The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

Between them, Alibaba and rival JD.com sold merchandise worth $115 billion on their e-commerce platforms during last year’s Singles’ Day sales period. The annual shopping festival has ballooned from a single day on Nov. 11 to an 11-day promotion starting on Nov. 1 as well as a “pre-sale” period that begins several weeks before that.

The online extravaganza, which is an important marketing milestone for many fashion and beauty brands, has been somewhat predictable up until this year. But the environment in which e-commerce companies operate has changed dramatically in China, as has the general vibe of this Singles’ Day sales period. Gone are the aggressive ‘bigger, better, faster, cheaper’ slogans from Alibaba. Instead, its messaging has turned to sustainability and the common good.

No-one seems quite sure whether this means Singles’ Day 2021 will fail to top sales records set last year but, when even Alibaba is playing down the importance of its long-prized metric of success, gross merchandising value (or GMV), it is clear enough that this marks the beginning of a new era for the Chinese e-commerce sector.

That was exactly the message coming from Alibaba’s chief marketing officer, Chris Tung, at a press event to kick off the festival in late October. “We have been shifting our focus from pure GMV growth to sustainable growth,” Tung told the virtually assembled media.

ADVERTISEMENT

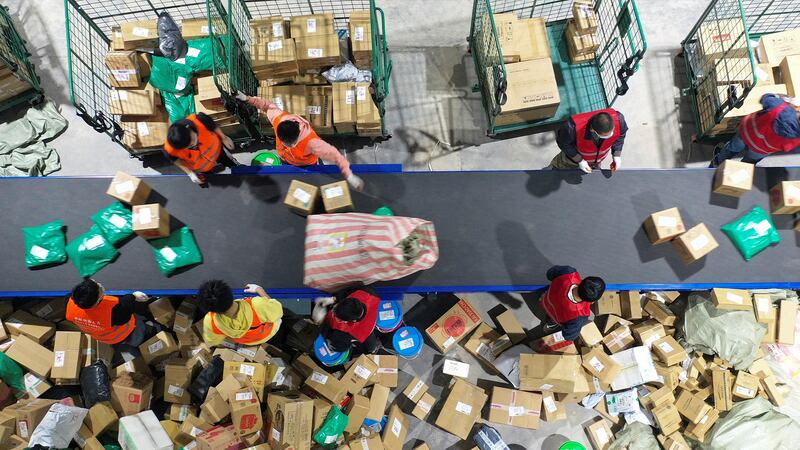

While campaigners understandably question the environmental credentials of any e-commerce behemoth facilitating the dispatch of billions of packages over a short period of time, Alibaba has been promoting sustainability initiatives hard over the course of this year’s festival, the climax of which is on Thursday.

The group plans to slash order-related carbon emissions by 30 percent this year and continue that level of reduction each year moving forward. Its Tmall platform promised to offer 100 million yuan ($15.7 million) worth of “green” shopping vouchers, to be used, for example, on more environmentally friendly appliances. Alibaba’s logistics arm, Cainiao, will also introduce package recycling across 60,000 postal pick-up points, as part of an aim to recycle 70 percent of handled packages.

It’s all about ‘charity’, ‘inclusion’, ‘sustainability’, [but really] this year is about staying out of jail, getting out of the penalty box.

The more responsible, understated tone is hardly surprising. The tech giant has been under enormous political pressure domestically, having incurred a record $2.8 billion antitrust fine in April. Keen to avoid any further heat, it was quick to donate $15.5 billion in October to “promote common prosperity” in China, responding to President Xi Jinping’s calls to rein in the country’s widening wealth gap.

According to Josh Gardner, chief executive and co-founder of Kung Fu Data, a business development and data analytics firm specialising in brand partnerships with e-commerce players in China, this backdrop has forced Alibaba and other tech giants to take a lower key approach to Singles’ Day.

“Alibaba has deliberately toned down the event this year because of government intervention. So it’s all about ‘charity’, ‘inclusion’, ‘sustainability’, [but really] this year is about staying out of jail, getting out of the penalty box,” Gardner said.

That’s not to say that Singles’ Day is no longer a massive driver of sales. On the opening day of this year’s pre-sales period, China’s top livestreamers, Li Jiaqi (also known as Austin Li) and Viya, together racked up a total of $3.1 billion in sales. However, Gardner says the fact that Alibaba is giving them more of the limelight points to heightened risks in the new era. Having to sell huge volumes to meet sales goals while trying not to attract too much attention to avoid further scrutiny from government regulators who are already on high alert is quite a balancing act.

