The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

In markets that are especially opaque, business leaders glean insights from wherever they can. When the market in question is China, a one-party state and the world’s second-largest economy, fashion executives would be wise to listen carefully as the government puts forward its vision for the next five years — even if it is delivered at a ceremony peppered with unfamiliar choreography and ambiguous metaphors.

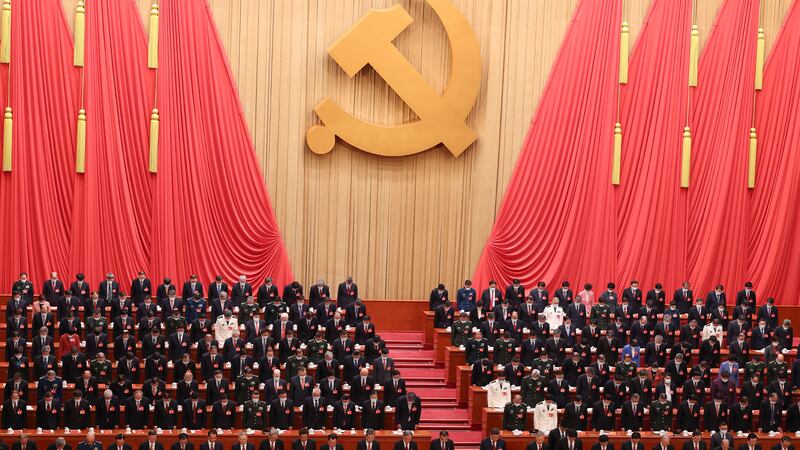

The National Congress of the Chinese Communist Party not only sets the tone for the CCP’s policies and defines its key personnel, but also shapes China’s economic outlook and the market environment in which companies operate. The 20th edition of the event ran from October 16 to 22 and saw around 2,300 delegates flock to Beijing’s Great Hall of the People.

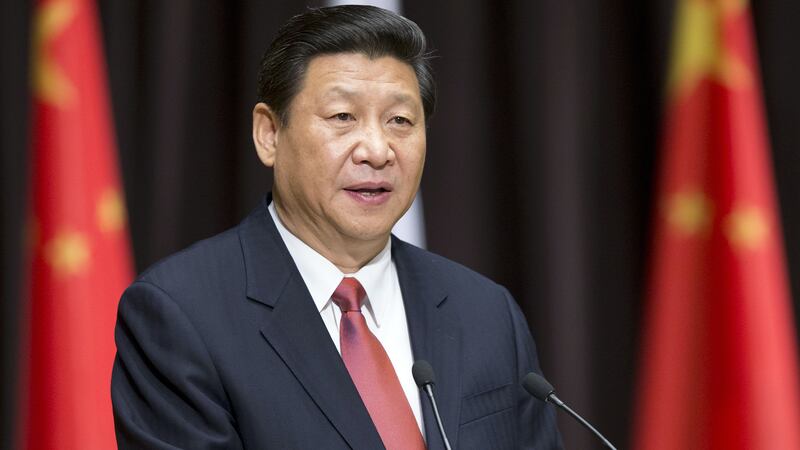

All eyes were on president and general secretary Xi Jinping, who as expected secured a precedent-breaking third term, highlighting his consolidation of power across the CCP’s top echelons. During the week, other key officials were elected to the party’s central committee, politburo and elite standing committee, the most powerful decision-making body in the mainland.

Though much of the congress was held behind closed doors, Xi’s opening speech did shed some light on Beijing’s plans for the coming years including its zero-Covid policy, geopolitical relations with the US, Taiwan and Hong Kong, international trade, issues shaping the national culture and regulatory crackdowns looming over the tech and property industries. All these factors have a direct or indirect impact on the future complexion of the Chinese fashion market, which remains the largest in the world.

ADVERTISEMENT

Many business leaders and investors were hoping for at least some shift in direction — particularly to the government’s stringent zero-Covid policies which have dampened consumer demand and made it even harder to operate in China — but Xi’s speech only cemented the CCP’s ongoing stance and dashed hopes for a short-term improvement in the Chinese consumer market and people’s mobility.

Market reaction to the congress was swift and unambiguous. By the end of last week, the yuan had slumped amid a 2.6 percent decline in the CSI 300 Index, a benchmark of the top 300 stocks traded on the Shanghai and the Shenzhen stock exchanges. That brought the year-to-date decline to more than 24 percent in what Bloomberg called a “dreadful year for Chinese markets” getting even worse because “expectations for stimulus measures at the… congress were left largely unfulfilled.”

