the US, savings in the first quarter of 2021 were estimated to be 3.1 times higher than in the first quarter of 2019. Alongside this, 43 percent of US consumers said they would increase their fashion spend in 2021, with clothing for work and special occasions top of their shopping lists. While pent-up demand has already played out as so-called “revenge shopping” in the luxury segment in China, similar behaviour is expected to pick up steam in the broader fashion market in the US in early 2022. In Europe, consumer confidence in economic recovery is more cautious, with approximately one quarter of respondents in a September 2021 survey optimistic that the economy would rebound to pre-pandemic levels by the end of 2021, while over half expected recovery only in 2022 or later.

As fashion inches towards rosier conditions in some regions, industry leaders have a more hopeful outlook than last year. Some 75 percent of luxury executives, 61 percent of mid-market executives and 50 percent of value executives expect better trading conditions in 2022 than 2021. This reflects a different distribution of mood compared to our last survey, which was conducted in 2020 to capture sentiment about 2021, in which mid-market executives were the least hopeful group, with only 22 percent expecting better trading conditions, whereas value executives were the most hopeful at 36 percent followed by luxury at 31 percent. While there are most likely a variety of reasons why mid-market executives are feeling more positive about 2022 than they were about 2021, one may be that the surviving and restructured players in that segment of the market are expecting a rebound after it fared poorly for several years.

From a demand perspective, younger cohorts such as Gen-Z and wealthier consumers from middle-income groups and upwards are predicted to demonstrate the strongest appetite for leisure spend (including fashion, dining out, travel, entertainment, electronics, etc.) in the US through 2021 and beyond. Fashion is one of the top three categories on which they seek to splurge or treat themselves. In China, there are strong prospects for growth in consumer spending power, where rising incomes will contribute to an anticipated increase of $10 trillion in consumption growth between 2021 and 2030.

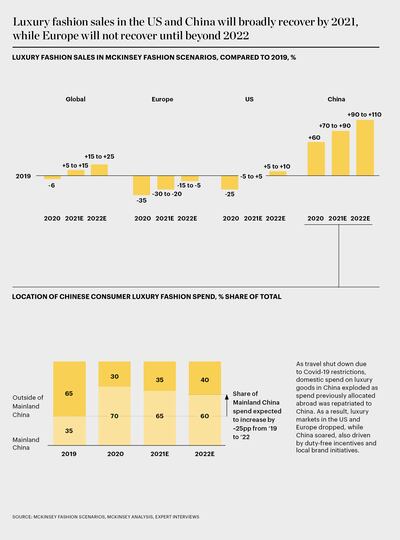

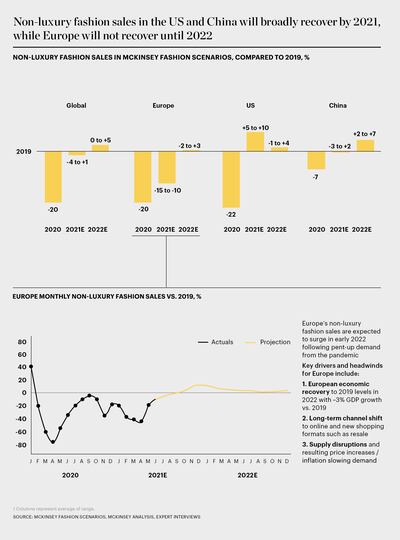

While the global fashion market will continue to grow overall, performance will be uneven across geographies, depending on their ability to recover from pandemic-induced health and economic shocks. The Chinese fashion market — including both luxury and non-luxury segments — is already back to pre-Covid sales levels. The non-luxury segment reached +2 percent over 2019 H1 sales in H1 2021. However, for a full-year comparison, macroeconomic disruptions through the latter half of 2021 will likely temper this growth to -3 to +2 percent for 2021 versus 2019 sales overall. On the other hand, the luxury sector shows strong signs of growth in China amid ongoing travel restrictions and increased domestic spend; the luxury segment is set to reach +70 to +90 percent over 2019 sales by the end of 2021.

The US is not far behind — US non-luxury segment fashion sales will have recovered to +5 to +10 percent over 2019 levels by the end of 2021, according to McKinsey Fashion Scenarios analysis. A similar picture will emerge in the US luxury segment, which is expected to return to -5 to +5 percent of 2019 levels in 2021, slightly below non-luxury due to ongoing luxury spend repatriation in China muting sales recovery in the US. In Europe, there will be a slightly slower trajectory for recovery of non-luxury fashion sales, reaching just -15 to -10 percent of 2019 sales by the end of 2021, and taking until 2022 to recover fully. Meanwhile, the European luxury segment will remain below 2019 levels until beyond 2022, as vast amounts of spend from Chinese nationals travelling abroad is redirected to Mainland China. Given this diverse set of dynamics and with the global fashion industry fully recovering only in 2022, growth will be front of mind in the year ahead: 87 percent of fashion executives plan to pursue sales growth in 2022.

