The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

The author has shared a YouTube video.

You will need to accept and consent to the use of cookies and similar technologies by our third-party partners (including: YouTube, Instagram or Twitter), in order to view embedded content in this article and others you may visit in future.

This article appeared first in The State of Fashion 2020, an in-depth report on the global fashion industry, co-published by BoF and McKinsey & Company. To learn more and download a copy of the report, click here.

LONDON, United Kingdom — When it comes to the environment, the fashion industry's record is well documented. Fashion accounts for 20 to 35 percent of microplastic flows into the ocean and outweighs the carbon footprint of international flights and shopping combined. It is no wonder, then, that campaigners who target the industry as part of Extinction Rebellion describe the industry's potential future impact as "catastrophic".

Demand for change is being led by the young. Activists such as 16-year-old Greta Thunberg attract global headlines, bringing forward a call to action to address environmental sustainability, adding to the lexicon on the subject by using “crisis” and “emergency” over “change” and “warming.” Thunberg says, “It’s 2019. Can we all now call it what it is: climate breakdown, climate crisis, climate emergency, ecological breakdown, ecological crisis and ecological emergency?” More than 7.6 million were inspired to participate in the Global Climate Strike in September.

In the fashion industry, scrutiny has been building. Environmental protests at London Fashion Week in September generated significant press. Commentators have been increasingly shedding light on the industry, from the mainstream press to publications like Dana Thomas’ Fashionopolis: The Price of Fast Fashion and the Future of Clothes.

ADVERTISEMENT

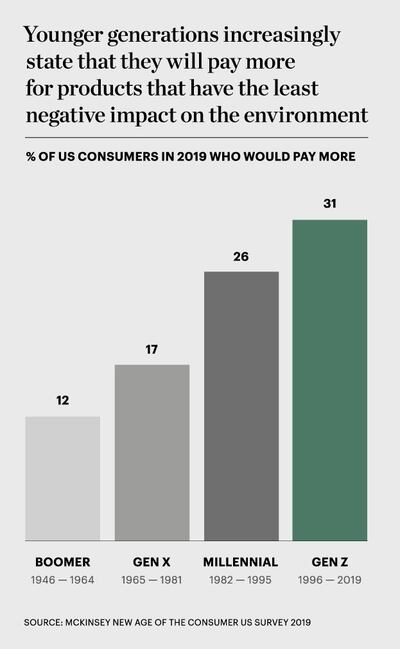

These activist movements are making consumers increasingly aware of the environmental impact of fashion. Some 66 percent of respondents to a McKinsey US cohort survey (and 75 percent of millennial respondents) say they consider sustainability when making a luxury purchase. Still, consumers do not always back words with actions. Only a minority are willing to pay more for sustainable products — only 31 percent of Gen-Z and just 12 percent of baby boomers.

Consumers are unsure what 'sustainability' means or how to identify sustainable brands.

It is well-known that even consumers’ stated willingness to vote with their wallets does not translate to the same degree in actual purchases of sustainable fashion. Closing this gap and changing consumer behaviour is made even more difficult because of a lack of clear information and tools for the consumer. Consumers are unsure what “sustainability” means or how to identify sustainable brands. A survey of corporate representatives across over 100 European firms shows consumers are often swayed by misinformation or lack of information. Still, as awareness has grown, so has the quest for knowledge. Internet searches for “sustainable fashion” tripled between 2016 and 2019.

“Nothing is black and white, unfortunately… It’s huge shades of green, really. That makes it very difficult because it lends itself very easily to greenwashing and misunderstanding… that can be quite confusing for the consumer,” concedes Nina Marenzi, founder and director of The Sustainable Angle, an organisation that stages the London-based Future Fabrics Expo. Industrial, governmental and international bodies are increasingly on the front foot to close this gap for consumers. In early 2019, ten UN organisations launched the UN Alliance for Sustainable Fashion. In June, France, a global leader in luxury fashion, introduced a ban on the destruction of unsold fashion goods (to be implemented by 2023), with manufacturers and retailers obliged to donate, reuse or recycle. The move was the first of its kind in the world on a national level.

The German government in September unveiled the Green Button — the world’s first government sustainable textile label. The EU’s Circular Economy action plan, meanwhile, aims to ensure products can be repaired or recycled, with textiles as a key priority.

All this activity is having an impact in now bringing the environmental agenda to centre-stage. At the G7 summit in August, Kering chief executive François-Henri Pinault spearheaded French President Emmanuel Macron's new Fashion Pact, aimed at reducing environmental impact. Mr Macron said roughly 150 brands had joined that weekend, with a further hundred joining since then.

Brands are taking action on other fronts too. Many are making efforts to increase sustainable options for consumers, or even make it the new normal in the future. Zara this year pledged to use 100 percent sustainable fabrics by 2025, joining H&M which earlier committed to using 100 percent recycled or sustainable materials by 2030, among a host of broader sustainability commitments by the company. Adidas has committed to phasing out virgin polyester by 2024. LVMH announced its own series of commitments for the environment and biodiversity during Paris Fashion Week in September, including an Animal-based Raw Materials Sourcing Charter; the Charter among other initiatives specifies a target of 70 percent of the groups leather to be sourced in Leather Working Group (LWG) certified tanneries, up from 48 currently.