At one point, Chinese stocks briefly rallied following news of a report circulating that officials may have debated about whether to reduce the time that inbound travellers must spend in quarantine, but gains were short-lived. Details of the rumoured report remain unclear and, more importantly, the duration of inbound quarantines is not the main issue hobbling the economy.

For months leading up to the National Congress, analysts and insiders predicted that Beijing’s zero-Covid policies, characterised by mass testing and sudden lockdowns, would remain in place to not rock the boat before the big event. But based on the lack of a direct statement on the ending or easing of China’s zero-Covid policy — and its disruptions to both the fashion market and supply chains in the country— the anti-virus strategy is very much here to stay, says Dr Xin Sun, senior lecturer in Chinese and East Asian business at King’s College London’s Lau China Institute.

In his near two-hour-long address, president Xi made no indication of how zero-Covid might even evolve saying instead: “we have demonstrated China’s sense of duty as a responsible major country, actively participating in the reform and development of the global governance system and engaging in all-around international cooperation in the fight against Covid-19.”

Despite concerns voiced by many in the international community, including the World Health Organization director general who said in May that he did not think China’s approach to Covid-19 would be sustainable and that “a shift would be very important”, president Xi made claims to the contrary. “All this has seen us win widespread international recognition. China’s international influence, appeal and power to shape have risen markedly,” Xi declared.

Xi’s speech didn’t spotlight many significant changes to policy in other areas either. “It demonstrated very strong continuity with what’s happened over the last two to five years,” said Sun. This meant a focus on terms like security and common prosperity, with fewer mentions of reforms or economic opening, excluding mentions of China’s trading prowess and plans to “expand institutional opening up with regard to rules, regulations, management, and standards.”

Xi did spotlight the role innovation — across fields like manufacturing, aerospace and cyberspace — will play in driving China’s economic growth, as well as the importance of sustainability initiatives like clean energy, both of which are already hallmarks of his tenure.

ADVERTISEMENT

According to Liqian Ren, director of Modern Alpha at WisdomTree Investments, the impact of any new policy born out of the closed-door sessions at last week’s national congress will depend on how it is implemented in practice at a local, provincial and bureau level.

All in all, Ren characterised the speech as a “boilerplate” but for fashion brands, she said, Xi reiterating the government’s commitment to common prosperity could signal increased demand for discreet, rather than ostentatious, types of luxury goods consumption. This started affecting users on social media as early as May, when Xiaohongshu cracked down on so-called “wealth flaunting” (posting “misleading” photos of luxury goods like bags, watches and cars without useful information).

It also suggests there is no end in sight for tighter regulations on the entertainment sector, nor takedowns of internet personalities and celebrities like livestream stars Viya and Li Jiaqi (aka Austin Li). The former faced a tax evasion fine and the latter appeared to have disappeared for several months after a controversial livestream featured a tank-shaped cake ahead of the anniversary of the 1989 Tiananmen crackdown.

The overall outlook for China’s luxury sector remains almost as uncertain as it was before the congress, not least because of the state of the wider economy.

The latest economic growth figures were released on Monday, after officials delayed publication until the congress had concluded. Analysts who had speculated that the delay was probably because the figures were not particularly strong were proven right. Third quarter GDP in 2022 expanded 3.9 percent year on year, slightly better than the forecast of 3.3 percent from analysts polled by Bloomberg but still far below that of China’s full-year target of 5.5 per cent, which is its lowest in three decades.

That doesn’t bode well for the economy, nor for global brands relying on Chinese shoppers to boost their bottom lines. Earlier this month the International Monetary Fund cut its forecast estimate for China’s 2022 GDP to 3.2 percent, down from 8.1 percent in 2021. Looking forward, China’s median growth is projected to be 5.2 percent in 2023 and 4.8 percent in 2024, according to Bloomberg’s quarterly survey of economists.

“Expectations for stimulus measures at the congress were left largely unfulfilled.”

“In the short-term there’s this big uncertainty due to [zero-Covid],” said Mario Ortelli of luxury advisory firm Ortelli & Co. But in the long-term, he suggested, brands could see an upside in both the government’s push for common prosperity — which if successful could eventually lead to a larger portion of the Chinese population able to spend more on luxury — and the lack of negative messaging regarding foreign brands.

