The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

With most of the world still rattled by Covid-19, many fashion brands are turning to the Chinese market — and its influencers — for much-needed growth. But to engage with consumers in the world’s largest fashion market, they’ll need to take a few lessons from Teacher Xu.

Fiona Xu Yan, more widely known by her online moniker, is one of many key opinion leaders (KOLs) dominating China’s luxury fashion and beauty landscape. Xu’s video formats aren’t revolutionary: she is often filmed getting her makeup done or raiding the wardrobes of socialites and top stylists. But her sense of humour and variety show-like editing style have captivated Chinese viewers on platforms like Bilibili, where her top video has clocked almost 19 million views.

KOLs have long been the linchpins of brands’ marketing strategies in the Chinese market. But experts are saying that sales-driving livestream stars and celebrity ambassadors are poised to gain importance in 2021. Chinese influencer marketing agency Parklu, which was recently acquired by Launchmetrics, forecasts that the KOL economy, which was worth $18 billion in 2019, will grow at a compound annual growth rate (CAGR) of 42.7 percent between 2017 and 2022.

Like China’s tech and retail sectors, its KOL industry is constantly evolving; brands need to revamp their strategies and stay up to date with the accounts of the moment to make the most of their marketing budgets. From the fashion director challenging beauty standards to Chinese nationals living abroad, here are the names to know.

ADVERTISEMENT

The Retailtainer

The rise of social media apps like Douyin, Xiaohongshu and Bilibili has pushed short videos and livestream content to the fore, but it also coincides with a changing of the KOL guard. The Chinese fashion blogger of years past — one that resided on Weibo and WeChat, reposting and critiquing fashion editorials — has been overtaken by KOLs creating personable, entertaining video content on buzzier platforms. Teacher Xu is a prime example.

Online platforms and their users are increasingly shifting towards retailtainment.

“The ability to entertain and [drive] commerce is the key,” said Kim Leitzes, chief executive of Parklu by Launchmetrics. ”Online platforms and their users are increasingly shifting towards retailtainment.”

While livestreaming, where the likes of Austin Li and Viya lead the pack, Teacher Xu is proof that livestreams aren’t the only route to engagement. According to Parklu, Xu this year climbed the ranks to become China’s top fashion KOL by tapping into Douyin, which grew her following by 6.7 million.

The Anti-Fashion Authority

China’s digital-first media landscape has in recent years rattled local editions of prestige fashion titles from Vogue to Elle to Harper’s Bazaar: the country’s shoppers are spoilt for choice when it comes to free beauty recommendations and styling advice from influencers, rendering print magazines somewhat redundant.

“Younger generations don’t care about brand messaging [like older Chinese consumers],” said Ariel Tsai, business development manager at PingPong Digital. “They’re more into personality and how fashion can help them show theirs off.”

iDest, however, has emerged as an answer to this shift. Helmed by former blogger Ye Fei, the independent magazine’s social media accounts provide followers with original editorials, shared content from other publications (both appraised and critiqued) and personal, unfiltered everyday photos from Ye himself, often featuring his dogs Miu Miu and Prada. The key to iDest’s success — with over 2 million followers, its Weibo account is among the platform’s top 12 fashion KOLs according to Parklu — lies in its rejection of a traditional publication’s sponsor- and celebrity-laden content and the adoption of an unvarnished, relatable tone of voice.

ADVERTISEMENT

The Fashion Editor

The rise of the editor-cum-influencer is hardly news, in China or elsewhere. But growing interest in subcultures, streetwear and increasingly diverse beauty standards have been boons for one in particular.

Mia Kong was appointed Dazed China’s style director last year and has made waves on social media both at home and abroad. Kong doesn’t fit into the KOL mould: her darker skin tone (China’s beauty standards continue to revolve around attaining a porcelain skin), penchant for bold, anime-esque streetwear ensembles and out-there beauty looks set her apart from the typical, ultra-feminine influencer, growing her following among younger fashion enthusiasts.

Kong, who has collaborated with the likes of Burberry and is the face of Fenty Beauty in China, was appointed to the British Fashion Council’s New Wave Creatives Steering Committee this year and has over 948,000 followers on Weibo.

“Five years ago I wouldn’t have believed that someone like me, who doesn’t fit into the Chinese mainstream influencer mould, could work with beauty brands. But everything is changing,” said Kong, who makes an effort to post unfiltered lifestyle content. “I want to tell them, ‘I’m not unlike you. Fashion doesn’t equal luxury, it’s not all about money.’”

The Expat

Often, brands equate targeting Chinese consumers with doing so within the Chinese market. But the smaller population of Chinese nationals residing in countries from the US to Australia are often overlooked and can provide brands with a stepping stone towards breaking into the mainland market.

According to the United Nations, around 10 million Chinese-born people lived abroad as of 2017; an increasingly popular cohort of expat KOLs, operating across global and Chinese social media, offer a targeted route to these screens.

