The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

LONDON, United Kingdom — "Ugg boots are over — the fashion world rejoices." So read a headline in the Guardian newspaper when California-based Ugg Australia, the brand behind the cosy sheepskin boots that shot to fame as the must-have fashion item of the late 2000s, posted a drop in sales in late 2012.

Ever since Paris Hilton packaged her pedicured feet in a pair of the brand’s squat slip-on boots, the fashion industry has been waiting for Ugg to die. But it won't. Apart from the brief blip that had fashion journalists jumping for joy in 2012, Ugg has consistently increased its profits over the last five years, with sales exceeding $1 billion every year since 2011. In the company’s fiscal year 2013, sales of Ugg products rose 9.7 percent to hit $1.299 billion, proving that the brand is much more than a passing trend.

“We don’t think of ourselves as just a trendy brand. We position it as a premium luxury and comfort brand,” Connie Rishwain, president of Ugg Australia, told BoF. “We’re a little fashion foolproof in that regard.”

The story of Ugg began, incongruously, on the beach. The boots emerged in the 1970s amongst Australian surfers, who embraced them as a comfy and warm post-surfing footwear fix. Brian Smith, one Australian surfer living in Santa Monica, California, saw that they were catching on in the US and began importing the boots from Australia, selling them to local surf shops and out of a van at surf competitions. He later set up Ugg Holdings Inc in Southern California, where the company is still based, and registered the Ugg trademark. In 1995, Smith sold the brand to US footwear company Deckers Outdoor Corporation for an estimated $14.6 million.

ADVERTISEMENT

By the late 2000s, the golden age of Ugg was in full swing, spurred by the growing popularity of Australian products (Uggs are manufactured in China, but made of Australian sheepskin and linked to the country's lifestyle) and a celebrity following that included Kate Moss, Sarah Jessica Parker and Stella McCartney. By 2010, Deckers' stock was up 2400 percent since the company first announced its plan to buy Ugg, back in 1995, largely propelled by the success of the brand's sheepskin boots.

However, it wasn’t long before the fashion media began to call time on Ugg. Practically every high street store had begun knocking off the boot and the market was rife with counterfeits (customs officials were confiscating tens of thousands of pairs of fake Ugg boots each year). Severe market saturation meant that, over time, the boot came to be associated with pink velour tracksuits as much as supermodels.

To make matters worse, the warm winter of 2011 contributed to disappointing results in the brand’s key selling season. Sheepskin costs also shot up due to a contracting global supply and increased demand. “Partly because the demand for Uggs had been so prolific, they had drove their own costing up,” said Erinn Murphy, a vice president and senior research analyst at Piper Jaffray.

Ugg suffered a period of serious growth margin contraction and, in 2012, the company reported sliding sales, down 1.5 percent to $1.184 billion compared to $1.202 billion in 2011.

Ugg’s future began to look shaky. The once-hot boot had lost its ‘must-have’ fashion status and Ugg’s limited product range was doing little to encourage customers to revisit the brand and buy more. It was then that Ugg's management took action, steering away from its 'trendy' profile to position its signature product as something even more powerful: a staple.

“You saw a transition period from a brand perspective. Coming off the hyper-growth periods of 2005, 2006, 2007, 2008 where the brand was just on fire, very much the key fashion brand to have, it started to enter into that transitional period in 2012 from, to some extent, a fad, to moving towards a much more established brand that I believe is a staple,” said Murphy. “I think it takes a very seasoned management team and one that is willing to make tough decisions in the short term to think about the brand equity long term.”

Deckers took some tough decisions. Over the years, the cost of Uggs had crept up, so the company sharpened the price points back down. Deckers also cleaned up the brand’s distribution channels, cutting out some independent retailers to leave a streamlined stack of quality stores, including the likes of Harrods and Selfridges, which adhere to closely managed price points. “[Ugg has] been very good about keeping focus and integrity around their distribution channels so that the brand itself doesn’t become too ubiquitous, it’s still very much protected,” said Murphy.

Since those shaky results in 2012, Ugg has pushed the comfort proposition of its core product into other product categories, including homeware, loungewear, slippers, sneakers, heels and men’s and children’s footwear, as well as lower-cost and premium versions of its original boot. The company does not break out figures by category, but confirmed that the classic Ugg boot now accounts for about 30 percent of global sales — compared to 65 percent only a few years ago.