Despite all this activity, the industry has a long way to go before achieving transformative change.

There is also increasing response to consumer demand for newer business models which tackle overconsumption, such as rental

and resale, as predicted in last year's report ("End of Ownership"). We expect this will continue, admittedly still accounting for a low share of the total market in 2020.

Digitally native brands are taking different approaches. Everlane has committed to “radical transparency” through its supply chain. On its website it posts photographs of shop floors in its supplier factories, gives a voice to factory workers and shares price breakdowns. Reformation made its first clothes exclusively from deadstock materials, and on its website runs the tagline “Being naked is the #1 most sustainable option — we’re #2.”

ADVERTISEMENT

There is movement among e-commerce players too. Multi-brand retailer Asos and Global Fashion Group's The Iconic earlier this year introduced search filters for recycled fabrics. Farfetch's Conscious Edit targets sustainable products, and Zalando has expanded its sustainable offering.

While the absolute number of mass market products made from sustainable materials remains low, there has been a five-fold increase over the past two years. In some corners a materials revolution is under way, with recycled and lab-created textiles to the fore. [See next theme, Materials Revolution.]

“There is no sustainable material, per se, because for everything you need a resource,” says Marenzi. “It’s a matter of how [long] the resource can stay in the [user] cycle, with the least amount of impact [from] extracting and processing, with end-of-life then being as easy as possible — going back into the soil or being used again for another purpose.”

"It is very complex [but] having a much more vertical, integrated supply chain approach [means] you are in full control of your materials; the more vertical you are, the more you can mitigate […] your impact on the oceans and

climate and biodiversity."

According to Lidewij (Li) Edelkoort, a trend forecaster and dean of hybrid studies at Parsons School of Design in New York, “material innovation is only one stitch in the complex rebirth of fashion. Slowing down, streamlining production and editing collections are the most important guidelines.”

A number of industry leaders have voiced their commitment to sustainable offerings across their product ranges, which will likely catalyse a virtuous circle of awareness, considered spending and progress. Mass-market players, meanwhile, are continuing to work on reducing prices of sustainable options which have traditionally been priced at a premium. This will help a broader range of consumers make more sustainable choices.

Despite all this activity, the industry has a long way to go before achieving transformative change. In fact, Global Fashion Agenda's Pulse 2019 Update reveals progress slowed in the past year, with most of the industry still not engaged. There remains a pervasive lack of consumer trust, amid accusations in some quarters of fashion industry greenwashing using sustainability as a marketing strategy without a significant positive impact on the environment. One controversial activity is carbon offsetting, by which brands pay a third party to either capture carbon or avoid emitting, without reducing their own carbon footprint. While an important step in accelerating decarbonisation, the practice in isolation is viewed by some as an excuse to take the easy route.

Regulators are set to push harder in 2020, and in some cases are already doing so. The UK’s Advertising Standards Authority (ASA) warned vegan fashion brand Matt & Nat over exaggeration of its use of recycled materials. The Norwegian Consumer Authority (CA) prompted H&M to more clearly communicate to consumers about the pollution it creates.

ADVERTISEMENT

Looking ahead, we expect in 2020 to see regulators continuing to raise standards and impose new rules and consequences. In addition, we anticipate the media to increasingly take a role in better educating and encouraging the conscious consumer. Emboldened by these forces, better-informed and more confident consumers will seek out sustainable brands and develop their awareness. Apps like Good On You and Buycott are becoming a major part of the consumer’s purchasing journey, and sources like the Sustainable Apparel Coalition’s HIGG index, which allows fashion players to assess their own sustainability, will be available to consumers.

Finally, some imperatives for brands. Their primary focus should be on helping customers consume fewer resources. One area they can target is overproduction. Reduced supply, combined with an ambition to reduce discounting, can even have a positive impact on the bottom line. Fashion players should consider fresh ways to tackle transparency, both at point of sale and across other touchpoints, understanding the need both to educate and emotionally engage. While a revolutionary notion for some, brands at the forefront should also invest in the circular economy, breaking the link between production and revenue, back recycling and embrace sustainable materials and technologies. One of the most immediately important things they need to do is take action to track and reduce environmental impact, moving beyond transparency (one of our 2019 themes) to real action. That means setting concrete (ambitious, but achievable) targets and publishing roadmaps so consumers and investors can hold them to account if targets are not met. This would be a strong step towards one day seeing collaborative sustainability roadmaps for the entire industry, providing clarity to the innovators and suppliers on the prerogatives for the future. None of these imperatives are easy, but taken together, they may finally tip the scale in favour of making more environmentally sustainable fashion a reality.

Fashion’s biggest sustainable cotton certifier said it found no evidence of non-compliance at farms covered by its standard, but acknowledged weaknesses in its monitoring approach.

As they move to protect their intellectual property, big brands are coming into conflict with a growing class of up-and-coming designers working with refashioned designer gear.

The industry needs to ditch its reliance on fossil-fuel-based materials like polyester in order to meet climate targets, according to a new report from Textile Exchange.

Cotton linked to environmental and human rights abuses in Brazil is leaking into the supply chains of major fashion brands, a new investigation has found, prompting Zara-owner Inditex to send a scathing rebuke to the industry’s biggest sustainable cotton certifier.