“Everyone is a target and I think Alibaba is being smart about redirecting [the attention. They can] still do the volume but let other people take the credit for them,” he said. “[But] Viya and Austin better start seriously thinking about charitable donations right away. They’re not going to get away with doing more trade on Singles’ Day [than some] developing countries do, [without attracting attention].”

Even if the regulatory stakes weren’t quite so high, there’s an argument that Singles’ Day would have reached a turning point soon anyway. The predictability and tone of the message — a deafening crescendo of year-on-year sales growth to drown out similar cries from rival e-commerce players — started to sound hollow to some consumers long before the onset of the pandemic.

ADVERTISEMENT

All these changes beg the question: if Singles’ Day isn’t the occasion for e-commerce players to shout about record-breaking sales, what is for? More to the point, what is its purpose for brands that have anchored their China marketing calendars to the mega-event?

Winning the year, not just the day

If the value proposition of the shopping festival is indeed changing, then brands need to reconsider how they measure return on investment during this well-established promotional period.

According to a report released by Bain & Co. in the lead up to this year’s festival, the answer can be summed up in a single word: loyalty.

“Going forward the rules of the game have changed from winning through penetration and customer acquisition, to winning with loyalty and winning share of wallet,” said Jonathan Cheng, Bain & Co. partner and the leader of its Greater China Retail practice, based in Hong Kong.

The firm’s research showed that more than 50 percent of consumers intended to use “three or more platforms” for their Singles’ Day shopping and, with China’s tech giants suffering major market cap losses since the beginning of China’s broader tech crackdown, no platform players have a big enough “war chest to fund and grow and win these events, particularly Singles’ Day, at all costs,” Bain & Co. partner, James Yang, added.

The rules of the game have changed from winning through penetration and customer acquisition, to winning with loyalty and winning share of wallet.

Following previous stages in the development of Singles’ Day, the first of which was focused on new user acquisition and the second on premiumisation and increasing average basket sizes, the next era is one in which “you are really forced to put and talk about loyalty at the forefront... User growth is stagnating; the only thing you can do is increase the customer lifetime value to [have] a sustainable and profitable growth model,” Yang explained.

One of the first things brands should do to help make this shift, according to Rakhee Jogia, managing director of international at Rakuten Advertising, is to examine their product portfolio and work out which of their products can tell the best story about what they stand for, rather than relying on hero SKUs sold at a discount, as has been the norm in the past. “It’s moving away from that discount, voucher messaging and talking more about the uniqueness of the products,” she said.

ADVERTISEMENT

Consumers may not be on board with the rules of this new era yet, however, having been trained to expect deals and discounts as part of their Singles’ Day experience.

Bain’s research showed that 80 percent of surveyed consumers wanted even more discounts and promotions from Singles’ Day. But the current disconnect doesn’t mean brands shouldn’t start working to change their marketing, product assortment and customer service approach now.

The journey isn’t going to be easy, it’s not going to be an overnight switch.

Most brands will need to begin shifting away from the fleeting nature of discount-driven sales goals in favour of strategies that attract the kind of attention that can be garnered during a high-profile event to set them up for year-round success.

According to Yang, this means not only offering their best products, but focusing on the experience of delivery, the opportunity to have meaningful interactions and introduce new consumers to a great loyalty programme; in short, focusing on the ability to “spark joy” that will stay with a consumer when Singles’ Day is over.

“The journey isn’t going to be easy, it’s not going to be an overnight switch,” he said.

What the transition can be, though, is an opportunity to try something new.

An opportunity to experiment

One way many players have worked to differentiate themselves this year, according to Gardner, is by diversifying budget away from Alibaba’s platforms in an effort to be more evenly distributed across both Alibaba’s and its competitors’ platforms.

In this first Singles’ Day sales period since Alibaba was fined for monopolistic practices including its famous er xuan yi (“choose one of two”) approach, which essentially forced merchants to exclusively work with its platforms, it’s no surprise that brands have been keen to do exactly that. What is interesting, Gardner says, is that the biggest winners seem to be Douyin (the Chinese version of TikTok) and JD.com, with limited added budget flowing to Pinduoduo or Kuaishou, for example.

“This is all you need to know where the commerce is happening,” he said, adding that there’s little doubt in his mind that Douyin has emerged as the third major Singles’ Day competitor.

“The attraction of Douyin is undeniable. The AI is unbeatable, the experience is so addictive. It [represents] consumers moving away from a marketplace environment for purchasing and wanting more engagement and entertainment and buying during that process,” Gardner added.

