The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

THE CHEAT SHEET

The RealReal Looks to Break E-Commerce's Losing Streak

Shopping bags from The RealReal | Source: @therealreal

The Bottom Line: This past week has likely been most unsettling for the countless direct-to-consumer brands and e-commerce platforms still hoping for an acquisition or IPO. Both futures look less secure after last week, between Friday's plunging share prices and reports Walmart, once a top buyer of digital brands, is shopping around Modcloth.

ADVERTISEMENT

Tapestry Looks Abroad for Growth

Coach Inc. offices | Source: Courtesy

The Bottom Line: One element to watch in Tapestry's results is sales to tourists visiting the US, another still-lucrative but steadily declining business since the 2016 election. The dollar's dramatic strengthening against the pound and yuan reduces the spending power of Chinese and British citizens in American shops.

Fashion Brands Caught Up in the Currency Wars

Chinese Yuan Renminbi banknotes | Source: Shutterstock

The intricacies of the foreign exchange market are rarely top of mind in the fashion industry. That's about to change. China's decision to allow the yuan's value to drop marks an escalation of trade tensions between the two countries and will almost immediately be felt by luxury brands that depend on Chinese consumers for growth. For starters, every Gucci dress, Moncler coat and Coach handbag just got more expensive for anyone who earns a salary in renminbi, and Chinese tourists may decide to stay home rather than go on that suddenly pricier trip to New York. Shares of companies as diverse as Kering, Adidas and L'Oréal sank after the yuan fell last week. More volatility is likely in the days and weeks ahead, as Trump could attempt to talk down the dollar's value via Twitter, or even order the Treasury and Federal Reserve to intervene in the market.

The Bottom Line: The currency moves appear slight, but over time, volatility can make it difficult for companies to plan for the future — whether it's determining where to open stores to which countries' factories should produce their clothes.

COMMENT OF THE WEEK

ADVERTISEMENT

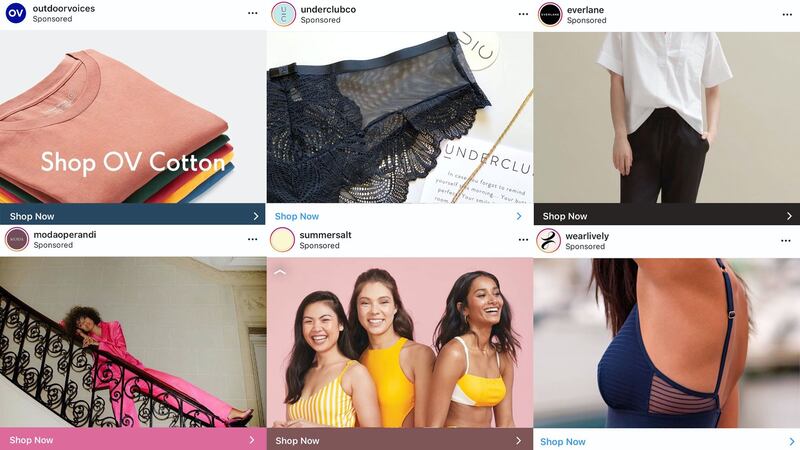

Instagram advertisements | Source: Instagram

"Brands and influencers need to make their accounts more of a community or extension of their lifestyle than a buy/sell/promote landing page. For brands, this may mean creating a profile that's more about the vibe of their brand than actually posting about and selling the products." @emilye.nina, commenting about "The Golden Age of Instagram Marketing Is Over."

SUNDAY READING

Professional Exclusives You May Have Missed:

The Week Ahead wants to hear from you! Send tips, suggestions, complaints and compliments to brian.baskin@businessoffashion.com.

Was this BoF Professional email forwarded to you? Join BoF Professional to get access to the exclusive insight and analysis that keeps you ahead of the competition. Subscribe to BoF Professional here.

Join us for a BoF Professional Masterclass that explores the topic in our latest Case Study, “How to Turn Data Into Meaningful Customer Connections.”

Social networks are being blamed for the worrying decline in young people’s mental health. Brands may not think about the matter much, but they’re part of the content stream that keeps them hooked.

After the bag initially proved popular with Gen-Z consumers, the brand used a mix of hard numbers and qualitative data – including “shopalongs” with young customers – to make the most of its accessory’s viral moment.

At The Business of Fashion’s Professional Summit in New York last week, Sona Abaryan, partner and global retail and luxury sector lead at tech-enabled data science firm Ekimetrics, shared how businesses can more effectively leverage AI-driven insights on consumer behaviour to achieve a customer-centric strategic approach.