The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

NEW YORK, United States — "Happy," "surprised" and "relieved" were the words used most often by Trump voters in a recent Pew survey on their reactions to the US presidential election result. Of Trump's supporters, 96 percent said the election made them feel hopeful, while 74 percent said they feel proud.

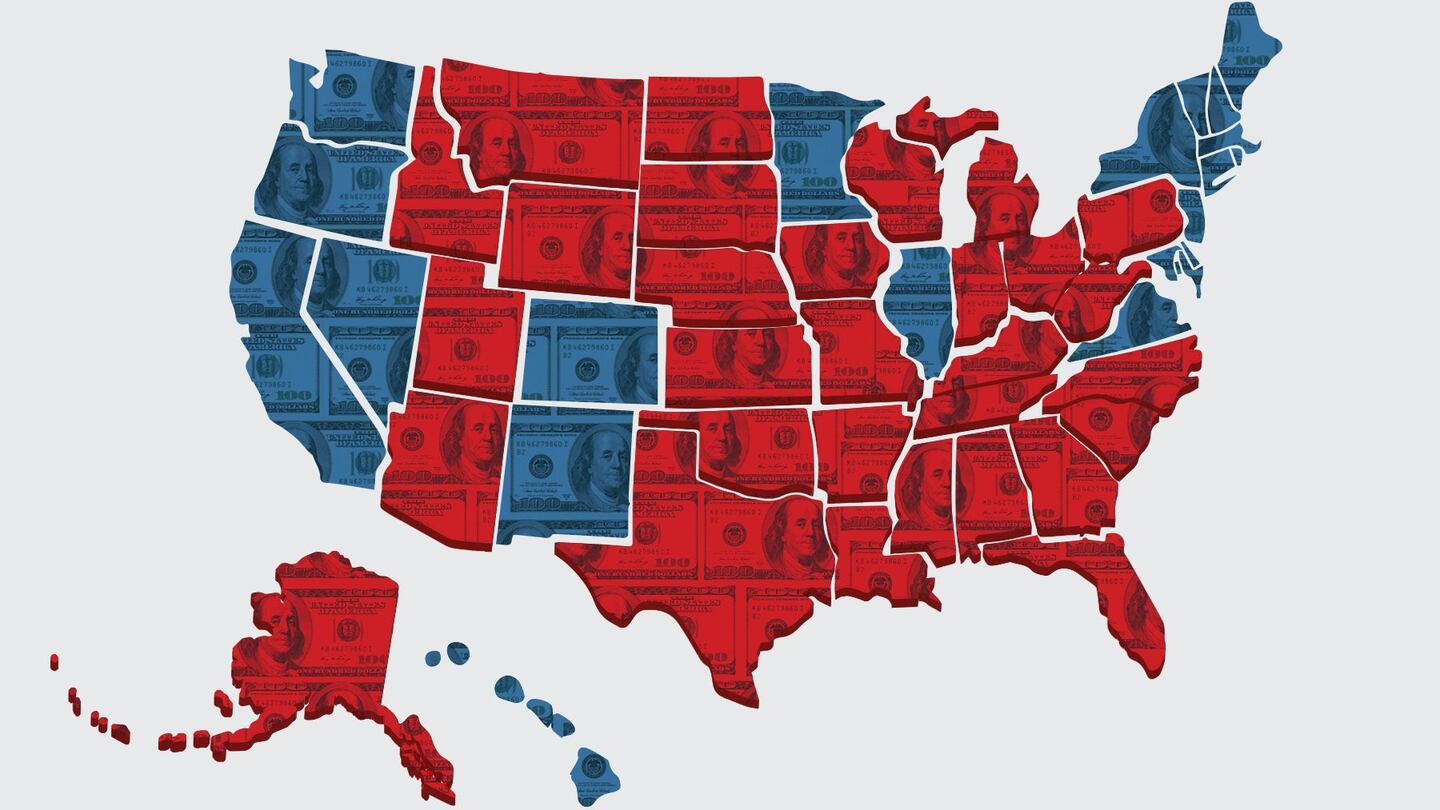

Lo and behold, their elation is reflected not only in the Pew survey but in US apparel sales. According to new data from Slice Intelligence, which tracks online purchases via electronic shopping receipts, the states in which a majority of the population voted for Trump saw the highest year-over-year gains in online apparel revenue in the month of November. Of the 26 states (including Washington, D.C.) that saw over 10 percent of growth in November in online apparel sales relative to the same period last year, 20 were won by Trump. What’s more, the opposite effect was seen amongst Hillary Clinton supporters. Of the 25 states that saw 10 percent or less growth, 15 were won by Clinton.

