The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

LONDON, United Kingdom — Covid-19 has thrown the global retail sector into a state of chaos from which it might take months, if not years, to recover. It also worsened tensions between the world’s two biggest superpowers as President Trump adopted a ‘blame China’ strategy. This month, an internal Chinese government dossier reportedly informed leaders that US-led anti-China sentiment was at its highest since 1989′s Tiananmen Square massacre.

But this isn’t the only US-China rivalry that intensified during the pandemic. For years, the two countries’ respective e-commerce giants, Amazon and Alibaba, have been locked in a battle for global supremacy. The coronavirus pandemic presented a high-stakes battleground for them to spar.

“The whole economy is shifting faster online due to Covid-19,” Patrice Nordey, managing partner at digital agency Fabernovel, told BoF. “[Amazon and Alibaba] are at a position in their local markets where there are few competitors at their level.”

Covid-19 has thrown the global retail sector into a state of chaos from which it might take months, if not years, to recover.

With few competitors in their respective home markets, both companies have made a fortune during the pandemic. Amazon, the US’ biggest apparel retailer, reported on May 22 that sales boomed to $75 billion during 2020's first quarter, anticipating a 28 percent rise in revenue to $81 billion in the second quarter. Last week, Alibaba publicised a 35 percent sales boost in the year to March 31, achieving its five-year goal of surpassing $1 trillion in gross merchandise volume.

ADVERTISEMENT

The crisis, in heightening demand for the company's services to an unprecedented degree, has accelerated existing shifts across tech and retail, altering their growth trajectories (and those of their rivals) for years to come. Here’s how they fared in the face of Covid-19, and the challenges and opportunities that lie ahead.

Crisis Management Crash Course

Nordey reckons that between the two giants, Amazon came out on top. Whilst e-commerce is as competitive as ever in China for Alibaba's e-commerce business, Amazon — which he says is ahead in its cloud services development — "appears to be stronger in the US...with no real contenders to challenge its dominancy." Nordey pegs Amazon's current price to earnings ratio at 100 while Alibaba's lags behind at around 50 (compared to 70 and 50 a year ago, respectively).

However, Amazon’s earnings call wasn’t all good news.

"If you're a share owner in Amazon, you may want to take a seat," Chief Executive Jeff Bezos said in a press release, on its plans to spend all of its profit for the second quarter (around $4 billion) on Covid-19 related costs. This money will go towards addressing its labour issues — including employee protests and reported activism-related dismissals — as well as supply chain obstacles, which Sucharita Kodali, retail analyst at Forrester, deemed its biggest hurdle.

“They had issues with being able to ship out all of the things [to meet demand]; they had to shut off non-essential products for a period of time and were many, many weeks behind on a lot of essential goods for a while,” said Kodali. Amazon operates across 13 worldwide markets from Japan to Brazil, but it was hit hardest in India, where for months the local government barred companies from delivering non-essential goods to shoppers.

But other experts predict that the challenges Amazon faced during the crisis will only strengthen it in the long run by providing it with data on shock scenarios that will allow it to improve its business model — something Asian e-commerce companies had to reckon with 17 years ago during the Sars epidemic, after which Alibaba emerged as the mainland's leading e-commerce company. Analyst Kim Khan told Reuters that history is likely to repeat itself for the American firm. In the same way that past investments on video streaming and cloud data systems unnerved investors but ultimately paid off, the $4 billion spent on Covid-19 costs will likely fortify its market position in the long run.

While Covid-19 has had a negative impact on Alibaba’s domestic business, the firm has seen a steady recovery since March, said Arnold Ma, Founder and Chief Executive of China-focused digital agency Qumin. "The focus and priority for brands during a crisis ...should be on building loyalty, it’s the best time to be building brand affinity with your customers," he said. "And Alibaba wins in this regard."

ADVERTISEMENT

According to Ma, Alibaba responded to the situation quickly by focusing on product categories that would be in high demand, investing in merchant on-boarding to boost sales through formats like livestreaming on its Tmall and Taobao platforms and adopting contactless delivery through its logistics arm Cainiao. And while its local rivals recover, the group is now advertising for over 100,000 jobs offering billions in loans to small and medium sized companies.

The challenges Amazon faced during the crisis will only strengthen it in the long run.

“This is the level of adaptation that we call ‘China speed,’ that, we believe a lot of western brands are lacking,” Ma added.