Despite the slower projected return to pre-pandemic sales levels in Europe, executives in that region are the most optimistic about the year ahead, likely owing to factors such as the comparatively strong presence of European luxury brands across global markets. Indeed, 67 percent of Europe-based executives expect better trading conditions in 2022 than 2021. This compares with 57 percent of executives in North America (where the release of pent-up buying spiked in 2021) and 52 percent in Asia, where most key markets have already returned to pre-pandemic sales levels. None of the executives in Asia anticipate worse trading conditions in 2022, while some scepticism remains among executives in Europe and North America, where 8 percent and 9 percent expect worse conditions respectively. Collectively, these sentiments likely reflect a relaxation of stimulus packages and the release of pent-up buying, and point to the caution required next year in the face of supply chain stresses and the challenges of maintaining stable growth.

Several forces are at work to create both opportunities and risks in 2022, including new growth channels, consumer behaviour patterns and complications in the global economy. Executives predict that supply chain pressures, the rise of domestic luxury spend amid muted international travel and the continuing evolution of digital channels will have the biggest impact on their business in 2022. To be sure, the disruption of global supply chains ranked at the top of the agenda for 84 percent of executives in the BoF-McKinsey survey, as the turmoil experienced over the last two years — amid material shortages, transportation bottlenecks and soaring shipping costs, exacerbated by surging consumer demand in some markets — is expected to remain in the year ahead. As the logistics industry continues to shift and challenges mount, executives need to pay close attention to the transparency and control measures in their supply chains to meet consumer demand.

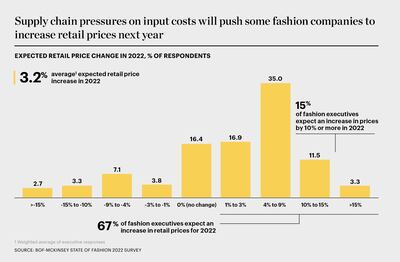

Invariably, supply chain stresses will impact margins. As a result of these cost inflation pressures, 67 percent of fashion executives expect to increase retail prices in 2022, with an average uplift of 3.2 percent, while 14 percent of executives even expect to increase prices by more than 10 percent. Since many players will be focusing on sales growth, price increases will be used to offset narrowing margins. Still, 17 percent of executives expect to lower prices, with the most expectation for price decreases coming from the mid-market, perhaps due to the segment’s ongoing squeeze throughout the pandemic.

ADVERTISEMENT

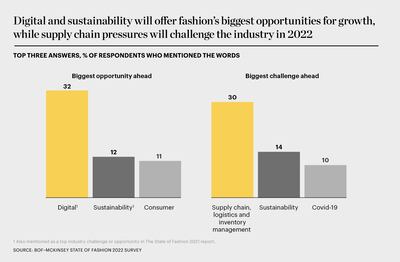

Following supply chain disruptions, the second most prominent challenge on executives’ minds is the sustainability gap, cited by 15 percent of executives as one of their top three concerns for 2022 in the BoF-McKinsey survey. However, 12 percent of executives also rate sustainability as an opportunity in the year ahead, suggesting that any costs or challenges they encounter relating to sustainability may be outweighed by business benefits associated with improving their company’s impact on the environment and society. Compared with 45 percent of executives who cited Covid-19 as a top challenge in last year’s survey, the health crisis was highlighted by just 10 percent of respondents as a top challenge for 2022, suggesting that measures to curb the impact of the pandemic on business are proving their mettle in some markets. Looking ahead, fashion companies will need to address these interconnected challenges by taking an active and vigilant approach to supply chain management while establishing priorities for an ambitious and revitalised sustainability agenda.

Alongside sustainability, executives are also looking to “digital” and “consumer engagement” as opportunities for 2022, cited by 32 percent and 11 percent of fashion executives respectively. While both digital and sustainability opportunities are longer-term themes that are highlighted by executives year on year, consumer engagement is a new opportunity cited by executives for 2022, reflecting the view that customer experiences with brands across online and offline channels are becoming even more important for brand differentiation in a highly competitive marketplace. Fashion players will therefore need to accelerate their use of data and analytics across business functions to develop customer insights and adjust their strategies accordingly.

The year ahead will present a welcome shift for some fashion players, having regained much of the ground lost to the pandemic after nearly two years of turmoil. Still, worrying signs, supply chain stresses and a degree of uncertainty across some geographies and parts of the industry point to a need for prudence as an increasingly inconsistent overall picture emerges. At the same time, as overall industry sales recover, fashion players will likely continue to suffer business disruptions through 2022, with some fighting for survival as both pandemic-related and global economy aftershocks are likely to emerge in the year ahead. All told, the state of the global fashion industry in 2022, defined by the 10 themes in this report, will be characterised by new and persisting challenges tempered by fresh opportunities to grow and evolve at a crucial time for most businesses.

The 10 fashion industry themes that will set the agenda in 2022:

1. Uneven Recovery

Recovery from Covid-19-related economic shocks will be uneven across consumer markets and sourcing regions, as countries with strong healthcare systems and economic resilience outperform. In this patchy environment, fashion players with international footprints will need to look at investment decisions with precision, reassessing local conditions regularly while mitigating for market-specific risks.