“It’s fairly unusual to see something this sharp,” says Neil Saunders, managing director at Conlumino, adding that while some shift in spending is normal after an election, the results of the highly polarising 2016 contest are having a more powerful effect. “If you’re in the Clinton camp, your reaction probably is: 'I don’t really know where we’re going, but I know I’m not going to like it very much.' And that you makes you feel quite gloomy about the future and even about your own prospects, to an extent. That’s why I think there’s been that sharp reaction in terms of the negativity and the spending decisions that people are making.”

Most of the growth in apparel sales was concentrated in the southern, Trump-supporting region of the country, specifically Arkansas, Florida and South Carolina (each up 20 percent); North Carolina, Georgia and Louisiana (each up 19 percent); Tennessee and Mississippi (up 16 percent); Kentucky and West Virginia (each up 15 percent), Oklahoma (up 14 percent); Alabama (up 13 percent) and Kansas (up 11 percent). Elsewhere in the country, Trump states including Idaho (up 19 percent), Utah (up 18 percent) and Wisconsin (up 17 percent) also showed strong November growth. However, two Clinton-supporting states topped the entire list: Washington, D.C. (up 27 percent) and Vermont (up 24 percent).

ADVERTISEMENT

Shoppers favored all-American mall brands, Slice's data reveals. J.Crew, Gap and Old Navy were each among the top five apparel brands in the five highest growth states (D.C., Vermont, Arkansas, Florida and South Carolina). Victoria's Secret, Loft, American Eagle and Express were also popular. Meanwhile, neither confidence in a Trump-led country nor anticipation of future tax cuts seem to be giving luxury brands a lift. While Wall Street is seeing a "Trump bump" as investors anticipate tax cuts and decreased regulation under the President-elect's administration, a similar boost cannot be seen in luxury stocks. The S&P 500 luxury goods index has not risen or fallen substantially since the election.

“I think the interesting thing is that for the underlying economics for most households, at the present time, there’s no change,” said Saunders. “It’s very much a psychological thing, rather than an actual thing, but it does have a very tangible impact. Whether someone buys something or not, and how much they spend and whether they put things on a credit card and take on debt, it can be a very psychological decision.”

A survey of 3,925 consumers conducted by Conlumino on Thanksgiving and Black Friday weekend (November 24 through 27) revealed that the number of Clinton supporters who planned to shop less than they anticipated before the election almost equaled the amount of Trump supporters who planned to shop more. Of Trump voters who were surveyed, 25.2 percent said they planned to spend more, while 10.3 percent of Clinton supporters said the same; 22.8 percent of Clinton voters said they planned to spend less, while 5.4 percent of Trump voters said the same. The survey did not take into account, however, by how much or by how little the respondents planned to adjust their holiday spending budgets.

Saunders thinks the enormous political uncertainties of a Trump administration are impacting Clinton supporters more strongly than Trump’s loss would have impacted his supporters. “Because in some ways, while they would have been disappointed, Hillary Clinton was very much the continuity candidate,” says Saunders. “Nothing really would have changed that much.”

Pew's survey showed that Clinton voters do indeed have more negative expectations for Trump's first term than John McCain's supporters did for President Obama's in 2008. Of Clinton supporters, 90 percent felt unease by Trump's election, while about 75 percent said they felt sad and scared.

But ultimately, Saunders says the shifts in apparel spending are happening on the margins, and while Clinton supporters’ fear of the future is not likely to fade away, they are still going to celebrate the holidays — and shop accordingly. “There’s just a bit more caution and reticence to spend, I think,” says Saunders. “People tend to get over it quite quickly [after past elections], but this is a lot more polarised.”

Related Stories:

[ The Age of UncertaintyOpens in new window ]

[ Will Fashion Learn to Love Melania Trump?Opens in new window ]

Nordstrom, Tod’s and L’Occitane are all pushing for privatisation. Ultimately, their fate will not be determined by whether they are under the scrutiny of public investors.

The company is in talks with potential investors after filing for insolvency in Europe and closing its US stores. Insiders say efforts to restore the brand to its 1980s heyday clashed with its owners’ desire to quickly juice sales in order to attract a buyer.

The humble trainer, once the reserve of football fans, Britpop kids and the odd skateboarder, has become as ubiquitous as battered Converse All Stars in the 00s indie sleaze years.

Manhattanites had little love for the $25 billion megaproject when it opened five years ago (the pandemic lockdowns didn't help, either). But a constantly shifting mix of stores, restaurants and experiences is now drawing large numbers of both locals and tourists.