The net result seems to be that there are two important takeaways for global fashion players: don’t expect a sudden influx of Chinese tourists to the shopping hubs of Europe, the US or other Asian countries, and don’t expect a spike in Chinese consumer sentiment either, any time soon. Though moderation is possible, it is unlikely that there will be any back-pedalling. “Many of these policies come from Xi himself, and if he delivered a U-turn, it’d be a huge blow to his personal credibility,” noted Sun.

ADVERTISEMENT

Besides, there will be few serious challenges to Xi’s position on most issues since he is now the most powerful Chinese leader since Mao Zedong. After being re-elected as communist party general secretary over the weekend, the announcement of his presidency of the country in March of next year is nothing more than a formality. Xi has filled the politburo and standing committees with loyalists, a move which shifts the country back to one-man rule after decades of power-sharing among the party elites.

The move is hardly surprising, given that a key thread running through Xi’s speech was the prioritisation of security over economic growth.

The term “security” was mentioned some 80 times during the address, but rather than confining it to geopolitical, military, food and economic security, Sun adopts a broader interpretation tied to the political survival of the communist party and the centralisation of government control.

This goes some way in explaining the ongoing property crackdown, where China’s heavily indebted real estate sector was seen as a major risk to the regime. Tech platforms and the influence they wield over public opinion are also a “serious threat,” said Sun: just last week, photos and videos of an anti-Xi banner on Beijing’s Sitong Bridge calling for “freedom, not lockdowns” were posted on Chinese social media before being promptly deleted.

In recent months, optimistic analysts heralded an end to the years-long tech crackdown, which in 2020 claimed e-commerce giant Alibaba’s Ant Group and its $34 billion IPO as its first big catch. But it is more likely to be a temporary break, says Sun. “Once the party decides it’s not facing serious economic challenges, it’s very likely that the policies will be re-emphasised, and new ones will be imposed.”

“Many of these policies come from Xi himself, and if he delivered a U-turn, it’d be a huge blow to his personal credibility.”

Renewed or new crackdowns would have knock-on effects for fashion companies, which have to adapt to tech sector laws around content and data, while reckoning with dampened discretionary spending caused by the real estate crisis. A huge share of China’s household wealth, 70 percent according to investment management firm Loomis Sayles, is invested in real estate, roughly double the 35 percent share seen in the US.

The culture of heightened scrutiny is spilling over into the fashion sector in other ways. Fosun International, whose Lanvin Group subsidiary includes namesake brand Lanvin as well as Sergio Rossi, Wolford, St. John Knits and Caruso, recently lowered its equity valuation and was downgraded by the S&P, after a visit by its in-house CCP secretary to the Beijing branch of SASAC (State-Owned Assets Supervision and Administration Commission of the State Council) sparked fears.

While no mention was made of Xinjiang province during Xi’s speech, his comments on Taiwan, Hong Kong and the US indicated — in a similar vein to zero-Covid and regulatory scrutiny — that the CCP would stay on course. Beijing’s elimination of political opposition in Hong Kong was deemed “a major turn for the better,” and a pledge to return Taiwan to mainland control drew a long round of applause, during which Xi reiterated that he will never renounce the right to use force to do so even if he prefers a peaceful resolution with the island.

An escalation of Chinese military action in and around Taiwan, an outcome which experts continue to deem as improbable, would almost certainly prove calamitous for not only the global economy but the fashion and luxury sectors. Though the geopolitics at play differ greatly from this year’s invasion of Ukraine by Russia, comparisons of a potential invasion of Taiwan by Beijing are understandable. Bernstein’s Luca Solca predicts a 40 percent drop in luxury sales on the back of sanctions targeting China over such a conflict.

Inextricably tied to this, of course, is Beijing’s increasingly rocky relationship with Washington and US allies, which has had and will continue to cast a long shadow over fashion brands’ supply chains.

On these relationships, Xi committed to strengthening China’s “mechanisms for countering foreign sanctions, interference, and long-arm jurisdiction.” Self-sufficiency, especially in relation to innovation and supply chains, was reiterated as a cornerstone of this stance.

For fashion, the comments are likely to hasten the decoupling of some global firms’ supply chains from the mainland. This will not be easy considering how much western brands continue to rely on China, the world’s largest exporter of apparel, according to World Trade Organisation data. It doesn’t help that the link between the two — as exemplified by the Xinjiang cotton backlash, which saw the likes of Adidas and H&M boycotted for voicing concerns over forced detention and labour allegations — is getting more complicated.

