The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

Hello BoF Professionals, your exclusive weekly briefing is ready.

When Marc Jacobs exited Louis Vuitton three and a half years ago, Bernard Arnault, chairman and chief executive of LVMH, said the designer was leaving to focus on his namesake label, which was gearing up for an IPO within two to three years.

At the time, some observers suspected talk of a public listing was simply PR spin to smooth the way for the arrival of Nicolas Ghesquière, Vuitton’s incoming creative director. But Arnault outlined a high-level roadmap for the future of Marc Jacobs, focused mainly on growing the brand’s product range and fortifying distribution by upgrading and expanding its retail network. The company also planned to reposition and grow its lower-priced line Marc by Marc Jacobs, which, a few months before, had made two significant appointments: Katie Hillier as creative director and Luella Bartley as women's design director.

That was then.

ADVERTISEMENT

In the intervening years, Marc Jacobs has reversed course on its Marc by Marc Jacobs strategy, folding the line into the Marc Jacobs brand, and closed several stores as part of an aggressive restructuring plan.

Now, it seems the transformation of the brand is taking much longer than anticipated and positive momentum has yet to materialise — let alone the kind of performance that would justify an IPO. Indeed, on a January earnings call, shortly after the inauguration of Donald Trump, Mr Arnault sounded a very different note, going so far as to say: “I’m more concerned about Marc Jacobs than the US president.”

By the end of March, there was only one remaining Marc Jacobs store on the stretch of Bleecker Street in New York’s West Village that was pioneered by the label and once housed four of its stores, selling everything from hardware-heavy it-bags to kitschy-cool pens shaped like lipsticks, all stamped with the brand name. The last store standing: Bookmarc, a Marc Jacobs-branded book store that sells no fashion. In recent years, the label has also shuttered stores in Paris, London and Milan.

What went wrong?

When LVMH first mentioned its plans to take Marc Jacobs public, accessible luxury juggernaut Michael Kors was still riding high off its 2011 flotation, one of the largest and most successful IPOs in the history of fashion. On their first day of trading on the New York Stock Exchange, shares in the company rocketed up 25 percent, valuing Michael Kors at $3.8 billion, or 44 times its net earnings in the previous four quarters. By the beginning of 2014, the brand’s market capitalisation was $15 billion. “If we could do something along those lines, or even half, everyone will be happy,” Arnault said during LVMH's 2014 annual results presentation.

But Kors' market capitalisation peaked at $20 billion and the retail market has since taken a turn for the worse, especially for widely distributed brands selling mid-priced product. Today, Michael Kors' market capitalisation is just over $6 billion. There’s little doubt the wider retail climate has hurt Marc Jacobs — and yet the brand is certainly facing its own set of specific challenges.

On LVMH’s latest earnings call on Monday, chief financial officer Jean-Jacques Guiony acknowledged that Marc Jacobs was “probably one of the few negative performances we have in the group.” On Tuesday, the label announced its decision to shutter its men’s business, ending a license agreement with Staff International, after the delivery of the Autumn/Winter 2017 season. But men’s was never a sizable part of the business and the move was characterised as part of a strategic decision to “focus on the core women’s business.” And, for the moment at least, LVMH seems steadfast in its commitment to Marc Jacobs.

Despite dramatic budget cuts, Marc Jacobs’ most recent women’s show — held in near-monastic silence in the cavernous Park Avenue Armory on the final day of New York Fashion Week — served to underscore the raw talent of its namesake designer. The question becomes how to effectively harness it — and where Marc Jacobs might go from here.

ADVERTISEMENT

There are a few potential scenarios:

A. LVMH could take advantage of the fact that its overall fashion portfolio is performing well and take as much time as necessary to restructure the Marc Jacobs business, stripping it down much as the designer did his runway show. Starting from scratch means maintaining a firm belief that Jacobs' creative talent will once again lead to positive results in the long term.

B. LVMH could double down on Marc Jacobs’ beauty business, where the brand name — which continues to impart a knowing cool — still resonates. This means launching new fragrances and refreshing old ones through its partnership with Coty and also raising the profile of Marc Jacobs Beauty, the brand’s cosmetics line developed and produced by Kendo, LVMH's brand incubator. (Ramp-up efforts have already included bringing on celebrity make-up artists as brand ambassadors.)

C. Marc Jacobs' status as a world-class designer remains alluring and there is always a chance that a thirsty bidder will make an impossible-to-ignore offer to buy the brand, compelling LVMH to sell, much as it did with the troubled DKNY in 2016.

Given the time and resource that has already been put into the restructuring of the Marc Jacobs brand, the group’s mostly likely approach will be a combination of scenarios A and B. Arnault has long championed Jacobs and made him into a household name.