Though the added cost of producing video content means that Douyin won’t be a viable investment for every brand, some that have bet big on the platform have found it to be a lucrative route to sales this Singles’ Day. Korean beauty brand Sulwhasoo leapfrogged to first place on Douyin’s GMV list for the category during the pre-sale period with a single live broadcast, in which it sold goods valued at 70 million yuan ($10.94 million).

For luxury brands, which have long tried to steer clear of the discounting aspect of China’s major sales festivals, a new era in which everyone is moving away from sales as the only metric for Singles’ Day success is good news. More high-end brands joined the festival this year, with over 200 taking part through Alibaba’s Tmall alone, with brands such as Hermès and Saint Laurent participating for the first time.

The attraction of Douyin is undeniable. The AI is unbeatable, the experience is so addictive.

For some, Singles’ Day is offering an opportunity to trial new technologies or test fresh ways to reach Chinese consumers or even specific cohorts within the market.

Swiss watchmaker Chopard, for example, is using Tmall Luxury Pavilion’s 3D shopping feature to create a virtual store mirroring one of its brick-and-mortar boutiques. Gucci, Vacheron Constantin and Maison Margiela, meanwhile, are all offering services traditionally found only in physical stores, such as membership privileges, consultation with sales associates and after-sales services, via Tmall Luxury Pavilion.

It’s no surprise that NFTs are making an appearance as part of the festival, given the impact the metaverse is making more broadly. Brands including Burberry, Balmain, Longines, Coach, La Perla and Emporio Armani have collaborated with Tmall’s Luxury Pavilion on its first-ever digital art gallery in the metaverse, selling limited edition virtual products.

For Coach, which consistently ranks among Luxury Pavilion’s top brands by sales, that means offering limited digital versions of its “Rexy” dinosaur character. According to Yann Bozec, president and chief executive of Tapestry Asia Pacific and president and chief executive of Coach China, experimenting in the metaverse this Singles’ Day is not only a way to engage with younger consumers, but also “reinforces the value of our ‘China Next’ digital strategy where the China market offers a proving ground for emerging consumer technology and behaviours at scale in advance of the rest of the world.”

There is no doubt that the “new era” of Singles’ Day will make life more complicated for brands in some respects. It won’t be as easy, for example, to measure ROI on Singles’ Day investments intended to pay dividends over the course of the year, or even longer. But no matter what their positioning, brands looking to leverage the festival will need to reassess their priorities. The key will be to strengthen loyalty by adding value for the customer through new experiences and going the extra mile.

“These are the elements that will create a differentiated and defensible proposition for you as a retailer,” said Bain’s James Yang. “Rather than going on price alone.”

时尚与美容

FASHION & BEAUTY

Global Fashion and Beauty Brands Descend on Shanghai for Import Expo

The fourth annual China International Import Expo (CIIE) is taking place in Shanghai this week with dozens of global fashion, beauty and luxury brands participating. Many have invested significant amounts to build ornate pavilions, in part to demonstrate their commitment to the world’s largest fashion and luxury market. The expo runs through Nov. 10. President Xi Jinping gave an opening address via video link on Thursday evening in which he pledged to further expand imports and “pursue balanced development of trade.” In the beauty hall of the expo, L’Oréal Group boasts the largest pavilion, in which it’s debuting five new brands in China: Carita, Mugler, Thayers, Takami and IT Cosmetics. While, the LVMH Group pavilion is designed to evoke the architectural elements of the iconic La Samaritaine department store in Paris, which reopened earlier this year following a seven-year renovation. Inside, the Dior section is surrounded by walls of fresh roses and displays a gown from Maria Grazia Chiuri’s most recent Autumn/Winter women’s ready-to-wear collection. (BoF)

Canada Goose Results Lifted by China Demand

Chinese consumers propelled Canada Goose in its most recent quarter earnings quarter as they continued to purchase its parkas and jackets despite fresh lockdowns in some cities due to a widening Covid-19 outbreak which began in October. Canada Goose reported revenue of C$232.9 million ($186.69 million) in the second quarter ended Sept. 26, up from C$194.8 million ($156.5 million) a year earlier, beating analysts’ estimates of C$206.1 million ($165.59 million), according to Refinitiv IBES. (Reuters)

科技与创新

TECH & INNOVATION

Yahoo Pulls Out of China After Two Decades

Yahoo Inc. said it was leaving China, citing the increasingly difficult business and legal environment, making it the latest foreign company to be caught up in the country’s toughening regulatory environment. The company said it had ceased to offer its services from Nov. 1, becoming the second major US tech firm to downsize China operations in less than a month following the closure of LinkedIn. Yahoo’s departure coincided with the implementation of China’s Personal Information Protection Law, a privacy law that will curb data collection by technology companies that went into effect on Nov. 1, though Yahoo didn’t refer directly to it. (The Wall Street Journal)