As China’s economic and foreign policies become more inward-looking, Xi wants its so-called “advanced socialist” culture to follow. “Fine traditional Chinese culture is undergoing creative transformation and development,” he said. “Our young people are filled with greater optimism and enterprise, and there is a notably stronger sense of cultural confidence and a higher level of morale throughout the party and the nation.”

For brands familiar with guochao, or national wave, which refers to the growing pride Chinese shoppers feel in buying locally designed and made goods, Xi’s speech should ring a bell. It signals more room for growth for domestic firms, which have taken market share from foreign competitors in categories like fast fashion and sportswear in recent years. Though there are opportunities awaiting global brands that reference and celebrate Chinese culture in the right ways, says Ren, doing so will continue to be risky.

Ultimately, this goes to the heart of what most fashion brands are (or should be) working to finesse: selling to the Chinese market in bold yet thoughtful and respectful ways that boost brand equity in China while aligning authentically with global brand values. That’s a tall order in an increasingly complex and turbulent global business environment.

Playing it safe is a tempting option, especially at a juncture when the president used his national congress speech to warn his people to be prepared for “dangerous storms” ahead and when there is heightened sensitivity and vocal criticism of perceived indignities by Chinese consumers. But it is not an approach that will help fashion players stand out in an increasingly competitive market.

THE LATEST NEWS FROM CHINA

by Annachiara Biondi

时尚与美容

FASHION & BEAUTY

Third Quarter Results Give Mixed Signals on China

French luxury house Hermès said sales in Greater China “picked up strongly” in the third quarter of 2022, despite temporary closures due to Covid-19 restrictions in July and August. The brand, which reported revenue of €3.1 billion ($3 billion) in the quarter, saw sales in Asia, excluding Japan, grow 34 percent. But China’s recovery hasn’t been uniform across brands. Luxury conglomerate Kering, which also published third quarter results, reported a more moderate Asia market growth at 7 percent. Kering’s finance chief Jean-Marc Duplaix pointed out that Gucci’s performance in China had “yet to normalise.” At L’Oréal, strong growth in Europe and North America managed to offset a modest 0.3 percent growth in sales in North Asia, which includes China. Adidas cut its revenue and operating margin outlook for 2022 citing a further deterioration in store traffic trends in Greater China, as well as inventory build-up caused by weaker demand. (BoF)

New Investigation Accuses Shein of Worker Exploitation

Shein’s suppliers pay workers as little as 2p per garment for 18 hours shifts with only one day off per month and no weekends, or so alleges a new investigation into two of Shein’s suppliers in the southern Chinese city of Guangzhou. The investigation, part of the documentary ‘Untold: Inside the Shein Machine’ by UK broadcaster Channel 4, also reveals that employees are subjected to fines of up to two-thirds of their daily wages if mistakes occur. Similar findings were published by Swiss independent organisation Public Eye last year. Shein, which just launched a resale platform in an attempt to combat criticism of its environmental impact, said it will investigate. (Yahoo Style, BoF)

Lanvin Group Lowers SPAC Valuation to $1 Billion

Lanvin Group, the company whose portfolio includes Lanvin, Sergio Rossi and Wolford among other international brands, has lowered its IPO valuation from $1.5 billion to $1 billion, citing changes in the currency and stock market environment and the performance of other listed luxury companies. The group, which is owned by Chinese conglomerate Fosun International, first announced its intention to list in New York through a SPAC deal with Primavera Capital Acquisition Corporation in March with the prospect of raising up to $544 million in funding. In the first half of 2022 the group reported revenues of €202 million ($199 million), a 73 percent increase on the same period in 2021 led by Europe and North America markets. (BoF)

Luxury Brands Bet on Private Boutiques for VIP Clients

Chanel, Dior and Louis Vuitton are expanding their offering to ultra-high-net-worth VIP clients by opening private boutiques inside first-tier city malls and department stores such as Beijing’s SKP. In these ‘salons’, where only the most loyal high spenders are invited, shoppers can access one-to-one sales and consulting services, trunk shows, private pre-orders, exclusive events and even education courses. The privileged services are designed to increase brand loyalty and spending, as access is correlated to a high purchase volume, and respond to the ongoing repatriation of luxury spending trend. (Jing Daily)

