The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

Opens in new window

Opens in new windowBrands and retailers that weathered 2008′s global financial crisis can be forgiven for feeling a sense of déjà vu as a steady stream of macroeconomic data signals challenging times ahead. Just like in 2008, consumer confidence has plummeted to record lows in reaction to economic uncertainty and households have reined in spending.

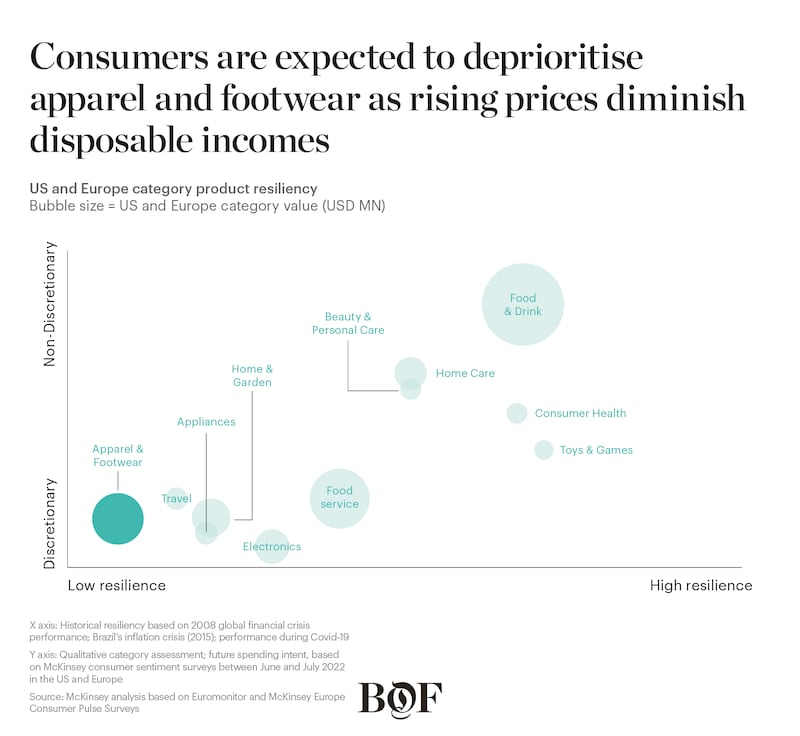

Economists increasingly expect lower-income households to bear the brunt of economic stresses over the short to medium term, particularly if the relatively low unemployment levels in some regions were to change dramatically. In regions such as Central and South America, consumers are already struggling to cover everyday expenses, as income levels fail to keep pace with escalating inflation, which hit a 26-year high in Brazil and 21-year high in Mexico in 2022. Many lower-income households will likely deprioritise discretionary spending, including fashion and beauty purchases. In the US, customers are “trading down.” A McKinsey US Consumer Sentiment survey conducted in the summer of 2022 found that 74 percent of respondents said they have been shopping from more lower-priced retailers or brands than usual, seeking discounts at their “go-to” retailers or paying for goods in instalments; 45 percent said they recently delayed making a discretionary purchase.

It is a different story for higher-income households, for now. These consumers should be less impacted by economic turbulence and look likely to continue spending on discretionary goods, in the short term at least. In a recent survey, 26 percent of higher-income consumers in China — which is among the countries where economic growth is slowing — said they increased their fashion shopping budgets in the first half of 2022 compared to the same period in 2021, citing a desire to “look and feel good.” Similarly, US credit card data from the spring of 2022 suggested that wealthier shoppers were increasing their spending on apparel.

Generational differences are also noteworthy. In the US, spending among younger consumers is expected to suffer the most: 76 percent of Gen-Z and 79 percent of Millennials reported that they are dipping into their savings, taking on more credit or taking on additional jobs to manage their finances, compared with 64 percent of Gen-X and 53 percent of Baby Boomers. In China, though inflation is less of a concern, younger generations are feeling the burden of an economic slowdown, driven by new outbreaks of Covid-19 and rising youth unemployment. The unemployment rate among 16 to 24 year olds in the country reached nearly 20 percent in 2022 compared to the overall national rate of 5.5 percent. Now, many young adults are embracing humbler lifestyles than their parents, in a shift described as tang ping, loosely translated as “checking out of the rat race to pursue a more low-key life.”

ADVERTISEMENT

Retailers are bracing themselves for reduced spending among younger generations: “We see [younger and less affluent] customers spending much more cautiously on discretionary items and often waiting for promotions before buying,” said Richard A. Hayne, chief executive officer of retail group Urban Outfitters in August 2022.

This includes turning to alternative payment methods and short-term financing, which has seen a boom in popularity and has helped to fuel apparel sales over the past year. In the US, 20 percent of customers said they bought discretionary goods in 2022 with interest-free, short-term financing, including Buy Now, Pay Later services. BNPL apps are particularly popular in the Nordic region, the UK and Germany. However, BNPL providers such as ClearPay and Affirm may face headwinds as lower-income consumers pull back on spending while the likelihood of a rise in default rates increases as economies continue to slow. Brands should consider BNPL where appropriate while monitoring changing consumer behaviours — and potentially focus more on promotions and special offers.

One way the fashion industry has been responding to spending shifts is to lean more heavily on discounting. According to global research from the summer of 2022 by retail tracking firm Edited, there have been year-on-year increases in discounting in several countries following a low during the summer of 2021. In the US, 36 percent more items were discounted in 2022 compared to 2021.