“The company, in my view, is making a big improvement in its product,” said Guiony this week. “In the meantime, we have to reduce the cost base. There is no plan B. There is no plan C,” he continued. “It will take the time it takes to fix this business, which we think is a very promising business [that] has proven quite complicated to develop, but we are great believers of the future of Marc Jacobs.”

Disclosure: LVMH, which owns Marc Jacobs, is part of a group of investors who, together, hold a minority interest in The Business of Fashion. All investors have signed shareholder’s documentation guaranteeing BoF’s complete editorial independence.

THE NEWS IN BRIEF

ADVERTISEMENT

BUSINESS AND THE ECONOMY

LVMH sales soar 15 percent, on easy comparables. The French luxury goods maker's first-quarter sales rose to $10.5 billion, beating analysts' estimates on comparable figures from 2016, dampened by terrorist attacks in Europe. LVMH's performance, which was supported by a 15 percent sales increase in its fashion and leather goods, follows similarly positive results from several key players, including Kering and Hermès, which reported signs of improvement in the luxury market after a period of weakening demand in China and a decline in European tourism.

Prada profit falls 15.9 percent. The Italian fashion group reported its lowest full-year profit since it went public in 2011, with net income falling to $295 million, missing analysts' estimates. In particular, the company was weighed down by a downturn in demand in Asia, which accounts for half of its business. However, CEO Patrizio Bertelli said he was confident of a turnaround, pointing to the "strong rebound" in the Chinese market in the fourth quarter.

Time Inc reportedly disappointed by acquisition offer. US media group Meredith Corp's bid to buy Time Inc fell below price expectations, according to reports. The publisher of InStyle and People magazines has been considering a sale for several months amid declining print sales, and is looking for more than $20 a share. While it is not averse to negotiating with Meredith, it is pursuing other offers to ensure a competitive sale process. Late last year, the company rejected a $1.8 billion offer by an investment group led by Edgar Bronfman Jr.

L'Oréal reportedly attracts multiple bids for The Body Shop. The French cosmetics giant has received bids from around 15 companies for The Body Shop, with bidders to be shortlisted next week, according to reports. L'Oréal announced in February it was considering a sale of the natural skincare chain, which has become a black spot in its portfolio, and was reportedly hoping for $1 billion. However, most investors have valued the brand at less than €700 million, as it will require significant turnaround efforts.

Jaeger goes into administration. The 133-year-old British fashion retailer has entered administration, following directors' unsuccessful attempts to sell the business. Known for its classic British clothing styles, in recent years the brand has struggled to stand out amid intense high street competition and the growth of fast fashion retailers.

CFDA releases report on industry's key immigration concerns. The CFDA has published a report, conducted in partnership with the tech lobbying group FWD.Us, calling for reform of the current "outdated" system that prohibits businesses from attracting "essential" foreign talent. Since President Donald Trump took office, immigration policies — specifically how stricter legislation may impact access to talent and affect undocumented workers — have become key concerns for the industry and country at large.

PEOPLE

François-Henri Pinault's departure from Puma board adds to sale speculation. The chairman and chief executive of Kering has stepped down from Puma's board of directors, reigniting rumours that the luxury conglomerate is preparing to sell the German sportswear brand. According to analysts, Kering could be interested selling Puma to focus on its luxury business, with interest possibly coming from China, where fitness is growing fast.

Charlotte Tilbury announces minority investment. The high-profile British makeup artist's namesake brand, which launched in 2013, has received a minority investment from Sequoia Capital, its first round of funding from a top-tier Silicon Valley venture capital firm, signalling its plans for continued growth. To date, Charlotte Tilbury is available at retailers in six countries, including the US and the UK, and ships to 39 countries via its online stores. It is currently planning a Middle East expansion.