ADVERTISEMENT

Take Emma Zhang, known by her username Oh Emma, a fashion and beauty Youtuber based in Toronto. Though Zhang posts bilingually on Instagram, the bulk of her videos on Youtube are filmed in Mandarin; most of her followers are Chinese nationals living in the US and Canada, she told BoF. Zhang has worked with brands like Tods and Roger Vivier, providing them with a link to over 387,000 and 253,000 users on Youtube and Instagram respectively. She has also introduced her audience to the likes of Toteme, Jacquemus and 111skin.

“Brands definitely don’t focus on Chinese oversees,” said Tsai, noting that these shoppers are often very well-off, making them prime targets for luxury brands. “But a lot [of these people] are trendsetters; a lot of new brands that make it into the mainland market are first discovered by Chinese living abroad, that’s how many brands start to get popular in China.”

The Everyman

For years, celebrities were seen as the most elite and effective KOLs for brands to tap, with the likes of Yang Mi known as major sales drivers: fans, seeing an A-lister with a bag, would take the plunge almost immediately. That dynamic has since changed: shoppers, having discovered a piece through a celebrity, will often consult reviews from micro-influencers, frequently known as key opinion consumers (KOCs), before making their purchases.

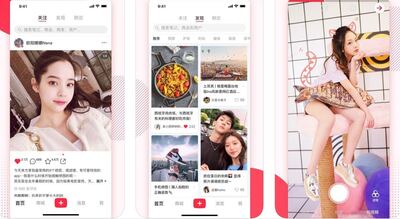

Platforms like Xiaohongshu, which was conceived as a social community providing recommendations, has driven the rise of KOCs due to its algorithm-centric app; users are just as likely to see content from a new account as they are a top influencer. And there are plenty of KOCs for brands to choose from.

“Celebrities are for brand messaging now, rather than driving sales,” said Tsai. Knowing about the big paychecks top KOLs receive, shoppers are more likely to trust smaller influencers, who are more likely to receive products as gifts or purchase them themselves. “Myself, before I buy something, I’ll go on Xiaohongshu to look for KOC reviews.”

时尚与美容

FASHION & BEAUTY

Prada’s Conversations Series Dives Into Ocean Sustainability

Conscious consumption may be gaining speed post-pandemic, but few luxury brands have pursued a sustainability agenda in the Chinese market. Prada saw this as an opportunity: In the brand’s latest installment of its “Possible Conversations” series of live dialogues, it brought together surfer Monica Guo, actor Luo Jin, architect and professor Lyla Wu and swimmer Ning Zetao to discuss ocean conservation at Beijing’s SKP-S mall on December 9. The talk was livestreamed on Prada’s WeChat mini program; after the session concluded, on-site viewers were invited to shop Prada’s Re-Nylon pop-up store and installation, followed by a star-studded cocktail party and preview presentation of its Spring/Summer 2021 collection. (Prada)

I.T Group Plots Privatisation

Ailing Hong Kong retail group I.T has plans to delist after a challenging year, which saw its bottom line hit hard by Covid-19 and social unrest. A buyout offer has been proposed, which if approved by shareholders will see shares purchased by founder Sham Kar Wai and private-equity investor CVC in a transaction valued at $168.37 million. Alongside its brands and own multi-brand stores, I.T operates stores across Asia for or through joint ventures with the likes of Comme des Garçons, Galeries Lafayette and Dover Street Market. In April, I.T more than doubled its estimated net loss for 2020 to $90 million. Six months later, the company warned shareholders it would post a loss of at least $38.7 million for the six months to August. (Inside Retail)

Beauty Drives E-Commerce Growth for Kuaishou

Douyin rival Kuaishou, also known for its short video format, has seen its e-commerce business boosted by beauty content. According to a new report published by the platform, likes, shares and group chats relating to beauty have grown 24.6 percent, 45.9 percent and 11.6 percent in 2020 respectively; its November IPO filing stated that e-commerce GMV had reached 109.6 billion yuan ($16 billion). Lower tier cities have become major growth drivers for beauty content, which in the past has struggled to attract high-end fashion and beauty brands given its start as an app for users to sell agricultural goods. Face masks and lipsticks are the most popular product categories in lower-tier cities, serving as entry level products for shoppers looking to invest in luxury brands. (Jiemian)

科技与创新

TECH & INNOVATION

Report: TikTok Sale Deadline on Hold as Talks With US Continue

A deadline set by the Trump administration for the forced sale of TikTok’s US assets will come and go Friday without a final deal, according to people familiar with the discussions. The deadline has been extended multiple times, but the Bytedance-founded platform isn’t expected to receive a new one as the two sides negotiate the sale, which the administration is keen to complete before President-elect Joe Biden takes office in January. Neither TikTok nor Bytedance will face a fine for missing the deadline. (Bloomberg)