Off-price channels are continuing to be attractive to bargain-hunters seeking big-name brands at lower prices. In Europe, off-price channels are expected to account for 12 percent of all fashion industry revenue by 2025, up from 11 percent in 2021.

Many off-price players were able to leverage the period after lockdown restrictions were lifted, during which US consumers splurged on purchases. In the US, sales at off-price retailers like Burlington and Ross Stores, and off-price divisions of retailers like Saks Off Fifth, grew more than 40 percent year on year in 2021. In the months ahead, off-price channels should benefit further from high inventories as brands see diminished supply chain disruptions coincide with a softening of consumer demand. The trend has accelerated in China too, where the number of fashion outlet malls has increased by more than 35 percent since 2019.

For brands, particularly higher-end ones, off-price channels should be carefully managed to avoid eroding brand perception among consumers. For example, Ralph Lauren has reduced its reliance on off-price and aims to use the channel for offloading merchandise misses, rather than selling low-margin products in high volumes like so many other luxury brands do.

There is also some evidence of consumers shopping for a more accessible type of luxury. Many newer luxury brands are catering to younger, more fashion-forward consumers that are looking to trade up from premium brands or wish to complement their wardrobes with more accessible pieces than can be found in the offerings of ultra-luxury players. This new category of brands has seen a surge in popularity in recent years; for example, Jacquemus is on track to double its sales by the end of 2022.

While higher-end luxury brands have been “premiumising” their merchandise and increasing prices, some entry-level luxury consumers are trading down to more affordable brands that still have high-end brand storytelling and aesthetics.

ADVERTISEMENT

There is a role for resale here, too. Resale revenue is expected to grow to $47 billion by 2025, from $15 billion in 2022 — 11 times faster than apparel retail overall, albeit from a lower base.

Online resale channels are growing in popularity in China. A 2020 survey of Chinese consumers from UBS found that 72 percent of respondents had increased their purchases on luxury resale via online platforms, compared to 31 percent who had done so in 2018. For some time now, Gen-Z consumers in China have been heading online to platforms like Xianyu, Zhuanzhuan and Idle Fish to buy and sell second-hand and slightly used fashion.

Regardless of age, resale shoppers say price points are driving this switch in shopping behaviour. A 2022 survey from American resale platform ThredUp found that 63 percent of respondents said they mainly shop resale to save money.

The popularity of resale has not been lost on big brands. Lululemon, Dr. Martens and Patagonia, among others, have started offering resale in recent years through their own service or through third parties. In addition to Kering’s 2021 investment in retail platform Vestiaire Collective, Farfetch announced plans to acquire B2B resale-technology platform Luxclusif to help expand the category. Meanwhile, Amazon has partnered with reseller What Goes Around Comes Around to sell pre-owned handbags from luxury brands.

Resale also creates opportunities for intermediaries. Technology and logistics platform Reflaunt recently partnered with Balenciaga to develop the brand’s resale solution.

Like resale, rental is expected to capture the attention of more shoppers and brands after struggling during pandemic lockdowns. As consumers look for value for money, they may turn to rental platforms such as peer-to-peer services like By Rotation and My Wardrobe HQ, or to brands’ own programmes offered from department stores like Selfridges. The market is expected to reach $2.1 billion by 2025. More than 40 percent of growth is expected to come from the APAC region.

Meanwhile, fashion giants like H&M, Zalando and Uniqlo are stepping up their repair services, providing consumers with another option for more affordable and sustainable ways to dress. Selfridges announced in 2022 that by 2030 nearly half of its sales should be from resale, repair, rental or refills.

For sure, difficult decisions lie ahead for brands as they face their own cost pressures. Input costs increased in 2022, including for transportation, energy and labour. If brands decide to preserve margins by passing on cost increases to customers, they must do so with a deep understanding of the risks, including the potential to lose customers to lower-priced rivals.

ADVERTISEMENT

Above all, fashion leaders should be especially attuned to the needs of their target customers, identifying changes that can lead to spikes in purchases or curtailed spending, or rapid shifts to different channels, categories or price points. In order to avoid having to increase their share of discounted or off-price products, brands must return to their core value propositions, while taking a laser-focused approach to products; tightening merchandising strategies to focus on bestsellers; developing more responsive methods to react to consumer demand; and increasing speed to market by taking steps such as nearshoring and on-demand manufacturing.

This article first appeared in The State of Fashion 2023, an in-depth report on the global fashion industry, co-published by BoF and McKinsey & Company.

Opens in new window

Opens in new windowThe seventh annual State of Fashion report by The Business of Fashion and McKinsey & Company reveals the industry is heading for a global slowdown in 2023 as macroeconomic tensions and slumping consumer confidence chip away at 2022′s gains. Download the full report to understand the 10 themes that will define the industry and the opportunities for growth in the year ahead.

The rental platform saw its stock soar last week after predicting it would hit a key profitability metric this year. A new marketing push and more robust inventory are the key to unlocking elusive growth, CEO Jenn Hyman tells BoF.

Nordstrom, Tod’s and L’Occitane are all pushing for privatisation. Ultimately, their fate will not be determined by whether they are under the scrutiny of public investors.

The company is in talks with potential investors after filing for insolvency in Europe and closing its US stores. Insiders say efforts to restore the brand to its 1980s heyday clashed with its owners’ desire to quickly juice sales in order to attract a buyer.

The humble trainer, once the reserve of football fans, Britpop kids and the odd skateboarder, has become as ubiquitous as battered Converse All Stars in the 00s indie sleaze years.