Alibaba's impressive pace presents Amazon with an opportunity to catch up. "Asian countries were so much more prepared because it's not their first time," said Fabernovel's Nordey. In China, Alibaba and arch-rival JD.com saw their e-commerce businesses take off after 2003 in part because Sars forced them to prioritise, focus and be nimble. "[Sars] was such a disaster in Asia. Next time, Amazon will be much more prepared."

The Great Luxury Brand Rush

As apparel sales declined across the world, by far the biggest wins for both Amazon and Alibaba’s fashion arms were the influx of previously hesitant luxury brands that flocked to them during the crisis.

The luxury division of Alibaba-owned Tmall called Luxury Pavilion — which prior to Covid-19 had already partnered with over 150 brands and e-tailers like Net-a-Porter — only became more indispensable during the country’s lockdown, thanks in part to livestream commerce capabilities on Tmall and Taobao, which brands relied upon to offset store closures: merchants livestreaming on Taobao grew 88 percent year-on-year in three months ended March 31.

This month, Tmall announced new brand partners in Balenciaga and Chloé, before reporting record-level participation from luxury players for 520, its Chinese Valentines Day sales campaign. Over 150 labels from Cartier to Chanel released 5,000 items and limited-edition gift sets for the occasion — according to Tmall, total luxury spending during the 520 campaign increased by 61 percent year-on-year. (The company declined to comment for this story and Amazon did not respond to a request for comment).

Tmall also hosted Shanghai Fashion Week's first fully digital, livestreamed season of shows and presentations featuring designers like Angel Chen and big-box retailers like Lane Crawford. After China lifted its lockdown, Alibaba then debuted its high-end discount channel, Luxury Soho, which will feature brands like Versace and Emporio Armani and allow the group to cash in on excess inventory made redundant by lockdowns elsewhere around the world.

ADVERTISEMENT

But challenges await the e-commerce giant. In China, social commerce startups like Xiaohongshu and major tech players like Tencent-owned WeChat and Sina-owned Weibo (both of which have amped up e-commerce channels in recent months) could dent its market share. Of China’s social media platforms, Weibo drove the most traffic to Alibaba’s e-commerce channels, said Nordey (the retail company doesn’t manage standalone social media platforms of its own, though it has a stake in Weibo).

“In the US, you don’t see start-ups think they can beat [Google, Amazon, Facebook and Apple]. In China, there’s always a company that thinks they can beat [Baidu, Alibaba and Tencent] and it happens,” said Nordey. “This is a big challenge.”

In China, there's always a company that thinks they can beat Baidu, Alibaba and Tencent, and it happens.

Meanwhile, Amazon — which for years has been angling for high-end fashion credentials, against its positioning as a marketplace for cheap basics — scored a win through a partnership with Vogue and the CFDA, who set up a storefront for 20 independent American designers on the platform. The timing was fortuitous as Amazon is reportedly working on a new luxury platform of its own.

But Amazon's small victory doesn't detract from the fact that the likes of LVMH's Chief Executive Bernard Arnault have spoken out against the platform and accused it of profiting from the sale of counterfeit goods. Granted, in 2016 LVMH also sued Alibaba merchants for selling counterfeit goods on its Taobao platform, but the Chinese company's efforts to win over European luxury groups have since paid off. By contrast, Amazon has a considerable way to go before it is seen as anything resembling a luxury destination.

“The challenge that Amazon has is they think that they can be all things to all people,” said Kodali, who reckons that the company is more suited to the discount market and anticipates that it too will purchase overstock merchandise in coming months. “You can put lipstick on a pig, but it's still a pig.”

Culture Wars

With subsidiaries and joint ventures scattered across China, Southeast Asia the Middle East and Russia, Alibaba already has its hands (and wallets) full. The demographics of the firm's home market on its own is enough to make Amazon envious. According to McKinsey, China’s middle class alone could hit 550 million by 2022. The entire US population stands at approximately 330 million.

Nevertheless, the crisis has highlighted the potential for Alibaba to achieve its goal of serving two billion global shoppers by 2036. The firm became a middleman between Chinese manufacturers and global firms, as governments and businesses in the west struggled to acquire personal protective equipment (PPE) for workers on the front lines. According to SimilarWeb, the group’s AliExpress cross-border e-commerce platform saw first quarter traffic spike 20 and 14 percent in Spain and Italy respectively compared to the same period last year.

For years, Alibaba has been using AliExpress to export the mainland's e-commerce ecosystem — from its vast network of manufacturers-turned-brands, SME suppliers and high-tech logistics solutions — to the wider world. The platform, which in the past partnered with Milan Fashion Week, could leverage its recent boost in international consumer awareness to help it expand in more conventional apparel categories.

