The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

In the early months of 2020, sneaker enthusiasts Jaren Amoroso and Robert Liss forged a friendship through a Discord group dedicated to New York-based menswear brand Aimé Leon Dore.

The two now spend upwards of 10 hours a day on the platform, checking in on conversations about their favourite brands, designers and artists, swapping fashion advice and paying monthly memberships for access to exclusive groups.

“Most of my shopping is done online, and that starts with Discord,” said Amoroso, estimating that almost all of his recent purchases were driven through the platform.

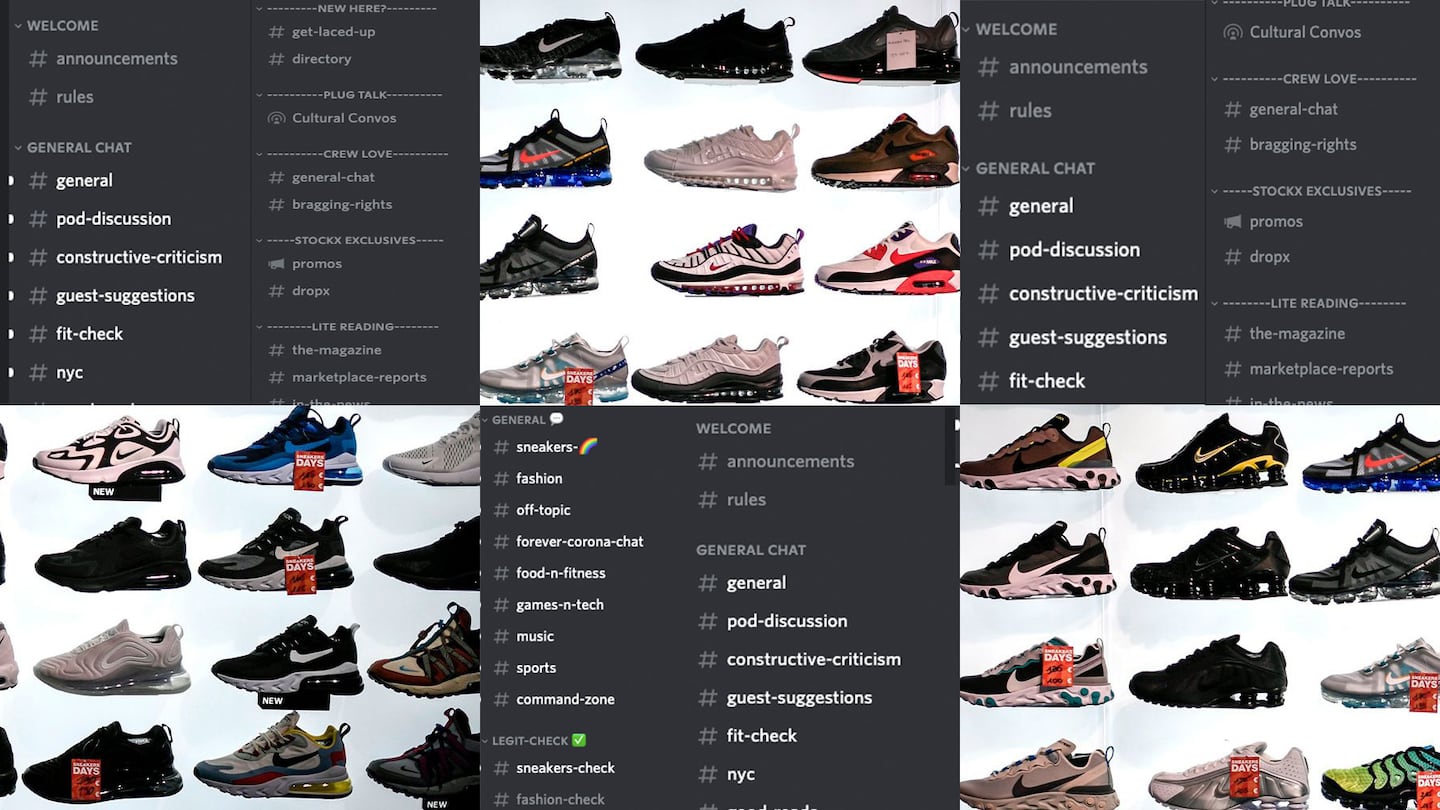

First launched in 2015 as a platform for gamers to connect, Discord now attracts more than 150 million monthly active users and has become a digital gathering spot for a young cohort of menswear fanatics. Users like Liss and Amorosa flock to the network for everything from outfit advice to software applications that facilitate early access to digital drops. Discord, with its offer of closely guarded groups (or servers) free from likes, invasive algorithms and advertising, is particularly appealing to the sneakerhead community, which often trades on exclusive access and knowledge. The platform has also become a near-prerequisite for users hoping to have a chance at buying hyped releases.

ADVERTISEMENT

Most of my shopping is done online, and that starts with Discord.

Discord is embracing its emerging toehold in the menswear market. The company rebranded last year to move beyond its gaming image (it said roughly 78 percent of active users now turn to the platform primarily for non-gaming purposes or a combination of gaming and other purposes). Its own sneaker server boasts over 12,000 members. It’s also exploring a range of new capabilities that could appeal to brands, including ticketed stage programming.

While the social media landscape is increasingly crowded, Discord’s position is based on a level of community engagement that few platforms can rival, and brands are beginning to explore how they can tap into it.