消费与零售

CONSUMER & RETAIL

Duty Free Companies Ramp-Up Online Services

Brick-and-mortar duty free stores in China are feeling the brunt of the country’s ‘zero-Covid’ policy, with even the island of Hainan, a prime destination, reporting a 45 percent year-on-year decrease in duty-free sales during the Golden Week holiday period. In response, many duty free operators have doubled down on their online offering, launching regional platforms and slashing prices to attract shoppers. Products on online platforms such as CDF-Sunrise Duty Free’s online shop can be purchased at less than half the price they cost in shopping malls and on Tmall’s official stores. (Yicai Global)

Chinese Consumers Embrace ‘Little Luxuries’

Facing slower economic growth, the growing threat of unemployment and an unstable property market, some Chinese consumers are redirecting their spending from material purchases such as luxury handbags and cosmetics to experiences and small everyday treats, including baijiu-infused ice cream, craft beer and dining out. The trend goes hand-in-hand with a new appreciation of ‘frugality’ among young Chinese who are particularly affected by current economic uncertainties. China retail sales increased 2.5 percent in September, missing a forecast of 3.3 percent and well below the 4.4 percent growth registered last year. (Reuters)

JD.com, Alibaba Kick-off Singles’ Day Pre-sales

On Oct. 20, e-commerce platform JD.com opened the pre-sale season for Double 11, the shopping event also known as Singles’ Day that takes place every year on Nov. 11 and usually reports record-breaking sales results. Rival Alibaba launched promotions on Oct. 24, pushing a membership programme for brands aimed at attracting traffic, cutting costs and better-managing inventory. This year the e-commerce event will miss its headline livestreaming stars Viya, who was fined for tax evasion in December, and might go without ‘lipstick king’ Austin Li Jiaqi, who just recently resurfaced after being offline for three months following a censorship incident in June. In line with subdued retail sales and economic growth across the country, analysts say Double 11 sales growth will continue to slow down. (South China Morning Post, Reuters)

科技与供应链

TECH & SUPPLY CHAIN

Douyin Allegedly Censors Cantonese Content

Creators who use Cantonese rather than Mandarin in their Douyin videos say that the app is interrupting livestreams, describing the language as “unrecognisable”. While Mandarin is China’s official language, Cantonese is primarily spoken in Hong Kong and Macau, as well as being in use in the southern Chinese province of Guangdong. An estimated 80 million people around the world speak Cantonese including many in the diaspora. Netizens often use non-Mandarin languages, such as Cantonese and Uighur, and regional dialects, which are difficult to monitor for algorithms and Mandarin-speaking internet moderators, and even puns, homophones and intentionally misspelt words to bypass China’s tight censorship machine. Douyin, which was previously accused of blocking content in Cantonese and Uighur in 2020, says it doesn’t prohibit the use of Cantonese. (Rest Of World)

China’s Garment Industry Reports Revenue and Profit Increase

According to data from the Ministry of Industry and Information Technology, between January and August China’s garment industry reported a 3.7 percent year-on-year increase in collective operating revenue, reaching 950.4 billion yuan ($133.86 billion). In the same period, the sector, which includes more than 13,000 companies, also registered a 3.4 percent increase in profits to 43.6 billion yuan ($6 billion) and a 17 percent growth in exports to $104.4 billion. (Fibre2Fashion)

Logistics and Warehouse Indices Rise as Market Demand Improves

A number of China’s logistics and warehouse indices passed the 50 point mark that indicates expansion rather than contraction in September, suggesting encouraging improvements in orders and demand. China’s logistics index registered an increase of 4.3 percentage points over its August figure, reaching 50.6 percent. The sub-index for new orders also showed an increase of 3.2 percentage points to 50.1 percent, while the country’s warehouse storage index rose to 52 percent. The country’s e-commerce logistics index increased to 108.1. (Fibre2Fashion)

政治,经济与社会

POLITICS, ECONOMY, SOCIETY

Xi Jinping Secures Third Term as Party General Secretary

China’s leader Xi Jinping was confirmed as the Chinese Communist Party (CCP) General Secretary for a third term on Sunday, a day after the week-long 20th Communist Party National Congress ended in Beijing. The Congress has approved a series of constitutional revisions that have cemented Xi’s position as China’s most powerful leader since Mao Zedong. Xi, who also retained his role as chair of the military commission, is expected to be re-confirmed as China’s President in March. Alongside Xi’s confirmation, on Sunday the CCP named new members of the Politburo Standing Committee including Xi’s loyalists Li Qiang, Zhao Leji, Wang Huning, Cai Qi, Ding Xuexiang and Li Xi. Xi Jinping opened the Congress on Oct. 16 with a nearly two-hour-long speech that emphasised the continued role of China’s zero-Covid policy in the country’s fight against Covid-19, the prioritisation of national security and social stability, and unification with Taiwan. (Al Jazeera; The Guardian)