Before Covid-19 hit, the group’s logistics arm Cainiao already reported 67 percent year-on-year growth for the quarter ended December 2019, due in part to a boost in overseas deliveries. Post-pandemic, the challenge (and opportunity) will be in convincing first-time western users and businesses to stay on and beyond that, partner with the group to sell to Chinese consumers.

According to a new survey conducted by consultancy Oliver Wyman, China's apparel market is expected to see a 15 percent contraction in 2020, equivalent to about $60 billion in market value. Nevertheless, Ma reckons it has never been a better time for global businesses to break into the mainland, thanks in part to the potential post-pandemic consumption rebound, Beijing’s easing of cross-border regulations and platforms like Alibaba that will be on the lookout for new global partners.

In a world where unemployment is at an all-time high, people need things inexpensively.

"The difficulty for Alibaba in general is becoming an international and global company rather than only a Chinese giant," said Nordey, adding that the company has had trouble cultivating a global working culture across its group, which many associate with the mainland's so-called '996' schedule (of working 12 hour days, six days a week) after comments made by Founder Jack Ma.

“[Alibaba needs to work out] how to on-board foreigners to make a career within the group,” said Nordey. “They will never deploy well overseas if they don’t manage to get this culture fit.”

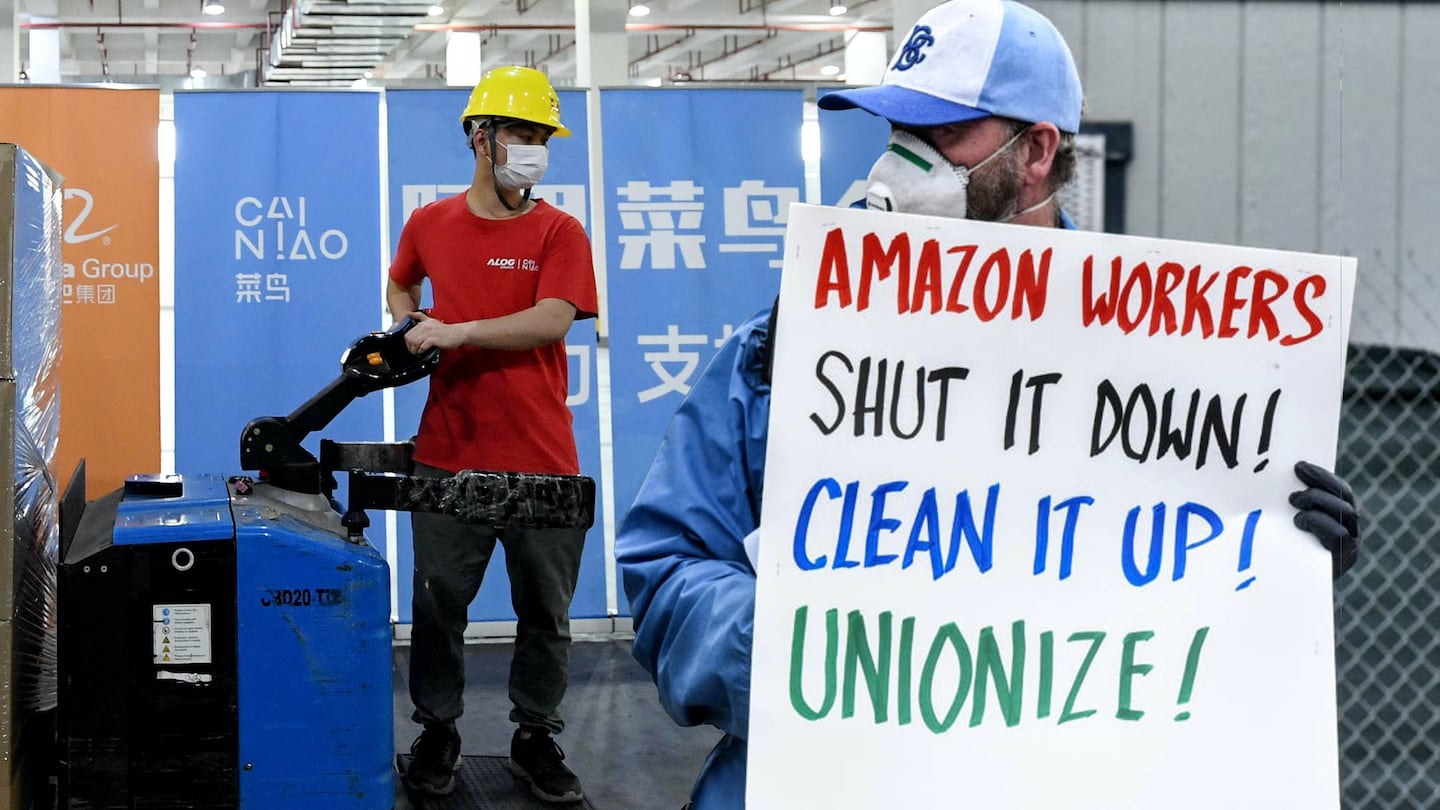

Throughout the pandemic, Amazon faced a different kind of culture crisis and was criticised by employees and politicians for the lack of measures implemented to protect its workforce. At least six employees who advocated for safer working conditions have been fired, while hundreds of its warehouse workers didn't show up for work in protest last month in a demand for paid sick leave.

According to Nordey, Alibaba — which holds no inventory and owns no warehouses, but rather manages its products through software — faced no such scrutiny in China.

In spite of its bad press, Kodali observed that scrutiny from the media and lawmakers aren’t affecting Amazon’s bottom line. “Their reputation with consumers for the most part remains intact...you can see their sales going up,” she said. In fact, in March the giant announced it would hire 100,000 more people to cope with surging demand.

“The watchdogs are watching Amazon as they should,” she said. “But in a world where unemployment is at an all-time high, people need things inexpensively and Amazon delivers.”

时尚与美容 FASHION & BEAUTY

Fashion enthusiasts are creating custom clothes in Nintendo's Animal Crossing. | Collage by Zoe Suen for BoF

Chinese Mall Hops on the Animal Crossing Bandwagon

After brands like Marc Jacobs and Valentino partnered with Instagram account Animal Crossing Fashion Archive to launch outfits on the game, Beijing's SKP has also made its debut. The retailer, which only recently reopened its store, is holding a competition for players to recreate its experimental retail spaces within the game for a chance to win store credit and a cash prize. The move is an attempt to not only engage with younger shoppers who for weeks were confined to their own homes, but draw them to the company's offline retail location as part of an omnichannel, or O2O (online to offline) strategy. (Jiemian.com)