Sneaker resale site StockX joined the platform earlier this month to host this year’s iteration of StockX Day, an annual event featuring talks from industry leaders and community members, exclusive give-aways and event chat channels for participants. The event broke the record for single-day signups for a brand server, with over 20,000 users registering. StockX also hosted four stage events, a new Discord feature that allows speakers to broadcast live audio discussions. It’s a function that competes directly with rival app Clubhouse.

If you want access and the ability to buy these products you need to be in these groups.

The event was originally meant to take place on a rival social media platform, but StockX switched to Discord to capitalise on its growing sneakerhead audience. It’s a move that felt inevitable, said chief marketing officer Deena Bahri. “We know Discord is the new platform of choice for Gen-Z and young Millenials,” she said.

Discord’s particular influence on the menswear market is built on the growing importance of private communities of elite streetwear fans and traders, known as “cook groups.” Many of its dedicated users have defected from other platforms as competition over limited releases and the rise of sneaker bots — applications and software used to speed up the checkout process — continues to grow.

Access is “almost as much of a necessity as having internet connection,” said Amoroso. “If you want access and the ability to buy these products you need to be in these groups.”

Many Discord channels require a level of fanaticism, and investment, from participants: users can be removed from channels for failing to participate or add valuable contributions. Acceptance into more exclusive “cook groups” hinges on an application or referral, along with fees that can range from around $5 to $80 a month. Memberships for top-tier Discord groups rarely open up, and for some servers, new spots can be filled within seconds.

Users are eager to join certain servers in part because of the advantage it gives them within the resale community. Many groups claim access to software programmes connected to the backend of brands’ e-commerce sites, alerting the entire channel to restocks or new products.

ADVERTISEMENT

For more inexperienced members, groups also offer guides to drops and chat rooms the night before to discuss strategies and the best bots and extensions to use. Moderators may share a private inventory list with analysis on the best products to buy for resale, as well as exclusive information on where to buy releases to avoid increased site traffic.

“I spend significantly more and I make significantly more,” said Liss of Discord’s effect on his shopping and resale habits. As for the membership fees, Liss isn’t fazed. “I don’t mind paying 50 bucks because I get my money’s worth out of it pretty quickly... I used to be able to use Twitter a lot [to check for releases], but by the time some random guy is tweeting something out, it’s too late.”

Brands, too, have jumped from platform to platform in recent years chasing new ways to connect with consumers and build communities online.

While Discord doesn’t offer the traditional marketing opportunities provided by many social media platforms, it is an avenue to a highly engaged community of consumers. And it’s quickly evolving its offer.

The platform also has a paid subscription membership service, Discord Nitro, for users to access exclusive features and capabilities, like personalisation and more file storage. Some fashion companies are beginning to experiment with creating their own servers to build a following and drive engagement.

Community exclusives and membership rewards are one way brands could expand on the platform, said Amber Atherton, head of strategic communities at Discord. She sees the platform working for brands via ambassadorship programmes, referrals and as an opportunity for brands to speak directly with their consumers.

Discord definitely feels like the crown jewel.

Hypebeast’s server already has roughly 18,000 members discussing recent articles and larger streetwear culture and trends. Media outlets can also link their Discord channels to Patreon subscriptions, ensuring that only fans willing to pay a premium can join. For menswear podcast Throwing Fits, Discord has developed into a community centre for fans that extends beyond clothing and shoes. Co-hosts James Harris and Lawrence Schlossman said almost half of its Patreon subscribers are also members of its Discord server, and roughly 200 members are online at any given time.

“Discord definitely feels like the crown jewel,” said Schlossman of the community the platform has fostered compared to other social media sites.

ADVERTISEMENT

The platform has faced challenges in scaling, however. Its member-led content leaves it vulnerable to insufficient moderation, and it has had to shut down a number of servers for issues like hate speech and fraud. Brands looking to launch their own servers must consider carefully how to navigate the issue. Discord said it has a zero-tolerance approach to illegal activity and takes immediate action when made aware of it. That includes removing content, banning users, and shutting down servers.

Throwing Fits has relied on its community to help police discussions. The podcast’s social media head is responsible for choosing moderators who help guide conversations and remove members for inappropriate behaviour.

There’s also a question as to whether Discord can retain its cachet with menswear’s most avid fans as it becomes more mainstream, or whether it will be superseded by a new player in the never-ending social media market cycle. That’s left some companies opting for a cautious approach.

StockX is exploring an ambassador programme and continued discussion channels, but steps towards a larger strategy are still nascent. “Creating a great, highly engaged, fun and interactive brand server is going to be our priority for the time being,” said Bahri.

Editor’s Note: This article was revised on 21 June 2021. A previous version of this story stated that the Throwing Fits podcast provided moderators of its Discord server with exclusive gifts. That is incorrect, and has since been removed from the article.

Related Articles:

How to Sell Menswear to Women and Womenswear to Men

The app, owned by TikTok parent company ByteDance, has been promising to help emerging US labels get started selling in China at the same time that TikTok stares down a ban by the US for its ties to China.

Zero10 offers digital solutions through AR mirrors, leveraged in-store and in window displays, to brands like Tommy Hilfiger and Coach. Co-founder and CEO George Yashin discusses the latest advancements in AR and how fashion companies can leverage the technology to boost consumer experiences via retail touchpoints and brand experiences.

Four years ago, when the Trump administration threatened to ban TikTok in the US, its Chinese parent company ByteDance Ltd. worked out a preliminary deal to sell the short video app’s business. Not this time.

Brands are using them for design tasks, in their marketing, on their e-commerce sites and in augmented-reality experiences such as virtual try-on, with more applications still emerging.