The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

Opens in new window

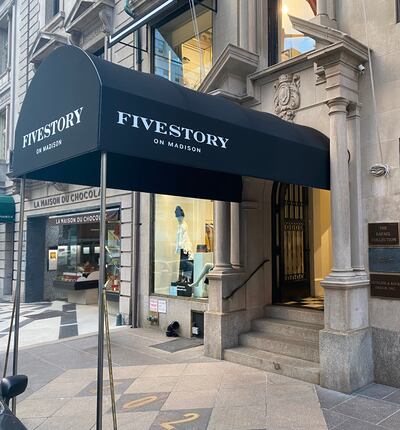

Opens in new windowBen Aryeh and his family have owned the building at 1020 Madison Avenue for more than four decades, including the gated ground-floor retail space that once housed Givenchy’s men’s store and, until, earlier this year, Lilly Pulitzer’s New York outpost.

Aryeh, who owns dozens of retail, commercial and residential properties in New York, was in negotiations with two possible tenants for the retail portion earlier this year — one luxury brand and one fashion — when he met Karen Murray, the new owner of luxury boutique Fivestory. He was charmed by her vision for the store and her honesty, he said.

But there was no way Murray could afford what the other contenders had offered to pay in rent. “He said, ‘Forget about the money, talk to me about your concept,’” Murray told BoF. “And he just fell in love with it.”

ADVERTISEMENT

In February, Aryeh not only offered Murray the space at a discounted rate but also suggested that they become business partners — the first time he has ever invested in a tenant. As part of the deal, he would help her open new locations, and once the business turns a profit, he would have a slice of equity. The duo is now looking to open another Fivestory outpost in Soho at a space that Aryeh owns, as well as locations in the Hamptons and Palm Beach.

The pandemic is forcing retail landlords and tenants to deepen their relationship beyond the monthly rent check, whether they’re in glitzy Manhattan skyscrapers or suburban shopping centres. Many fashion brands can no longer afford their leases, particularly in cities and enclosed malls where foot traffic is still a fraction of pre-Covid levels. Meanwhile, landlords worry they’ll be sitting on vacant spaces for years if their tenants fail. An August survey of storefronts on Manhattan’s Broadway thoroughfare, for instance, found more than 300 street level vacancies — a nearly 80 percent increase since 2017.

Some retailers are paying a percentage of revenue to landlords to top off — or even replace — their rent. Increasingly, landlords are taking stakes in their tenants. Simon Property Group this year bought stakes in Forever 21 and Brooks Brothers, both tenants in many of its malls. There are plenty of smaller deals such as the agreement between Aryeh and Murray.

It’s a trend that real estate professionals say was well underway before 2020. Plenty of mall operators in the US and UK entered into revenue-sharing agreements with their tenants. But the pandemic kicked this trend into higher gear.

It used to be just these old school landlords collecting your rent at the beginning of every month and [many] are now thinking they’re due for a change.

“It used to be just these old school landlords collecting your rent at the beginning of every month and [many] are now thinking they’re due for a change,” said Corey Shuster, a retail broker at Douglas Elliman who worked on the Fivestory lease. “Retail’s been changing for the past 10 years with e-commerce, and I think this is just part of that change.”

Why They Team Up

But for many landlords, providing these amenities as well as investment or modified lease structures is a last resort: if they don’t, then they risk losing their tenants at a time when demand for brick-and-mortar retail is at an all-time-low. In the third quarter of 2020, the average asking rent in Manhattan’s 16 major retail corridors was 12.8 percent lower than the previous year, according to a report from CBRE.

Simon and Brookfield Property Group’s September acquisition of J.C. Penney, for instance, is a case in point. If J.C. Penney had been forced to liquidate post-bankruptcy, these landlords would’ve had to deal with more than 600 empty anchor spaces in their malls, which would have also prompted their other tenants to evoke co-tenancy clauses in their leases that allow them to either vacate or renegotiate terms.

ADVERTISEMENT

“It could’ve been risky for Simon if J.C.Penney closed in their malls, because then other retailers would start leaving,” said Robin Abrams, a retail broker at Compass.

In most cases right now, tenants are the ones with leverage, compelling landlords to agree to certain setups they never would have signed up for prior to this year.

“[Once] you start to threaten bankruptcy and they realise they won’t get someone else to pay rent, then the landlords are forced to consider other options,” said Murray.

The market nonetheless had begun moving in this direction in recent years. Rents may have fallen dramatically in the second quarter this year, but they were already on the decline for 10 straight quarters before, according to the CBRE report.

[Once] you start to threaten bankruptcy and they realise they won’t get someone else to pay rent, then the landlords are forced to consider other options.

“We were starting to see this before the pandemic, where this model of base rent plus percentage rent was starting to be more accepted by landlords outside of the malls,” Abrams said. “But landlords today are being much more flexible and creative with regard to how they structure their deals in order to maintain existing tenants and attract new tenants.”

True Partners

With closer financial ties to its tenants’ success, a landlord will be more involved in running the business itself. Real estate landlord Jamestown uses the percentage rent plus low base rent model for the bulk of its retail tenants, according to its president, Michael Phillips.

When Covid-19 cases began rising in early 2020, Jamestown, whose properties include Chelsea Market in Manhattan before it was sold to Google and shopping centre Malibu Village, knew it had to provide retailers extra support. In March, it launched an online dashboard for tenants to help them find grants, improve their business models during the pandemic and use other tactics like social media to drive online sales. Two months later, Jamestown announced a $50 million “restart” fund set aside for rent abatements as well as other forms of pandemic relief, Phillips said.