China's Apparel Market Faces $60 Billion Contraction This Year

The world's largest apparel market is expected to see a 15 percent contraction in 2020, equivalent to about $60 billion in market value, according to a new consumer survey conducted by consultancy Oliver Wyman. The data reveals that over 75 percent of Chinese consumers reduced or postponed purchases on apparel and footwear, while total spending decreased by 45 percent in the first quarter of 2020, with only marginal improvement in April and May. On a more positive note, the consultancy predicts that consumer spending could return to pre-pandemic levels in the second half of 2020. (Oliver Wyman)

Covid-19 Accelerates Shifts Across Chinese Print Media

For its March issue, Esquire China's millennial vertical, Esquire Fine featured one advertiser throughout: Dior. Thanks to its cover star and Dior ambassador Wang Junkai, the issue sold out of ten thousand copies in minutes and the hashtag #WangJunkaiFirstMagazineCover received over 360 million hits on Weibo. China's quick-changing tech landscape hit local players hard in recent years, but these titles have been quick to adapt in the face of Covid-19. Esquire is just one of many local publications placing a renewed focus on digitisation and bankable millennial-beloved celebrities. Titles have also adapted to the changing landscape by diversifying revenue streams, experimenting with creative agency models and formats like livestreaming. (Jing Daily)

科技与创新 TECH & INNOVATION

Screenshots of videos on Douyin | Collage by BoF

How Fashion is Doing on Douyin

Though global brands have yet to tap into TikTok, its sister app should be on their radars when targeting younger consumers. A new white paper published by Douyin provides new data on the rise of fashion content on its platform. The app's daily active users as of January 2020 numbered at 400,000 and among its categories, clothing and style has seen notable growth. Last November during Singles Day, the category even outpaced beauty and received the highest volume of user traffic. Since last March, the number of fashion-focused accounts on the app has increased more than five times, with follower numbers increasing over threefold. The platform is now home to vast numbers of fashion key opinion leaders (KOLs) — from plus sized influencers to runway-focused livestream stars — that brands can consider partnering with to test out their Douyin strategies. (Toutiao.com)

TikTok Owner’s Profits Hit $3 Billion Last Year

Are the days of China's tech trifecta over? ByteDance generated over $17 billion in revenue and more than $3 billion of net profit last year, according to sources familiar with the matter. The company's revenue for 2019 more than doubled its $7.4 billion in 2018, due in part to rapid growth in user traffic that has drawn advertisers away from Tencent and Baidu, firms that alongside retail giant Alibaba were known as the country's top tech giants. With TikTok, Bytedance is not only challenging the dominance of its local behemoths but those in the US, too. Analysts estimate that the company, which is reportedly profitable, could see a valuation of between $150 billion and $180 billion. Though sources said that preliminary discussions about an IPO were held last year, they added that the company is in no rush to go public. (Bloomberg)