New Livestream Rules Derail Blockbuster E-Commerce Deal

New restrictions on China’s burgeoning livestreaming industry have reportedly upended a share acquisition deal involving a livestreaming e-commerce company. According to a stock filing on Friday, Shanghai-listed cable maker Sunway has halted its planned purchase of a 40.27 percent stake in Chengdu Xingkong Yewang Technology for 589 million yuan ($89 million) after the new rules were announced. Xingkong Yewang could be the first of many businesses to be hit by the recent crackdown, which requires livestreaming platforms to cap the tips users can give to broadcasters and demands age and identity verification for creators and users. Underage users have also been banned from sending virtual gifts and tips. (Caixin Global)

消费与零售

CONSUMER & RETAIL

Alibaba and Farfetch Open Up About Their Mega-Deal with Richemont

LVMH is notably absent from the landmark deal between Farfetch, Alibaba and Richemont and the resulting Chinese joint venture announced November 5. But speaking with Imran Amed at BoF’s VOICES 2020 summit last week alongside Farfetch’s José Neves, Alibaba Group president J. Michael Evans said that the deal wasn’t about domination or exclusion. Rather, he suggested that digitising the global luxury market is simply too big a task for even the biggest e-tail giants to shoulder alone. Evans is confident that the accelerated digitisation of Chinese retail will persist beyond 2020; to tap into this growth, Farfetch China will need to help over 3,500 brands think like Chinese consumers, with an omnichannel mindset. (BoF)

JD.com Becomes China’s First Online Mall to Test Digital Yuan

China’s second-biggest e-retailer will become the country’s first marketplace to use the cryptocurrency backed by its central bank. JD Digits, the e-commerce giant’s fintech affiliate, will launch a pilot programme this month, and customers will pay for certain items with digital yuan, it announced this week. About 100,000 digital cash vouchers, worth 20 million yuan ($3 million) in total, will be issued on December 11. According to the People’s Bank of China, the digital currency was already used in over four million transactions by early November. The central bank kicked off tests in April to bolster the currency’s status and to help control the domestic economy during a period of rapid digitisation. (Bloomberg)

政治、经济、社会

POLITICS, ECONOMY, SOCIETY

US Enforces Ban on Cotton Linked to Forced Uighur Labour

The US Customs and Border Protection agency began detaining shipments only a day after announcing a ban on cotton and cotton products from Xinjiang Production & Construction Corps (XPCC), which it alleges uses the forced labour of detained Uighur Muslims. The move is the latest by the Trump administration in its final weeks to harden the US position against Beijing. It not only makes it more difficult for President-elect Joe Biden to ease US-China tensions but could have a sweeping effect on global companies selling to the US; US customs is also requesting that importers provide documentary evidence of full visibility over their cotton supply chain. (SCMP)

China’s US, Australia Trade Breaks Records Despite Geopolitical Tensions

Trade between China and the US as well as Australia broke records last month, in spite of ongoing political and trade disputes. Shipments to Australia rose by 22.6 percent in November, in the most lucrative month on record for China’s overall exports, while Chinese imports of Australian goods grew 9.4 percent year-on-year. Despite President Trump’s vow to eradicate China’s trade surplus, it soared to a record $75.4 billion as exports surged 21.1 percent compared to 2019, propelled by consumer demand in the US; exports to the US rose 46 percent. (SCMP)

China’s Virus-Free ‘Hawaii’ Courts Tourist Spending

While international travel remains at a standstill, millions of Chinese tourists are descending on the country’s southernmost island province of Hainan, known as the “Hawaii of China.” The island, which has been free of coronavirus for six months, is drawing shoppers to its growing number of duty-free malls as duty-free businesses (and their partners, one of which is Alibaba) bet on its travel retail potential. Though foreign visitors dropped by 87 percent, October arrivals of 9.6 million, according to official data, exceeded last year’s figure by 3.1 percent. Hainan’s sense of normalcy is drawing luxury spenders to its shores: queues have already been spotted outside the Chanel and Gucci boutiques at developments like Sanya’s Haitang Bay Duty Free Shopping Center. (Reuters)

China Decoded wants to hear from you. Send tips, suggestions, complaints and compliments to our Shanghai-based Asia Correspondent casey.hall@businessoffashion.com.

With consumers tightening their belts in China, the battle between global fast fashion brands and local high street giants has intensified.

Investors are bracing for a steep slowdown in luxury sales when luxury companies report their first quarter results, reflecting lacklustre Chinese demand.

The French beauty giant’s two latest deals are part of a wider M&A push by global players to capture a larger slice of the China market, targeting buzzy high-end brands that offer products with distinctive Chinese elements.

Post-Covid spend by US tourists in Europe has surged past 2019 levels. Chinese travellers, by contrast, have largely favoured domestic and regional destinations like Hong Kong, Singapore and Japan.