2. Logistics Gridlock

The fashion industry is reliant on an intricate web of global supply chains that are seeing unprecedented levels of pressure and disruption. With logistical logjams, rising shipping costs and shortages of many kinds adding new layers of complexity, companies must rethink their sourcing strategies while implementing cutting-edge supply chain management, and building in greater flexibility to keep products flowing with customer demand in the year ahead.

ADVERTISEMENT

3. Domestic Luxuries

Travel has traditionally been a key driver of luxury spending, but international tourism is not expected to fully recover until between 2023 and 2024. To capture the shift in shopping patterns set to shape the year ahead, luxury players should engage more deeply with domestic consumers, rebalance their global retail footprints and duty-free networks and invest in clienteling for local e-commerce channels.

4. Wardrobe Reboot

After focusing on the likes of loungewear and sportswear for nearly two years, consumers will reallocate wallet share to other categories as pent-up demand for newness coincides with more social freedoms outside the home. To anticipate these nuanced and sometimes paradoxical preferences, brands should lean more on data-driven product development, adjusting their inventory mix accordingly to ensure that assortments resonate with consumers adjusting to new lifestyles.

5. Metaverse Mindset

As consumers spend more time online and the hype around the metaverse continues to cascade into virtual goods, fashion leaders will unlock new ways of engaging with high-value younger cohorts. To capture untapped value streams, players should explore the potential of non-fungible tokens, gaming and virtual fashion — all of which offer fresh routes to creativity, community-building and commerce.

6. Social Shopping

Social commerce is experiencing a surge in engagement from brands, consumers and investors alike as new functionality and growing user comfort with the channel unlocks opportunities for seamless shopping experiences from discovery to checkout. Though use cases differ across global markets, brands should double-down on tailored in-app purchase journeys and test opportunities in technologies such as livestreaming and augmented reality try-on.

7. Circular Textiles

One of the most important levers that the fashion industry can pull to reduce its environmental impact is closed-loop recycling, a system which is now starting to be rolled out at scale, promising to limit the extractive production of virgin raw materials and decrease textile waste. As these technologies mature, companies will need to embed them into the design phase of product development while adopting large-scale collection and sorting processes.

8. Product Passports

In a bid to boost authentication, transparency and sustainability, brands are using a portfolio of technologies to store and share product information with both consumers and partners. To get the most from these digital ‘product passports,’ which can help brands tackle counterfeiting, differentiate themselves and build loyalty by enhancing consumer trust, businesses must coalesce around common standards and engage with pilot projects at scale.

9. Cyber Resilience

As the digitisation of fashion businesses reaches new heights, companies face more threats of cyber attacks and growing risks relating to improper data handling. Amid increased sophistication in cyber crime and rises in consumer and regulatory pressure, brands need to act urgently to shore up their defences and invest more to make digital security a strategic imperative.

10. Talent Crunch

Companies that rely on brand appeal or the allure of fashion to attract and retain talent will need to raise their game as competition from both within and outside the industry intensifies, leading to more vacancies next year. As employees from upper management to the retail front line reconsider their priorities, companies must refresh their talent strategies for an increasingly flexible, diverse and digitised workplace.

Industry Outlook as of the beginning of November 2021.

The sixth annual State of Fashion report forecasts that global fashion sales will surpass their pre-pandemic levels in 2022 thanks to outperforming categories, value segments and geographies, while supply chain headwinds will pose a risk to growth prospects. Download the report to understand the 10 themes that will define the state of the fashion industry in 2022 and the strategies to deploy to safeguard recovery and maintain sustainable growth.

1. Navigating Fashion's Uneven Recovery

2. The Great Logistical Gridlock

3. Global Luxury Adapts to New Travel Trends

4. Consumers to Reboot Wardrobes for Post-Pandemic Life

5. Building Brands With a Metaverse State of Mind

6. Unlocking Next-Generation Social Shopping

7. Paving the Way for Closed-Loop Recycling

8. What Product Passports Will Do for Brands

9. Shoring Up Fashion's Cyber Defenses

10. A Talent Crunch Is Heading Our Way

Antitrust enforcers said Tapestry’s acquisition of Capri would raise prices on handbags and accessories in the affordable luxury sector, harming consumers.

As a push to maximise sales of its popular Samba model starts to weigh on its desirability, the German sportswear giant is betting on other retro sneaker styles to tap surging demand for the 1980s ‘Terrace’ look. But fashion cycles come and go, cautions Andrea Felsted.

The rental platform saw its stock soar last week after predicting it would hit a key profitability metric this year. A new marketing push and more robust inventory are the key to unlocking elusive growth, CEO Jenn Hyman tells BoF.

Nordstrom, Tod’s and L’Occitane are all pushing for privatisation. Ultimately, their fate will not be determined by whether they are under the scrutiny of public investors.