ADVERTISEMENT

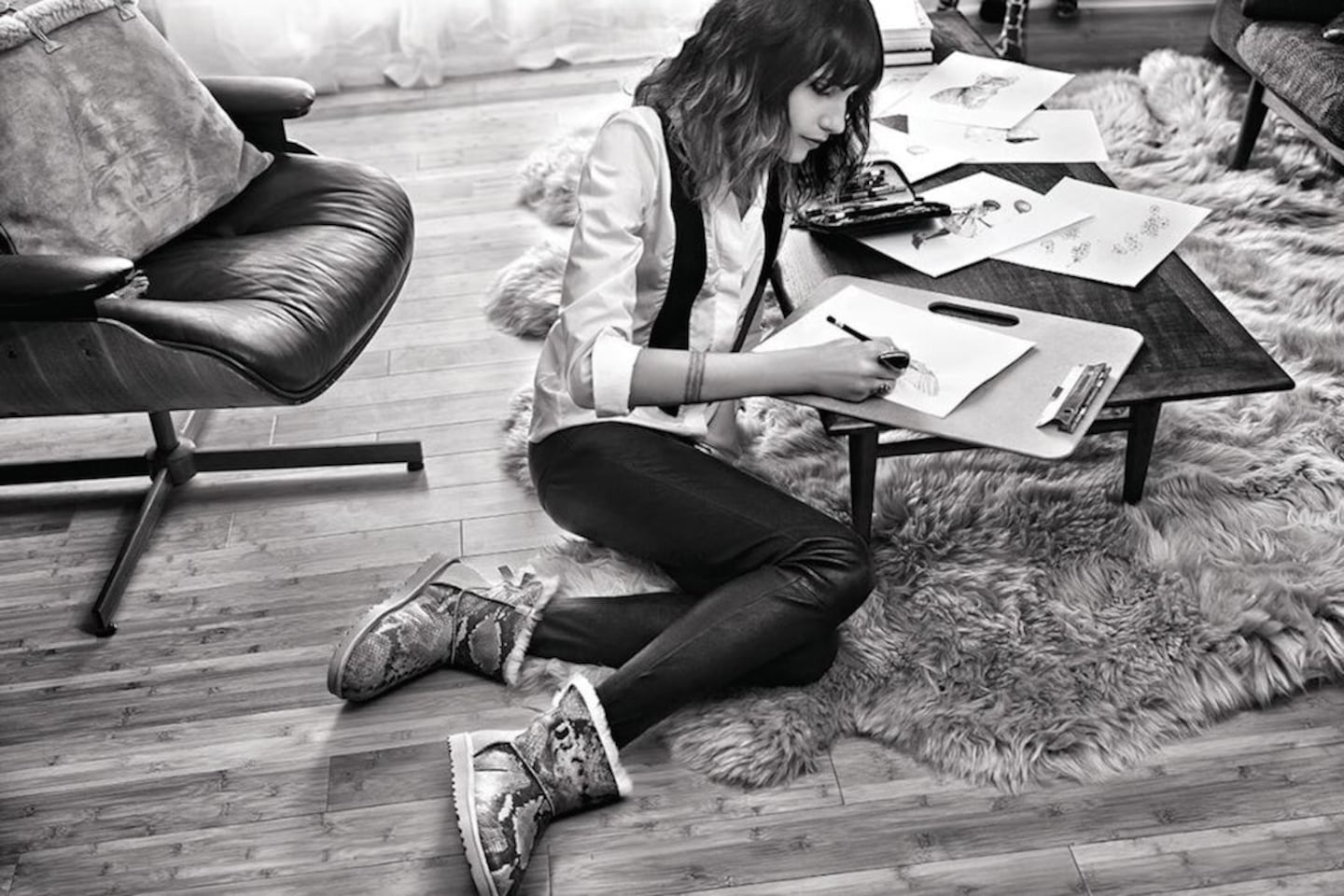

Ugg has also ramped up its marketing, repositioning itself as a premium lifestyle label via grainy black-and-white billboard campaigns starring sketch artist Langley Fox Hemingway and American football quarterback Tom Brady. Its first global brand marketing campaign, launched in August and titled ‘This is Ugg,’ shows the product worn during outdoor activities or in the home — more ‘comfort’ and ‘practicality’ than ‘hot trend.’ “In the past, before 2014, we had separate men’s campaigns, kids campaigns and women’s lifestyle,” explained Rishwain. “‘This is Ugg’ was really a way of bringing it all together under one umbrella as a global lifestyle brand.”

Ugg is certainly Deckers’ star brand, currently accounting for 84 percent of the company’s overall revenue. But could it be a global lifestyle brand? Barbara Kahn, a marketing professor at The Wharton School, University of Pennsylvania, would go even further.

"Burberry's a really good model for Ugg," said, Barbara Kahn, a marketing professor at The Wharton School, noting the brands' common trajectory of overexposure and diluted brand equity, which Burberry reversed through a careful brand turnaround. "Burberry did that over several years, through incredible control and through really good management," said Kahn. Of Ugg boots, she added, "It's like the Burberry trench, there's something about it… it's easy to see why people like it, why they go away from it and then come back. But the further you go from that product, the harder that is."

“When you look at this company, relatively large, wholesale-oriented with a retail and e-commerce component, they have done a tremendous job of integrating all three of those channels,” added Murphy, who predicts that the brand’s direct-to-consumer retail will grow to 50 percent of the business (the majority is currently wholesale, with direct-to-consumer accounting for about a third of the business). “I think their platforms and their systems are a lot more sophisticated than that of their peers.”

At present, Ugg’s business is largely driven by the US market, where the company does 70 percent of its sales, though the brand has begun to push into foreign markets, taking over its distribution in Germany and adding stores in second-tier cities in Japan to build out its 37-strong store network in Asia. “I would say a lot of our growth is going to come from international, because it’s not as developed as the US business,” predicted Rishwain. “I believe we’re going to end the year with more than 130 stores globally, so it’s still a fairly small footprint. There’s a lot of opportunity in retail and e-commerce as well.”

This October, Ugg reported $417.1 million in Q3 sales, an increase of 23.8 percent from the same period last year. Their sheepskin boots may now be deemed ugly by the fashion crowd, but from wherever you stand, Ugg Australia is a business that looks pretty good.

Nordstrom, Tod’s and L’Occitane are all pushing for privatisation. Ultimately, their fate will not be determined by whether they are under the scrutiny of public investors.

The company is in talks with potential investors after filing for insolvency in Europe and closing its US stores. Insiders say efforts to restore the brand to its 1980s heyday clashed with its owners’ desire to quickly juice sales in order to attract a buyer.

The humble trainer, once the reserve of football fans, Britpop kids and the odd skateboarder, has become as ubiquitous as battered Converse All Stars in the 00s indie sleaze years.

Manhattanites had little love for the $25 billion megaproject when it opened five years ago (the pandemic lockdowns didn't help, either). But a constantly shifting mix of stores, restaurants and experiences is now drawing large numbers of both locals and tourists.