Chinese Team Wins League of Legends Esports World Championship

EDG, China’s Edward Gaming team, is dominating trending topic lists on Chinese social media this week after upsetting the favoured Damwon Kia team from South Korea 3-2 to win the League of Legends World Championship 2021 title. On Sunday, the hashtag “EDG Wins Championship” had over 2.6 billion views on social media site Weibo. The LoL World Championship was originally scheduled to take place in Shenzhen, but due to logical issues relating to Covid-19 restrictions, the esports tournament was eventually held in Reykjavik. Esports are wildly popular in China, but the country’s regulatory environment and a seeming recent hostility to gaming has made the area a tricky one for brands to engage with. (What’s on Weibo)

消费与零售

CONSUMER & RETAIL

Report: 88% of China’s Luxury Growth Driven By New Consumers

China’s luxury fashion market in 2021 is being propelled by a cohort of 1.5 million consumers who each spend more than 40,000 yuan ($6,255) per year on fashion-related luxury products. As a group, they are responsible for 81 percent of the sector’s total sales over the past 12 months, according to a new research report from consulting firm, Oliver Wyman. The report, compiled in October after surveying 3,000 mainland luxury fashion consumers, in addition to completing supplementary interviews with luxury brand sales associates working closely with them, also found that 50 percent of this group bought luxury fashion items (including ready-to-wear, footwear, leather goods and accessories) for the first time between October 2020 and September 2021. According to “The New Faces of Chinese Luxury Shoppers” report, it’s this surge in first-time luxury fashion consumers that will be responsible for 88 percent of China’s luxury fashion market growth in 2021. (BoF)

World’s Most Expensive Retail Rents Tumble to Decade Low in Hong Kong

Rents in three of the city’s prime shopping areas are near the lowest in more than a decade and owners are offering discounts of close to 80 percent from the peak about eight years ago in Hong Kong’s Russell Street, according to data from Cushman & Wakefield. The strip in Causeway Bay on Hong Kong Island was ranked as the world’s most expensive for shop rentals until 2019, the last time that the firm released global numbers. It’s a sharp reversal of fortune for the well-to-do families and individual investors behind Hong Kong’s retail meccas, who in better times could count on mainland tourists to splash money on upmarket handbags, watches and cosmetics. Now shops that used to sell Swiss watches offer budget mobile phone gadgets after the 2019 anti-government demonstrations and some of the world’s strictest Covid-19 travel restrictions deterred China’s affluent travellers. (Bloomberg)

政治,经济与社会

POLITICS, ECONOMY, SOCIETY

China Trade Surplus Tops $80 Billion in October

China’s exports remained strong in October, the country’s customs agency said Sunday that exports totalled $300.2 billion, up 27.1 percent from a year ago. This marks a slowdown from the 28.1 percent increase seen in September but still better than many expected given China’s economy is battling power shortages and Covid-19 outbreaks. Imports came in at $215.7 billion, a 20.6 percent year-on-year rise. The growth in both exports and imports is so strong because a year ago much of the world was closed due to the pandemic, but there is growing concern that broader economic headwinds are slowing growth. The world’s second-largest economy grew 4.9 percent in the three months ending September, down from 7.9 percent in the previous quarter. (Associated Press)

Shanghai to Build Giant Shipping Centre

Shanghai will accelerate the construction of a “world-class” cluster of ports and airports the city’s mayor, Gong Zheng, recently told the 2021 North Bund Forum on international shipping. President Xi Jinping also sent a message to the forum which read in part that China is willing to work with other countries to overcome the difficulties currently being experienced in shipping, while also adapting to new low-carbon and intelligent shipping. (Xinhua)

China Decoded wants to hear from you. Send tips, suggestions, complaints and compliments to our Shanghai-based Asia Correspondent casey.hall@businessoffashion.com.

With consumers tightening their belts in China, the battle between global fast fashion brands and local high street giants has intensified.

Investors are bracing for a steep slowdown in luxury sales when luxury companies report their first quarter results, reflecting lacklustre Chinese demand.

The French beauty giant’s two latest deals are part of a wider M&A push by global players to capture a larger slice of the China market, targeting buzzy high-end brands that offer products with distinctive Chinese elements.

Post-Covid spend by US tourists in Europe has surged past 2019 levels. Chinese travellers, by contrast, have largely favoured domestic and regional destinations like Hong Kong, Singapore and Japan.