China Releases Delayed Q3 2022 Economic Growth Figures

On Oct. 24, almost a week after the original publishing date, China finally released a series of official economic data for the third quarter, failing to reassure markets already unsettled by Xi Jinping’s consolidation of power after the 20th Communist Party National Congress, and no suggestions of a relaxation of the country’s tight zero-Covid policy. The Hang Seng index plunged to a 14-year low of 7.4 percent, while the CSI 300 index fell 3.1 percent. According to the release, China’s GDP grew 3.9 percent year on year, below the country’s 5.5 percent full-year target, while retail sales inched only by 2.5 percent. Data on property sales and new construction starts were down 22 percent and 38 percent respectively, and figures showed an 8 percent drop in property investment highlighting the country’s ongoing property crisis. On a positive note, industrial production increased 6.3 percent, beating estimates. (Financial Times)

IMF Cuts China’s GDP Growth Forecast for 2023

The International Monetary Fund (IMF) has joined the World Bank and the Asian Development Bank (ADB) in trimming China’s GDP growth for 2022 citing Covid-19 outbreaks, lockdowns and the ongoing property market crisis as factors. In its latest World Economic Outlook update, the financial agency downgraded China’s growth for 2022 to 3.2 percent from an estimated 3.3 percent published in July, the lowest growth in more than four decades (excluding the initial impact of Covid-19 in 2020). The IMF also lowered its expectations for 2023, cutting China’s GDP growth from 4.6 percent to 4.4 percent, adding that China’s economic slowdown will “weigh heavily” on global trade and activity. (IMF)

Hong Kong Launches Plan to Attract Businesses, Investment and Talent

In his first policy address since he was appointed Hong Kong chief executive in July, John Lee said the city would spend HK$30 billion ($3.8 billion) to attract businesses, while launching a scheme that would give a “two-year pass” to high-skilled foreigners in an attempt to boost the city’s status after years of decline. Lee has admitted the city’s workforce has shrunk by 140,000 in the last two years. The address, which also included a pledge to enact new national security laws in cybersecurity, crowdfunding activities and false information, didn’t reassure markets, with the Hang Seng index falling around 2.4 percent after the speech. (CNBC, Reuters)

Glimmers of Dissent Criticising Xi Appear Inside and Outside China

Slogans criticising Xi Jinping and China’s zero-Covid policy have appeared in cities in and outside China after two protest banners were hung from a bridge in Beijing a few days before the start of the 20th Chinese Communist Party National Congress. The banners, which read “we don’t want Covid tests, we want to eat,” and “we don’t want lockdowns, we want freedom” and “go on strike, remove dictator and national traitor Xi Jinping,” among other slogans, are a rare sign of public discontent. Similar public comments have been reported in Shenzhen, Shanghai, Guangzhou and Hong Kong, as well as universities in the UK, the US and in the Netherlands. Protesting outside the country still presents risks to critics: last week a Hong Kong pro-democracy protester was assaulted in Manchester. (The China Project, BBC, CNN)

China Decoded wants to hear from you. Send tips, suggestions, complaints and compliments to robb.young@businessoffashion.com.

Shanghai’s current lockdown will eventually end but a new outbreak in Beijing and no end to the country’s rigid pandemic strategy suggest retail disruptions are likely elsewhere.

The long-term fundamentals of the all-important China market remain strong but short-term headwinds mean luxury brands could face a challenging year ahead.

Experts warn global brands to tread carefully as they experiment with new ‘guochao’ strategies amid growing nationalism and local competition in China.

With consumers tightening their belts in China, the battle between global fast fashion brands and local high street giants has intensified.

Investors are bracing for a steep slowdown in luxury sales when luxury companies report their first quarter results, reflecting lacklustre Chinese demand.

The French beauty giant’s two latest deals are part of a wider M&A push by global players to capture a larger slice of the China market, targeting buzzy high-end brands that offer products with distinctive Chinese elements.

Post-Covid spend by US tourists in Europe has surged past 2019 levels. Chinese travellers, by contrast, have largely favoured domestic and regional destinations like Hong Kong, Singapore and Japan.