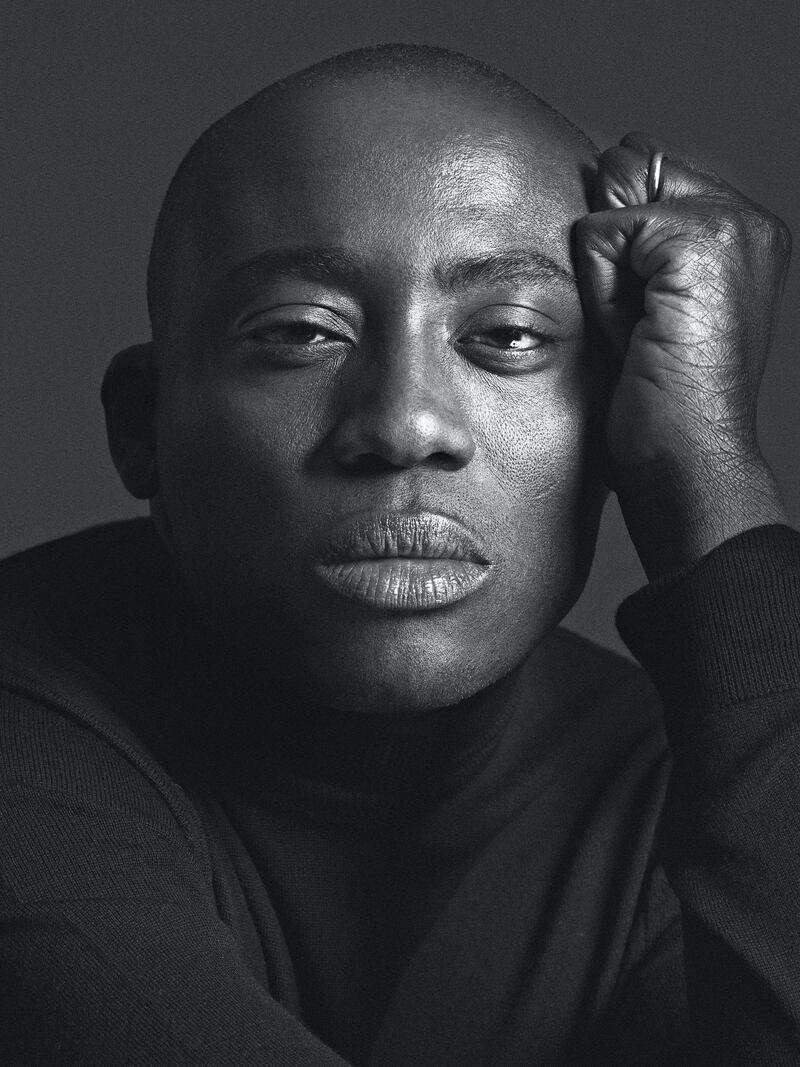

Edward Enninful | Photo by Mert & Marcus, source: Courtesy

Edward Enninful appointed Editor of British Vogue. The former style director of W magazine has been announced as the successor to Alexandra Shulman, who resigned after 25 years in January. Enninful, who will be British Vogue's first male editor and Vogue's first ever black editor, has been hailed by many as a bold and progressive choice, whose skill creating powerful and memorable imagery will help revitalise the Vogue brand for a new generation.

Deena Aljuhani Abdulaziz exits Vogue Arabia. The Saudi princess was dismissed by Condé Nast International after only two issues, having been appointed in July 2016 to lead the publisher's long-awaited move into the Middle Eastern market. Nervora, which publishes the magazine under a licensing agreement with Condé Nast International, appointed Manuel Arnaut as her replacement. He comes from Architectural Digest Middle East, which he launched in 2015, and previously helmed GQ Portugal.

TECHNOLOGY

Farfetch launches Store of the Future. The online fashion platform has developed an operating system for physical retail, which will provide third-party businesses with digital services such as RFID-enabled clothing racks, digital mirrors and mobile payment. So far, physical stores have benefited little from the digital revolution, with most in-store technology serving just as PR gimmicks. Farfetch's venture, which is still in its beta stage, aims to improve retail productivity by capturing customer data and enhancing interactions between shoppers and sales associates. The concept will launch this autumn with London boutique Browns, with a full rollout planned for 2018.

Flipkart raises $1.4 billion. The Indian e-commerce company, which will have a valuation of $11.6 billion after this latest funding round, secured investment from Tencent Holdings, Microsoft and Ebay, which invested $500 million in exchange for a stake in the business. As a result, the two companies will merge their operations in India, with Flipkart owning and operating Ebay's business in the country. This news comes amid speculation that Flipkart is looking at a potential takeover of smaller rival Snapdeal.

BoF Professional is your competitive advantage in a fast-changing fashion industry. Your Professional membership comes with unlimited access to BoF’s agenda-setting journalism, Professional-only briefings like this and, coming soon, live networking events and a BoF Professional iOS mobile app.

This is your weekly BoF Professional briefing. If you are not a BoF Professional member, sign up here for unlimited access to our agenda-setting journalism, exclusive briefings and other Professional-only benefits.

IWC’s chief executive says it will keep leaning into its environmental message. But the watchmaker has scrapped a flagship sustainability report, and sustainability was less of a focus overall at this year’s Watches and Wonders Geneva.

The larger-than-life Italian designer, who built a fashion empire based on his own image, died in Florence last Friday.

This week, designers, collectors and major fashion brands will flock to Milan’s design fair. Also, LVMH reports first-quarter sales.

The Italian designer, best known for vibrant animal prints and sand-blasted denim, was 83.