ADVERTISEMENT

When landlords work alongside their tenants, the two parties work collaboratively to increase sales, sharing costs in renovations and even marketing. Jamestown goes as far as “incubating” young brands, Phillips said, allowing retail companies to take on pop-up spaces or new concepts in its properties, often at below-market rent rates. In turn, these buzzy labels end up driving traffic and hype into Jamestown’s developments, and the ever-changing roster of tenants keep these retail destinations from being stale.

This is going to be good for retail, this evolving relationship.

Throughout the years, “incubated” brands include Sid Mashburn, which opened its first location at the Jamestown-owned Westside Provisions District in Atlanta, and marijuana paraphernalia brand Higher Standards in Chelsea Market.

“[Landlords] are becoming much more cognisant of what’s going on, paying more attention to the business models of their clients, not just looking for a good financial sheet,” said Shuster. “This is going to be good for retail, this evolving relationship. It’s not just a monetary but a personal interest in the tenants they’re signing.”

Taking On Risks

But going the extra step of owning interest in a tenant poses certain risks, analysts warn. While landlords like Jamestown are involved in their tenants’ operations, they don’t intend on actually investing in them.

For one, some retail concepts are simply beyond help, and no landlord investor can turn the business around.

“There’s a difference between bailing out your tenants versus investing in hopes they make it,” said Alex Goldfarb, a REITs analyst at Piper Sandler. “Subsidising tenants helps no one.”

Goldfarb points to Simon’s investments in retailers like Aeropostale, Forever 21 and most recently, Brooks Brothers, as calculated plays. Simon’s biggest strategic advantage is its partnership with licensing company Authentic Brands Group in these acquisitions, he said. While Simon controls the real estate element, what ABG brings to the table is manufacturing and distribution expertise. The two parties are also picky in what they buy, choosing retailers with the strongest brand recognition that makes a successful turnaround more likely.

When Simon purchased Aeropostale in 2016 — its first retail acquisition — the brand was losing $100 million in EBITDA across its 500 stores. Earlier this year, the landlord said Aeropostale is on track to generate positive EBITDA of $80 million.

“Simon isn’t looking to get involved in money-losing businesses, they’re looking to get into businesses that they can restructure and make money,” Goldfarb said. “They’re buying only a fraction of their tenants that go bankrupt.”

You don’t want to see a mall developer put a brand all over the place.

Taking money from a landlord also poses risks on the brand side. A small chain that excels in local marketing, for example, would not want to be pressured to expand its retail footprint by the dozens.

“You don’t want to see a mall developer put a brand all over the place. It has to maintain the integrity of the brand while they make real estate decisions, and there’s a careful balance here,” said Abrams. “It’s not just a real estate play. If [landlords] look at it that way, there will be huge issues.”

Still, there is ample room for tenants to ask for extra help from their landlords in today’s difficult retail landscape. The result could be creative arrangements unique to every relationship. In addition to being business partners, Fivestory’s Murray told Aryeh that she would exhibit and help sell artwork from his gallery in her store.

“I like to say there are no rules and there are no standards right now,” Abrams said. “Every deal stands on its own.”

Related Articles:

Why Fashion Brands and Their Retail Landlords Are Suing Each Other

Is This the End of the American Mall as We Know It?

BoF’s ANNUAL GATHERING FOR BIG THINKERS

VOICES brings together the movers, shakers and trailblazers of the global fashion industry and unites them with the big thinkers, entrepreneurs and inspiring people who are shaping the wider world, hosted by BoF founder and editor-in-chief, Imran Amed, and led by BoF's expert editors and correspondents.

Register now to reserve your spot.

1. THE WIDER WORLD: Making sense of 2020 and charting a way forward

2. INSIDE THE FASHION SYSTEM: Addressing the industry’s most important challenges and opportunities

3. TECHNOLOGY & INNOVATION: Exploring how new technologies will change consumer behaviour

4. REINVENTING RETAIL: Understanding how forces accelerated by the pandemic are completely reshaping the retail landscape

5. LIVE YOUR BEST LIFE: Finding the balance, insight and inspiration to be the most authentic, healthy version of yourself

JOIN US FOR A GLOBAL CONVERSATION ABOUT THE FUTURE OF THE FASHION INDUSTRY

This year, VOICES will be delivered via a live broadcast adapted to the unique circumstances of the Covid-19 era — and BoF Professional and BoF Professional Student members anywhere in the world can take part in this live global conversation as the industry looks ahead to 2021. If you are not a member, sign up today with our 30 day trial, including access to VOICES 2020.

The rental platform saw its stock soar last week after predicting it would hit a key profitability metric this year. A new marketing push and more robust inventory are the key to unlocking elusive growth, CEO Jenn Hyman tells BoF.

Nordstrom, Tod’s and L’Occitane are all pushing for privatisation. Ultimately, their fate will not be determined by whether they are under the scrutiny of public investors.

The company is in talks with potential investors after filing for insolvency in Europe and closing its US stores. Insiders say efforts to restore the brand to its 1980s heyday clashed with its owners’ desire to quickly juice sales in order to attract a buyer.

The humble trainer, once the reserve of football fans, Britpop kids and the odd skateboarder, has become as ubiquitous as battered Converse All Stars in the 00s indie sleaze years.