消费与零售 CONSUMER & RETAIL

I.T store in Hong Kong | Source: Shutterstock

Wracked with Losses, I.T Issues Profit Warning

The Hong Kong retailer, store operator and joint venture partner to the likes of Comme des Garçons and Galeries Lafayette more than doubled its estimated net loss for 2020 to $90 million. The news came just a day after protesters in Hong Kong attacked its stores following reports that the group's Founder Sham Karwai sided with Beijing against the city's recently restarted pro-democracy protests. I.T is feeling the heat from Hong Kong's dismal retail landscape — ongoing social unrest and Covid-19 have flattened tourist numbers and local demand over the past year — in addition to weak sales across other operating markets and tough competition from digital players. (SCMP)

Secrets to Selling Lipstick in the Mainland

CBN Data recently analysed the lipsticks recommended by China's livestream 'Lipstick King' Austin Li, who tests up to 2,000 shades a year and in 2019 broke records after selling 15,000 lipsticks in five minutes. The firm found that Li's favourite shades tended to be bright red or orange (pink shades rarely made the cut), with hues ranging between 352.5 and 357.5. The influencer tends to focus on shades that compliment Asian skin tones and has a track record of recommending homegrown beauty brands like VNK and Perfect Diary who cater to mainland shoppers. In the past, he has criticised brands like Hermès and Chanel for developing colours that didn't compliment Chinese customers. (CBNData)

JD.Com Links Up With Kuaishou

As livestream e-commerce gains traction and retailers approach '618' (China's mid-year shopping extravaganza), the country's second largest e-tailer has announced a new partnership with the short video platform that will allow Kuaishou users to purchase JD.com products without leaving the former app. (An existing deal between the companies from last June transfers Kuaishou users to JD.com's app to complete their purchases.) Where JD.com has brand partners, a mature supply chain and post-sales support systems, Kuaishou — which reportedly multiplied its goal for this year's live e-commerce GMV to 250 billion yuan ($35 billion), up from 2019's 35 billion yuan — will bring its content, traffic and conversion-driving capabilities to the table. (Technode)

政治、经济、社会 POLITICS, ECONOMY, SOCIETY

The national legislature of the People's Republic of China | Source: Shutterstock

China Unveils $500 Billion Fiscal Stimulus

Beijing has unveiled a fiscal stimulus package of nearly 3.6 trillion yuan ($506 billion), as it attempts to offset Covid-19's economic fallout. At the National People's Congress on Friday, plans were also announced to increase the budget fiscal deficit to a record high of 3.6 percent of GDP, adding an extra 1 trillion yuan to the budget to bolster the economy. Faced with China's most dramatic economic downturn since the '70s, its leaders have not set a growth target for the year ahead, signalling their willingness to tolerate lower growth in the months ahead. (SCMP)

China’s Youth Struggle for Jobs

Post-pandemic, China's youngest workers are entering what could be the country's toughest job market in modern times and the pressure will only increase as nearly 8.7 million graduates join the race. Though young job seekers in markets like the US are facing a similar crisis, recovery across the world is depending on growth in China to get kick things off, which will be near impossible unless younger citizens are positioned to help. At last week's annual parliamentary gathering, Premier Li Keqiang promised "to make every effort to stabilise and expand employment" and the country's leaders are working to create nine million new jobs this year. Meanwhile, lowering salary expectations and settling for a stable gig at a state-owned company (where competition is typically less fierce) is becoming the norm for job seekers that have had their plans upended by the pandemic. (The New York Times)

China Decoded wants to hear from you. Send tips, suggestions, complaints and compliments to our Shanghai-based Asia Correspondent casey.hall@businessoffashion.com.

With consumers tightening their belts in China, the battle between global fast fashion brands and local high street giants has intensified.

Investors are bracing for a steep slowdown in luxury sales when luxury companies report their first quarter results, reflecting lacklustre Chinese demand.

The French beauty giant’s two latest deals are part of a wider M&A push by global players to capture a larger slice of the China market, targeting buzzy high-end brands that offer products with distinctive Chinese elements.

Post-Covid spend by US tourists in Europe has surged past 2019 levels. Chinese travellers, by contrast, have largely favoured domestic and regional destinations like Hong Kong, Singapore and Japan.